Some variation of the phrase “the rich ought to pay their fair proportion of taxes” is ceaselessly echoed by activists, pundits, politicians, and even some millionaires and billionaires (referred to as the “Proud to Pay Extra” group).[1],[2] This sentiment leads many to imagine that the federal government can shut funds deficits, cut back the debt, and absolutely fund entitlement packages by merely elevating taxes on high-income earners.

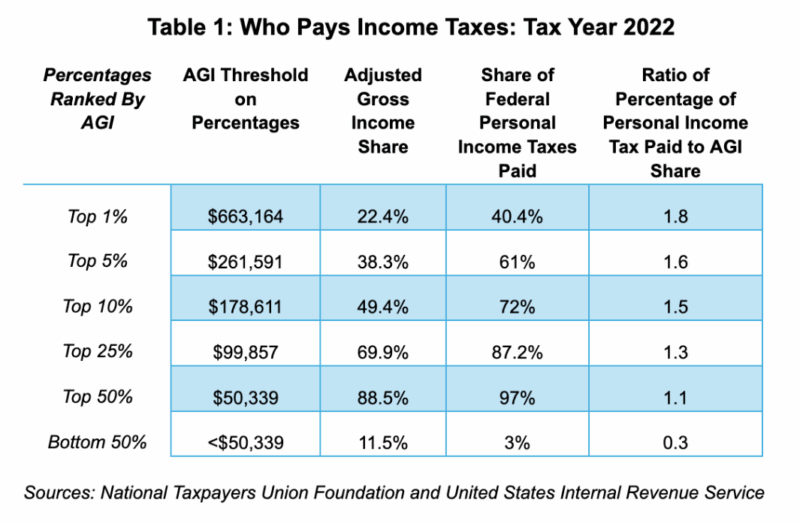

First, it’s essential to take a look at who pays revenue taxes. Desk 1 (recreated from Brady, 2024) illustrates revenue brackets by adjusted gross revenue (AGI) for taxes paid in tax 12 months 2022 (the most recent out there information).[3]

Brady (2024) finds that the highest 10 p.c of filers earned practically half of all revenue in 2022 however have been chargeable for 72 p.c of all revenue taxes paid. Moreover, proof reveals that the highest 25 p.c of filers have constantly paid no less than 73 p.c of all revenue taxes paid since 1980.[4]

In the meantime, lower-income tax filers pay comparatively little in private revenue taxes themselves. Hodge (2021) reveals that almost one-third of all revenue tax filers (all within the backside 50 p.c) paid no revenue taxes because of the enlargement of tax credit and deductions since 1980.[5] Hodge (2021) additionally cites the Congressional Funds Workplace (CBO) report “The Distribution of Family Earnings,” noting that in 2017 the bottom revenue earners obtain extra in direct federal advantages than they pay in revenue taxes whereas the highest earners see the other impact.[6]

Under is an up to date model of Hodge’s desk utilizing 2019 revenue teams:

Desk 2: The Ratio of Authorities Transfers Acquired to Federal Taxes Paid

| Earnings Group | Switch to Tax Ratio |

| Lowest Quintile | $68.17 |

| Second Quintile | $6.29 |

| Center Quintile | $2.35 |

| Fourth Quintile | $1.05 |

| Highest Quintile | $0.24 |

| 81st to ninetieth Percentiles | $0.54 |

| 91st to ninety fifth Percentiles | $0.33 |

| 96th to 99th Percentiles | $0.18 |

| High 1 P.c | $0.04 |

Sources: Hodge (2021) and the US Congressional Funds Workplace.

Notes: Greenback quantities are in 2024 {dollars}. This desk makes use of 2019 information as a result of it’s the latest non-pandemic 12 months out there as of July 2024.

