luza studios

Digital Realty (NYSE:DLR) is a leading global provider of data center solutions, offering a wide range of services to a diverse customer base. With a strong presence across multiple continents, DLR has positioned itself as a valuable partner for multinational businesses seeking a comprehensive data center solution. In this article, I will examine DLR’s competitive position, financial performance, and future prospects, ultimately recommending whether to invest in DLR stock.

Business Overview

DLR specializes in the acquisition, development, and management of data centers worldwide. Its portfolio includes over 300 data centers, which serve a variety of customers, including cloud service providers, IT and network service providers, and enterprises across numerous industries. DLR’s primary revenue source is rent paid by its customers for space, power, and connectivity services.

Company website

Business Strategy and Outlook

DLR has effectively adapted its business model by transitioning from a wholesale data center provider to a more versatile colocation data center provider. Wholesale data centers traditionally catered to large enterprises, government agencies, and service providers with substantial footprint requirements, offering space and power while the client company provided cloud connectivity, hardware, and IT expertise. In contrast, retail colocation houses multiple customers in a shared space, and typically involves less than 10 rack spaces. In this model, the colocation provider often procures and deploys the necessary hardware on behalf of the client in the facility.

This strategic shift, primarily driven by acquisitions, has enabled DLR to cater to a broader range of clients with varying space, power, and connection requirements. For instance, the $8.4 billion merger with Netherlands-based Interxion in March 2020 established DLR as a leading global provider of cloud and carrier-neutral data center, colocation, and interconnection solutions.

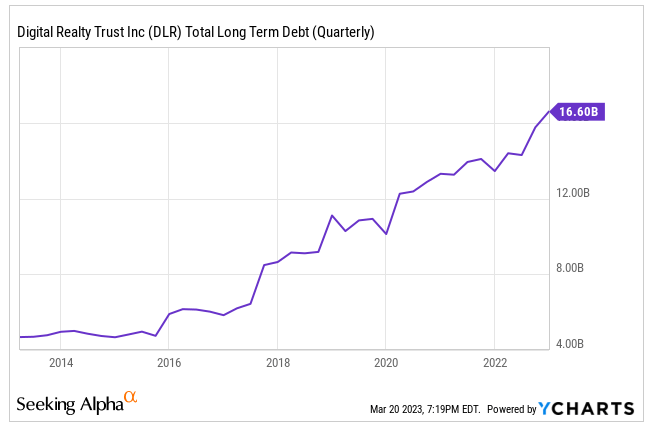

DLR has made several noteworthy acquisitions in recent years besides the merger with Interxion. Additionally, DLR acquired DuPont Fabros for 7.6 billion in 2017, Ascenty for 2.25 billion in 2018, and Teraco for 3.5 billion in 2022. Despite the high cost of these acquisitions and the resulting strain on DLR’s balance sheet, they have improved DLR’s network density and established DLR as a key player in the global data center market. Ultimately, these acquisitions have bolstered DLR’s competitive position and long-term growth prospects.

YCharts

DLR has a strong global presence and offers a full range of services, giving it an advantage over smaller competitors. The demand for data storage and processing, driven by the use of data by businesses worldwide and the expansion of cloud computing, reinforces its position. DLR has cost advantages, a mature portfolio, scale, and property ownership that provide favorable deals with suppliers and utility companies. Its competitive edge is strengthened by switching costs, high occupancy rates, and long-term customer relationships.

Long-Term Growth Prospects Remain Strong, but Short-Term Challenges Persist

Looking ahead, I anticipate that DLR will experience a consistent organic revenue growth of 5% to 8% over the next ten years. This growth will stem from DLR’s expanding presence in the retail co-location market and its ability to provide a global interconnected network to its customers. Furthermore, DLR’s upgraded portfolio of services will allow it to capitalize on the escalating demand for data storage and processing solutions.

However, in the short term, DLR’s high debt level may hamper cash generation until it can successfully deleverage, as discussed during the earnings call.

