Themes in Numerous Investments. 2023. Shaen Corbet and Charles Larkin, eds. De Gruyter.

The selection funding home continues to develop previous hedge funds and private equity to embrace quite a few types of financial innovation. This amount affords the topic a rich and completely different presentation from a variety of authors, not solely of investments however as well as of themes that occupy this realm of the funding universe.

Opacity and illiquidity are half and parcel of this evolution. With new options come challenges in effectivity measurement, due diligence, and regulation. Technological innovation proceeds apace, environment friendly oversight a lot much less so. Analysts, portfolio managers, menace professionals, and regulators will uncover this work a properly timed and useful compendium. Officialdom in a regulation-averse incoming presidential administration within the USA that has promoted digital overseas cash with abandon would do properly to heed the teachings contained inside its covers.

CFA charterholders and candidates might even uncover price on this textual content material as they could increasingly more be confronted with the realities and challenges of the ever-changing completely different asset class.

The gathering of issues on this e-book appears at first blush to be random. Not so. Comparatively, the chapters characterize a cross-section of factors associated to the current state of nontraditional investments. Information asymmetry is a typical thread, presenting an ongoing downside to regulators and practitioners who aspire to a bigger understanding of the complexities of this class.

An account of the Mozambican tuna bond scandal underscores the risks inherent in a lot much less developed markets. This study on state-owned enterprise misappropriation of funds earmarked for tuna fishing and maritime security reminds us of how rapidly points can devolve. The revelation of the misused funds occasioned a collapse of the nationwide overseas cash and a sovereign debt default. Poor due diligence and oversight by lenders who accepted these loans present a cautionary story for menace managers and regulators who address higher-risk economies.