Desk 2 measures how a lot the typical particular person in every revenue bracket receives for every greenback paid in taxes.[7] For every greenback paid in taxes, the typical lowest quintile of revenue filers acquired $68.17 in federal transfers. Conversely, the typical revenue filer within the prime 1% acquired 4 cents in federal transfers for each tax greenback paid. There may be clear proof that the typical tax burden will increase as revenue will increase. Excessive-income earners pay a disproportionate share of the tax burden whereas receiving a lot much less direct federal transfers (i.e. refundable tax credit and revenue help) than low- and middle-income earners.

It is usually essential to think about the financial impacts of such a tax system. Varied literature evaluations present that tax burdens and behavioral responses are advanced.[8] Excessive-income earners could determine to earn much less, retire early, change the kind of revenue (i.e. dividends or capital beneficial properties) or the timing of revenue to decrease their tax burden. This will imply that low-income earners could shoulder the next portion of the tax burden, however revenue switch packages should even be thought-about. Earnings from switch packages also can drastically offset any revenue tax burdens.[9] The time, expertise, and assets used to stability offsetting tax burdens whereas remaining compliant with the tax code come at the price of that point, expertise, and assets being saved and invested elsewhere. Excessive-income earners might have grown their companies. Low-income earners might have used these funds to avoid wasting for emergencies or enhance their lifestyle. As an alternative, it was spent navigating a posh and convoluted system of taxes and transfers.

Regardless of proof on the contrary, there are nonetheless frequent cries that the wealthy will not be paying their fair proportion in taxes. What constitutes a “fair proportion” is usually extremely obscure, however virtually all the time means “greater than what the folks wealthier than I’m are at the moment paying in revenue taxes.”

A lot of this resentment stems from the “Miser Fallacy.” Generally referred to as the “Scrooge Fallacy” or the “Smaug Fallacy,” this fallacy assumes that rich people hoard wealth.[10] They image the likes of Scrooge McDuck swimming in a vault full of cash, however this isn’t an correct depiction. Even the stingiest high-income earners make investments their cash through the inventory market or particular person tasks. In the event that they have been to avoid wasting their cash in a financial institution, the financial institution would then take the deposit to present entry to capital within the type of enterprise loans and mortgages. The rich saving and investing creates entry to capital for all, permitting folks to create and innovate, making everybody wealthier. On the connection between entry to capital and financial savings, economist Ludwig von Mises said,

“Capital will not be a free reward of God or of nature. It’s the end result of a provident restriction of consumption on the a part of man. It’s created and elevated by saving and maintained by the abstention from dissaving.”[11]

The notion that rich individuals are hoarding wealth is additional bolstered by the looks of revenue inequality. Hodge (2021) notes that the decline of conventional C Firms[12] and the rise of pass-through companies[13] that don’t pay company revenue taxes have shifted the federal tax base.[14] Hodge (2021) states that this variation in sort of companies impacts the looks of revenue inequality as a result of enterprise revenue is now reported on private revenue tax kinds (IRS kind 1040) as an alternative of company revenue tax kinds (IRS kind 1120).[15] This provides the looks of an explosion of private revenue among the many High 1 p.c of taxpayers. Nonetheless, Hodge (2021) notes that with the rise in wage revenue of the High 1 p.c of taxpayers, there may be an equal decline in enterprise revenue and dividend revenue with the decline of the C Company.[16]

If high-income taxpayers don’t imagine that they’re paying their fair proportion in taxes, they will all the time make a voluntary contribution to the US authorities. People can contribute to the Treasury’s “Items to the US” fund or, if they’re significantly involved concerning the nationwide debt, they will contribute to the Treasury’s “Items to Scale back the Public Debt.”[17]

It is usually value noting the generosity of People throughout the revenue spectrum. Analysis from Paul Mueller notes that “the overwhelming majority of People who give to charity obtain no federal tax profit from doing so.”[18] Moreover, America is without doubt one of the most charitable nations on this planet. In closing, Mueller opines,

“Most People give generously with out considered return—even with a big welfare state and excessive taxes. There’s something deeply admirable about this sort of generosity that provides with out anticipating any materials profit in return. Think about how they might give if the welfare state have been trimmed down and their taxes have been decrease. That’s what George W. Bush’s compassionate conservatism ought to have meant.”[19]

Regardless of excessive tax charges and expansive welfare methods, People (together with the rich) nonetheless give to charity. The proof is obvious: the wealthy already pay greater than their fair proportion—and anybody who nonetheless disagrees is ignoring the info.

