jetcityimage/iStock Editorial by way of Getty Photos

I final wrote you about CVS Well being inventory (NYSE:CVS) in late December 2020. On the time, funding thesis remained legitimate. The inventory was buying and selling a bit of below $70 a share. This represented an approximate 10 % acquire versus September 2019, after I first recognized CVS as a possible alternative.

Extra lately, the inventory rose to as excessive as $111, on the heels of excellent earnings and money flows.

Nevertheless, over a number of buying and selling classes, CVS has been buying and selling down. On April 4, shares dipped under $100, however closed proper on the century mark.

This may occasionally become a chance for buyers to build up extra shares or open a brand new place.

Worries About Ahead EPS and Money Movement Grip the Road

The Road’s angst (and score downgrades) seems to be associated to 2 points.

This primary is corporate’s publicity to opioid-related settlements. In late 2021, a federal jury in Cleveland discovered that CVS, Walgreens and Walmart had been answerable for contributing to the opioid epidemic in two Ohio counties. This marked the primary time the retail section of the drug business has been held accountable within the many years lengthy opioid epidemic. The ruling is being appealed. Notably, the plaintiff’s arguments had been rejected twice by judges in California and Oklahoma in instances towards opioid producers. In any occasion, fears the case will set a precedent for different U.S. cities and counties trying to take authorized motion towards firms stay.

In March, CVS added gasoline to the fireplace when it reached a settlement with the State of Florida for $484 million: with out admission of legal responsibility or wrongdoing. Funds are to be revamped a interval of 18 years. Some buyers consider that is the primary in an extended record of settlements that may crimp money movement over the subsequent two years.

The second problem revolves round what’s referred to as the 340B program. This system requires drug producers to promote sure drugs at vital reductions to contracted pharmacies of hospitals and clinics on behalf of low-income and uninsured sufferers. Not less than 16 massive drug producers introduced elimination or curtailment of the participation in this system. This has the propensity to cut back the variety of extremely worthwhile 340B prescriptions stuffed by pharmacy majors like CVS.

My Tackle Issues

I acknowledge each points could have an effect on CVS Well being’s financials. Nevertheless, I don’t consider the magnitude of this stuff can be nice sufficient to vary the corporate’s normal earnings / money movement trajectories. One Road analyst instructed the opioid problem may trim 2024 EPS by 1 % to 2.5 %. I couldn’t discover a forecast for the way the 340B program curtailment could have an effect on CVS’ backside line.

Nevertheless, I don’t consider both of those points stunned CVS administration. Each these considerations have been lengthy within the making.

As lately as February, administration reaffirmed their earlier 2022 EPS forecast: $8.10 to $8.30 per share. Working money movement is projected to vary between $12 billion and $13 billion; indicating this years’ money movement will (once more) be higher than income.

In the meantime, different main enterprise targets stay on monitor:

develop the Well being Care (Aetna) and Pharmacy Companies segments by high-single-digits

shut unprofitable / duplicative retail areas

increase HealthHubs and MinuteClinics to offer entry to extra People

proceed to cut back debt leverage, and

proceed to extend the dividend and repurchase shares

Money Is King!

Considered one of CVS Well being’s strongest attributes is the corporate’s capacity to generate prodigious money flows.

When analyzing CVS’ money movement, I prefer to dig deeper than the OCF figures. I choose to do a levered free money movement workup. It seems like this:

CVS Well being – Levered Free Money Movement ($B)

2021 | 2020 | |

Working Money Movement | 18.3 | 15.9 |

X Working Capital Motion | -0.94 | -0.29 |

Much less Capex | -2.52 | -2.44 |

Subtotal | 14.8 | 13.2 |

Internet Debt Proceeds / Repaid | -9.31 | -5.64 |

Complete LFCF | 5.53 | 7.53 |

In each 2021 and 2020, working money movement per share exceeded adjusted EPS. One of many hallmarks of a stable inventory is the corporate’s capacity to earn its income in money.

CVS does it one higher: the enterprise generates extra free money movement than income.

Debt Is Underneath Management

When CVS closed on its Aetna Well being acquisition, the $69 billion deal added a vertical element to an already healthcare big. Nevertheless, the tab was steep: long-term debt elevated by $49.2 billion to complete $71.4 billion. The 2018 net-debt-to-equity ratio rose to 116 % from 58 % pre-acquisition. Wall Road gave the steadiness sheet the fish-eye. Administration promised to get the debt down.

And they also have.

By year-end 2021, CVS Well being recorded a net-debt-to-equity ratio of 58 %. This is similar stage it was previous to buying Aetna Well being.

