DNY59/E+ by way of Getty Photos

Funding Thesis

There isn’t any doubt that the market didn’t anticipate Digital Turbine, Inc (NASDAQ:APPS) to report revenues of $184.1M in FQ4’22. Nevertheless, it’s important to notice that that is attributed to the modifications in its accounting report strategies, for the reason that firm nonetheless reported first rate YoY income development of 19%. Nonetheless, given the potential deceleration of income development in opposition to the hypergrowth throughout the COVID-19 pandemic, the inventory would have declined anyway, although at an admittedly slower price.

Because of this, although APPS represents a stable inventory for a long-term maintain, it’s obvious that the time so as to add isn’t right here but, given the potential retracement within the subsequent few weeks because the market continues to dwell in bearish sentiments.

APPS’ Pandemic Hyper-Development Has Formally Ended By FQ4’22

APPS Income and Gross Revenue

S&P Capital IQ

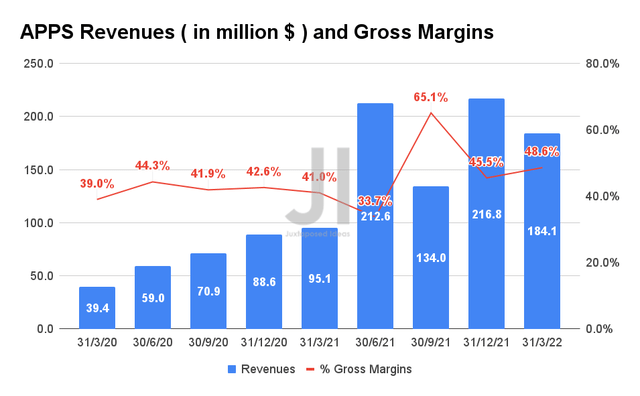

Up to now 5 years, APPS reported income development at a formidable CAGR of 79.43%, largely attributed to the large development prior to now two years at a median of 130% YoY. For FY2022, the corporate reported revenues of $747.6M, representing a superb enhance of 41% YoY, with revenues of $184.1M in FQ4’22, with YoY development of 19%, each on a professional forma foundation. Its gross margin additionally improved YoY from 41% in FQ4’21 to 48.6% in FQ4’22. Nevertheless, it is usually vital to notice that these have been partly attributed to its latest acquisitions of Respect, AdColony, and Fyber in 2021.

Nonetheless, since analysts and buyers have been anticipating revenues within the vary of $300M with a consensus income estimate of $336.45M, representing YoY development of 253.9%, it’s obvious that many have been stunned by the modifications in its accounting reporting technique. Due to this fact, it’s evident that the inventory skilled a 41.2% inventory worth decline from its pre-earnings name inventory worth of $25.43 on 31 Might 2022 to $14.94 on 16 June 2022.

Nonetheless, resulting from APPS’ aggressive enlargement of its product choices and media collaborations with key media companions, corresponding to TikTok and AccuWeather, we might anticipate to see sustained enchancment in its income development shifting ahead, given the superb development in its income per machine. Within the US alone, the corporate had reported spectacular income per machine development at a CAGR of 49.6% prior to now two years, from $2.10 in FY2020, $3.30 in FY21, and at last $4.70 in FY2022. As well as, with 19.8% YoY development in added gadgets from 222M in FY2021 to 266M in FY2022, we concur with consensus estimates on APPS’ projected income development shifting ahead.