Endnotes

[1] Galles, Gary. “Not a Very Virtuous Sign.” American Institute for Financial Analysis. February 2, 2024. Accessed July 25, 2024. https://www.aier.org/article/not-a-very-virtuous-virtue-signal/

[2] Hebert, David. “Wish to Pay Extra Tax? You Can” American Institute for Financial Analysis. July 19, 2024. Accessed July 25, 2024. https://www.aier.org/article/want-to-pay-more-tax-you-can/

[3] Brady, Demian. “Who Pays Earnings Taxes: Tax Yr 2022” Nationwide Taxpayers Union Basis. February 13, 2024. Dec 2, 2024. https://www.ntu.org/library/doclib/2024/12/Who-pays-tax-year-2022.pdf

[4] “Who Pays Earnings Taxes (2013).” Nationwide Taxpayers Union Basis. 2013. Accessed July 25, 2024. https://www.ntu.org/basis/tax-page/who-pays-income-taxes-2013

[5] Hodge, Scott. “Testimony: Senate Funds Committee Listening to on the Progressivity of the U.S. Tax Code.” Tax Basis. March 25, 2021. Accessed July 25, 2024. https://taxfoundation.org/analysis/all/federal/rich-pay-their-fair-share-of-taxes/#Burden

[6] “The Distribution of Family Earnings in 2020.” Congressional Funds Workplace. November 14, 2023. Accessed July 25, 2024. https://www.cbo.gov/publication/59509

[7] These transfers embrace social insurance coverage (this consists of Social Safety, Medicare, unemployment insurance coverage, and staff’ compensation) in addition to means-tested transfers (particularly the Supplemental Vitamin Help Program, Medicaid and the Youngsters’s Well being Insurance coverage Program, in addition to Supplemental Safety Earnings). Federal taxes paid embrace particular person revenue taxes and payroll taxes.

[8] Congressional Funds Workplace. Current Developments within the Literature on Labor Provide Elasticities. Washington, DC: U.S. Congressional Funds Workplace, October 2012. https://www.cbo.gov/publication/43675.

[9] Savidge, Thomas. The Work vs. Welfare Commerce-Off: Revisited. Nice Barrington, MA: American Institute for Financial Analysis, Feb 18, 2025. https://www.aier.org/article/the-work-vs-welfare-tradeoff-revisited/.

[10] Murray, Iain. “The Smaug Fallacy.” The Basis for Financial Schooling. October 30, 2014. https://price.org/articles/the-smaug-fallacy/

[11] Mises, Ludwig von. The Anti-Capitalistic Mentality. The Ludwig von Mises Institute. 2008 (1956). Accessed July 25, 2024. p. 84 https://mises.org/library/guide/anti-capitalistic-mentality

[12] C Firms (named for being in subchapter C within the Inside Income Code) is an unbiased authorized entity owned by its shareholders. A C Company’s income are taxed each as enterprise revenue on the entity degree and on the shareholder degree when distributed as dividends or realized because the revenue constituted of promoting a share (referred to as capital beneficial properties).

[13] A pass-through enterprise is a sole proprietorship, partnership, or S Company that’s not topic to company revenue taxes. S Firms (named for being in subchapter S within the Inside Income Code) is a enterprise that chooses to go enterprise revenue and losses by its shareholders, who then pay private revenue taxes on this revenue.

[14] Hodge, supra be aware 5.

[15] Id.

[16] Id.

[17] Hebert, supra be aware 2.

[18] Mueller, Paul. “What Scrooge Impact? People Hold Giving, Regardless of the Welfare State.” American Institute for Financial Analysis. 24 April 2025. https://thedailyeconomy.org/article/philanthropy-despite-the-state-americans-give-generously-even-without-tax-breaks/

[19] Id.