Up to date on January thirtieth, 2025 by Bob Ciura

Selecting the best asset class is likely one of the greatest questions for buyers. The dividend stocks-versus-bonds debate continues, as these are the biggest two asset lessons.

We consider the objective of any investor ought to be both:

- Maximize returns given a set stage of danger

- Decrease danger given a set stage of desired returns

Incorporating each return and danger into an funding technique might be tough. Whereas efficiency is simple to measure, danger might be tougher to quantify.

Volatility is a typical measure of danger. Volatility is a inventory’s tendency to ‘bounce round’. Low volatility shares will produce constant returns, whereas excessive volatility shares have extra unpredictable return sequences.

With this in thoughts, dividend shares have traditionally produced superior complete returns in comparison with their mounted earnings counterparts.

It is because established dividend shares just like the Dividend Aristocrats – shares with 25+ years of consecutive dividend will increase – have generated superior efficiency that greater than offsets their greater volatility relative to bonds.

You may obtain the complete listing of all 69 Dividend Aristocrats (together with metrics that matter akin to price-to-earnings ratios and payout ratios) by clicking on the hyperlink under:

Disclaimer: Positive Dividend is just not affiliated with S&P International in any means. S&P International owns and maintains The Dividend Aristocrats Index. The knowledge on this article and downloadable spreadsheet is predicated on Positive Dividend’s personal evaluate, abstract, and evaluation of the S&P 500 Dividend Aristocrats ETF (NOBL) and different sources, and is supposed to assist particular person buyers higher perceive this ETF and the index upon which it’s primarily based. Not one of the data on this article or spreadsheet is official information from S&P International. Seek the advice of S&P International for official data.

Because of this, we consider dividend shares are a compelling funding alternative when in comparison with bonds – their greatest ‘competitor’ as an funding.

This text will examine the risk-adjusted returns of dividend shares and bonds intimately.

The article will conclude by detailing a number of actionable ways in which buyers can enhance the risk-adjusted returns of their portfolio.

Measuring Danger-Adjusted Returns

The most typical metric to measure risk-adjusted returns is the Sharpe Ratio. By understanding the Sharpe Ratio of the 2 main asset lessons, buyers can come just a little nearer to settling the dividend shares vs. bonds debate.

Associated: The Highest Sharpe Ratio Shares Inside The S&P 500

The Sharpe Ratio measures how a lot further return is generated for every unit of danger. It’s calculated with the next equation:

One of many difficult parts of performing a Sharpe Ratio evaluation is figuring out what to make use of for the risk-free price of return.

When analyzing shares, the 10-year U.S. authorities bond yield is commonly used, because the chance of a default from the U.S. Authorities is mostly assumed to be zero.

Nevertheless, this text shall be analyzing each shares and bonds, so utilizing a 10-year bond yield because the risk-free price could be inappropriate (as it can assign a Sharpe Ratio of zero to fixed-income devices).

Accordingly, the yield on the 3-month U.S. Treasury Invoice shall be used because the risk-free price of return all through this text.

For reference, the 3-month Treasury Invoice yield is 4.3% proper now.

Subsequent, we have to choose applicable benchmarks by which to measure the efficiency of dividend shares and bonds.

As a proxy for dividend shares, this evaluation will use the iShares Choose Dividend ETF (DVY). This ETF is benchmarked to the Dow Jones U.S. Choose Dividend Index.

Usually, I would like to make use of a dividend ETF that tracks the efficiency of the Dividend Aristocrats, which is our favourite universe for figuring out high-quality dividend shares.

Sadly, the ETF which greatest tracks the efficiency of the Dividend Aristocrats index is the ProShare S&P 500 Dividend Aristocrats ETF (NOBL).

This ETF has solely been buying and selling since 2013 and thus is just not a very good proxy for long-term funding returns. DVY has been buying and selling since 2003 and has a for much longer observe document for which to make comparisons.

As such, DVY shall be used to signify dividend shares throughout this evaluation.

For bonds, we’ll be utilizing the iShares Core U.S. Combination Bond ETF, which trades on the New York Inventory Alternate underneath the ticker AGG. The fund is benchmarked to the Bloomberg Barclays U.S. Combination Bond Index.

The subsequent part of this text compares the efficiency of those two asset lessons intimately.

