Updated on March twelfth, 2025 by Nathan Parsh

Yearly, we consider the complete Dividend Aristocrats. Attaining membership to this group is hard: companies should be of a certain dimension, belong to the S&P 500 Index, and (most importantly) have at least 25 consecutive years of dividend progress.

There are merely 69 Dividend Aristocrats, proving the exclusivity of the itemizing.

Chances are you’ll get hold of an Excel spreadsheet of all 69 Dividend Aristocrats, along with important financial metrics just like P/E ratios and dividend yields, by clicking the hyperlink beneath:

Disclaimer: Sure Dividend is simply not affiliated with S&P World in any technique. S&P World owns and maintains The Dividend Aristocrats Index. The info on this text and downloadable spreadsheet is based on Sure Dividend’s private consider, summary, and analysis of the S&P 500 Dividend Aristocrats ETF (NOBL) and totally different sources, and is meant to help specific individual merchants greater understand this ETF and the index upon which it’s based. Not one of many information on this text or spreadsheet is official data from S&P World. Search the recommendation of S&P World for official information.

Albemarle Firm (ALB) joined this distinctive itemizing in 2020. The company is doubtless one of the crucial unstable names among the many many Dividend Aristocrats, nevertheless this makes its dividend progress streak way more spectacular.

This article will consider Albemarle’s funding prospects.

Enterprise Overview

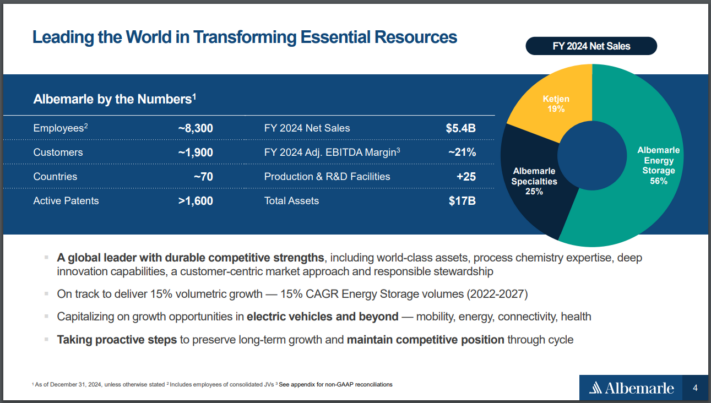

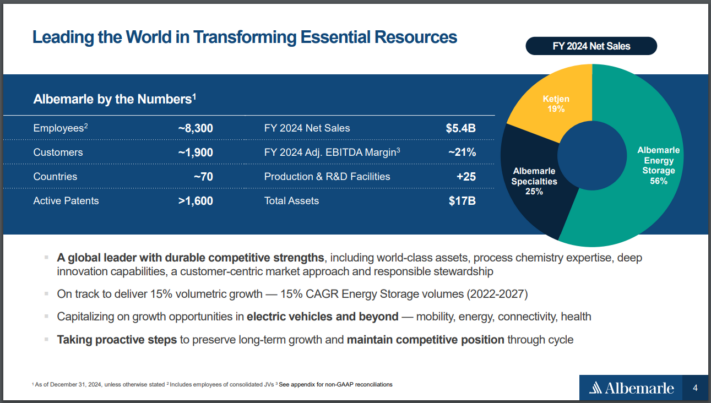

Albemarle is crucial producer of lithium and second-largest producer of bromine on the planet. The two merchandise account for the overwhelming majority of annual product sales. Albemarle produces lithium from its salt brine deposits throughout the U.S. and Chile.

The company has two joint ventures in Australia that moreover produce lithium. Albemarle’s Chile property present a extremely low-cost provide of lithium. The company operates in nearly 100 worldwide areas.

Beginning January 1st, 2023, the company reorganized into the following segments: Energy Storage, Specialties, and Ketjen.

Albemarle produces annual product sales above $5 billion.

