grandriver

Diamondback Energy, Inc. (NASDAQ:FANG) is one of the largest upstream exploration and production companies in the wealthy Permian Basin of West Texas. Admittedly, we have not really discussed upstream companies too often here at Energy Profits in Dividends because they have typically not had the kind of yields that we like to see. The high energy price environment that has dominated the economy over the past year or two has changed this. As such, the addition of an upstream company like Diamondback Energy could prove to be a good way to diversify our portfolio into another sub-sector of the energy industry while still allowing us to maintain the high yield that we have come to appreciate. Diamondback Energy yields 6.60% based on its most recent dividend payment, despite the fact that the stock has appreciated 29.35% over the past twelve months. The company still remains substantially undervalued though, so there is still the potential for significant capital gains here, and of course, we will be able to collect a very attractive dividend while we wait. This is exactly the kind of stock that we like to invest in. Thus, let us investigate and see if Diamondback Energy could be a good addition to your portfolio today.

About Diamondback Energy

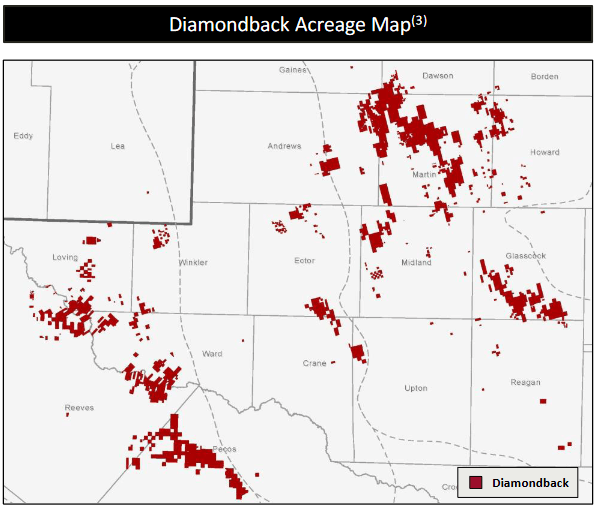

As stated in the introduction, Diamondback Energy is one of the largest independent exploration and production companies in the Permian Basin. The company controls approximately 490,000 net acres across the Midland and Delaware Basins, which both comprise the Permian:

Diamondback Energy

This is a very good region in which to operate because of the incredible wealth in the area. This mineral wealth is the reason why anyone that follows the energy industry has heard of this area. After all, the Permian Basin has been at the center of America’s energy renaissance over the past decade. The basin is widely believed to be the second-largest in the world in terms of resource wealth. As of 2018, the region produced a cumulative 33 billion barrels of crude oil and 118 trillion cubic feet of natural gas over its nearly one-hundred-year operational history. Despite this, the U.S. Energy Information Administration states that the basin still holds five billion barrels of crude oil and nearly nineteen trillion cubic feet of gas in proved reserves. It is important to note that these figures only consider the economically-recoverable reserves at 2018’s prices. As energy prices are significantly higher now, it is quite possible that these reserves have increased. This resource wealth certainly reflects itself in Diamondback’s acreage as the company has identified approximately 17,000 drilling locations that can be profitably exploited at $50 per barrel crude oil prices. As of the time of writing, West Texas Intermediate trades at $79.40 per barrel, so the company clearly has some considerable growth potential.

