In keeping with PC Gamer, crypto miners are dumping their GPUs in growing numbers as token costs falter throughout the downturn.

The knock-on impact has seen a gentle lower in the price of graphics playing cards because the market will get flooded with availability.

In analyzing European costs, Tom’s {Hardware} reported a divergence in pricing between producers. AMD choices, on common, are presently 8% beneath retail, whereas Nvidia merchandise are nonetheless 2% above retail on common.

Nonetheless, players, who’ve lengthy and onerous complained about being priced out of the market, will welcome the event.

Crypto mining is fractured

The evolution of crypto mining, specifically the popularization of Software Particular Built-in Circuits (ASICs) mining, has fractured digital asset mining into two distinct camps.

The primary is company mining corporations with deep pockets and the liberty to relocate operations wherever circumstances, corresponding to the price of electrical energy and regulatory help, are most favorable.

Some people method crypto mining as a worthwhile pastime. Nonetheless, they are usually frozen out of mining ASIC tokens, corresponding to Bitcoin, because of the intense competitors from the primary camp.

A minimum of previously, Hobbyist miners might compete by mining non-ASIC tokens utilizing GPUs — the most well-liked being Ethereum, whereas others embrace Monero, Ravencoin, and Ethereum Traditional.

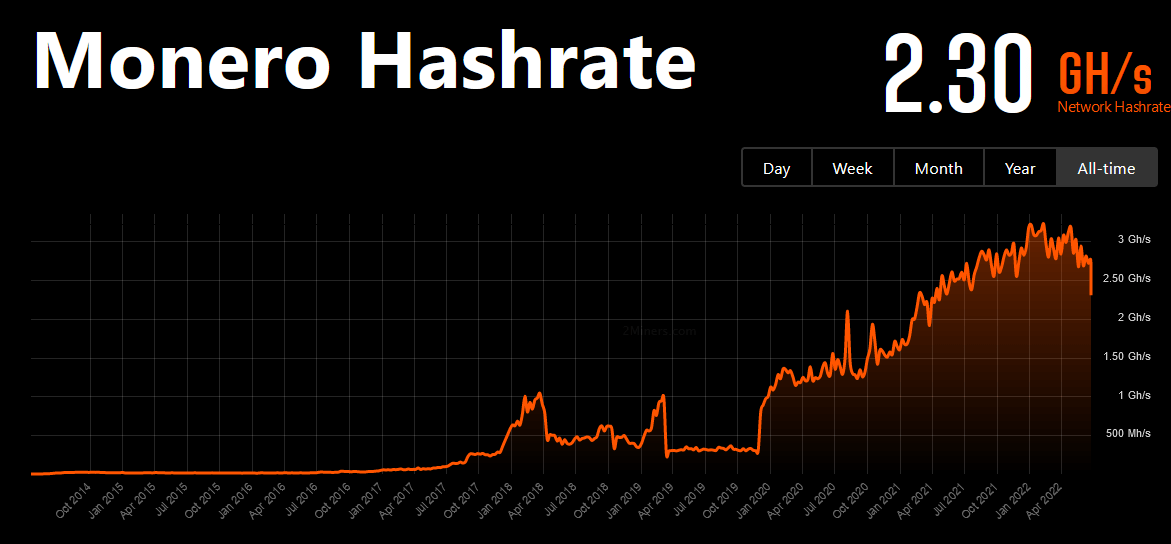

Nonetheless, falling hash charges trace that hobbyists are leaving.

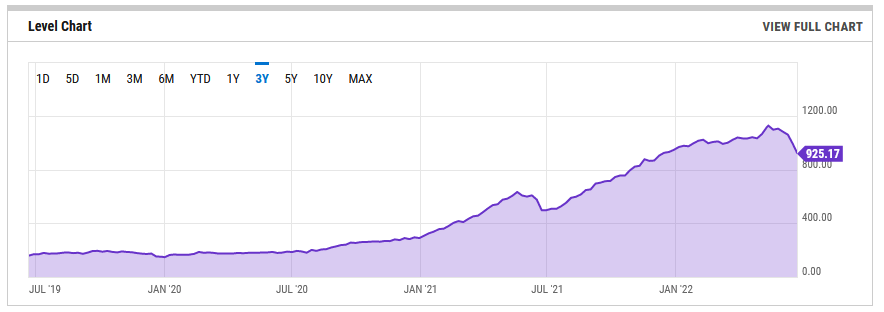

Hash charges present a pointy drop off

Evaluation of the Ethereum hash price reveals a pointy decline to 925 TH/s, representing an 18% drop from the Could 13 all-time excessive of 1,127 TH/s.

The drop suggests miners are leaving the community, but it surely’s unclear why. Within the case of Ethereum, the transition to a Proof-of-Stake (PoS) consensus mechanism means plans are in place to make mining more and more tough and subsequently unprofitable, in what is called the issue bomb.

Because the Merge between the Proof-of-Work (PoW) and PoS chains nears, this can be a issue weighing on miners’ minds. On the identical time, falling token costs and rising world power prices are additionally in play.

Equally, Monero’s hash price additionally reveals a pointy drop-off. On February 4, Monero’s hash price peaked at 3.22 GH/s, however since then, it has declined by 29%, falling to 2.30 GH/s.

Not like Ethereum, Monero has no plans to transition to a PoS community, suggesting the GPU mining exodus is industry-wide and pushed primarily by profitability considerations.

Till the subsequent bull cycle, players now not have trigger responsible GPU miners for lack of stock and worth gouging.