Provide: Investor Presentation

On February twelfth, 2025, Albemarle launched fourth-quarter and full-year 2024 outcomes. For the quarter, earnings declined 48% to $1.23 billion, which was $110 million decrease than anticipated. Adjusted earnings-per-share of -$1.09 in distinction very unfavorably to $1.85 throughout the prior 12 months, which was $0.42 beneath estimates.

For the 12 months, earnings declined 44% to $5.4 billion, whereas adjusted earnings-per-share have been—$2.34 compared with $22.25 in 2023. It have to be well-known that the company had nearly $10 billion in product sales in 2023, serving to for instance that massive swings throughout the enterprise can occur rapidly.

Lower lithium prices as quickly as as soon as extra negatively impacted outcomes. For the quarter, earnings for Energy Storage decreased 63.2% to $616.8 million. Amount declined 10%, whereas prices have been down 53%.

Specialties revenues have been lower by 2.0% to $332.9 million, as a 3% enchancment in amount was offset by a value decrease. Ketjen product sales of $245 million have been down 17.4% from the prior 12 months, as a slight value improve was higher than offset by weakening amount.

Albemarle supplied an outlook for 2025 as successfully, with the company anticipating earnings in quite a lot of $4.9 billion to $5.2 billion. The company is anticipated to provide earnings-per-share of -$0.80 in 2025. We think about that Albemarle has earnings power of $3.50.

Progress Prospects

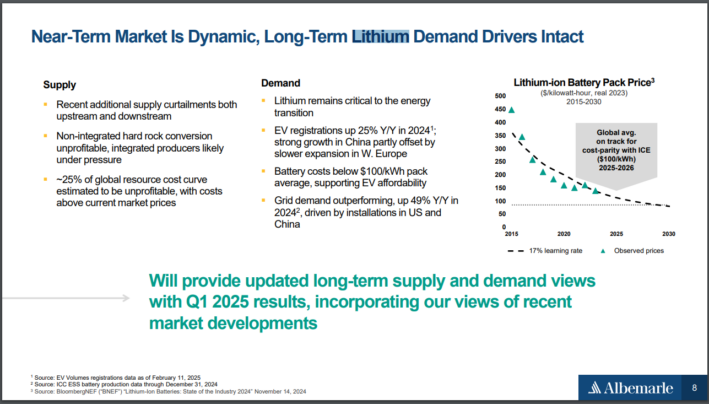

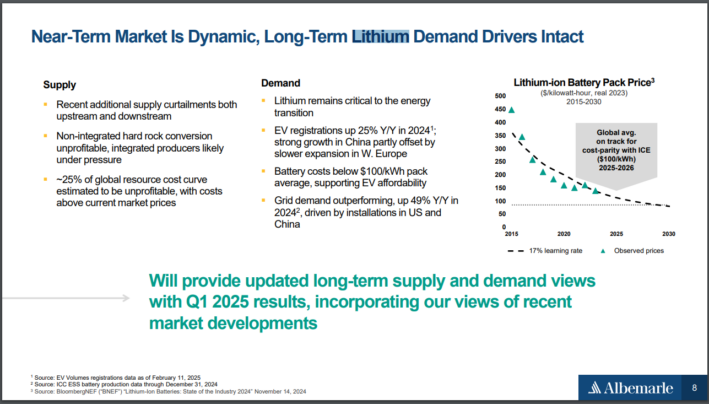

Outcomes are anticipated to be successfully above prior numbers, and Albemarle stands to study from the elevated product sales {of electrical} cars, as the company’s lithium is used to provide the batteries.

Lithium is anticipated to be a progress part over the next 5 years due to rising demand for quite a lot of capabilities, along with electrical cars and shopper electronics.

Provide: Investor Presentation

Demand for vitality storage tends to fluctuate, nevertheless the long run seems to be like promising for electrical cars as further prospects have in mind making that purchase. By 2035, electrical cars are projected to account for 26% of all cars on the freeway throughout the U.S. Battery dimension may be anticipated to develop.

With this progress will come a serious improve in demand for lithium.

As a consequence of its administration positions in lithium and bromine, we think about the company can develop earnings per share at a worth of seven.5% yearly for the next 5 years.

