Printed on October twenty ninth, 2024 by Aristofanis Papadatos

The Dividend Kings include corporations which have raised their dividends for at the very least 50 years in a row. Due to their unparalleled streak of annual dividend will increase, it is not uncommon to view the Dividend Kings as among the many finest dividend development shares within the inventory market.

You possibly can see the complete listing of all 53 Dividend Kings right here.

We additionally created a full listing of all Dividend Kings, together with related monetary statistics like dividend yields and price-to-earnings ratios. You possibly can obtain the complete listing of Dividend Kings by clicking on the hyperlink under:

Consolidated Edison (ED) just lately elevated its dividend for the fiftieth consecutive yr. Consequently, the corporate now joins the unique listing of Dividend Kings.

Through the years, utilities have turn out to be relied upon for his or her regular dividend payouts, even throughout recessions. This text will analyze the corporate’s enterprise overview, future development prospects, aggressive benefits, and extra.

Enterprise Overview

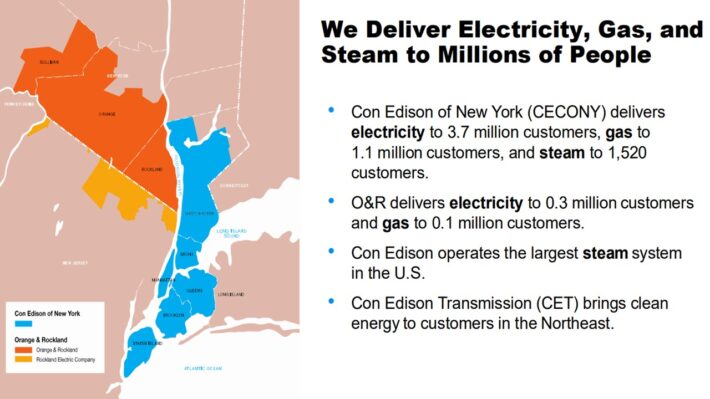

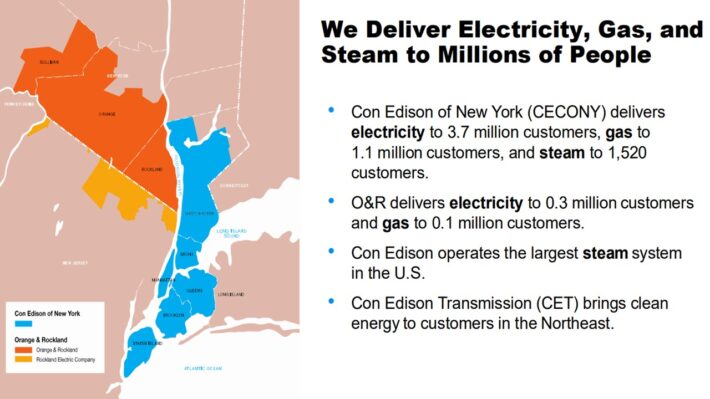

Consolidated Edison is a large-cap utility inventory. The corporate generates practically $15 billion in annual income and has a market capitalization of roughly $36 billion.

The corporate serves 3.7 million electrical prospects, and one other 1.1 million fuel prospects, in New York.

Supply: Investor Presentation

It operates electrical, fuel, and steam transmission companies, with a steam system that’s the largest within the U.S.

On October 1st, 2022, Consolidated Edison introduced that it was promoting its curiosity in its renewable vitality enterprise to RWE Renewables Americas, LLC for $6.8 billion. The transaction closed final yr.

On account of this transaction, Consolidated Edison has not issued frequent inventory in every of the final two years. The corporate sometimes points shares for financing frequently.

On August 1st, 2024, Consolidated Edison introduced second quarter outcomes for the interval ending June thirtieth, 2024. In the course of the quarter, income grew 9% to $3.22 billion, which was $92 million greater than anticipated.

Adjusted earnings of $203 million, or $0.59 per share, had been 3% decrease than adjusted earnings of $210 million, or $0.61 per share, within the earlier yr. Adjusted earnings per share exceeded the analysts’ estimates by $0.02.

As with prior durations, increased price bases for fuel and electrical prospects had been the first contributors to leads to the CECONY enterprise, which accounts for the overwhelming majority of the corporate’s property.

Nonetheless, the denial of approval to capitalize prices associated to the implementation of the brand new buyer billing and knowledge programs was a headwind to outcomes.

Common price base balances are anticipated to develop by 6.4% per yr on common between 2024 and 2028, up from 6% beforehand. Consolidated Edison expects capital investments of practically $28 billion in the course of the interval 2024-2028.

In its newest convention name, Consolidated Edison reaffirmed its steerage for 2024. The corporate expects adjusted earnings per share in a spread of $5.20 to $5.40 for 2024. On the midpoint, the steerage implies 4.5% development over the prior yr.

Development Prospects

Earnings development throughout the utility business sometimes mimics GDP development. Over the following 5 years, we count on Consolidated Edison to develop earnings per share by 4.0% per yr.

