metamorworks

This ETF (exchange-traded fund) article series aims at evaluating products regarding the relative past performance of their strategies and quality metrics of their current portfolios. As holdings and weights change over time, updated reviews are posted when necessary.

DFIV strategy and portfolio

Dimensional International Value ETF (NYSEARCA:DFIV) is an actively managed fund with 519 holdings, a 12-month distribution yield of 4.01%, and an expense ratio of 0.27%. It was launched on 04/16/1999 and listed as an ETF on 09/13/2021. Therefore, price history is available from the latter date.

As described in the prospectus by Dimensional, the fund:

“may overweight certain stocks, including smaller companies, lower relative price stocks, and/or higher profitability stocks within the large-cap value segment of developed ex U.S. markets. An equity issuer is considered to have a low relative price (i.e., a value stock) primarily because it has a low price in relation to its book value. In assessing relative price, the Advisor may consider additional factors such as price to cash flow or price to earnings ratios. An equity issuer is considered to have high profitability because it has high earnings or profits from operations in relation to its book value or assets. The criteria the Advisor uses for assessing relative price and profitability are subject to change from time to time.“

This description gives a lot of flexibility to managers, and it also makes the investing process a black box. It is impossible for us to duplicate and back-test it. The most recent annual turnover rate is quite low: 12% of the portfolio’s average value.

In this article, I will use as a benchmark one of its largest and most liquid competitors: iShares MSCI EAFE Value ETF (EFV), which passively tracks the MSCI EAFE Value Index. Both funds are ex-U.S. global funds with a value investing style, and both hold mostly large and mega-cap companies: about 80% of asset value for DFIV, 86% for EFV.

DFIV is a bit cheaper than EFV regarding the usual valuation ratios, as reported in the next table.

DFIV | EFV | |

Price/Earnings TTM | 8.41 | 9.69 |

Price/Book | 0.99 | 1.12 |

Price/Sales | 0.72 | 0.88 |

Price/Cash Flow | 5.01 | 5.99 |

Source: Fidelity

It is also better at finding stocks combining value and growth, especially “good” growth: in earnings and cash flow rather than sales. The next table reports growth rates in the trailing 12 months.

DFIV | EFV | |

Earnings growth % | 12.34% | 10.94% |

Sales growth % | 9.62% | 10.48% |

Cash flow growth % | 14.15% | 11.27% |

Source: Fidelity

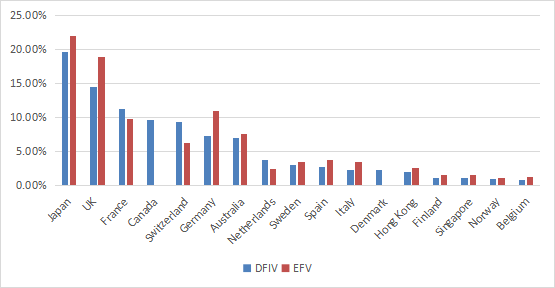

Europe is the heaviest region in both funds, with about 59% of asset value for DFIV and 64% for EFV. A noteworthy difference in country allocation is the absence of Canada in EFV, whereas DFIV has almost 10% of assets in this country. Japan and the UK take the first two ranks in both funds. Hong Kong weighs 2% of assets, so direct exposure to geopolitical and regulatory risks related to China is low.

Country allocation (chart: author: data: Dimensional, iShares)

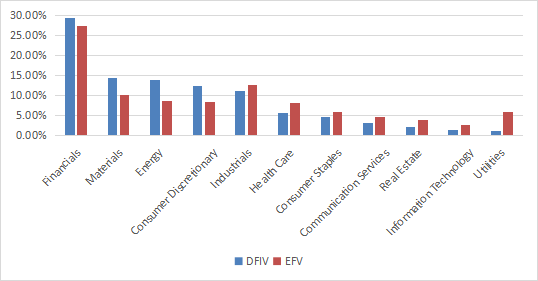

Financials are the heaviest sector in DFIV (29.5%) and EFV (27.5%). Compared to the passive index ETF, the actively managed fund moderately overweights financials, materials, energy, and consumer discretionary. It underweights all other sectors.

Sector breakdown (chart: author: data: Dimensional, iShares)

The next table lists the top 10 holdings, representing 17.2% of assets. The heaviest one weighs 4.01%, so risks related to individual companies are moderate.

Ticker | Name | Weight |

SHEL US | Shell plc | 4.01% |

TTE FP | TotalEnergies SE | 3.20% |

NVS US | Novartis AG ADR | 1.71% |

MBG GR | Mercedes-Benz Group AG | 1.54% |

ZURN SW | Zurich Insurance Group AG | 1.38% |

HSBC US | HSBC Holdings plc | 1.19% |

CFR SW | CIE FINANCIERE RICHEMONT | 1.11% |

AD NA | Koninklijke Ahold Delhaize | 1.07% |

7203 JP | Toyota Motor Corporation | 1.02% |

BATS LN | British American Tobacco | 1.01% |

Performance

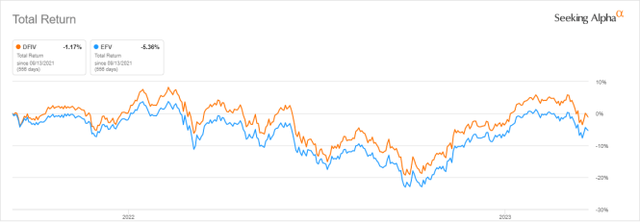

Since DFIV listing 18 months ago, it has outperformed EFV by about 4% in total return. Anyway, the price history is too short to assess the strategy performance.

DFIV vs EFV since inception (Seeking Alpha)

Takeaway

Dimensional International Value ETF is an actively managed fund investing in value stocks outside the U.S. Its top 2 countries are Japan and the U.K., and it is overweight in financials (almost 30% of assets). Otherwise, it is well-diversified across countries and holdings. Dimensional International Value ETF is slightly superior to the MSCI EAFE Value Index regarding valuation ratios, growth metrics, and total return since the listing date. However, the price history is too short to make a statement about Dimensional International Value ETF performance.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.