Dividend Shares vs. Bonds: Evaluating Danger-Adjusted Returns

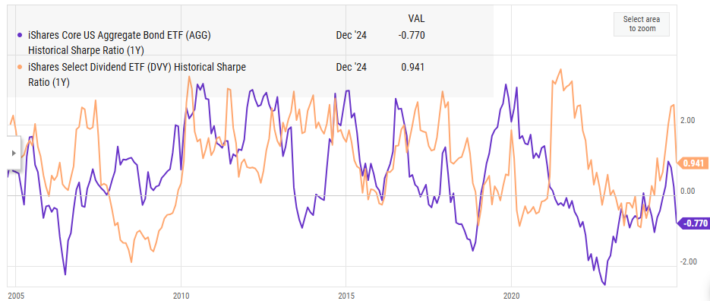

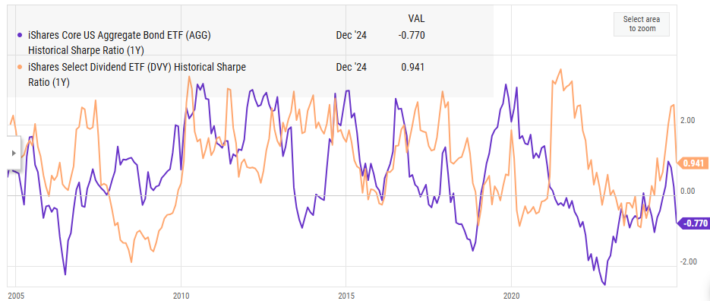

The trailing 1-year Sharpe Ratio for dividend shares and bonds might be seen under.

Supply: YCharts

With regards to dividend shares vs. bonds, dividend shares have a better 1-year Sharpe Ratio.

Whereas it seems that dividend shares are likely to have a better Sharpe Ratio than a diversified basket of bonds throughout most time durations, there are notable stretches (together with the 2007-2009 monetary disaster) the place this didn’t maintain true.

Certainly, dividend shares have outperformed bonds over the previous decade. This development is best illustrated under.

Supply: YCharts

Prior to now 10 years, DVY has generated a complete annualized return of 9.10%, almost eight proportion factors greater than AGG.

In consequence, the dividend shares vs. bonds battle appears to have a transparent winner, at the least so far as the previous decade goes.

There are two the reason why we stay far extra bullish on dividend shares than on bonds:

- Dividend shares have delivered greater absolute returns than bonds throughout all significant time durations. Generally, ‘risk-adjusted returns’ aren’t a very powerful metric in the event that they expose you to the chance of compounding your wealth at charges which are extremely insufficient. For example, the 10-year U.S. Treasury bond yields about 4.14% whereas many dividend shares have greater dividend yields.

- We’re coming to the top of a multi-decade bull market in bonds. Bond costs fall whereas rates of interest rise, and it’s possible the Federal Reserve will proceed to lift rates of interest shifting ahead, to decrease inflation.

Altogether, we stay satisfied that dividend development investing is likely one of the greatest methods to compound particular person wealth. With that stated, there are counter-arguments to shares versus bonds.

The subsequent part of this text will describe actionable strategies that buyers can use to enhance the risk-adjusted returns of their funding portfolios.

Enhancing Danger-Adjusted Returns

Wanting again to the method for the Sharpe Ratio, there are mathematically 3 ways to extend this metric:

- Enhance funding returns

- Scale back the risk-free price of return

- Scale back portfolio volatility

Whereas these three components are mathematical variables, buyers truly haven’t any management over the risk-free price of return. Accordingly, this part will concentrate on rising funding efficiency and decreasing portfolio volatility.

Many buyers mistakenly consider that they haven’t any management over the efficiency of their investments and resort to index investing (extra particularly, ETF investing) to match the efficiency of some benchmark.

This isn’t essentially the case. There are lots of traits that buyers can make the most of to extend portfolio returns.

One instance is the statement that shares with steadily rising dividends are likely to outperform the market. Firms which are capable of improve their annual dividend funds for years (and even a long time) clearly have a sturdy aggressive benefit which permits them to stay extremely worthwhile by way of varied market cycles.

Accordingly, we view a protracted dividend historical past as an indication of a high-quality enterprise.