Dividend Development Is Again

As well as, administration promised to boost the dividend (frozen at $0.50 quarterly because the Aetna acquisition) as soon as the debt load was so as.

They made good on that, too.

On February 1, 2022 the corporate paid its shareholders a $0.55 money dividend, a ten % enhance. Together with the rise, the board of administrators additionally approved a $10 billion share repurchase plan. That represents about 7.5% of the overall diluted shares excellent.

Is The Inventory A Good Funding?

For long-term buyers, I understand latest Road hand-wringing could change into extra of a chance than a menace.

Previous to the latest slide, as CVS inventory rose above $100, I started to change into much less sanguine on the shares: not as a result of enterprise and fundamentals, however on valuation considerations. Valuation issues.

Nevertheless, if the inventory slips under $100, the valuation considerations start to fade.

I supply a number of valuation methodologies supporting an acceptable FVE (Honest Worth Estimate) for CVS inventory.

Worth-and-A number of Metrics

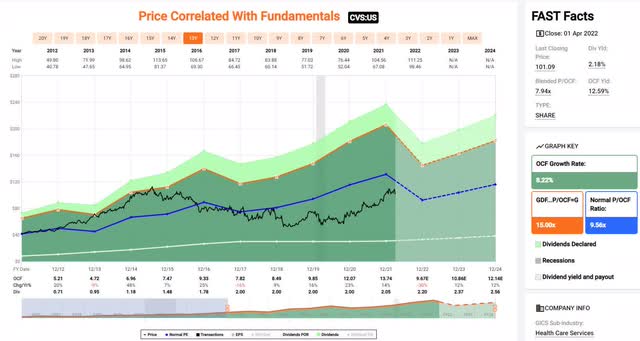

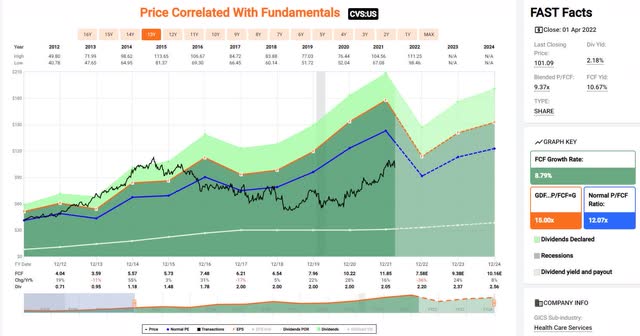

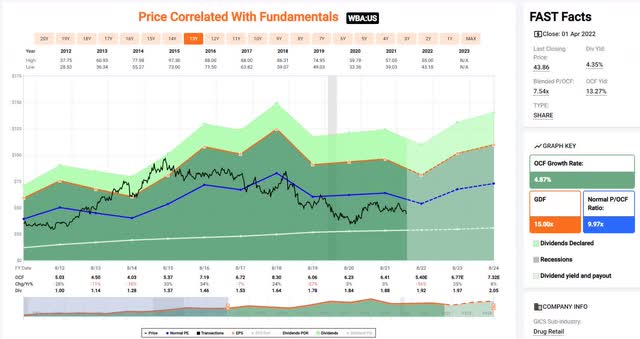

FAST Graphs supplies pictorial view depicting present and historic P/E, P/OCF, and P/FCF.

fastgraphs.com fastgraphs.com fastgraphs.com

I chosen 13-year charts for my valuation work. I picked this time-frame as a result of, 1) it displays post-Nice Recession efficiency, and a pair of) extending the timeframe will increase the valuation multiples. I elected to take a extra conservative method.

Moreover, the elevated valuation multiples utilizing a longer-dated chart are justified, because the underlying EPS and money movement progress charges are greater when together with these years when CVS was a smaller and faster-growing firm.

Traders may bear in mind that if we distinction the valuation multiples after the Aetna acquisition, we discover CVS inventory skilled a number of compression. This is a recap desk:

CVS Well being Valuation Multiples – Put up-Nice Recession and Put up-Aetna

Put up Nice Recession | Put up Aetna | |

P / E (Working) | 13.7x | 10.3x |

P / OCF | 9.6x | 7.1x |

P / FCF | 12.1x | 8.7x |

I contend the Road pressured valuation as a result of considerations about:

the power of CVS administration to combine Aetna efficiently

the debt incurred by the acquisition, and

the suspended dividend.

