Up to date on July ninth, 2025 by Nathan Parsh

An organization will need to have an extended observe report of producing regular dividend development, even throughout recessions, to turn into a dividend king. That is removed from a straightforward job, which makes it all of the extra spectacular.

It needs to be no shock that we think about the Dividend Kings to be among the many highest-quality dividend shares in your complete inventory market.

With this in thoughts, we created a full checklist of all 55 Dividend Kings, together with essential monetary metrics reminiscent of dividend yields, payout ratios, and price-to-earnings ratios. You’ll be able to obtain the total checklist by clicking on the hyperlink under:

Real Components Firm (GPC) has elevated its dividend for 69 consecutive years, giving it one of many longest streaks of annual dividend raises in your complete inventory market. It has achieved this development with a high model in an trade that has seen constant development over a few years. A transparent path stays forward for continued development, significantly as autos age.

Real Components inventory seems barely undervalued at current, providing a yield above the market common and a excessive chance of continued dividend hikes for a few years, along with a sturdy development forecast.

Enterprise Overview

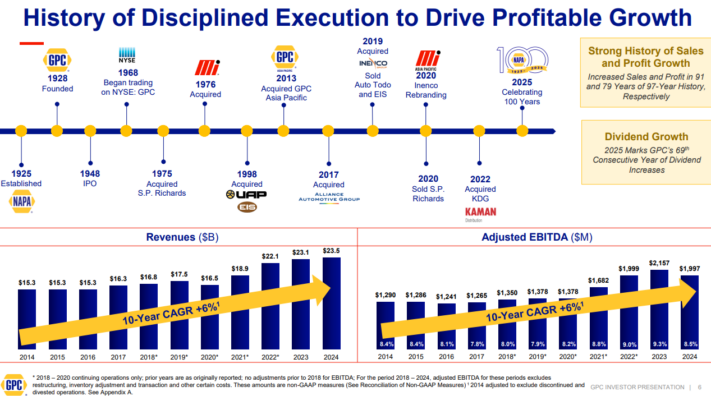

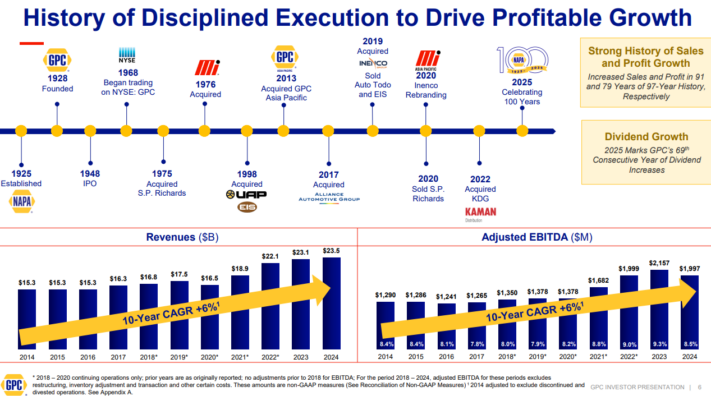

Real Components traces its roots again to 1928, when Carlyle Fraser bought Motor Components Depot for $40,000. He renamed it, Real Components Firm. The unique Real Components retailer had annual gross sales of simply $75,000 and employed solely six individuals.

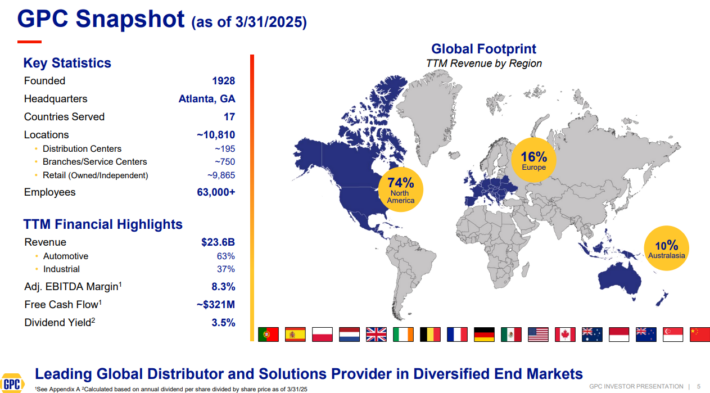

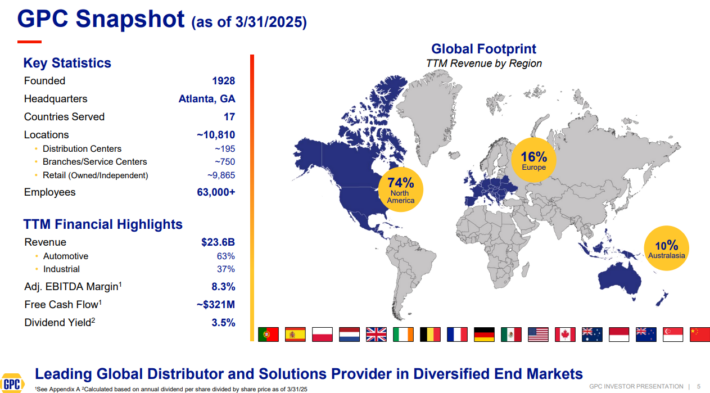

Immediately, Real Components has the world’s largest world auto elements community, with greater than 10,800 places worldwide. As a significant distributor of automotive and industrial elements, Real Components generates annual income of practically $24 billion.