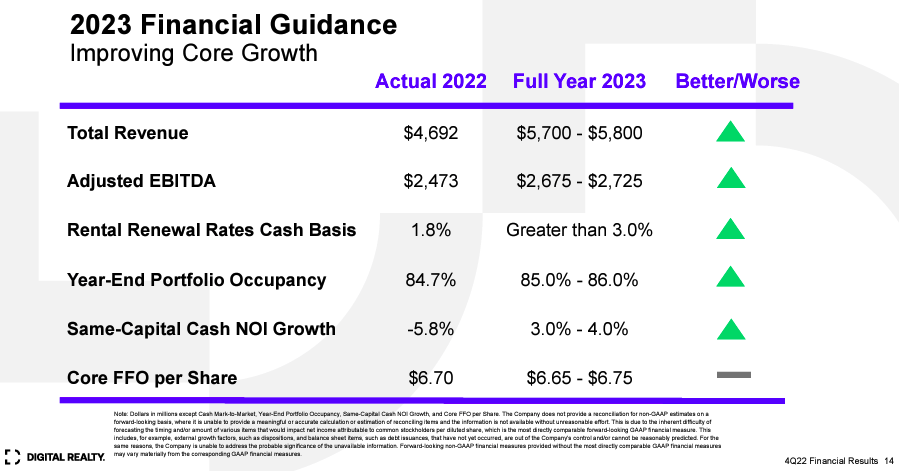

We have provided an initial core FFO per share guidance range for the full year 2023 of $6.65 to $6.75, reflecting flat growth at the midpoint of the range. as the recovery in our stabilized portfolio is balanced by the impact of higher interest expense and capital recycling.

Company presentation

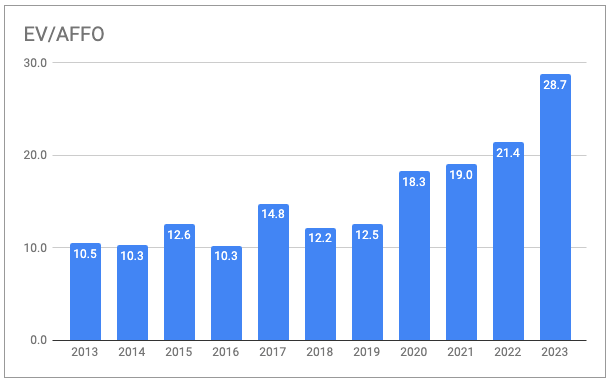

Despite DLR’s AFFO tripling over the past decade, its enterprise value has increased by a factor of eight, causing the EV/AFFO multiple to surge from 10.5x to 28.7x. Although I acknowledge that the quality of the business has improved during this time, I believe that the current valuation is rich, and I would prefer to wait for a boost in AFFO generation before investing.

Company filings & Seeking Alpha

Risk and Uncertainty

DLR’s capital-intensive nature makes it less agile in the face of market downturns, and its long-term prospects are dependent on continued technological advancements and growth in the data center industry.

The greatest risk to DLR’s long-term prospects is the possibility that technological advances could result in customers meeting their data needs with less physical space and power, reducing the demand for DLR’s services.

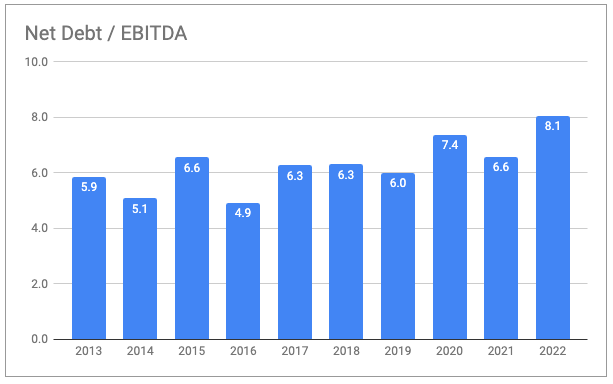

Another risk is the high leverage. DLR’s balance sheet remains stretched, with a high net debt/EBITDA ratio persisting. However, only a small portion of total debt matures within the next three years.

Company filings & Seeking Alpha

Assuming no further major acquisitions, cash flow generation should enable DLR to reduce debt levels and provide a greater buffer for interest payments. During the Q4 earnings call, Matt Mercier said they would bring leverage closer to 6x by the end of the year.

I would say we’re going to be well on our way to bringing leverage back down closer to 6x by the end of the year.

Conclusion

DLR’s shift towards retail colocation and its recent acquisitions have established DLR as a global leader in the data center industry, offering a comprehensive range of services to a diverse customer base. However, DLR’s high debt level and the risk of technological advancements reducing demand for its services present potential challenges. While I anticipate moderate organic revenue growth in the future, I believe the current valuation is rich and would wait for a boost in AFFO generation before investing. DLR’s competitive position, financial performance, and long-term growth prospects suggest that it is a company worth monitoring.