Selman Keles/E+ by way of Getty Pictures

Funding Thesis

Digitization is the method of changing analog info into digital kind utilizing an analog-to-digital converter, akin to in a picture scanner or for digital audio recordings. As the recognition of the web has risen throughout the Nineties, so has the prevalence of digitalization. Nevertheless, the digital transformation consists of greater than merely digitizing outdated processes. Eager about how new digital applied sciences might alter items, processes, and organizations is crucial for digital transformation.

One of many key applied sciences on this change is blockchain. Though the basics of database expertise have been specified by 1991, it wasn’t till 2009 that blockchain was deployed in follow with Bitcoin. Since then, the potential purposes for blockchain have grown dramatically. Nevertheless, expertise remains to be in its infancy in lots of sectors. Nonetheless, analysts imagine that blockchain could have a big affect on enterprise within the subsequent years.

In response to a current report, the digital transformation market is predicted to develop at a compound annual development price of 19.1% from $521.5 billion in 2021 to $1’247.5 billion in 2026. Subsequently, firms on this trade are more likely to develop at a sooner tempo than the world economic system and in consequence, outperform different sectors of the economic system. That mentioned, a lot of publicly listed firms concerned within the digital revolution had a unbelievable run within the final 24 months and rewarded shareholders handsomely. Because of this, a lot of them are actually costly from a elementary perspective, at a second in time when central banks all over the world are withdrawing liquidity from the system. On this report, I’ll assessment the VanEck Digital Transformation ETF (NYSEARCA:DAPP) which gives publicity to a basket of worldwide shares concerned within the enterprise of digital belongings.

Technique Particulars

The VanEck Digital Transformation ETF tracks the efficiency of the MVIS International Digital Belongings Fairness Index. This index selects firms which can be on the forefront of the transformation of digital belongings, akin to digital asset exchanges, miners, and different infrastructure firms.

If you wish to study extra concerning the technique, please click on right here.

Portfolio Composition

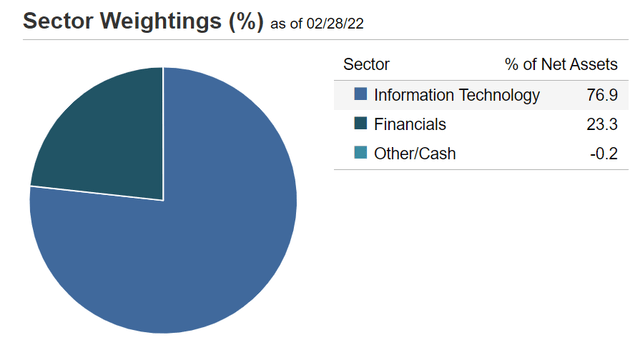

From the sector allocation chart under, we will see the index locations a excessive weight on the data expertise sector (representing round 77% of the index) and the monetary sector (accounting for 23% of the index). DAPP is subsequently extremely concentrated in these two industries, that are very delicate to modifications within the economic system, significantly rates of interest.

VanEck

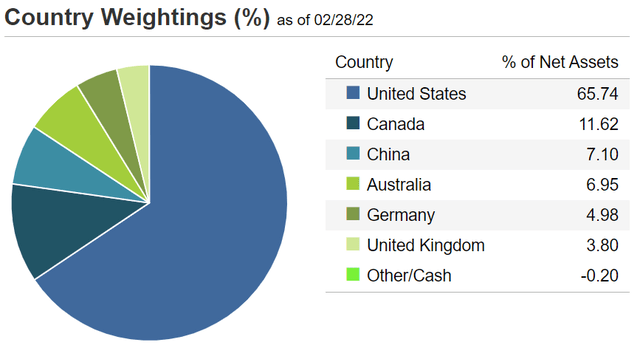

When it comes to geographical allocation, DAPP invests in 6 international locations, most of them being labeled as developed economies. The US accounts for 66%, whereas different international locations such because the UK appear to be underrepresented given the low weight (solely a 4% allocation to the UK).

