Up to date on November 4th, 2024 by Aristofanis Papadatos

The Dividend Kings are an illustrious group of firms. These firms stand aside from the overwhelming majority of the market as they’ve raised dividends for a minimum of 50 consecutive years.

We imagine that buyers ought to view the Dividend Kings as probably the most high-quality dividend development shares to purchase for the long run.

With this in thoughts, we created a full record of all of the Dividend Kings.

You possibly can obtain the complete record, together with essential monetary metrics similar to dividend yields and price-to-earnings ratios, by clicking the hyperlink beneath:

This group is so unique that there are simply 53 firms that qualify as a Dividend King. United Bankshares (UBSI) raised its dividend for the fiftieth consecutive 12 months in 2023, becoming a member of the record of Dividend Kings.

This text will focus on the corporate’s enterprise overview, development prospects, aggressive benefits, and anticipated returns.

Enterprise Overview

United Bankshares was shaped in 1982 and since that point, has acquired greater than 30 separate banking establishments.

This deal with acquisitions, along with natural development, has allowed United to broaden right into a regional powerhouse within the Mid-Atlantic with about $30 billion in whole property, and annual income of about $1 billion.

United posted third quarter earnings on October twenty fourth, 2024, and outcomes had been first rate. Earnings-per-share edged down marginally, from $0.71 within the prior 12 months’s quarter to $0.70, however exceeded the analysts’ estimates by $0.03.

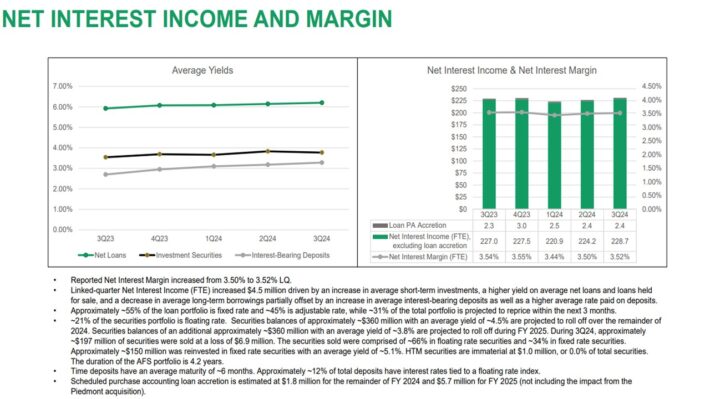

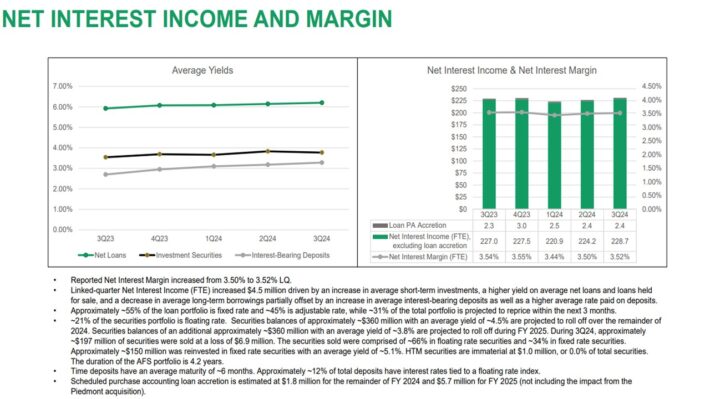

Internet curiosity margin marginally expanded on a sequential foundation, from 3.50% to three.52%.

Supply: Investor Presentation

In consequence, internet curiosity earnings grew 2% over the earlier quarter. Q3 outcomes benefited from larger common short-term investments and better yields on loans, which had been partly offset by larger deposit prices.

Whereas internet curiosity earnings edged up in the course of the quarter, provisions for mortgage losses elevated as properly. In consequence, earnings per share dipped 1%. We count on earnings per share of $2.75 within the full 12 months, which is able to mark a 1.5% enhance vs. 2023.

Development Prospects

United has did not develop its earnings per share over the past 4 years, as the corporate has struggled with translating asset and mortgage development into earnings.

The first motive behind the stagnation of the financial institution is the surge of rates of interest to 23-year highs, which have exerted strain on the web curiosity margin of the financial institution by way of excessive deposit prices amid intense competitors amongst banks for deposits.

On the brilliant facet, as inflation has lastly moderated, the Fed has simply begun to scale back rates of interest. In consequence, the web curiosity margin of United is probably going to enhance within the upcoming years.

United has at all times grown by means of acquisitions, and we don’t imagine that may change. General, due to acquisitions and an anticipated enchancment in internet curiosity margin, we count on United to develop its earnings per share by 3% per 12 months on common over the subsequent 5 years.

This development price is decrease than the three.9% common annual development price of the financial institution over the past decade however we want to be considerably conservative, given the stagnation in recent times.

Aggressive Benefits & Recession Efficiency

United’s aggressive benefit is in its robust market place within the areas it serves. It’s headquartered in West Virginia the place competitors is comparatively gentle, and it’s increasing into extra densely populated areas like northern Virginia.

That doesn’t make it immune from recessions, however its efficiency in 2008 and 2009 was exemplary, and held up in very difficult situations in 2020, whereas the financial institution thrived in 2021.

Beneath are the corporate’s earnings-per-share outcomes throughout, and after, the Nice Recession:

- 2007 earnings-per-share: $1.32

- 2008 earnings-per-share: $1.52 (15% enhance)

- 2009 earnings-per-share: $1.51 (~1% lower)

- 2010 earnings-per-share: $1.81 (20% enhance)

The corporate grew its diluted earnings-per-share in 2008, adopted by only a minor decline in 2009, which was the worst 12 months of the recession. United Bankshares then shortly rebounded with 20% earnings development in 2010.

Valuation & Anticipated Complete Returns

We count on United Bankshares to generate earnings-per-share of $2.72 in 2024. On the present share value, UBSI inventory trades for a price-to-earnings ratio of 13.7.

We see truthful worth at 12 occasions earnings, given the place peer valuations are at current. We see elevated threat for United given the comparatively weak efficiency traditionally of the corporate’s internet curiosity margin and we expect buyers pays barely much less for the inventory consequently. Shares are considerably overvalued in the intervening time.

A contracting P/E a number of may cut back annual returns by -2.6% over the subsequent 5 years. Dividends may also enhance shareholder returns. UBSI inventory is yielding 3.9% proper now.

Given additionally anticipated 3.0% common annual development of earnings per share, UBSI is anticipated to return 4.2% per 12 months by means of 2029. It is a comparatively weak anticipated price of return, which renders UBSI inventory a maintain.

Remaining Ideas

United is now anticipated to provide 4.2% annual returns within the upcoming years. The yield is enticing at 3.9% and may stay secure for years to return, so United could possibly be value a search for earnings buyers.

Nevertheless, the inventory seems considerably overvalued round its present value. In consequence, we advise buyers to attend for a considerably decrease entry level earlier than contemplating to buy this inventory.

Extra Studying

The next articles include shares with very lengthy dividend or company histories, ripe for choice for dividend development buyers:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].