Digital asset funding merchandise attracted $3.3 billion in inflows final week, marking the sixth consecutive week of positive factors.

In accordance with CoinShares‘ newest weekly knowledge, this brings complete inflows over the previous six weeks to $10.5 billion and year-to-date (YTD) flows to a document $10.8 billion.

CoinShares’ head of analysis, James Butterfill, famous that investor demand has pushed complete property beneath administration in crypto exchange-traded merchandise (ETPs) to briefly hit a document $187.5 billion.

He stated:

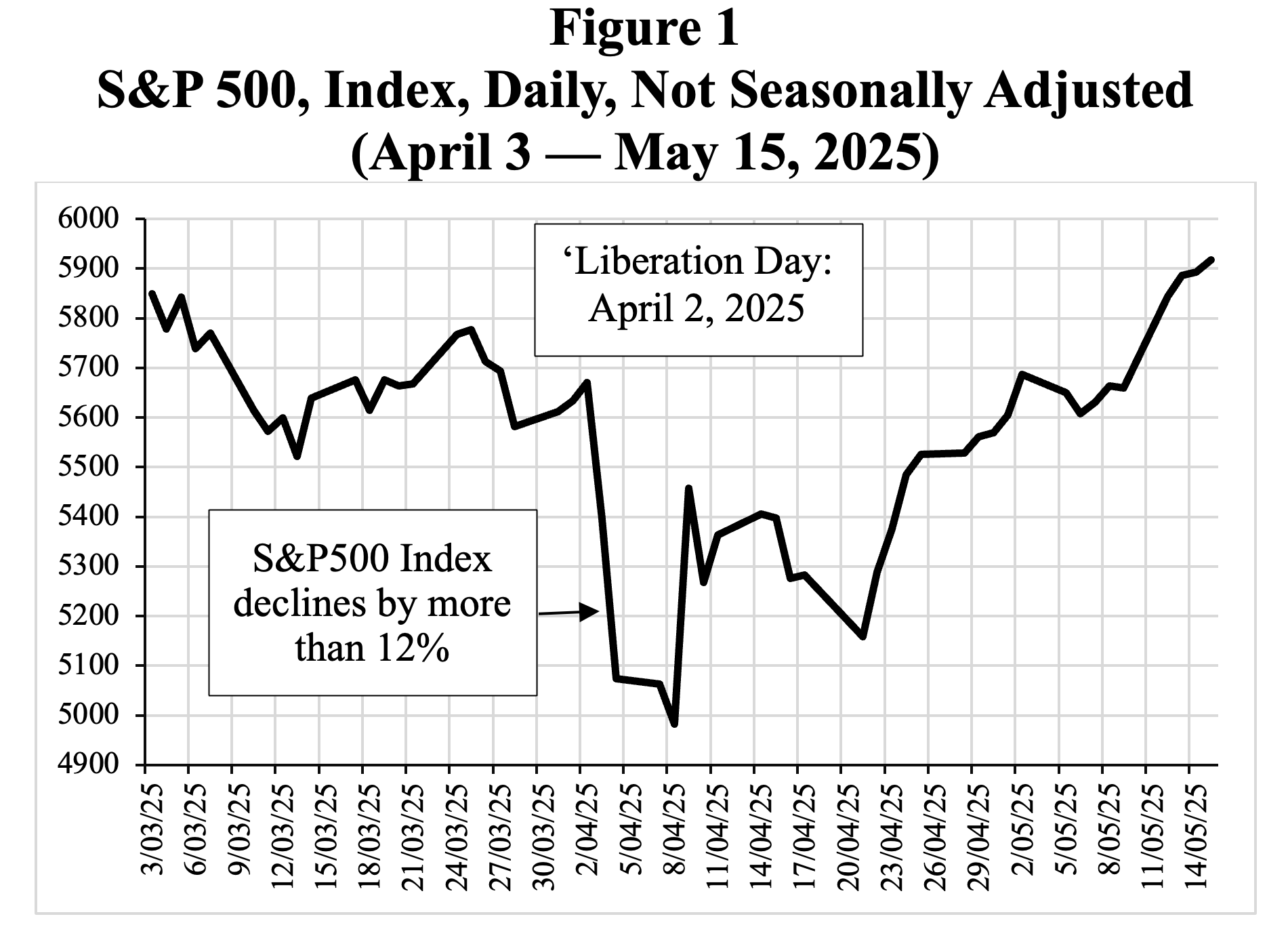

“We imagine that rising issues over the US financial system, pushed by the Moody’s downgrade and the ensuing spike in treasury yields, have prompted traders to hunt diversification by way of digital property.”

Bitcoin and Ethereum gasoline the momentum

In accordance with CoinShares, Bitcoin-backed merchandise dominated market flows, pulling in $2.9 billion final week alone.

That determine represents 1 / 4 of all inflows for 2025 to date and raises Bitcoin’s year-to-date complete to $10.1 billion. Collectively, Bitcoin ETPs now handle near $160 billion in property.

The newest market rally additionally sparked renewed curiosity in shorting Bitcoin.

Butterfill acknowledged that funding merchandise betting towards the value of BTC recorded $12.7 million in inflows, their highest since December 2024. This got here as its value reached a brand new all-time excessive of over $111,000 final week.

Ethereum merchandise additionally maintained sturdy momentum, registering $326 million in weekly inflows.

This marks ETH’s fifth week of positive factors, boosted by market optimism surrounding the Pectra improve, which went dwell earlier this month. This month, Ethereum-related funding funds have drawn internet inflows of round $568 million.

XRP sees document outflows

Whereas Bitcoin and Ethereum ETPs soared, XRP funding merchandise skilled historic losses.

CoinShares knowledge confirmed that XRP noticed $37.2 million in outflows final week, the most important on document, snapping an 80-week streak of inflows. This got here whilst institutional participation grew, primarily attributable to XRP futures contracts launching on CME Group’s platform.

Then again, most altcoins noticed modest exercise. Solana merchandise attracted $4.3 million in inflows, whereas Sui merchandise recorded $2.3 million regardless of a DeFi exploit on its community.