hsyncoban

I’m initiating safety on DexCom, Inc. (NASDAQ:DXCM) following its Q2 2024 earnings launch on Thursday, July twenty fifth.

DexCom, Inc. is a medical machine agency centered on insulin monitoring, significantly regular glucose screens that help monitor insulin ranges all by means of the day. The agency’s revenue is generated primarily from product sales of the devices and corporations supporting them.

After a sturdy run in late 2023 and early 2024, DexCom dropped 33% following Q2 earnings as soon as they lowered guidance for 2024. This locations the stock down 38% over the earlier 12 months.

DXCM Worth Sample (TrendSpider)

DexCom’s guidance was positively unfavorable and couldn’t help the share price over $110. That said, I think about this generally is a conventional overreaction to harmful info, and the stock has now been pushed properly beneath trustworthy price.

DexCom might have decreased improvement guidance, nevertheless the enterprise stays to be rising. In addition to, demographic tailwinds are too strong to ignore, and effectively being insurers will grow to be increasingly more motivated to promote this know-how. Even on the lowered guidance, a conservative DCF analysis based totally on enterprise and market developments suggests a price objective of $94.30, a 26% upside to proper this second’s pricing.

I cost DexCom a purchase order and think about the market overreaction is providing an excellent different for long-term merchants to enter the stock.

Q2 Earnings Recap

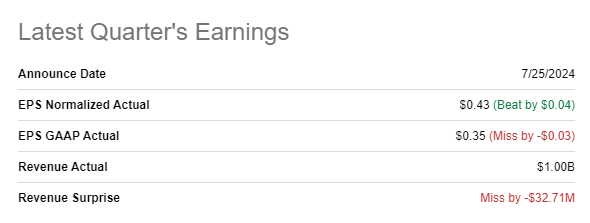

DexCom reported Q2 EPS of $0.43, beating consensus by $0.04, and revenue of $1.00 billion, missing consensus by $33 million.

Q2 Earnings Summary (Searching for Alpha)

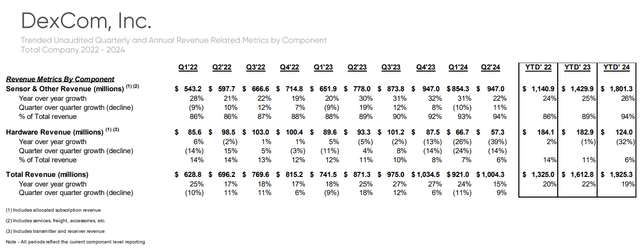

Earnings improvement slowed, significantly in {{hardware}} revenue, with full revenue improvement returning to 2022 ranges. Mandatory to note that costs had been properly managed and this had minimal have an effect on on profitability.

Earnings Sample (DXCM Investor Relations)

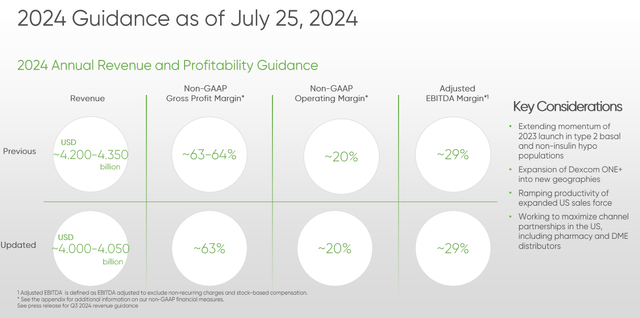

Administration expects the slower revenue improvement to proceed and lowered revenue guidance for the 12 months sending the stock plunging.

DXCM 2024 Steering (DXCM Investor Relations)

And that’s the place the market overreacted. Positively, they deserved a less expensive value objective; I might need lowered it, too. Nonetheless, the updated guidance nonetheless shows double-digit improvement and no change in profitability. That’s nonetheless a extremely useful enterprise.

Valuation

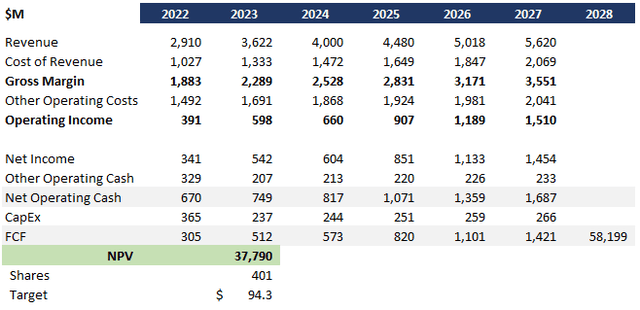

I ran a DCF analysis incorporating the model new guidance and market developments. Listed below are the assumptions I used:

- 12% near-term revenue improvement based totally on near-term market CAGR, low-end of administration guidance, and historic effectivity

- 6.5% long-run improvement cost heading once more market CAGR to account for rivals, value improvement, and diminishing returns as a result of the enterprise scales

- 9.1% low value cost based totally on estimated WACC

This DCF analysis yields a price objective of $94.30, 26% upside to proper this second’s prices.

DexCom DCF (Data: SA; Analysis: Mike Dion)

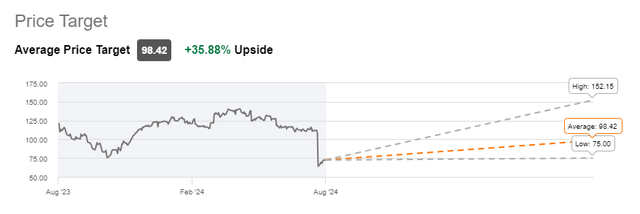

Wall Avenue analysts actually land in the identical fluctuate with a median price objective of $98.42 and a variety of $75 to $152. Phrase that the low end of their fluctuate is principally flat to current pricing.