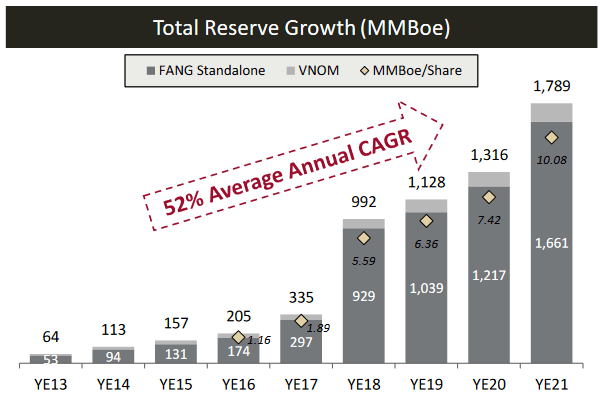

The wealth of Diamondback Energy’s acreage also reflects itself in the company’s reserves. An upstream company’s reserves are a characteristic of the business that many investors overlook but they are critically important. This is because the production of crude oil and natural gas is by its nature an extractive process. After all, exploration and production companies literally obtain their products by pulling them out of reservoirs in the ground. As these reservoirs contain finite quantities of hydrocarbons, a company must continually acquire or discover new sources of resources or it will eventually run out of products to sell. As a firm’s success at this task is by no means guaranteed, a company’s reserves determine the amount of time that it can continue to operate without success in this endeavor. Fortunately, Diamondback Energy has considerable reserves due to the wealth of its acreage. At the start of the year, the company had proved reserves of 1.789 billion barrels of oil equivalents. This actually represents a 36% year-over-year increase despite the fact that the company was producing over the course of 2021:

Diamondback Energy

As we can see, the company has managed to increase its reserves at a 52% compound annual growth rate over the 2013 to 2021 period. This is in spite of the fact that it also managed to grow its production over the period. One reason for this, of course, is that the company managed to grow its acreage both organically and through the acquisition of other companies. Another reason is that rising energy prices and improving technology have allowed some of the resources on its land to become economically viable to produce that was not in the past. Overall, this is exactly what we like to see since it demonstrates that the company is making its operations more sustainable even though it did grow production. In the third quarter of 2022, Diamondback Energy produced an average of 390,600 barrels of oil equivalents per day. At this production rate, the company’s reserves are sufficient to allow it to produce for 4,580 days (about 12.5 years). This is easily on par with any of the majors and it allows Diamondback Energy to be patient about acquiring new acreage. This is nice because it could allow the company to make its purchases at attractive prices as opposed to needing to waste money due to desperation. Overall, it is very nice to see in a long-term investment.

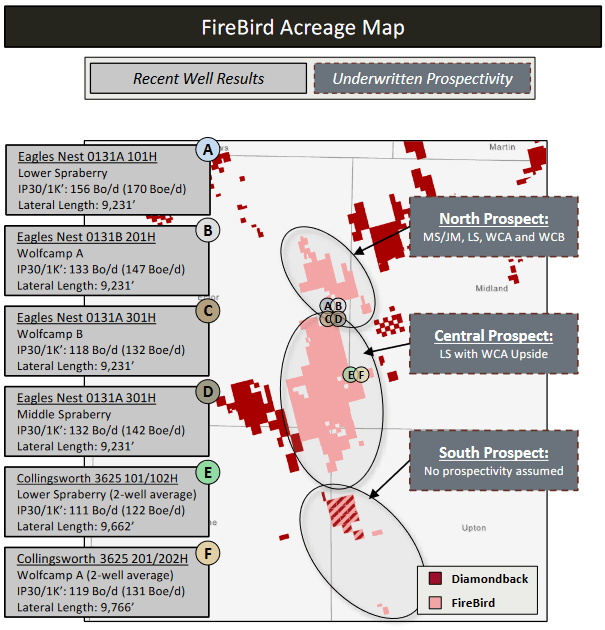

As just mentioned, Diamondback Energy has a history of making strategic acquisitions to expand its presence in the Permian Basin. It continued that historic policy in November through the acquisition of Firebird back in November. This $1.6 billion acquisition brought the company approximately 68,000 net acres in the Midland Basin:

Diamondback Energy

It did not do nearly as much to boost Diamondback Energy’s production, however. Firebird was only producing an average of 22,000 barrels of oil equivalents per day at the time of the acquisition. Diamondback Energy plans to increase this to 25,000 barrels of oil equivalents per day by the end of 2023, but this still only represents a small percentage increase for the company as a whole.

