Printed on August twenty seventh, 2025 by Bob Ciura

The Dividend Kings are a choose group of 56 shares which have elevated their dividends for a minimum of 50 consecutive years. We consider the Dividend Kings are among the many highest-quality dividend progress shares to purchase and maintain for the long run.

With this in thoughts, we created a full listing of all 56 Dividend Kings.

You’ll be able to obtain the total listing, together with essential monetary metrics resembling dividend yields and price-to-earnings ratios, by clicking on the hyperlink under:

Every year, we individually overview all of the Dividend Kings. The most recent member of the Dividend Kings listing is MGE Power (MGEE), which just lately elevated its dividend for the fiftieth consecutive yr.

This text will present a extra detailed evaluation of the corporate.

Enterprise Overview

Progress Prospects

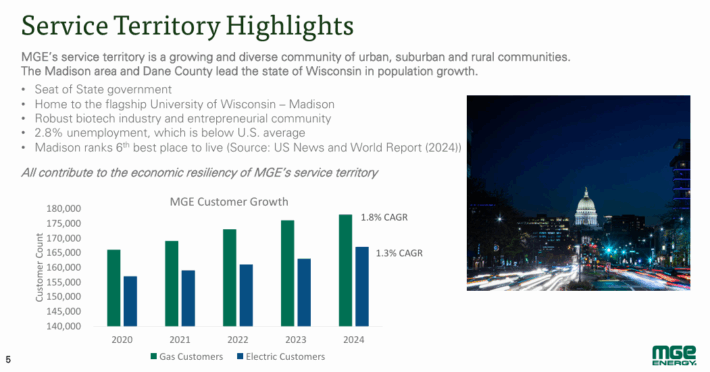

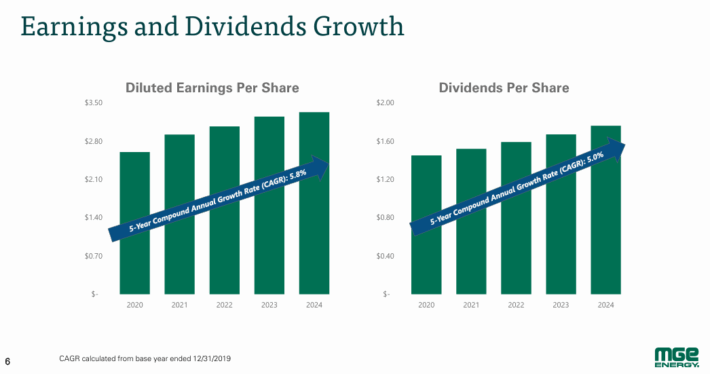

Earnings-per-share have grown persistently over the previous decade, although they did encounter a short bump within the street in 2015.

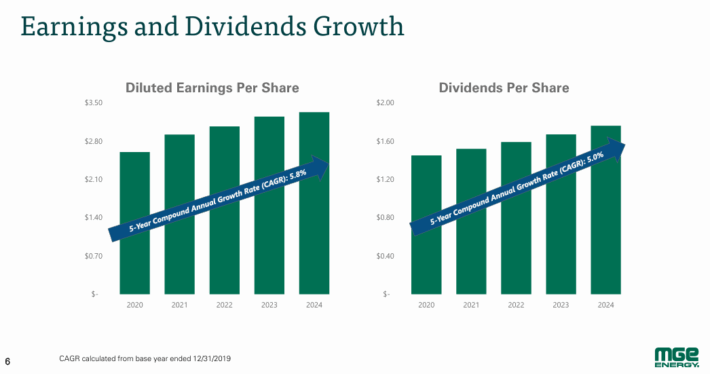

Current outcomes have been sturdy, and we consider that between its two sustainable progress catalysts of buyer acquisition and renewable asset progress, the corporate ought to have the ability to obtain mid-single-digit earnings-per-share progress going ahead.

Climate can contribute positively however can simply swing ends in the opposite path. We see mid-single-digit progress for the dividend in addition to MGE is snug with the place the payout ratio is right now.

Aggressive Benefits & Recession Efficiency

MGE’s high quality metrics have been roughly flat over the previous decade, because it doesn’t go after progress through acquisition, and its enterprise has probably not modified. Gross margins have drifted up over time however seem to have plateaued.

MGE’s curiosity protection is excellent for a utility, and we forecast this can enhance barely over time as earnings develop and MGE retains its debt at manageable ranges.

The payout ratio ought to stay round 50% as dividend progress will doubtless lag earnings progress, however the two needs to be very shut.

Supply: Investor Presentation

Total, MGE is conservatively financed and run mainly the identical manner yr after yr, that means adjustments within the high quality metrics will doubtless be few and much between. MGE’s important aggressive benefit is its digital monopoly in its service space.

Like many different utilities, MGE has a small however worthwhile service space the place it’s persevering with to develop its buyer base. That helped it maintain up effectively within the Nice Recession as earnings-per-share dipped barely however then recovered rapidly.

Earnings-per-share efficiency through the Nice Recession is under:

- 2007 earnings-per-share of $2.27

- 2008 earnings-per-share of $2.38 (4.8% improve)

- 2009 earnings-per-share of $2.21 (7.1% decline)

- 2010 earnings-per-share of $2.50 (13.1% improve)

The corporate remained extremely worthwhile through the Nice Recession. This allowed it to proceed growing its dividend yearly through the recession, even when earnings declined in 2009.

Valuation & Anticipated Returns

Utilizing the present share worth of $88 and anticipated earnings-per-share of $3.58 for the yr, MGEE inventory trades for a price-to-earnings ratio of 25.9.

Contemplating the corporate’s slow-growth nature as a utility, we consider {that a} valuation goal of 17.5 occasions earnings is a good valuation evaluation.

Subsequently, it appears that evidently MGEE inventory is considerably overvalued. We count on a contracting valuation a number of to scale back annual returns by 7.5% over the following 5 years.

Apart from adjustments within the price-to-earnings ratio, future returns shall be pushed by earnings progress and dividend yields.

We count on 5.8% annual earnings progress over the following 5 years, which is its common price of EPS progress over the previous 10 years.

As well as, MGEE inventory has a present dividend yield of two.2%. The dividend can also be well-protected, with an estimated payout ratio for 2025 of 53%.

In whole, we mission that MGEE inventory will present a complete annual return of simply 0.5% by means of 2030.

Closing Ideas

MGE seems overvalued proper now. We’re forecasting whole annualized returns for the following 5 years to be 0.5% as a number of contraction will offset the dividend and earnings-per-share progress.

MGE has didn’t develop its earnings sooner than a mid-single-digit price for some time now and seems poised to proceed rising at a mediocre price transferring ahead.

Nevertheless, the valuation is pricing in a bit extra progress than that. MGE due to this fact is rated a maintain proper now.

Moreover, the next Positive Dividend databases comprise essentially the most dependable dividend growers in our funding universe:

For those who’re on the lookout for shares with distinctive dividend traits, take into account the next Positive Dividend databases:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].