APPS Internet Revenue and Internet Revenue Margin

S&P Capital IQ

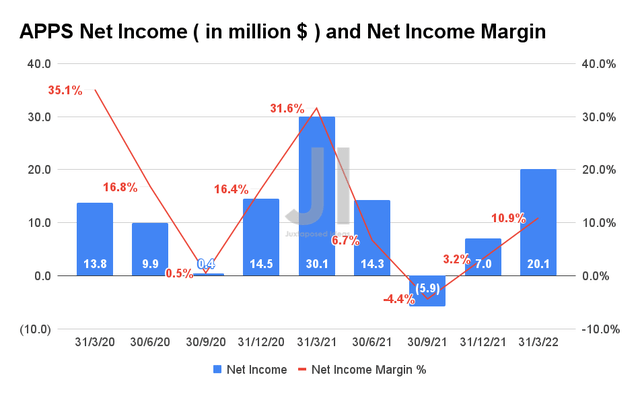

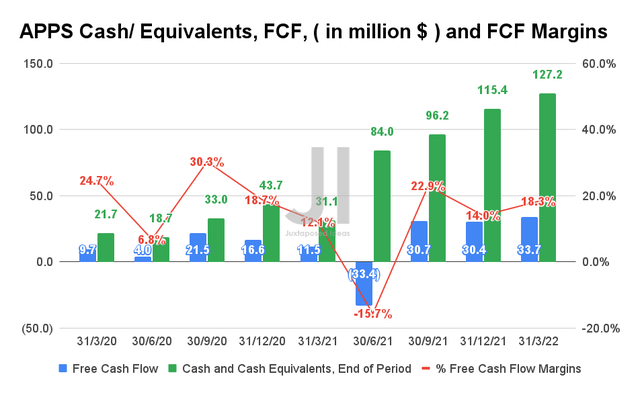

In FQ4’22, APP reported internet incomes of $20.1M with a internet earnings margin of 10.9%, representing a rise of 40.5% and 4.2 share factors YoY, respectively. The corporate additionally reported a Free Money Circulate (FCF) of $33.7M in FQ4’22 with improved FCF margins of 33.7%, representing YoY development of 293% and 6.2 share factors, respectively. Due to this fact, it’s evident that APPS reported first rate profitability in FQ4’22, although the corporate additionally elevated its reliance on debt to extend its money and equivalents to $127.2M on its stability sheet to assist its excessive working prices.

APPS Money/ Equivalents, FCF, and FCF Margins

S&P Capital IQ

APPS Working Expense

S&P Capital IQ

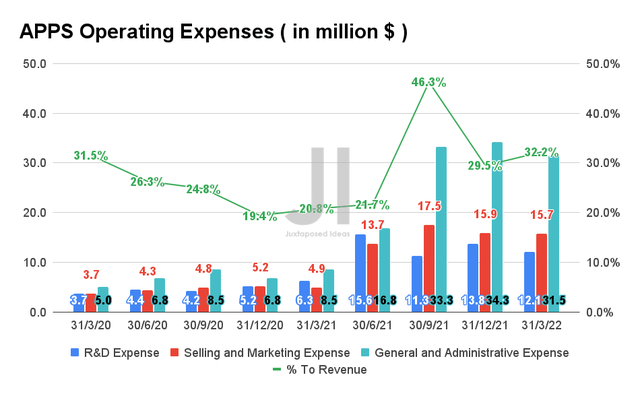

In FY2022, APPS spent a complete of $231.33M in operational bills, representing 30.9% of its income, 650.7% of its internet earnings, and 376.3% of its FCF for the yr. Since these numbers additionally signify YoY development of 330.2%, it’s evident that the corporate would want to boost extra capital within the close to future, given its decrease profitability. With out strategic cost-cutting measures, APPS’ inventory efficiency and valuations may fall much more within the subsequent few quarters, given its decelerating income development.

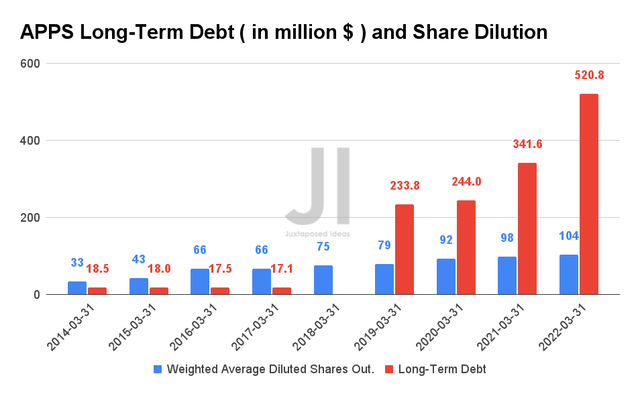

APPS Lengthy-Time period Debt and Share Dilution

S&P Capital IQ

It’s also evident that long-term APPS buyers have been diluted by over 3 fold prior to now eight years at whole diluted shares excellent of 104M as of FY2022. The corporate additionally elevated its reliance on debt leveraging, with a complete long-term debt of $520.8M within the newest fiscal yr. APPS additionally reported huge stock-based compensation (SBC) with a complete of $19.3M in SBC bills in FY2022, representing 328% YoY development. Given the latest fall in its inventory worth, we might doubtlessly anticipate the corporate to spend as much as $60M in SBC bills in FY2023, which can additional affect its profitability shifting ahead. We will see.

