Try the businesses making headlines earlier than the bell:

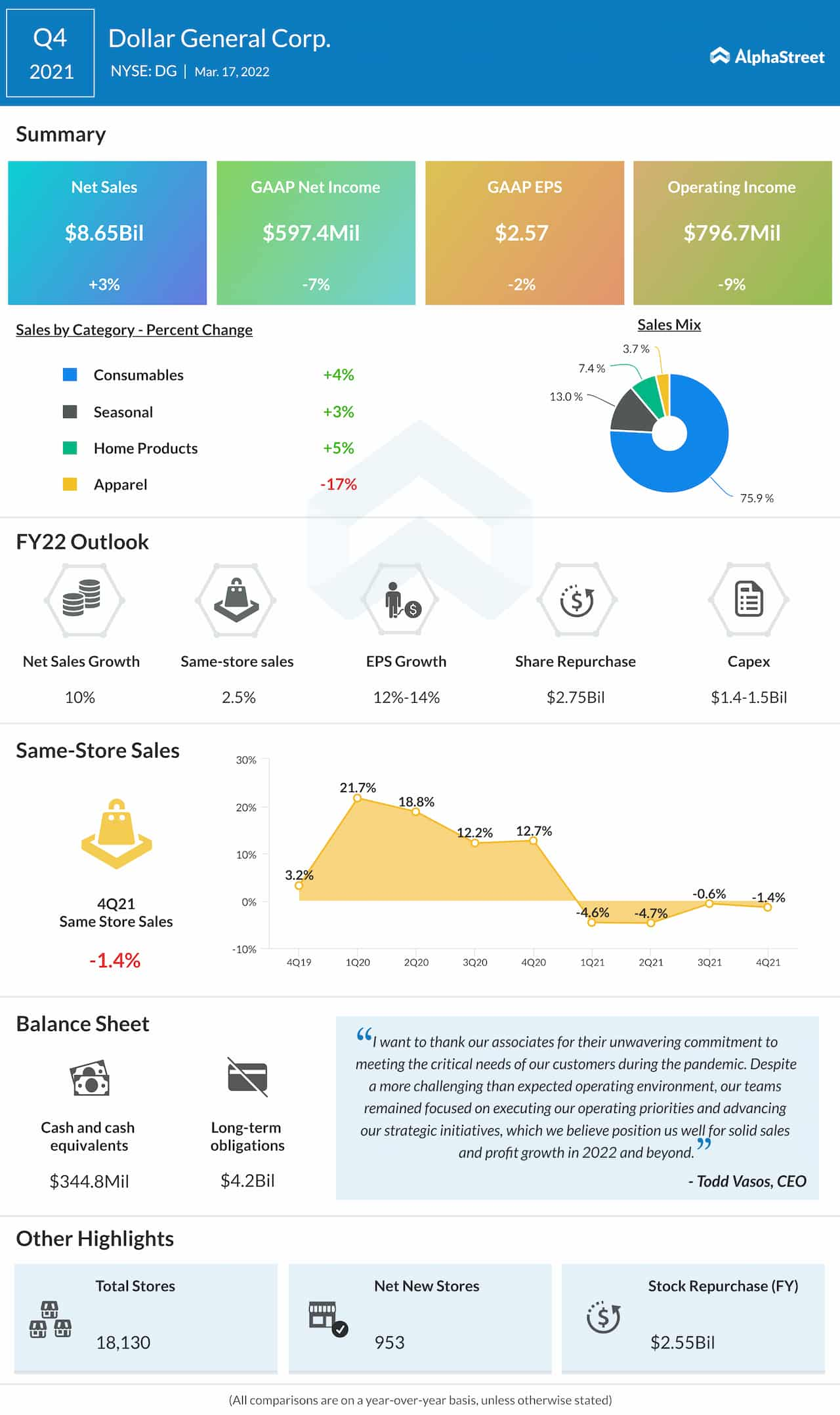

Greenback Common (DG) – Greenback Common rallied 5% within the premarket after the low cost retailer forecast better-than-expected full-year gross sales. Greenback Common’s quarterly earnings of $2.57 per share matched forecasts, though income was barely beneath estimates and same-store gross sales fell greater than anticipated. The corporate additionally raised its dividend by 31%.

Accenture (ACN) – Accenture jumped 5.3% in premarket buying and selling after beating prime and bottom-line estimates for its newest quarter and forecasting current-quarter income above present analyst forecasts. The consulting agency earned $2.54 per share for its most up-to-date quarter, in contrast with the $2.37 consensus estimate.

Signet Jewelers (SIG) – The jewellery retailer’s inventory surged 7.4% in premarket motion after it reported quarterly outcomes. Signet’s adjusted earnings of $5.01 per share matched analyst forecasts, whereas income and same-store gross sales exceeded estimates. Signet additionally raised its quarterly dividend to twenty cents from 18 cents.

Warby Parker (WRBY) – Warby shares slumped 13.4% within the premarket after the eyewear retailer forecast 2022 income that fell in need of consensus. For its newest quarter, Warby Parker reported an adjusted lack of 8 cents per share, 1 cent smaller than anticipated, with income matching analyst forecasts.

Lennar (LEN) – The homebuilder reported quarterly earnings of $1.69 per share for its fiscal first quarter, lacking the $2.60 consensus estimate. Income beat analyst forecasts on robust demand and better costs, however the backside line was hit by increased prices for supplies and labor. Lennar added 1% in premarket buying and selling.

Williams-Sonoma (WSM) – Williams-Sonoma earned an adjusted $5.42 per share for its newest quarter, beating the $4.82 anticipated by Wall Road analysts, even because the housewares retailer’s income fell barely in need of estimates. The corporate mentioned it was capable of navigate provide chain challenges and materials and labor shortages. Williams-Sonoma surged 7.6% within the premarket.

PagerDuty (PD) – PagerDuty misplaced an adjusted 4 cents per share for its newest quarter, 2 cents lower than analysts had been anticipating, with the digital operations platform supplier’s income additionally exceeding Road forecasts. PagerDuty additionally issued an upbeat income forecast, and its inventory soared 13.6% in premarket buying and selling.

Occidental Petroleum (OXY) – Berkshire Hathaway (BRK.B) purchased one other 18.1 million shares of Occidental, in keeping with an SEC submitting. That brings Berkshire’s holdings within the vitality producer to 136.4 million shares, or a couple of 14.6% stake. Occidental shares rose 3.6% in premarket buying and selling.

Guess (GES) – Guess reported adjusted quarterly earnings of $1.14 per share, one cent beneath estimates, whereas the attire maker’s income additionally fell in need of Road forecasts. Nevertheless, revenue margins had been higher than anticipated, and the inventory jumped 4.9% within the premarket.