Supply: Investor Presentation

It operates two segments: automotive (which incorporates the NAPA model) and the economic elements group, which sells industrial alternative elements to MRO (upkeep, restore, and operations) and OEM (authentic gear producer) clients. Prospects are derived from a variety of segments, together with meals and beverage, metals and mining, oil and gasoline, and well being care.

On April 22, 2025, the corporate reported its first-quarter 2025 outcomes, with gross sales reaching $5.9 billion, a 1.7% improve from the identical interval within the earlier yr. Nevertheless, internet earnings fell to $194 million, or $1.40 per diluted share, down from $249 million, or $1.78 per diluted share, in Q1 2023. Adjusted diluted earnings per share (EPS) additionally decreased to $1.75 in comparison with $2.22 final yr. Restructuring prices and the continuing integration of acquired unbiased automotive shops drove this decline.

Development Prospects

Real Components is primed for fulfillment, because the setting for auto alternative elements is extremely supportive of development. Shoppers are holding onto their vehicles longer and are more and more making minor repairs to maintain their vehicles on the street for longer, relatively than shopping for new vehicles.

As the common value of car restore will increase with a automobile’s age, this instantly advantages Real Components. As newer autos turn into more and more costly, clients usually tend to maintain older vehicles for longer.

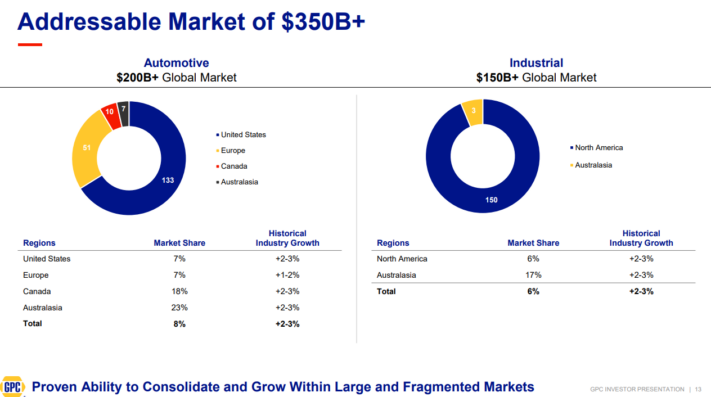

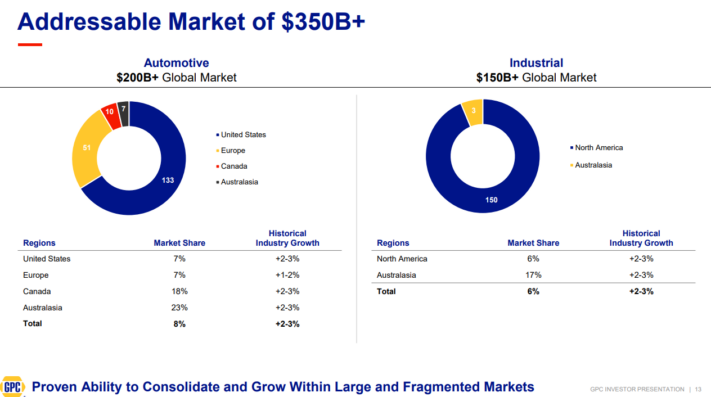

In response to Real Components, autos aged six years or older now symbolize nearly all of vehicles on the street, which bodes very nicely for Real Components. As well as, the entire addressable marketplace for automotive aftermarket services and products, in addition to trade merchandise, is big and fragmented, leaving loads of alternative for enlargement.

Supply: Investor Presentation

Real Components has a large portion of the $200 billion and rising automotive aftermarket enterprise. One particular approach Real Components has captured market share on this house has traditionally been by way of acquisitions.

Real Components continuously acquires smaller corporations within the U.S. and worldwide markets to spice up market share in present classes or broaden into new areas. All through its historical past, Real Components has made a number of acquisitions.

Supply: Investor Presentation

These acquisitions have helped result in earnings development in every of the final 10 years. For instance, Real Components acquired Alliance Automotive Group for $2 billion. Alliance is a European distributor of car elements, instruments, and workshop gear.

This was a beautiful acquisition, as Alliance Automotive holds a high 3 market share place in Europe’s largest automotive aftermarkets: the U.Okay., France, and Germany. The deal added $1.7 billion of annual income to Real Components, together with extra earnings development potential from value synergies.