Aggressive Advantages & Recession Effectivity

No matter being amongst worldwide leaders in a lot of firms, Albemarle isn’t content material materials to rest on its earlier success. The company has been energetic in shopping for firms that strengthen its market share.

Albemarle is simply not a recession-proof agency. Listed beneath are the company’s earnings-per-share all through and after the ultimate recession:

- 2007 earnings-per-share of $2.41

- 2008 earnings-per-share of $2.40 (0.4% decrease)

- 2009 earnings-per-share of $1.94 (19% improve)

- 2010 earnings-per-share of $3.51 (45% improve)

The specialty chemical enterprise is carefully reliant on purchaser demand. Lower demand ends in lower pricing, which negatively impacts Albemarle’s effectivity. The company is extra prone to face a similar type of slowdown all through the next recession.

That talked about, the company has sturdy aggressive advantages. A key aggressive profit is that it ranks as crucial producer of lithium on the planet. The metallic is utilized in batteries for electrical cars, pharmaceuticals, airplanes, mining, and totally different capabilities.

Albemarle could be a excessive producer of Bromine, which is used throughout the electronics, growth, and automotive industries. The company possesses a dimension and scale that others cannot match.

Patrons involved with investing in Albemarle should understand that possession of the stock comes with risks due to the character of its enterprise.

Valuation & Anticipated Returns

Using our anticipated earnings power decide of $3.50 for the 12 months, ALB shares have a price-to-earnings ratio of 20.9. Over the previous decade, Albemarle has traded with a imply price-to-earnings ratio of 21.3.

Our a lot of objective is 18x earnings, which we actually really feel takes into consideration the demand for the company’s provides and the extreme volatility of lithium prices. If the stock have been to commerce with this objective by 2030, then valuation may very well be a 2.9% headwind to annual returns over this time interval.

In addition to, the dividend yield of two.2% will add to shareholder returns. The dividend payout is well-covered, as a result of the projected payout ratio for the 12 months is just 46% of our earnings power estimate.

Given the character of its enterprise, the company has been worthwhile at prudently managing its dividend. Albemarle has raised its dividend for 29 consecutive years.

Because of this reality, we mission that Albemarle will current an entire annual return of 6.6% over the next 5 years, stemming from 7.5% earnings progress and a starting yield of two.2% which is likely to be offset by a low single-digit headwind from a lot of contraction.

Final Concepts

Reaching Dividend Aristocrat standing isn’t any small feat. Albemarle is the dominant participant throughout the lithium enterprise. The company benefits from low-cost mines and its administration place in a lot of courses.

Albemarle is way from recession-proof and has expert some very important earnings declines over the previous decade, nevertheless this makes the company’s dividend progress observe report way more spectacular.

Whereas the company’s enterprise is likely to be unpredictable, we worth Albemarle’s shares as a preserve.

Furthermore, the following Sure Dividend databases embody most likely probably the most reliable dividend growers in our funding universe:

Within the occasion you’re trying to find shares with distinctive dividend traits, have in mind the following Sure Dividend databases:

The important thing dwelling stock market indices are one different robust helpful useful resource for finding funding ideas. Sure Dividend compiles the following stock market databases and updates them month-to-month:

Thanks for finding out this textual content. Please ship any strategies, corrections, or inquiries to [email protected].

rn

rn

Source link ","writer":{"@sort":"Individual","identify":"Index Investing Information","url":"https://indexinvestingnews.com/writer/projects666/","sameAs":["https://indexinvestingnews.com"]},"articleSection":["Investing"],"picture":{"@sort":"ImageObject","url":"https://www.suredividend.com/wp-content/uploads/2022/10/Dividend-Aristocrats-Picture-150x150.png","width":0,"top":0},"writer":{"@sort":"Group","identify":"","url":"https://indexinvestingnews.com","emblem":{"@sort":"ImageObject","url":""},"sameAs":["https://www.facebook.com/Index-Investing-News-102075432474739","https://twitter.com/IndexInvesting_"]}}

Source link