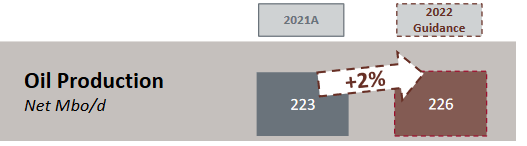

With that said, Diamondback Energy has not been placing a whole lot of emphasis on growing its production, despite the steep increase in resource prices that occurred over the past two years. The company’s oil production guidance for 2022 was only 2% above its actual 2021 production level:

Diamondback Energy

The company is on track to come in at about that level. Curiously, Diamondback Energy has not yet released any guidance for 2023 but based on recent statements made by management about strategy it is unlikely that production will grow significantly next year, either. This is something that has been fairly common in the upstream sector lately as companies focus on maximizing their free cash flow as opposed to growth at all costs. It was this growth-at-all-costs business model that got so many shale companies into financial trouble when the pandemic occurred and caused energy prices to collapse. The company’s strategy has certainly been paying off as Diamondback Energy has been generating copious amounts of free cash flow in recent quarters:

|

Q3 2022 |

Q2 2022 |

Q1 2022 |

Q4 2021 |

Q3 2021 |

Q2 2021 |

Q1 2021 |

|

|

Levered Free Cash Flow |

814.8 |

716.8 |

280.5 |

(0.8) |

271.6 |

391.9 |

261.0 |

|

Unlevered Free Cash Flow |

881.0 |

740.5 |

305.5 |

17.4 |

307.3 |

427.5 |

261.0 |

(all figures in millions of U.S. dollars)

This works out quite well for us as income-focused investors. This is because it is ultimately free cash flow that dictates a company’s ability to pay its dividend. After all, free cash flow represents the amount of money that is generated by a company’s ordinary operations and is left over after a company pays all of its bills and makes its capital expenditures. This is therefore the money that can be used to do things such as reducing debt, buying back stock, or paying a dividend. Thus, free cash flow is the money that a company can use to reward its stockholders. Diamondback Energy has been doing exactly this. The company has the stated objective of returning at least 75% of its free cash flow to its investors in the form of both share buybacks and a dividend. The dividend is not a fixed amount though like most companies pay. Instead, Diamondback Energy pays out $0.75 per share quarterly. In addition to that, it pays out whatever extra amount it needs to in order to ensure that the shareholders receive that 75% that was promised. In the third quarter, the company paid out an extra $1.51 for a total of $2.26 per share. That works out to $9.04 per share annualized, which is a 6.60% yield at the current stock price of $137.03. The company also repurchased $472 million worth of its own stock at an average price of $120.50 per share.

This is something that is important to understand when considering this company as a dividend investment. The company may opt to pay out less money in the form of a dividend and more in the form of share repurchases. This could cause the dividend and resulting yield during the given quarter to be less than we like. This is basically what happened with Viper Energy Partners (VNOM), which is affiliated with Diamondback Energy, recently. It may also pay out far more than usual in the form of a dividend, resulting in us getting a much higher yield than we expect temporarily. The only thing that the company has promised is that its dividend will not go below $3.00 per share annually. That is only a 2.19% yield at the current price, which is obviously much lower than we want from the companies that we invest in. The company has had an annualized dividend yield in the high single-digits since it implemented this policy though, so it would be reasonable to assume that Diamondback Energy will continue to be in that ballpark. Investors should therefore not depend on it as a source of income to pay for necessities but it could help a lot with the discretionary spending portion of your budget and provide some diversification for an income portfolio consisting of midstream and downstream companies.

Fundamentals Of Crude Oil And Natural Gas

For quite some time now, the media and others in the investment world have been pushing the idea that the era of fossil fuels has come to an end. However, nothing could be further from the truth as the demand for both crude oil and natural gas is likely to increase over the coming years. In addition, the fundamentals are pointing towards significantly higher prices than most people are accustomed to. This will all ultimately benefit Diamondback Energy and investors in the company.

