[ad_1]

Tesla CEO Elon Musk provides recommendation for surviving robust financial instances resulting in pumps in Bitcoin, Ethereum, and Dogecoin.

He advocates shifting capital to “bodily issues,” i.e., not cryptocurrency. Nonetheless, his tweet nonetheless spiked the three talked about tokens, demonstrating that the “Elon impact” is alive and properly.

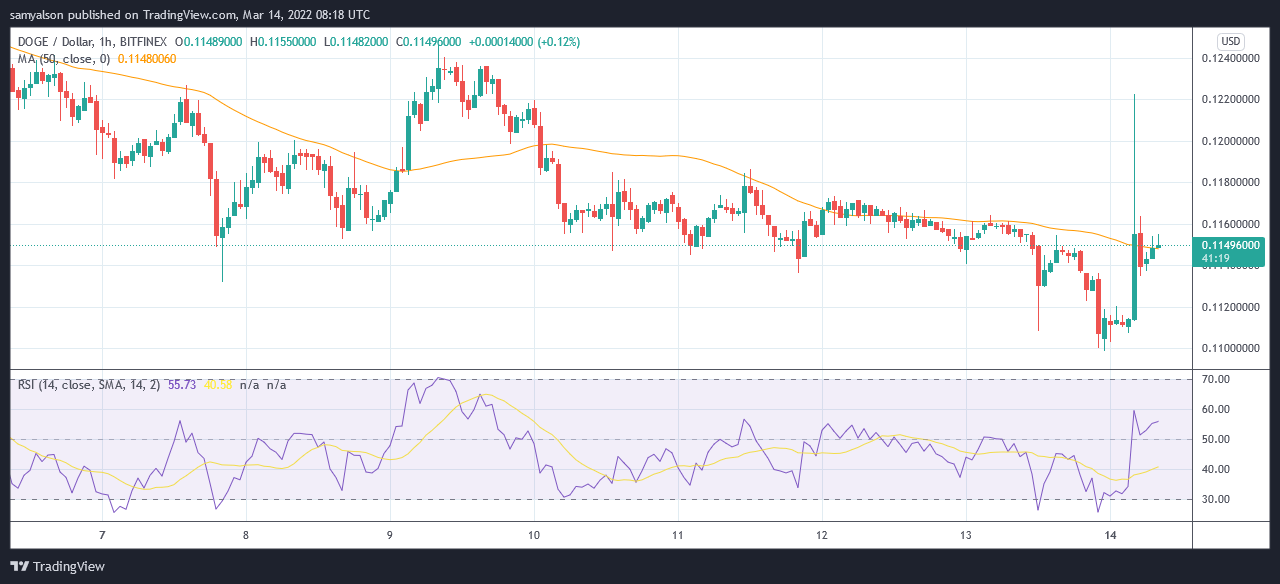

Of the three, Dogecoin moved probably the most, with an 8% swing to the upside, peaking at $0.1223 within the early hours (GMT). Nonetheless, the market took again most of these beneficial properties to shut the hourly candle at $0.1156.

Equally, Bitcoin noticed a 2% spike, with Ethereum posting a 3% swing. Like Dogecoin, profit-taking leaves a protracted prime wick on each value charts.

Final yr, Musk revealed his crypto portfolio consists of Bitcoin, Ethereum, and Dogecoin solely. The disclosure took place in an obvious snub of Shiba Inu, which was buying and selling at all-time highs on the time.

Nonetheless, the current price of dwelling disaster is evolving into dissatisfaction with the political class, together with the ultra-wealthy.

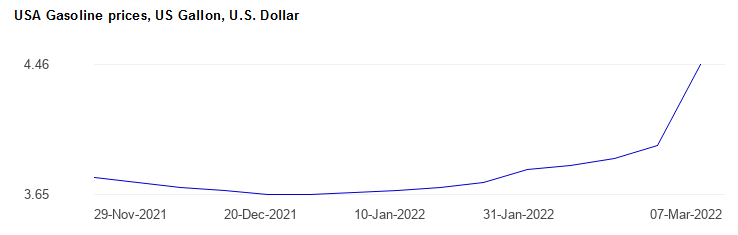

Runaway inflation is occurring

The consequences of inflation turn out to be extra evident every day, none extra so than on the petrol pump. Though globalpetrolprices.com places the value of petrol at $4.46/gallon within the U.S, some report costs as excessive as $7.56/gallon in excessive tax states.

Runaway inflation is primarily attributable to a rise within the cash provide not supported by financial development or a state of affairs the place demand exceeds provide. Sadly, by means of the final two years’ occasions, international economies face the double whammy of coping with each circumstances.

Sharing his ideas on the matter, MicroStrategy CEO Michael Saylor predicts worse to come back, resulting in a collapse in weaker currencies and a flight to scarce property, like Bitcoin.

“USD client inflation will proceed close to all time highs, and asset inflation will run at double the speed of client inflation. Weaker currencies will collapse, and the flight of capital from money, debt, & worth shares to scarce property like #bitcoin will intensify.”

What does Musk advise?

Musk takes a extra balanced view, saying Saylor’s take was “not solely unpredictable.” However reasonably than advocate Bitcoin, Musk encourages individuals to personal bodily issues, together with actual property or shares in well-regarded firms.

On the identical time, Musk additionally mentioned that he intends to hodl his Bitcoin, Ethereum, and Dogecoin holdings.

As a basic precept, for these on the lookout for recommendation from this thread, it’s typically higher to personal bodily issues like a house or inventory in firms you assume make good merchandise, than {dollars} when inflation is excessive.

I nonetheless personal & received’t promote my Bitcoin, Ethereum or Doge fwiw.

— Elon Musk (@elonmusk) March 14, 2022

The jury remains to be out on whether or not Bitcoin, and by extension cryptocurrency, is an inflationary hedge. Little question, extra might be revealed within the coming weeks and months.

Get your day by day recap of Bitcoin, DeFi, NFT and Web3 information from CryptoSlate

It is free and you may unsubscribe anytime.

Get an Edge on the Crypto Market 👇

Turn into a member of CryptoSlate Edge and entry our unique Discord group, extra unique content material and evaluation.

On-chain evaluation

Value snapshots

Extra context

Be a part of now for $19/month Discover all advantages

[ad_2]

Source link