Up to date on July eighth, 2025 by Nathan Parsh

Solely one of the best firms can improve dividends by way of a number of recessions.

The Dividend Kings are a bunch of shares which have elevated their dividends for not less than 50 consecutive years. Undertaking this process is not any small feat. The truth that solely 55 firms meet the requirement to change into a Dividend King is proof of this.

You possibly can see all 55 Dividend Kings right here.

You too can obtain an Excel spreadsheet with the complete record of Dividend Kings (plus necessary metrics corresponding to price-to-earnings ratios and dividend yields) by clicking on the hyperlink beneath:

Johnson & Johnson (JNJ) has elevated its dividend for 63 consecutive years, one of many longest dividend progress streaks within the inventory market.

This healthcare big is without doubt one of the hottest dividend progress shares on account of its wonderful recession-resistant enterprise mannequin and powerful dividend observe report.

Johnson & Johnson inventory stays a superb holding for long-term dividend progress.

Enterprise Overview

Johnson & Johnson was based in 1886 and has reworked into one of many largest firms on the planet. Johnson & Johnson is a mega-cap inventory with a market capitalization of $376 billion. The corporate generates annual gross sales of $89 billion.

Johnson & Johnson operates a diversified enterprise mannequin, enabling it to attraction to a broad vary of consumers inside the healthcare sector. J&J now operates two segments: prescription drugs and medical gadgets, following the spin-off of its client well being companies.

Progress Prospects

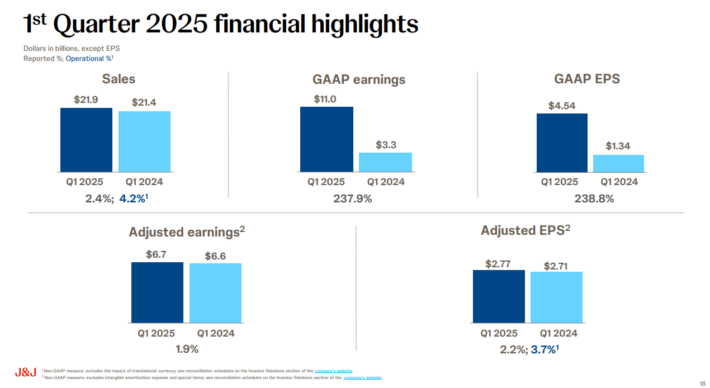

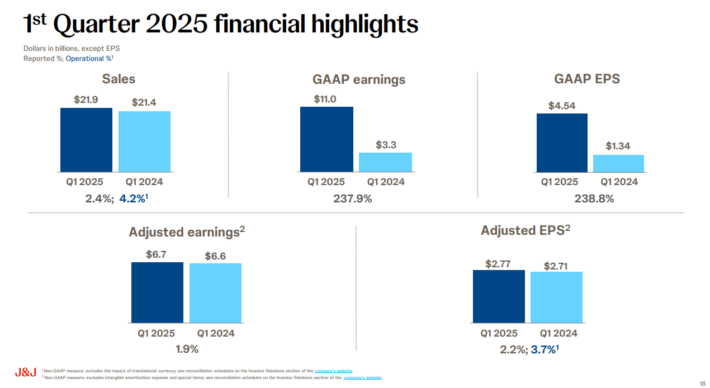

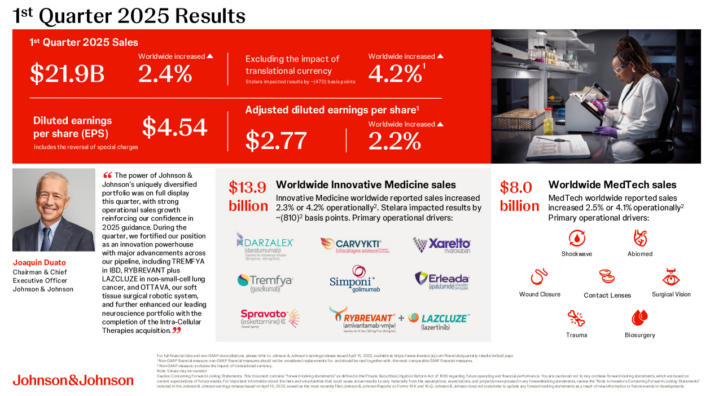

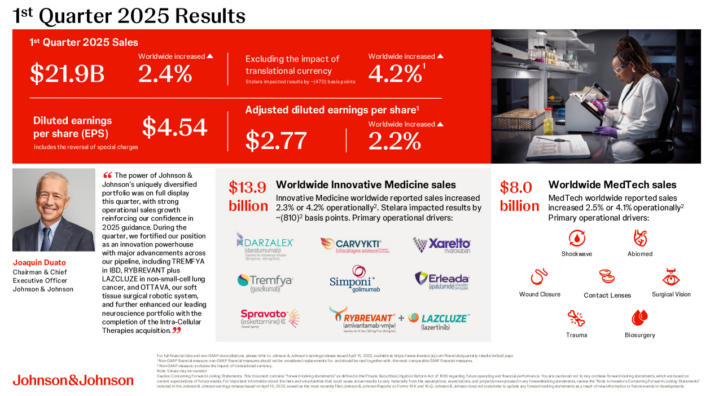

Johnson & Johnson reported first-quarter outcomes on April fifteenth, 2025.

