Published on November 2nd, 2022, by Quinn Mohammed

The Dividend Kings are a group of just 48 stocks that have increased their dividends for at least 50 years in a row. We believe the Dividend Kings are among the highest-quality dividend growth stocks to buy and hold for the long term.

With this in mind, we created a full list of all the Dividend Kings. You can download the full list, along with important financial metrics such as dividend yields and price-to-earnings ratios, by clicking the link below:

The newest member to join this list is V. F. Corporation (VFC), an apparel company that has been in business for 123 years.

This article will discuss the company’s business overview, growth prospects, competitive advantages, and expected returns.

Business Overview

V.F. Corporation is a giant in the apparel industry. The company’s annual sales amount to nearly $12 billion, but the company has humble beginnings. It started all the way back in 1899 and has seen many twists and turns in the 123 years since.

The company was first started by John Barbey and a group of investors. Together, they created the Reading Glove and Mitten Manufacturing Company. During the 1960s, the company adopted its current name, V.F. Corporation. It has a highly diverse product portfolio with many category-leading brands.

In 2019, V.F. Corp separated its VF’s Jeanswear organization, including the Wrangler, Lee, and Rock & Republic brands. The separation was completed via a 100% distribution of shares to V.F. Corp shareholders, with the new entity named Kontoor Brands trading as an independent, publicly-traded company under the ticker KTB.

Source: Investor Presentation

The stock has performed very poorly this year due to the effect of 40-year high inflation on the company’s costs, on consumer spending and on the valuation of the stock. There are also fears that the interest rate hikes of the Fed may cause a recession, which would likely weigh heavily on V.F. Corp.

On October 26th, V.F. Corp reported second-quarter 2023 results, and revenue came in at $3.1 billion, a 4% decline over the prior year period. However, revenue was up 2% in constant currency. The North Face brand generated $951 million in revenue, which was up 8% year-over-year.

In the first six months of fiscal 2023, The North Face brand has grown revenue by 15%, while the Vans, Timberland, and Dickies brands all saw revenues decline. The company’s Other Brands also grew revenue by 6% year-over-year in the first six months.

Adjusted operating income equaled $379 million compared to $534 million previously, while adjusted earnings-per-share equaled $0.73 versus $1.11 prior.

V.F. Corp also reduced its fiscal 2023 guidance, anticipating adjusted earnings-per-share of $2.40 to $2.50, down from previous guidance of $3.05 to $3.15.

We now expect the company to earn $2.40 per share for fiscal 2023, which is at the lower end of updated guidance.

Growth Prospects

V.F. Corp has multiple avenues for future growth, which include acquisitions, a renewed focus on core brands, and growth through e-commerce.

The company acquired Timberland in 2011 and completed its $820 million purchase of Williamson-Dickie Manufacturing Co in 2017. Also, the company acquired Supreme on December 28th, 2020. Acquisitions are an evident and important part of V.F. Corp’s growth strategy, and we expect it will remain so.

