Sundry Photography

Introduction

Despite recording a beat on both top and bottom lines in Q1 FY2024 and raising revenue guidance for full-year FY2024, CrowdStrike Holdings, Inc. (NASDAQ:CRWD) stock is experiencing a double-digit plunge in the after-hours session. In this note, we will briefly review the CrowdStrike Q1 report, re-evaluate its fair value and expected return, and look at its technical setup. Let’s go!

Reviewing CrowdStrike’s Q1 Earnings Report

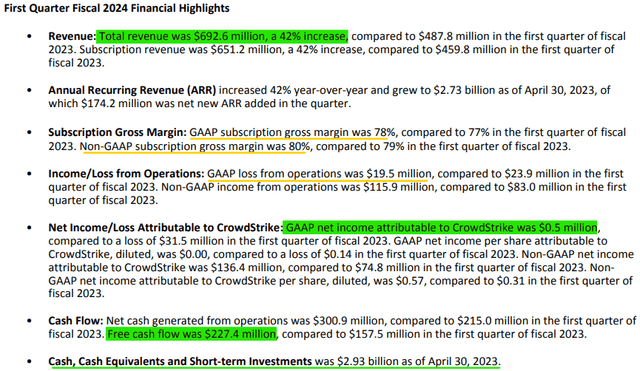

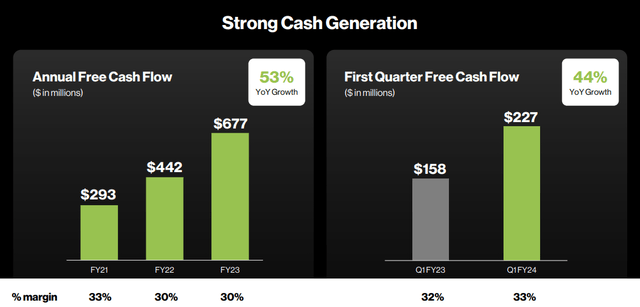

In Q1 FY2024, CrowdStrike’s revenue of ~$693M (up 42% y/y) came in well ahead of management’s guidance and consensus street estimates of roughly $676M (a beat of ~4%). This stronger-than-expected top line performance, combined with robust gross & operating margins, resulted in record free cash flow generation of ~$227M in Q1 FY2024.

CrowdStrike Q1 FY2024 Earnings Release

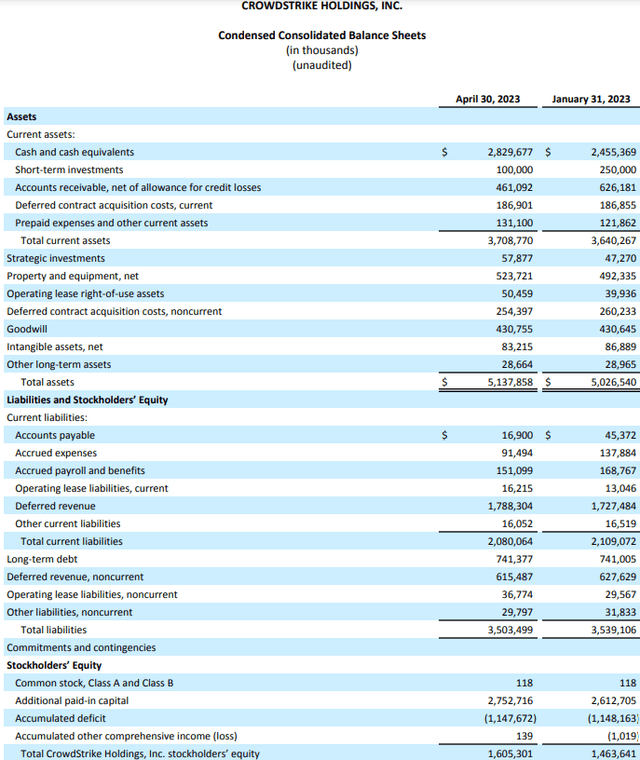

By the end of Q1 FY2024, CrowdStrike’s cash balance reached ~$2.93B (net cash of +$2.2B), and with robust FCF generation (>$1B per year), CRWD’s balance sheet is only going to get stronger in the upcoming years. At some point, I expect to see this free cash flow machine turn into a capital return (stock buyback) machine for its shareholders.

CrowdStrike Q1 FY2024 Earnings Release

For Q1 FY2024, CrowdStrike reported GAAP profitability, with a GAAP net income of $0.5M. During the Q1 earnings call, management expressed confidence about maintaining net profitability going forward and keeping SBC (stock-based compensation) in check whilst attaining and retaining top talent.

While CrowdStrike’s SBC structure remains aggressive, SBC as a % revenue is moderating rapidly and landed at ~19% for Q1 FY2024. As I have said in the past – “High SBC is a problem, but it is far from being a dealbreaker.”

After being insulated from the macroeconomic environment until Q3 2022, CrowdStrike’s management has now highlighted greater deal scrutiny and elongated sales cycles over the last couple of quarters, including Q1 FY2024. According to CRWD’s management, CrowdStrike’s customers are consolidating on the Falcon platform; however, deals are taking longer to close, and this is what’s driving lower net ARR (annual recurring revenue). In Q1 FY2024, CrowdStrike’s net new ARR came in a little short of expectations, and the management team attributed this miss to macroeconomic headwinds causing elongated sales cycles with SMBs (small and medium-sized businesses) and phased deployments among large customers.