The corporate has offered steerage for five%-7% common annual development of earnings per share throughout 2024-2028 however we favor to be considerably conservative, given the 9-year common annual development price of three.8% of the utility.

We count on ConEd to proceed its sample of modest development shifting ahead. ConEd ought to proceed to generate modest earnings development annually by way of a mix of latest buyer acquisitions and price will increase, helped by the gradual enchancment of the U.S. financial system.

The expansion drivers for Consolidated Edison are new prospects and price will increase. One good thing about working in a regulated business is that utilities are permitted to boost charges frequently, which nearly assures a gradual degree of development.

Supply: Investor Presentation

Consolidated Edison expects to develop its price base by 6.4% per yr on common by way of 2028. This can be a pure approach for a utility to generate regular income and earnings development.

One potential risk to future development is excessive rates of interest, which might enhance the price of capital for corporations that make the most of debt, resembling utilities.

The Fed simply decreased rates of interest due to a moderation of inflation and expects to cut back charges additional, from 4.75%-5.0% to 2.75%-3.0% in 2026.

Decrease rates of interest assist corporations that rely closely on debt financing, resembling utilities, so buyers don’t must be involved about Consolidated Edison in a falling-rate cycle.

Even when charges stay elevated, Consolidated Edison is in sturdy monetary situation. It has an investment-grade credit standing of A-, and a modest capital construction with balanced debt maturities over the following a number of years.

A wholesome stability sheet and robust enterprise mannequin assist present safety to Consolidated Edison’s dividends.

Traders can moderately count on low single-digit dividend will increase annually, at a price just like the corporate’s annual adjusted earnings-per-share development.

Aggressive Benefits & Recession Efficiency

Consolidated Edison’s principal aggressive benefit is the excessive regulatory hurdles of the utility business. Electrical energy and fuel providers are mandatory and very important to society.

Consequently, the business is extremely regulated, making it nearly inconceivable for a brand new competitor to enter the market. This gives a substantial amount of certainty to Consolidated Edison.

As well as, the utility enterprise mannequin is extremely recession-resistant. Whereas many corporations skilled massive earnings declines in 2008 and 2009, Consolidated Edison held up comparatively nicely. Earnings per share in the course of the Nice Recession are proven under:

- 2007 earnings-per-share of $3.48

- 2008 earnings-per-share of $3.36 (3% decline)

- 2009 earnings-per-share of $3.14 (7% decline)

- 2010 earnings-per-share of $3.47 (11% enhance)

Consolidated Edison’s earnings fell in 2008 and 2009 however recovered in 2010. The corporate nonetheless generated wholesome earnings, even in the course of the worst of the financial downturn.

This resilience allowed Consolidated Edison to proceed elevating its dividend annually.

The identical sample held up in 2020 when the U.S. financial system entered a recession because of the coronavirus pandemic. ConEd has remained extremely worthwhile, with report earnings per share in every of the final three years, which has allowed the corporate to boost its dividend yearly.

Valuation & Anticipated Returns

Utilizing the present share worth of ~$105 and the midpoint of 2024 steerage, the inventory trades with a price-to-earnings ratio of 19.8. That is a lot increased than our truthful worth estimate of 16.0, which is in step with the 10-year common price-to-earnings ratio for the inventory.

Consequently, Consolidated Edison shares seem like overvalued. If the inventory valuation retraces to the truthful worth estimate, the corresponding a number of contractions would scale back annualized returns by 4.2%.

Thankfully, the inventory might nonetheless present constructive returns to shareholders, by way of earnings development and dividends. We count on the corporate to develop earnings per share by 4.0% per yr over the following 5 years. As well as, the inventory has a present dividend yield of three.2%.

Utilities like ConEd are prized for his or her steady dividends and secure payouts. Placing all of it collectively, Consolidated Edison’s whole anticipated returns might appear to be the next:

- 0% earnings development

- -4.2% a number of reversion

- 2% dividend yield

Added up and Consolidated Edison is predicted to return 2.9% per yr on common over the following 5 years. This can be a modest price of return, however not excessive sufficient to warrant a purchase advice.

Earnings buyers might discover the yield enticing, as the present yield is meaningfully increased than the 1.2% yield of the S&P 500 Index and grows very constantly. The corporate has a projected payout ratio of 63%, which signifies a sustainable dividend.

However, we price the inventory a maintain on the present valuation.

Last Ideas

Consolidated Edison is usually a useful holding for revenue buyers, resembling retirees, due to its 3.2% dividend yield. The inventory presents safe dividend revenue, and can also be a Dividend King, which means it ought to increase its dividend annually.

Due to this fact, risk-averse buyers trying primarily for revenue proper now–resembling retirees–might see better worth in shopping for utility shares like Consolidated Edison. Nonetheless, we price the inventory as a promote at at present’s present worth of $105.

Further Studying

The next articles comprise shares with very lengthy dividend or company histories, ripe for choice for dividend development buyers:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].