Up to date on February twenty second, 2022 by Prakash Kolli

For superior long-term returns, buyers ought to concentrate on high-quality dividend progress shares. This involves thoughts when reviewing the Dividend Aristocrats, a choose group of 66 corporations within the S&P 500 Index with at the least 25 consecutive years of dividend will increase.

We’ve got created a free Excel checklist of all 66 Dividend Aristocrats, together with related monetary metrics comparable to P/E ratios and dividend payout ratios.

You possibly can obtain the complete checklist by clicking on the hyperlink under:

We assessment all 66 Dividend Aristocrats every year. The 2022 Dividend Aristocrats In Focus collection continues with beverage large The Coca-Cola Firm (KO).

Not solely is Coca-Cola a Dividend Aristocrat, it’s a Dividend King as effectively. The Dividend Kings have elevated their dividends for 50+ consecutive years. You possibly can see all of the Dividend Kings right here.

Coca-Cola has a dividend yield of two.7%, which is significantly larger than the S&P 500 Index common yield of 1.4%. As well as, Coca-Cola is prone to proceed elevating its dividend every year.

However it is a tough time for Coca-Cola. Client preferences are altering, and soda consumption continues to wane within the U.S. As a result of Coca-Cola’s earnings progress has slowed, the inventory continues to look overvalued. Nonetheless, it stays a high-quality enterprise with sturdy manufacturers, and a beautiful dividend yield.

Associated: Canines of the Dow: the best yielding Dow Jones 30 shares.

As well as, it has been diversifying away from glowing drinks in recent times and people efforts have paid off. This text will look at Coca-Cola’s funding prospects intimately.

Enterprise Overview

Coca–Cola is the world’s largest beverage firm, because it owns or licenses greater than 500 distinctive non–alcoholic manufacturers and 200 grasp manufacturers. For the reason that firm’s founding in 1886, it has unfold to greater than 200 international locations worldwide. It presently has a market capitalization of greater than $270 billion, making it a mega-cap inventory.

Associated: See detailed evaluation on the highest beverage shares.

Its manufacturers account for about 2 billion servings of drinks worldwide every single day, producing roughly $36 billion in annual income. It additionally has 20 manufacturers that every generate $1 billion or extra in annual gross sales.

The glowing beverage portfolio contains the flagship Coca-Cola model, in addition to different soda manufacturers like Weight loss plan Coke, Sprite, Fanta, and extra. The nonetheless beverage portfolio contains water, juices, and ready-to-drink teas, comparable to Dasani, Minute Maid, Vitamin Water, and Trustworthy Tea.

Supply: Investor Presentation

Coca-Cola dominates glowing delicate drinks. The corporate is making an attempt to keep up and even enhance this dominant place with product extensions of current in style manufacturers, together with lowered and zero-sugar variations of manufacturers like Sprite and Fanta.

It is a difficult time for Coca-Cola. Gross sales of soda are slowing down in developed markets just like the U.S., the place soda consumption has steadily declined for years.

Declining soda consumption is a major risk for the corporate. Whereas Coca-Cola’s complete volumes actually nonetheless rely on glowing drinks comparable to soda, the corporate has gone to nice lengths in recent times to diversify away from its core merchandise, understanding that the long-term progress prospect for glowing drinks isn’t notably inspiring. Coca-Cola has acquired a number of nonetheless beverage manufacturers in recent times.

Coca-Cola reported 2021 fourth-quarter earnings on February tenth. World unit case quantity grew 9% for the quarter, however income elevated 10% year-over-year, pushed by 10% progress in value/combine offset by a 1% decline in focus gross sales. Adjusted earnings-per-share decreased 5% for the quarter.

Development Prospects

In an effort to return to progress, Coca-Cola has invested closely outdoors of soda, in areas like juices, teas, dairy, and water, to enchantment to altering client preferences. As a result of success of its progress initiatives, we proceed to see Coca-Cola as having a good long-term progress outlook.

One motive we just like the inventory is as a result of it competes in an business that continues to develop globally in extra of the speed of broad financial progress. This results in sturdy ranges of total progress within the business, which Coca-Cola has actually been capitalizing on in recent times.

As well as, the ready-to-drink class is offered by highly-diversified channels and continues to have mid-single digit projected progress charges, each for Coca-Cola and the business. That is notably true for nonetheless drinks like tea and water. Coca-Cola’s years-old technique to diversify away from glowing drinks is because of this and it’s undoubtedly bearing fruit.