DXCM Wall Avenue Rating (Searching for Alpha)

Demographic Tailwinds Too Sturdy To Ignore

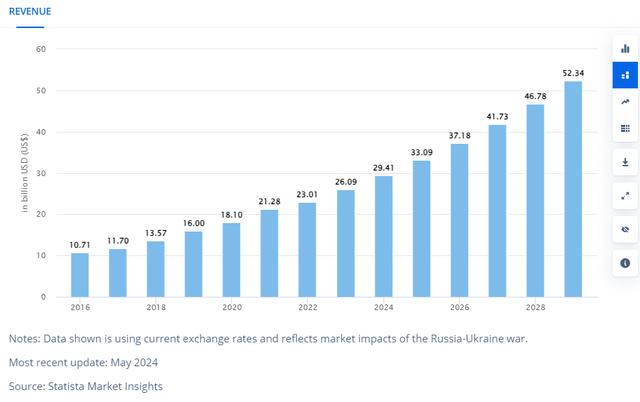

DexCom is a frontrunner in a shortly rising market with extraordinarily favorable demographic tailwinds. Starting with diabetes care devices in isolation, the market is predicted to develop at a CAGR of 12.22% by way of a minimal of 2029.

Diabetes Care Gadget Market (Statista)

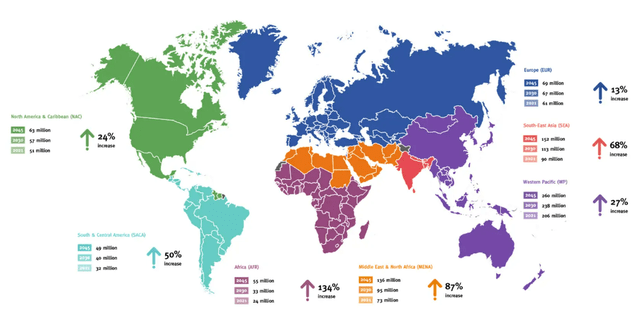

Previous the current expectations for diabetes care devices, the eligible inhabitants is predicted to develop shortly. Mature markets just like North America and Europe will proceed to see double-digit improvement, whereas creating areas just like South America, Africa, and Asia will see wherever from 50% to 134% in diabetes prevalence.

Diabetes Prevalence (Worldwide Diabetes Federation)

And this solely shows diabetes prevalence. DexCom will also be engaged on devices and devices for prediabetes and diabetes prevention. This over-the-counter market is predicted to develop to over $5 billion over the next 10 years, a billion higher than DexCom’s full revenue closing 12 months.

Properly being Insurers Need CGM

Previous the demographic developments, effectively being insurers are going to grow to be more and more motivated to help regular glucose monitoring.

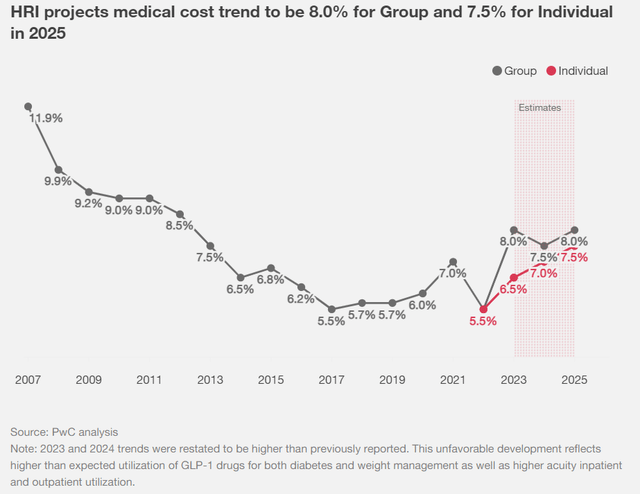

Properly being insurers medical costs are anticipated to develop on the very best cost as a result of the early 2010s pushed by GLP-1 medication and acute inpatient/outpatient utilization.

Medical Worth Sample (PwC)

This improvement benefits DexCom in two strategies. First, GLP-1 medication for treating diabetes are being authorised for weight discount shortly driving up costs. This spending nearly doubled from 2021 to 2022 alone. DexCom reduces the need for GLP-1 and insulin over time by way of monitoring and supporting life-style modifications.

Second, regular glucose screens have been confirmed to cut back common medical costs for managing diabetes by lowering the velocity of inpatient and outpatient acute care, the troubling improvement well-known above.

Draw again Hazard

The draw again menace is primarily execution on the part of DexCom’s administration. CEO Kevin Sayer well-known all by means of the earnings identify that factors with distributor relationships had come up materially impacting product sales.

U.S. purchaser improvement has remained strong in our pharmacy enterprise as we improve our attain into foremost care and kind 2 diabetes further broadly. Nonetheless, our improvement throughout the DME channel has trailed our plan. The DME distributors keep important companions for us in our enterprise, and we have now not executed properly this quarter in direction of these partnerships. Now we have to refocus on these relationships.

DexCom drives elevated profitability by means of distributors than pharmacies and should quickly rectify this relationship.

The second draw again menace is rivals. Upside requires pacing with or just behind the market over-time and DexCom should be cautious to not give up an extreme quantity of share.

Verdict

Q2 earnings had been positively an issue for DexCom and the revised guidance couldn’t help the $110 plus share price. Nonetheless, demographic developments along with value pressures on the insurance coverage protection commerce all bode properly for future improvement. DCF analysis even on the low end of guidance and market developments helps a price objective of $94, 26% upside from proper this second’s pricing. Whereas there could also be draw again menace from execution, significantly on the product sales side, administration is acutely aware and taking steps to mitigate.

Based totally on all of the above, I firmly think about the market overreacted to the guidance change. I cost DexCom a purchase order with the current downturn being an excellent different to enter the stock.