VanEck

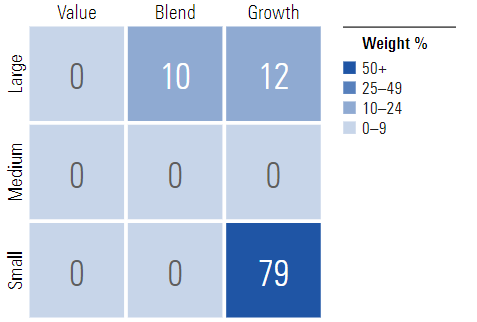

DAPP invests over 79% of the funds into small-cap development issuers, characterised as small-sized firms the place development traits predominate. Small-cap issuers are usually outlined as firms with a market capitalization under $2 billion. The second-largest allocation is large-cap development equities. It’s attention-grabbing to see that DAPP allocates roughly 80% of the funds to small-cap issuers, which usually have a bigger runway to compound than large-cap issuers, however are usually extra unstable.

Morningstar

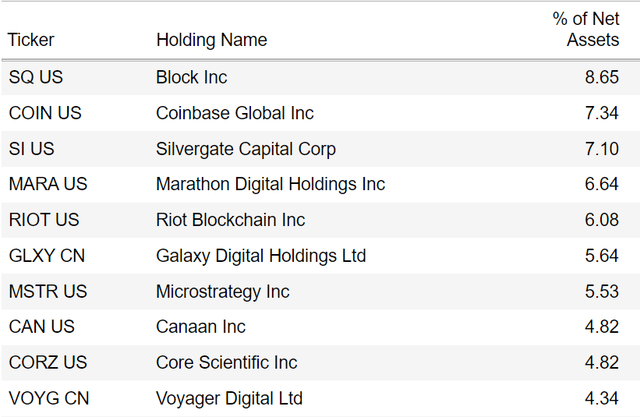

The fund is at the moment invested in 25 totally different shares. The highest 10 holdings account for 61% of the portfolio, with no single inventory weighting greater than 9%. All in all, I’d say that DAPP is concentrated round a couple of names, that are more likely to drive returns going ahead. Given the excessive allocation to the highest 10 holdings, I believe you will need to be snug with a concentrated portfolio earlier than shopping for DAPP.

VanEck

Since we’re coping with equities, one necessary attribute is the portfolio’s valuation. In response to information from VanEck, the fund at the moment trades at a mean price-to-book ratio of ~3 and a mean LTM price-to-earnings ratio of ~14. Nevertheless, if we take a look at the highest 10 holdings, most of those shares are buying and selling at over 25x LTM earnings. I believe DAPP did a very good job at placing collectively a basket of firms which can be leaders of their discipline. That being mentioned, I am undecided if most of those firms will be capable of keep their aggressive benefit and never be disrupted by new entrants over a protracted time period. On the similar time, I anticipate a majority of constituents buying and selling at lofty valuations to appropriate within the upcoming months, as central banks all over the world are starting to withdraw liquidity from the system, which is more likely to be a drag on DAPP’s future efficiency.

Is This ETF Proper for Me?

I’ve in contrast under DAPP’s value efficiency towards the Invesco QQQ ETF (NYSEARCA:QQQ), which tracks the NASDAQ 100 index, over the past 12 months to evaluate which one was a greater funding. Over that interval, QQQ outperformed DAPP by a ~60.5 proportion factors margin. It’s attention-grabbing to see that QQQ has solely delivered a 6.8% return over that interval. A lot of the outperformance was realized on the again of DAPP’s huge drawdown since late 2021.

To place DAPP’s efficiency into perspective, a $100 funding on this ETF at its inception would now be value ~$46.28, which is a horrible return for buyers which can be lengthy the inventory because the starting. I think future buying and selling information will affirm how unstable this ETF is in comparison with QQQ. Even when DAPP has sturdy development prospects in the long run, I anticipate plenty of volatility within the quick time period, which is a worthwhile alternative for choices merchants.

Refinitiv Eikon

Key Takeaways

DAPP gives publicity to a basket of worldwide shares concerned within the enterprise of digital belongings. The fund has a excessive allocation to the highest 10 holdings, which makes future returns extremely correlated to the efficiency of those constituents. I imagine buyers buying ETFs for his or her diversification advantages ought to assess if they’re snug with a 60%+ allocation to the highest 10 holdings prior to purchasing DAPP.

If we take a look at the larger image, I am undecided how lengthy most of those constituents will be capable of keep their aggressive edge and keep away from being disrupted by new entrants. On the similar time, I anticipate {that a} majority of elements buying and selling at excessive valuations will appropriate within the coming months, as central banks all over the world start to take away liquidity from the system. On prime of that, I see digital belongings dealing with regulatory threat going ahead, which provides one other layer of threat.