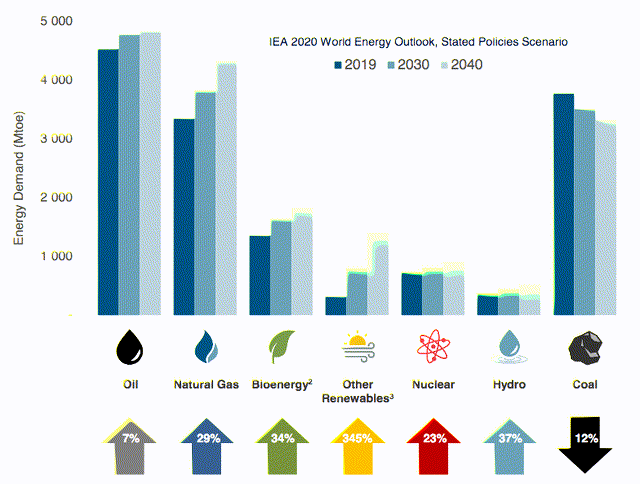

According to the International Energy Agency, the global demand for crude oil will increase by 7% and the global demand for natural gas will increase by 29% over the next twenty years:

Pembina Pipeline/Data from IEA 2021 World Energy Outlook

Perhaps surprisingly, the demand growth for natural gas will be driven by international concerns about climate change. These concerns have induced governments all over the world to impose a variety of incentives and mandates that are meant to reduce the carbon emissions of their respective nations. One common way that this is being accomplished is through various incentives meant to get utilities to retire their old coal-fired power plants in favor of renewables. Unfortunately, renewables are not reliable enough to support a modern electric grid. After all, wind power does not work when the sun is not shining and solar power does not work at night. Thus, utilities are generally opting to supplement their renewable facilities with natural gas turbines in order to deliver the “always-on” capability that we have come to expect in our modern lives.

The case for crude oil demand growth might be harder to understand. After all, many governments in Western nations are actively attempting to stop the consumption of crude oil within their nations. However, it is a very different situation in the various emerging nations around the world. As many of those reading this are no doubt well aware, these nations are widely expected to experience considerable economic growth over the projection period. This growth will have the effect of lifting the citizens of these nations out of poverty and putting them firmly into the middle class. These newly middle-class people will naturally begin to desire a lifestyle that is much closer to that of their counterparts in the developed world than what they have today. This will require growing consumption of energy, including energy derived from crude oil. As the populations of these nations are significantly greater than the population of the developed world, the rising demand for crude oil here will more than offset the stagnant-to-declining demand in Western nations.

It is unlikely that the production of crude oil and natural gas will grow sufficiently to meet this demand growth. We have already seen that Diamondback Energy has no plans to grow its production. It is largely the same across the energy sector, despite the Biden Administration asking for production increases. One of the biggest reasons for this is that traditional energy companies are having substantial difficulty obtaining the capital that is needed to grow production, as is discussed in the article that was just linked. This difficulty comes in the footsteps of the fact that the energy industry as a whole has underinvested in production and transportation capacity since the bear market of 2015. According to Moody’s, the energy industry needs to immediately increase its capital expenditures by $542 billion per year in order to increase production sufficiently to avoid a supply shock. It is highly unlikely that the industry will do that, even if it could obtain sufficient capital to do so. After all, it has politicians and activists pushing it to improve its environmental credentials and it has investors demanding higher returns. Thus, it is likely that we will see a situation in which the demand for crude oil and natural gas rises much more rapidly than the supply of these resources. The laws of economics tell us that such a situation will result in rising energy prices. Fortunately, that should benefit investors in Diamondback Energy due to its aforementioned policy of returning at least 75% of its free cash flow to the investors. In this way, a position in Diamondback Energy could help us hedge against the rising energy prices that we will have to pay as consumers.

Financial Considerations

It is important to have a look at the way that a company finances its operations before making an investment in it. This is because debt is a riskier way to finance a company than equity because debt must be repaid at maturity. This is usually accomplished by issuing new debt to repay the maturing debt, which can cause a company’s interest expenses to increase following the rollover in certain market conditions. In addition to this, a company must make regular payments on its debt if it is to remain solvent. As such, an event that causes a company’s cash flow to decline could push it into financial distress if it has too much debt. This is something that could be particularly important to consider for an upstream energy company when we consider the overall volatility of commodity prices.

