Jun/iStock via Getty Images

Every once in a while, a company that was recently stagnant really hits its stride. That is certainly the case with e.l.f. Beauty (NYSE:ELF) in the past 2 years. The company has been a solid player in the low end of the cosmetic space for many years, but the recent inflationary environment has proven to be a huge boon to ELF. The company is benefitting greatly from women trading down to lower priced cosmetics for value. At a price point 1/4th of the most expensive competitors on average, they have a large advantage among younger less wealthy consumers. ELF is also really leaning into digital marketing and pushing for growth among the youngest demographics. This should lead to outsized market share gains and revenue growth for the long term.

DTC strength and Department expansion

Elf reported a powerhouse fiscal second quarter with revenue growth up a robust 33% to $122.3m. This was a growth acceleration over Q2, a rarity in the consumer space with most companies struggling to grow against hard comparisons. Gross margins were also strong, and improving with 65% gross margin up 190 basis points over the prior year. These margin improvements will continue as the company scales its revenue and direct to consumer business. Net income was $14.5m in a GAAP basis or 27 cents per share. Market share was up 115 basis points over the prior quarter, an impressive bit of momentum heading into the essential holiday season. Unlike many other consumer discretionary stocks, ELF has a reasonable inventory level with no risk of markdowns. The stock only had inventory in the quarter of $81m, up just $4.5m from the prior year Q2. The company pointed out it actually has a bit less inventory than it wants, as it tries to keep popular SKU on shelves showing strong sales momentum. Certain products go viral where they sell far more than the company expects, such as the Halo glow liquid filter. The company keeps selling the product out and it sells at just $14 compared to $46 for comparable prestige brands. This kind of value is the reason to be bullish the stock as people look to cut their budgets where they can. Digital sales were up 75% y/y in Q2, up to 15% of total sales which is the companies own website sales. The increasing direct business will help achieve higher margins in the long term with over 70% achievable. The company continues to increase its share of space at major retailers with expansions in Walmart (WMT), Target (TGT) and CVS (CVS) in early 2023. The reason is obvious – ELF brings in strong sales volumes. CEO Tarang Amin pointed out

“…on the skincare side, category is up 15%, e.l.f. skin grew 44%. So the strength that we’re seeing is really across the board. We are getting trade down from Prestige, but we’re also getting trade from within other mass brands.”

This strength in skincare especially shows that young women would rather trade down than give up spending in these areas. Outgrowing the category by 3x is incredibly impressive in the current environment. Current estimates for Fiscal 2024 starting in April 2023 seem very beatable with just 11% estimated revenue growth at $542m for the year. A growth rate of 15-20% is certainly possible if the continued inflationary environment pushes consumers down to the better value that ELF provides. The company should benefit from weakness in the real economy and continue to gain market share because of the strong social media presence.

Digital marketing – Key to Gen Z success

The company has continued to lean into advertising on TikTok with over 9 Billion views on the main page. They have increased digital spend and marketing to 16% of sales which has greatly increased growth and brand awareness in the past 3 years. They called out even higher marketing spend for the full year of 19% as they are seeing big gains from their digital strategy and viral videos. Their ‘beauty squad’ loyalty program is up to 3.2 million members good for a solid 20% growth year over year in Q2. These customers spend significantly more than non-loyalty customers. They provide 70% of all sales on elfbeauty.com and provide a trove of data leading in continued product innovation. ELF continues to resonate with consumers with their environmentally friendly approach and large digital presence compared to competition. The company is strongly cruelty free and vegan which is often mandatory for young customers.

Companies have proven that viral marketing on TikTok is essential to success among Gen Z and Millennial women. This is paying great dividends now with revenue continuing to increase at a fast pace. The company is leaning into other popular platforms like Amazon’s (AMZN) Twitch and Snapchat (SNAP) making sure to be visible wherever modern Gen Z consumers are. Piper Sandler’s recent teen survey showed the dominant mind share ELF has. For teens surveyed 16% said ELF was their favorite brand in cosmetics – a great sign for the coming decade. This continued growth among the most important demographic for the coming years bodes very well for the stock’s long term prospects. Viral products continue to dominate and are not possible without a strong presence in all digital channels that appeal to young of today.

Piper Sandler Teen Survey (ELF Q2 presentation)

Risks

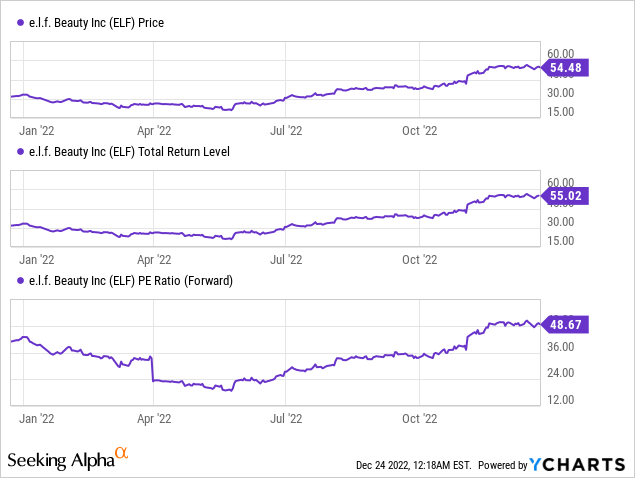

The main risk for ELF investors right now is an overall selloff in the market, rather than a recessionary environment. A recession may actually prove to help market share for ELF, however a strong economy and weak stock market may lead to profit taking in the name. The stock is one of the few stocks that is up significantly in the past 6 months, with a gain of 64% in the past year giving the stock a ‘full valuation’. Any hot inflation readings will be a risk to shares in the coming year so make sure to offset the name with safer options in any portfolio. The stock trades at forward price earnings ratio of 48.67 which is expensive compared to a continuously decreasing market multiple. It is also a significant premium to its own historical P/E. As you can see below the stock spent much of the past year in the 25-35 forward earnings range. In the event of a revenue or earnings miss the stock is more at risk of a big fall of 10% or more than other consumer names which is important to keep in mind. However, the benefits far outweigh the risks in this case with such momentum in shares and improving fundamentals.

Right time to buy?

ELF continues its impressive 2022 with this most recent quarter and companies in the space have continued to show the young female consumer is resilient. Look for continued strong growth in 2023, although it is less clear how much additional upside ELF shares could have with the stock trading above 45x 2023 earnings. Accumulating shares on any pullback into the $40s would be ideal during one of the markets inevitable swoons in 2023. Any investors looking for long-term growth should look closely at this recession resistant name knowing the risks of an expensive stock in what has been a tough market in 2022.