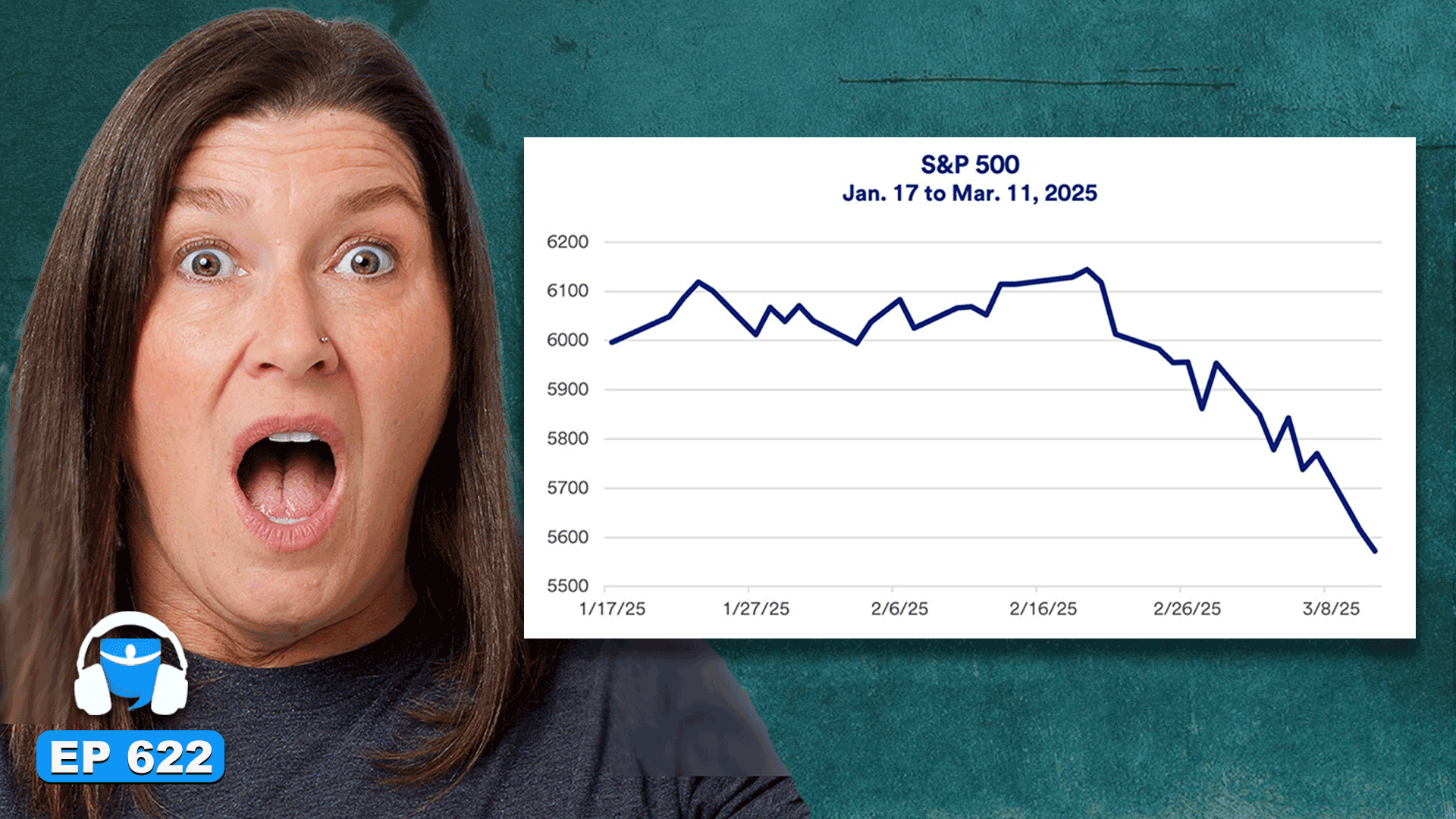

Relatedly, the dialogue and analysis of Silicon Valley Monetary establishment’s rise and fall advocate ongoing deficiencies in regulation and protection. Regulatory surveillance and capital requirements arising from the Dodd-Frank Act, enacted throughout the wake of the 2007-2009 World Financial Catastrophe, had been alleged to go off the collapses of financial institutions of the sort that led to that calamity. However a remainder of the applicability of regulatory scrutiny and stress testing to banks with belongings under $250 billion via the primary Trump administration afforded SVB freer rein in its underwriting of loans to the experience sector, subjecting it to a far bigger diploma of industry-specific risks.

A confluence of strategic picks, such as a result of the monetary establishment’s enormous pandemic-era accumulation of deposits that it invested largely in interest-rate-sensitive US Treasury and mortgage-backed securities, along with the exogenous shock of the Federal Reserve’s decision to spice up costs to staunch inflation, served the monetary establishment poorly when it was hit with a surfeit of withdrawal requests.

Discovering itself caught out, SVB wanted to advertise fixed-income holdings at a significant loss, which in flip, occasioned a vicious circle of ever-increasing withdrawal requests. This reverberative influence further eroded investor confidence and the monetary establishment’s share price, resulting in SVB’s implosion. The implications of this collapse had been far-reaching: interest-rate menace administration is important, as is portfolio diversification to mitigate sector-specific risks.

Centralized and decentralized finance appear to have further in frequent than would seem like so at first look. Opacity, illiquidity, and menace focus are as associated throughout the digital overseas cash home as they’re on this planet of fractional-reserve banking. The e-book’s analysis of FTX’s quick ascent and decline underscores the seemingly ephemeral nature of the burgeoning cryptocurrency {{industry}}.

Actually, the company’s travails and downfall should operate a robust reminder that the promise and potential of decentralized finance are as fraught with menace as their counterparts inside the usual kind. On this event, fraudulent conduct was very loads at work; the lure of innovation and subsequent disarray emphasizes the importance of rigorous due diligence. Additional intensive regulation and firm governance will possible be important prospectively.