One metric that we can use to evaluate a company’s debt load is the net debt-to-equity ratio. This ratio tells us the degree to which a company is financing its operations with debt as opposed to wholly-owned funds. The ratio also tells us how well the company’s equity can cover its debt obligations in the event of a liquidation or bankruptcy, which is arguably more important.

As of September 30, 2022, Diamondback Energy had net debt of $5.533 billion compared to $14.558 billion in shareholders’ equity. This gives the company a net debt-to-equity ratio of 0.38. Here is how that compares to some of the company’s peers:

|

Company |

Net Debt-to-Equity |

|

Diamondback Energy |

0.38 |

|

Pioneer Natural Resources (PXD) |

0.16 |

|

Devon Energy (DVN) |

0.51 |

|

Matador Resources (MTDR) |

0.26 |

|

CNX Resources (CNX) |

1.23 |

As we can clearly see, all of these companies except for CNX Resources have a net debt-to-equity ratio below 1.0. This is nice to see but unfortunately, Diamondback Energy is not the lowest on the list. Despite this though, the value of the company’s assets substantially exceeds the amount of its debt. This is a nice position to be in during a worst-case scenario and we should not really have too much to worry about here in terms of the company’s debt.

The company’s ability to carry its debt is much more important than its overall financial structure. The way that we usually judge the company’s ability to carry its debt is by looking at its leverage ratio, which is also known as the net debt-to-trailing twelve-month EBITDAX ratio. This ratio essentially tells how many years it would take the company to completely pay off its debt if it were to devote all of its pre-tax cash flow to that task. As of the end of the third quarter of 2022, Diamondback Energy had a leverage ratio of 0.80x based on its trailing twelve-month EBITDAX. This is in line with the sub-1.0x ratio that we like to see among upstream companies as well as being in line with the ratios possessed by the strongest companies in the industry. This reinforces our earlier conclusion that Diamondback Energy poses no particular risk due to its debt. We should not have anything to worry about here.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return on that asset. In the case of an upstream energy company like Diamondback Energy, one metric that we can use to value it is the price-to-earnings growth ratio. This ratio is a modified form of the more familiar price-to-earnings ratio that takes a company’s earnings per share growth into effect. A price-to-earnings growth ratio of less than 1.0 is a sign that the stock is undervalued relative to the company’s forward earnings per share growth and vice versa.

As I have pointed out in various previous articles, pretty much the entire traditional energy sector is substantially undervalued right now. This is certainly true for Diamondback Energy. According to Zacks Investment Research, Diamondback Energy will grow its earnings per share at a 21.94% rate over the next three to five years. That gives the company a price-to-earnings growth ratio of 0.25 at the current price. Thus, the stock is looking significantly undervalued but let us compare it to the company’s peer group:

|

Company |

PEG Ratio |

|

Diamondback Energy |

0.25 |

|

Pioneer Natural Resources |

0.86 |

|

Devon Energy |

0.13 |

|

Matador Resources |

N/A |

|

CNX Energy |

0.52 |

As we can see here, Diamondback Energy looks fairly reasonable as it is cheaper than its peer companies with the exception of Devon Energy. In fact, Diamondback Energy would have a fair value of $548.12 per share using this metric, which would obviously be a very nice return from the current price of $137.03 per share. Admittedly, the stock may never reach that price given the market’s dislike for energy stocks right now but we can still enjoy that dividend yield while we wait. Overall, the price is very reasonable here.

Conclusion

In conclusion, Diamondback Energy looks like a reasonably good investment right now for someone seeking energy income. The fact that the company will likely increase its dividend with energy prices is also quite nice because it allows us to hedge our exposure to these prices as consumers. The only downside here is that Diamondback Energy is not really planning any production growth but it should still be able to deliver earnings growth through share buybacks and rising energy prices. It may be a while before we see significant capital gains but we can enjoy the nice dividend yield while we wait. Overall, this company is recommended for a portfolio.