Supply: Investor Presentation

For the interval, income grew 2.4% to $21.9 billion whereas adjusted earnings-per-share of $2.77 improved from $2.71 within the prior yr. Each outcomes topped the market’s expectations.

Regionally, U.S. gross sales elevated by 5.9%, whereas worldwide markets declined by 1.8%, leading to a 2.4% progress in complete worldwide gross sales. Adjusting for foreign money trade, income grew 4.2% worldwide.

The Progressive Medication section reported 4.2% currency-neutral progress, pushed by merchandise in oncology, cardiovascular, and metabolism. MedTech had a 4.1% improve, with progress pushed by cardiovascular and imaginative and prescient merchandise. Regardless of some slowdowns in particular product classes, each segments contributed to the corporate’s optimistic efficiency.

Johnson & Johnson revised its full-year 2025 steerage to replicate higher operational efficiency. The corporate anticipates adjusted operational EPS to be within the vary of $10.50 to $10.70, down from the beforehand reported vary of $10.75 to $10.95. Gross sales for 2025 are anticipated to develop between 3.0% and three.9%, demonstrating confidence in sustained progress regardless of short-term earnings pressures.

Supply: Investor Presentation

We anticipate Johnson & Johnson to generate 6% annual earnings-per-share progress over the following 5 years. The pharmaceutical section will proceed to be the corporate’s essential progress driver, because it has for a number of years.

Aggressive Benefits & Recession Efficiency

Johnson & Johnson has a number of benefits over its rivals.

Johnson & Johnson’s measurement and scale are unmatched in its business. It additionally has a AAA credit standing from Commonplace & Poor’s and Moody’s Buyers Service, which is greater than the U.S. authorities’s.

Microsoft Company (MSFT) is the one different firm with an AAA credit standing.

The corporate’s measurement and scale, together with its credit standing, present Johnson & Johnson with the monetary flexibility to make acquisitions that gasoline additional progress.

Johnson & Johnson additionally invests closely in analysis and growth to convey new merchandise to market. This funding has resulted within the firm’s intensive portfolio of manufacturers that lead their respective classes.

These aggressive benefits allowed Johnson & Johnson to climate a number of recessions. Listed beneath are the corporate’s earnings-per-share outcomes earlier than, throughout, and after the final main recession:

- 2006 earnings-per-share: $3.76

- 2007 earnings-per-share: $4.15 (9.4% improve)

- 2008 earnings-per-share: $4.57 (10.1% improve)

- 2009 earnings-per-share: $4.63 (1.3% improve)

- 2010 earnings-per-share: $4.76 (2.8% improve)

Johnson & Johnson had EPS progress of just about 12% from 2007 by way of 2009, a powerful accomplishment given the circumstances of the Nice Recession.

The corporate’s dividend additionally continued to develop. With six a long time of dividend progress, Johnson & Johnson is prone to proceed growing its dividend properly into the long run.

Johnson & Johnson’s aggressive benefits and recession efficiency make the inventory a superb defensive inventory.

Valuation & Anticipated Returns

With a present share value of $157 and anticipated earnings per share of $10.60 for the yr, Johnson & Johnson has a price-to-earnings ratio of 14.8.

We view the inventory as barely undervalued, with a good worth P/E estimate of 17. Growth of the P/E a number of from 14.8 to 17 would improve annual returns by 2.8% over the following 5 years.

Whole returns will even include earnings progress and dividends.

Given the corporate’s aggressive benefits and up to date enterprise efficiency, we really feel {that a} 6% common annual EPS progress charge is achievable over the following 5 years.

Lastly, Johnson & Johnson inventory has a present dividend yield of three.3%. Due to this fact, complete annual returns are anticipated to be 11.6% yearly by way of 2030.

Remaining Ideas

Few Dividend Kings are as well-known or standard amongst dividend progress buyers as Johnson & Johnson.

For good cause, Johnson & Johnson’s diversified enterprise mannequin has enabled the corporate to endure a number of recessions whereas nonetheless growing its dividends for the previous 63 years. This progress streak is sort of unmatched.

Moreover, the inventory is buying and selling at a really engaging valuation, in our opinion. Total, projected returns earn the inventory a purchase suggestion.

The next articles comprise shares with very lengthy dividend or company histories, ripe for choice for dividend progress buyers:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].