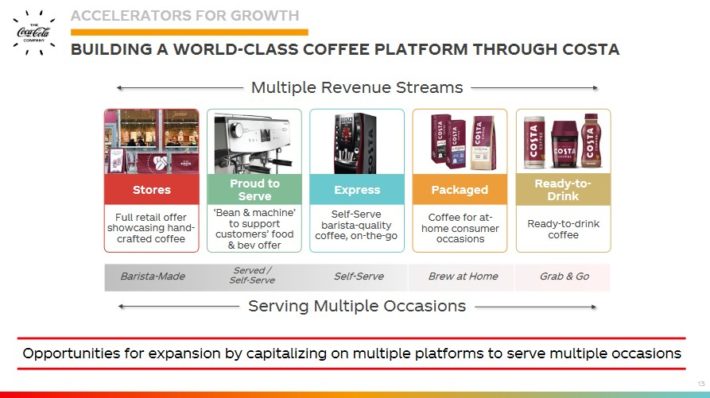

Coca-Cola additionally continues to amass manufacturers with the intention to develop, together with its sudden acquisition of Costa, a espresso model primarily based within the UK.

Supply: Investor Presentation

That is actually an out-of-the-box purchase for a glowing beverage behemoth, however Coca-Cola is doing what it takes to safe its future.

Lastly, we proceed to love the divestiture of the corporate’s bottling operations. This has resulted in some fairly vital income declines through the years, however the finish objective is way larger margins. This variation will make Coca-Cola extra worthwhile relative to its friends.

Taking all of this into consideration, along with the corporate’s ample buyback program and productiveness enchancment efforts, we see complete earnings-per-share progress of 6% yearly over the subsequent 5 years.

Aggressive Benefits & Recession Efficiency

Coca-Cola enjoys two distinct aggressive benefits, that are its sturdy model and international scale. In accordance with Forbes, Coca-Cola is the sixth-most priceless model on the earth, value over $64 billion.

As well as, Coca-Cola has an unparalleled distribution community. It has the biggest beverage distribution system on the earth. A brand new entrant can be laborious pressed to recreate this distribution system.

These benefits permit Coca-Cola to stay extremely worthwhile, even throughout recessions. The corporate held up very effectively in the course of the Nice Recession:

- 2007 earnings-per-share of $1.29

- 2008 earnings-per-share of $1.51 (17% enhance)

- 2009 earnings-per-share of $1.47 (3% decline)

- 2010 earnings-per-share of $1.75 (19% enhance)

Not solely did Coca-Cola survive the Nice Recession, it thrived. Coca-Cola grew earnings-per-share by 36% from 2007-2010. This exhibits the sturdiness and power of Coca-Cola’s enterprise mannequin. The corporate’s dividend additionally seems very protected.

Coca-Cola continued its spectacular outcomes final 12 months, when the corporate remained extremely worthwhile regardless that the U.S. economic system swung to recession.

Valuation & Anticipated Returns

We count on Coca-Cola to generate adjusted EPS of $2.45 for 2021. Primarily based on this, Coca-Cola inventory trades for a price-to-earnings ratio of 24.5. That is above our truthful worth estimate of 23X, which implies the inventory is barely overvalued. A declining P/E a number of may cut back annual returns by -1.3% over the subsequent 5 years.

The inventory will generate constructive returns by future earnings-per-share progress (estimated at 6%) plus the two.7% dividend yield. Placing all of this collectively, we count on complete annualized returns of 6.2% by 2027.

Nonetheless the inventory is presently overvalued, the corresponding contraction of the valuation a number of is predicted to scale back complete returns over the subsequent 5 years. The general result’s that we count on Coca-Cola inventory to generate respectable, albeit unspectacular, shareholder returns on the present share value.

Last Ideas

Coca-Cola has made nice strides repositioning its portfolio to satisfy altering client tastes. It has constructed a big portfolio of juices and teas, to cater to a extra health-conscious client. As well as, the Costa Espresso acquisition provides Coca-Cola a platform for increasing into coffees.

There may be extra work to be achieved to diversify away from glowing drinks, and we see much-improved progress prospects starting in 2021.

We charge the inventory a maintain since it’s overvalued, however the inventory stays a robust alternative for revenue buyers as a result of its above common dividend yield and lengthy historical past of annual dividend will increase. These qualities make Coca-Cola a time-tested Dividend Aristocrat, and a blue chip inventory.

Associated: Two’s Are Now Underestimated: The Mikan Drill for Shares.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].