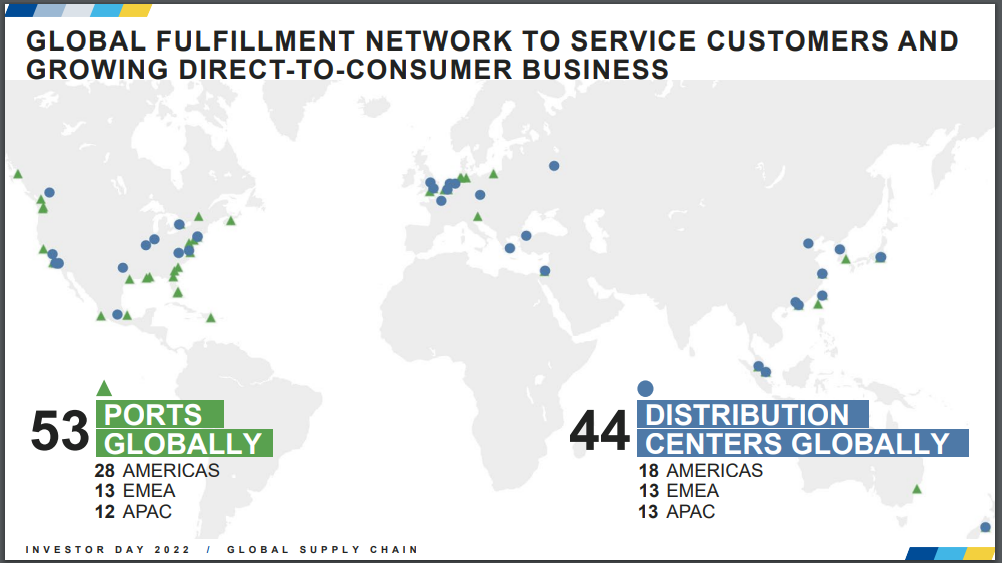

Source: Investor Presentation

V.F. Corporation also makes use of divestitures when it sees fit. For example, V.F. Corp completed the announced spinoff of its Wrangler, Lee and outlet businesses into a separate company called Kontoor Brands, Inc. (KTB) in 2019.

Jeans had been a very tough business for V.F. Corp. Removing these underperforming brands allowed V.F. Corp to focus on its core brands. Other divestitures include Terra, Kodiak, Red Kap, and others.

Source: Investor Presentation

The company is currently being weighed down by the impact of high inflation on its business, but this is likely to be a temporary headwind.

We expect V.F. Corp to grow its earnings-per-share by 7.0% per year on average over the next five years.

Competitive Advantages & Recession Performance

There are a few key competitive advantages that have fueled V.F. Corp’s impressive growth for so many years. First are its strong brands–the company has several well-known, premium brands that lead their respective categories. This gives the company pricing power.

In addition, V.F. Corp benefits from operating in a steady industry. Many of the products V.F. Corp sells—such as workwear–have not changed much (if at all) in the past 100 years.

These qualities help V.F. Corp remain profitable, even during recessions. For example, V.F. Corp kept on raising its dividend through the Great Recession, thanks to its consistent profitability.

The company’s earnings during the Great Recession are below:

- 2007 earnings-per-share of $1.35

- 2008 earnings-per-share of $1.39 (3% increase)

- 2009 earnings-per-share of $1.29 (7% decline)

- 2010 earnings-per-share of $1.61 (25% increase)

V.F. Corp experienced a mild earnings decline in 2009 but returned to strong growth in 2010 and beyond.

The company has the ability to remain profitable even during economic downturns. This gives it the ability to continue raising its dividend each year, even when business conditions deteriorate.

V. F. Corp has increased its dividend for 50 years now, including 2020, which was a very difficult year for the company, and the broader economy, due to the coronavirus pandemic.

Valuation & Expected Total Returns

V.F. Corp recently reduced its guidance for the fiscal year. The company expects to earn $2.40 to $2.50, which is down from prior guidance of $3.05 to $3.15. The updated guidance midpoint of $2.45 per share in fiscal 2023 would be a significant year-over-year decrease of 23% compared to fiscal 2022.

Our 2023 earnings-per-share estimate stands at $2.40 following updated guidance.

Trading at a price of $28.63, the expected EPS of $2.40 gives the stock a price-to-earnings ratio of 11.9. We have a target P/E multiple of 19.0. If shares were to close in on our target average over the next five years, then annual returns would be increased by 9.9% over this period of time.

Shares of V.F. Corp have a current dividend yield of 7.1%. Given the new annualized dividend of $2.04, the payout ratio is 85% using our base estimate of $2.40 in EPS. The company’s current payout ratio is elevated against its historical average, but the dividend payout remains safe, barring a prolonged recession.

Putting it all together, a projection of expected five-year total shareholder returns is below:

- 7.0% earnings-per-share growth

- 9.9% valuation expansion

- 7.0% dividend yield

We expect a total annual return of 21.2% through 2027. This projection is an incredible rate of return, as the earnings growth, valuation expansion, and dividend yield all add to returns meaningfully.

Final Thoughts

V.F. Corp is currently experiencing a rough patch, as is indicated by its significant share price plunge. The company’s share price has decreased by 62% year-to-date, which compares unfavorably to the S&P 500 Index’s 20% loss.

The share price plunge appears to be overstated, so the stock appears to be very attractive at this juncture, barring further earnings declines in a prolonged recession.

The company’s North Face brand is still performing well, but its other brands are experiencing softness.

Our projected total annual return of 21.2% is highly attractive and causes us to assign a buy rating on V.F. Corporation.

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].