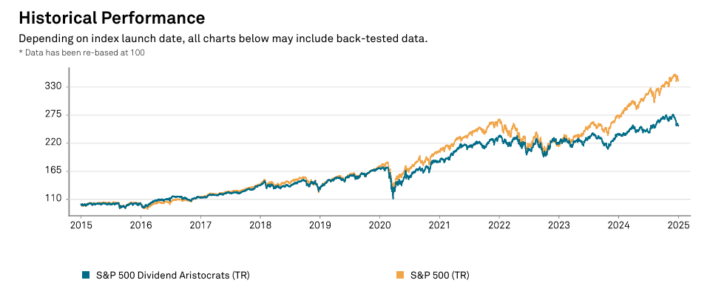

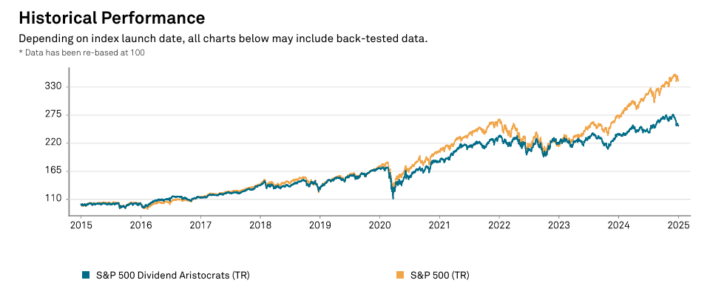

There isn’t any higher instance of this than the aforementioned Dividend Aristocrats, which have almost matched the efficiency of the S&P 500 whereas producing much less volatility – a development which is proven under.

Supply: S&P Reality Sheet

Buyers may additionally think about investing within the much more unique Dividend Kings. To be a Dividend King, an organization should have 50+ years of consecutive dividend will increase – twice the requirement to be a Dividend Aristocrat.

You may see the complete listing of all 54 Dividend Kings right here.

For a extra broad universe of shares, the Dividend Achievers Checklist incorporates roughly ~400 shares with 10+ years of consecutive dividend will increase.

Apart from investing in high-quality companies, buyers may enhance returns by investing in shares which are low-cost in comparison with each the remainder of the market and the inventory’s historic common.

The standard metric that’s used to measure valuation is the price-to-earnings ratio, however dividend yields are also indicative of an organization’s present valuation.

If a inventory is buying and selling above its long-term common dividend yield, its valuation is extra enticing. For this reason the Positive Dividend Publication ranks shares by dividend yield in response to The 8 Guidelines of Dividend Investing.

Lastly, buyers may enhance risk-adjusted returns by decreasing portfolio volatility. The best technique to cut back portfolio volatility is to well diversify throughout industries and sectors.

Mathematically, one of the simplest ways to scale back portfolio volatility is by investing in pairs of shares which have the bottom correlation.

Portfolio volatility may also be decreased by investing in corporations with low inventory value volatility.

Shares with sturdy complete return potential however low inventory value volatility embody Johnson & Johnson (JNJ), Hormel Meals (HRL), and The Coca-Cola Firm (KO).

Last Ideas

The dividend shares vs. bonds debate will possible rage for a while. At Positive Dividend, we consider dividend development shares are one of the simplest ways to speculate for long-term wealth creation.

Dividend development investing is a lovely funding technique on each an absolute foundation and a risk-adjusted foundation. This will help the newbie investor get began constructing their dividend development portfolio:

As well as, the next Positive Dividend lists comprise many extra high quality dividend shares to think about:

- The Excessive Yield Dividend Kings Checklist is comprised of the 20 Dividend Kings with the best present yields.

- The Blue Chip Shares Checklist: shares that qualify as Dividend Achievers, Dividend Aristocrats, and/or Dividend Kings

- The Excessive Dividend Shares Checklist: shares that attraction to buyers within the highest yields of 5% or extra.

- The Month-to-month Dividend Shares Checklist: shares that pay dividends each month, for 12 dividend funds per yr.

- The Dividend Champions Checklist: shares which have elevated their dividends for 25+ consecutive years.

Word: Not all Dividend Champions are Dividend Aristocrats as a result of Dividend Aristocrats have further necessities like being in The S&P 500.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].