In 2018, Real Components agreed to purchase Hennig Fahrzeugteile, a Germany-based provider of elements for gentle and business autos. The acquisition expanded Real Components’ attain in Europe and in addition gave it additional publicity to the business market. Real Components expects the acquired firm to spice up its annual gross sales by $190 million.

Extra just lately, Real Components has made a number of acquisitions which can be anticipated to strengthen the corporate’s management place in numerous markets. In 2019, Real Components accomplished its acquisition of PartsPoint, a number one distributor of automotive aftermarket elements and equipment based mostly within the Netherlands.

The corporate accomplished its buy of main industrial distributor Inenco in 2019. Inenco has operations in Australia, New Zealand, and Indonesia. Later that month, Real Components introduced it was including Todd Group, a pacesetter within the heavy-duty aftermarket section in France.

In 2022, the corporate accomplished its $1.3 billion acquisition of Kaman Distribution Group, increasing its portfolio of alternative elements.

Real Components divested its S.P. Richards US operations and its Security Zone and Influence Merchandise operations in 2020. It continues to optimize its portfolio, specializing in its core automotive and industrial elements companies.

General, Real Components’ a number of acquisitions have clearly contributed to the corporate’s long-term development. The outcomes of Real Components’ development technique communicate for themselves. We anticipate Real Components to generate 8% annual earnings-per-share development over the following 5 years.

Aggressive Benefits & Recession Efficiency

The largest problem going through the economic system continues to be provide chain points stemming from the pandemic; nonetheless, because the economic system recovers, Real Components’ outcomes are additionally enhancing. To this point, Real Components seems to not have been closely impacted by these points.

The opposite risk to bodily retailers is e-commerce competitors, however automotive elements retailers reminiscent of NAPA are usually not uncovered to this threat. Automotive repairs are sometimes advanced, difficult duties. NAPA is a number one model, thanks partially to its popularity for high quality merchandise and repair. It’s useful for purchasers to have the ability to ask inquiries to certified employees, which provides Real Components a aggressive benefit.

Real Components has a management place throughout its companies. All of its working segments symbolize the #1 or #2 model in its respective class. This results in a powerful model and regular demand from clients.

Real Components’ earnings-per-share throughout the Nice Recession are under:

- 2007 earnings-per-share of $2.98

- 2008 earnings-per-share of $2.92 (2.0% decline)

- 2009 earnings-per-share of $2.50 (14% decline)

- 2010 earnings-per-share of $3.00 (20% improve)

Earnings per share declined considerably in 2009, which ought to come as no shock. Shoppers are inclined to tighten their belts when the economic system enters a downturn.

That mentioned, Real Components remained extremely worthwhile all through the recession and returned to development in 2010 and past. The corporate additionally generated money circulation throughout the coronavirus pandemic, which allowed it to lift its dividend in 2020.

Given their consumable nature, there has at all times been a sure degree of demand for automotive elements, which provides Real Components’ earnings a excessive flooring.

Valuation & Anticipated Returns

Based mostly on our anticipated earnings per share of $7.75 for 2025, Real Components has a price-to-earnings ratio of 16.4. Our honest worth estimate for Real Components is a price-to-earnings ratio of 15.0. Because of this, Real Components seems overvalued at the moment. A number of contractions might scale back annual returns by 1.8% per yr over the following 5 years.

Happily, Real Components’ whole returns may even embrace earnings development and dividends.

We anticipate Real Components to develop its earnings per share by 8% yearly over the following 5 years. The inventory has a 3.2% present yield, which is considerably larger than the common yield of the S&P 500 Index. Moreover, Real Components raises its dividend every year, together with a 3% improve in 2025. Real Components Firm’s dividend development streak now stands at 69 consecutive years.

Real Components has a extremely sustainable dividend. The corporate has paid a dividend yearly since its preliminary public providing in 1948. The dividend is more likely to proceed rising for a few years to come back. That mentioned, traders must also think about the affect of valuation relating to a inventory’s whole returns.

In whole, Real Components is anticipated to ship an annual whole return of 8.9% by way of 2030.

Ultimate Ideas

Real Components has an extended historical past of regular development, benefiting from the rising demand for automotive elements. The growing old automobile fleet within the U.S. is anticipated to proceed rising shifting ahead. Within the meantime, shareholders ought to obtain annual dividend will increase as has been the case for practically seven many years.

We discover the inventory to be barely overvalued right this moment, which means that now might not be the best time to purchase Real Components. Whereas the dividend yield stays stable and the corporate has an extended historical past of dividend development, we charge shares of Real Components as a maintain on account of projected returns.

Extra Studying

The next databases of shares include shares with very lengthy dividend or company histories, ripe for choice for dividend development traders.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].