Now that these points have been successfully eliminated, it appears affordable the inventory ought to as soon as once more take pleasure in historic long-term valuation multiples. We should acknowledge an vital caveat: a re-rate on valuation must be accompanied by comparable EPS and money movement progress charges. To not fear: present CVS ahead earnings and money movement progress price estimates are anticipated to satisfy or exceed these recorded post-Nice Recession by means of year-end 2021.

Subsequently, utilizing long-term valuation ratios and 2023 earnings / money movement estimates, we discover CVS’ inventory Honest Worth could also be calculated to be $122, $104, and $113 per share, respectively.

EV-to-EBITDA Ratio

One other frequent valuation metric is EV-to-EBITDA. In contrast to price-and-multiple ratios, this measure considers Enterprise Worth. EV consists of market capitalization (worth) and debt much less cash-on-hand. It is an approximation of the overall worth of a enterprise.

This is a long-term FAST Graph chart highlighting CVS Well being EV-to-EBITDA:

CVS Well being EV-to-EBITDA (fastgraphs.com)

We discover the many of the annual outcomes lie between 10x and 12x. On the finish of 2021, CVS recorded an 11.7x EV-to-EBITDA ratio. On the time, the inventory was buying and selling ~$103 per share.

Since that point, the inventory worth seems to be easing, and administration continues to pay down debt. In 2021, complete debt was decreased by $8.8 billion. To realize their debt leverage targets, administration plans to proceed to cut back debt aggressively in 2022. Decrease share costs and decreased debt will decrease the EV.

As well as, EBITDA is predicted to extend. Present forecasts point out EBITDA can be flat this yr, earlier than resuming to rise mid-single-digits in 2023 and 2024.

Decrease enterprise worth and better EBITDA translate right into a decrease EV-TO-EBITDA ratio; thereby making proudly owning part of the enterprise extra engaging. Certainly, CVS was not overvalued within the first place.

Comps With Walgreens

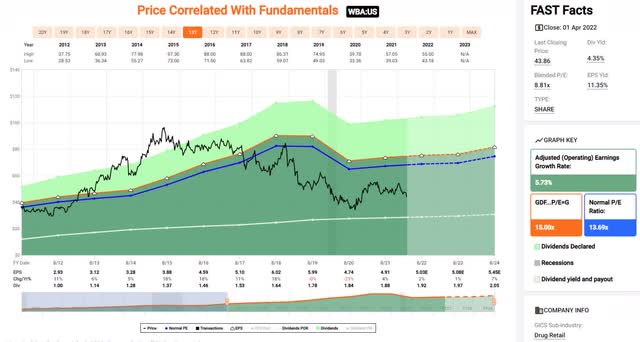

Performing a valuation examine versus peer Walgreens Boots Alliance, Inc. (WBA) upholds the valuation thesis. This is the identical three price-and-multiple FAST Graphs for WBA.

fastgraphs.com fastgraphs.com fastgraphs.com

In an effort to prevent time, the next desk supplies a fast abstract of the foregoing:

CVS Well being v Walgreens – Lengthy-Time period Valuation A number of Comparability

CVS | Walgreens | |

P / E (Working) | 13.7x | 13.7x |

P / OCF | 9.6x | 10.0x |

P / FCF | 12.1x | 13.4x |

The market has awarded comparable long-term trimmed valuation multiples; Walgreens incomes considerably greater money movement ratios.

Nonetheless, one could make an honest case WBA gives a less-compelling enterprise mannequin and ahead outlook. Certainly, Walgreens has the identical set of dangers going through CVS, however with a less-diversified enterprise scope. CVS seems to be a greater operator, too. In 2021, CVS recorded greater EBIT and EBITDA margins than Walgreens.

Turning to present TTM present inventory valuations, Walgreens is cheaper on price-and-earnings. CVS is cheaper on price-and-free money movement. The 2 shares are roughly equal on price-and-operating money movement.

Traders may word in 2020 and 2021, Walgreens’ EV-to-EBITDA ratio was about one or two turns greater than CVS Well being.

When in comparison with Walgreens, CVS doesn’t seems overvalued. If the inventory will get extra cheap, it seems higher.

Backside Line

If one concurs CVS deserves a FVE ~$110, shares begin to look engaging under $95. It is potential Mr. Market could oblige. On condition that place to begin, one may make a case there is a good likelihood shares might even see mid-teens capital appreciation. Toss in one other two or three % by way of a rising dividend.

Not a nasty return for a big, secure, well-managed, and cash-rich American enterprise.

Please do your personal cautious due diligence earlier than making any funding determination. This text is just not a suggestion to purchase or promote any inventory. Good luck with all of your 2022 investments.