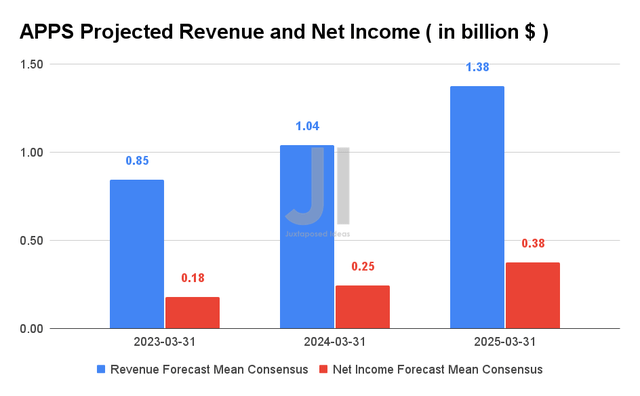

APPS Projected Income and Internet Revenue

S&P Capital IQ

Over the following three years, APPS is anticipated to develop its income and internet earnings at a formidable CAGR of 81.64% and 80.82%, respectively. Consensus estimates that the corporate will report revenues of $0.85B and internet earnings of $0.18B in FY2023, representing glorious YoY development of 13.6% and 506.3%, respectively. APPS profitability can be projected to enhance over time, from a internet earnings margin of 17.5% in FY2021 to 27.5% in FY2025.

Nonetheless, with the steerage of FQ1’23 revenues of as much as $187M, we could possibly be 1.5% QoQ development (on a professional forma foundation), thereby highlighting the deceleration of its income development post-reopening cadence. Due to this fact, the APPS inventory would expertise an uphill battle for its inventory restoration, equally skilled by many promoting tech firms, given the macro points, the continuing Ukraine conflict, and a possible recession. APPS CEO, Invoice Stone, stated:

I believe that we’re seeing some advert spend softness, as many others have talked about in Europe. I believe I sort of equate this time slightly bit to when IDFA got here out a yr in the past. (In search of Alpha)

So, Is APPS Inventory A Purchase, Promote, or Maintain?

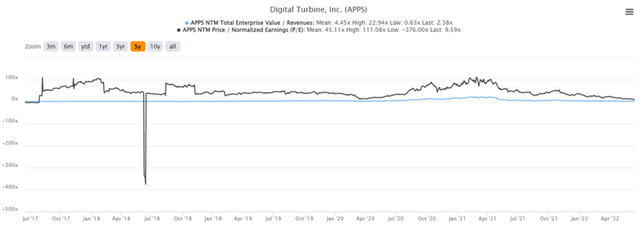

APPS 5Y EV/Income and P/E Valuations

S&P Capital IQ

APPS is presently buying and selling at an EV/NTM Income of two.38x and NTM P/E of 9.59x, decrease than its 5Y imply of 4.45x and 45.11x, respectively. The inventory can be buying and selling at $14.94, down 84.1% from its 52 weeks excessive of $93.98 whereas additionally hitting a brand new 52 weeks low.

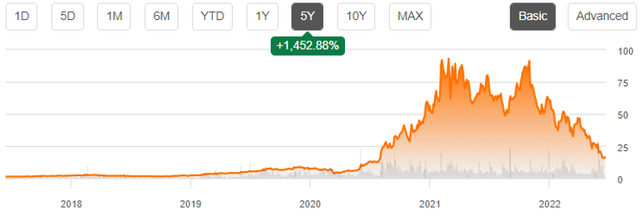

APPS 5Y Inventory Value

In search of Alpha

Regardless of the robust purchase ranking from consensus estimates with a worth goal of $55, we’re much less optimistic, on condition that it’s evident that APPS’ income development will likely be slowing down shifting ahead. The corporate may proceed to depend on long-term debt and SBC bills to fund its larger working prices after the top of its digital work association.

Due to this fact, we consider that the inventory would doubtlessly fall even additional, earlier than settling at a brand new low within the subsequent few weeks. That will be a extra enticing entry level for tech buyers.

Due to this fact, we price APPS inventory as a Maintain for now.