This very important regulatory rigor should likewise apply to the novel seductiveness of the non-fungible token (NFT), a digitized innovation using the blockchain experience chassis that undergirds cryptocurrencies to create a particular noninterchangeable merchandise of price. NFTs have gained recognition in paintings, music, and precise property as a way of determining a chunk’s originality and possession.

However this stuff are matter to different types of fraud—rug-pull schemes, price manipulation, illusory price creation, and so-called tech enamorment or undue fascination with the novelty of this experience with indifference to its doubtlessly hostile affect on society. Market saturation of these tokens, the questionable promise of decentralized finance, and the precarity of their price throughout the wake of the FTX commerce collapse implies that these are early days for a product requiring further scrutiny and oversight.

Two chapters current an attention-grabbing and fairly detailed examination of the challenges of investing in wine. Exterior the expertise of most advisors, extraordinarily specialised information of such {{industry}} dynamics as terroir, local weather, vintages, and agriculture is essential, as is information of {{industry}} dynamics.

The scarcity of fixed information makes investing in wine a daunting course of. And there are different methods to accumulate publicity along with direct funding, bespoke allocation by way of the steering of a wine funding administration agency, and wine mutual funds managed like hedge funds. In addition to, the sector lacks prime quality information, and there are numerous opinions on menace and return measurement. Funding advisors would advocate a small allocation to this sector. Would it not not be larger to imbibe than make investments?

One different chapter revisits what could possibly be thought-about further typical completely different investments. As a result of the dialogue of private equity and hedge funds makes plain, regulation is usually uneven and incomplete. Inside the aftermath of the World Financial Catastrophe, the private market home has been matter to tremendously expanded regulation. Views distinction on its benefits in a realm the place opacity is essential to understand alpha however concurrently presents risks to prospects.

As hedge funds and private equity funds have grown as a result of the catastrophe, they’ve supplied systemic risks that regulation needs to take care of. The emergence of the Dodd-Frank Act (DFA) within the USA and the Numerous Funding Managers Fund Directive (AIMFD) in Europe presents an issue to policymakers and regulators, particularly, variations in these two regimes may induce funding advisors to engage in regulatory arbitrage. These challenges and options proceed as a result of the home grows and avails itself of varied fintech choices.

Even the seemingly benign European money market funds pose an issue to regulators as these autos are by design liquid however put cash into a lot much less marketable securities, a difficulty when merchants en masse want or require entry. Liquidity mismatch continues to be a difficulty, as a result of the March 2020 run on money market funds made evident. Variations in valuation methods may affect withdrawal risks to the fund and, by extension, its merchants. Liquidity and valuation thresholds may compel managers to utilize liquidity administration devices to limit withdrawals.

Macroprudential protection needs to take care of every liquidity mismatch and interconnectedness, as these funds sometimes keep short-term monetary establishment and non-financial agency debt. Exogenous shocks to money market funds which may impede their ability to purchase short-term paper may, in flip, propagate illiquidity amongst banks and companies. The fragility of money market funds, along with their important place throughout the financial ecosystem, will proceed to be a priority for regulators.

The amount concludes with two chapters on the place of artificial intelligence (AI) throughout the operation and regulation of financial markets. This burgeoning experience has good promise throughout the detection of market manipulation methods inside high-frequency shopping for and promoting. These comprise artificial stock price inflation and product sales to the detriment of less-informed merchants, the creation of false order e-book imbalances to deceive retailers, and the utilization of algorithms to induce price momentum and entice completely different retailers to further such momentum.

Regulators will need a deeper information of the risks and benefits of AI to know how these applications operate. Consider the potential for AI’s rising operational autonomy and finding out capabilities and the way in which which may (im)appropriately decide manipulative conduct. Regulation should be explicitly tailored to AI’s utility in financial markets, with a view in the direction of cross-border harmonization. Transparency and ethical utilization will possible be important to rising a course of which will enhance the correct functioning of markets. These are early days.