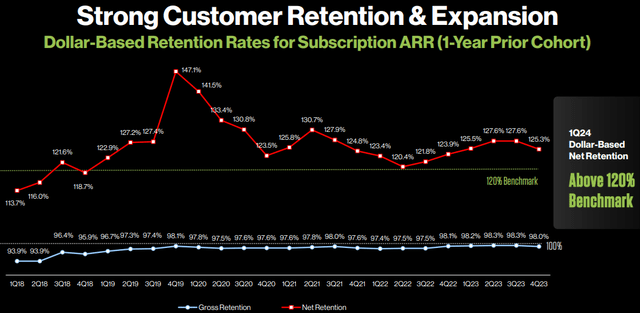

Once again, management reiterated confidence about win rates for CrowdStrike’s platform on the earnings call. While CrowdStrike is struggling to close deals with new customers (just like in Q4), it continues to get more out of its existing customer base, as evidenced by Net Retention Rates [NRR] of more than 120.

CrowdStrike Q1 FY2024 Investor Presentation

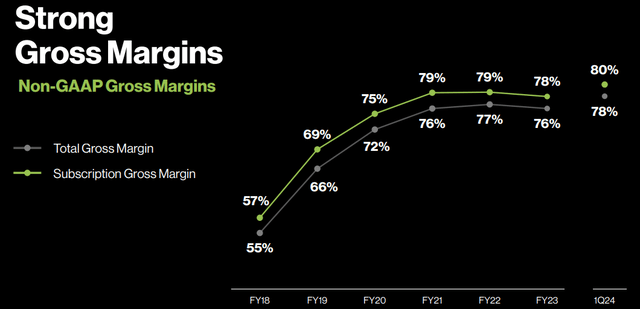

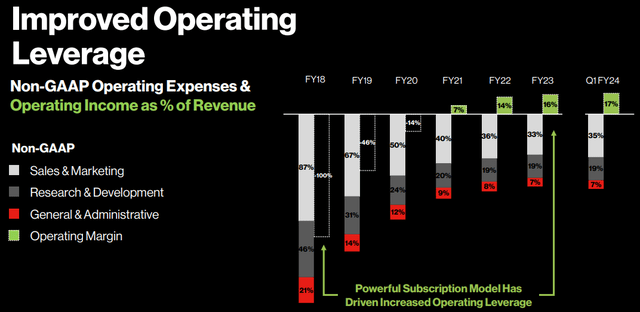

Despite facing macro headwinds, CrowdStrike managed to outperform revenue expectations in Q1. Furthermore, CrowdStrike saw an improvement in non-GAAP gross margins, which expanded to 78% (up from 77% from a year ago period). As you can see below, CRWD’s subscription gross margins rose to 80%. With improved margins and greater scale, CrowdStrike is also driving incredible operating leverage, with non-GAAP operating margins reaching +17% in Q1 FY2024.

CrowdStrike Q1 FY2024 Investor Presentation CrowdStrike Q1 FY2024 Investor Presentation

As revenues scale up, CrowdStrike is delivering enhanced operating leverage, with free cash flow margins reaching ~33% in Q1 FY2024. In the long run, CrowdStrike’s management expects free cash flow (“FCF”) margins of ~30-32%, and clearly the company is operating above this key guardrail. In my view, CrowdStrike could easily end up generating a 35-40% FCF margin at steady-state.

CrowdStrike Q1 FY2024 Investor Presentation

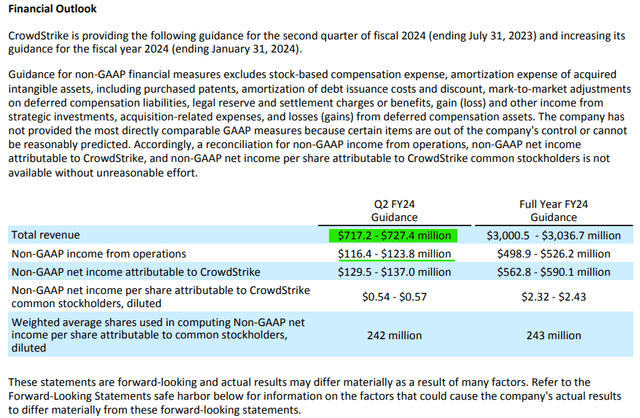

For Q2 FY2024, CrowdStrike is projected to deliver revenues of $717-727M, and the midpoint of this guided range is slightly ahead of consensus analyst estimates of $718M. Furthermore, CrowdStrike’s non-GAAP EPS of $0.54-0.57 came in ahead of Street estimates of $0.54.

CrowdStrike Q1 FY2024 Earnings Release

Additionally, CrowdStrike’s management raised the revenue forecast to $3.000-3.036B despite facing continued macro headwinds that have resulted in elongated sales cycles. While Mr. Market has reacted negatively to CrowdStrike’s ER, the reaction seems unjustified based on the Q1 numbers and management’s guidance.

Now, as we know, CrowdStrike’s management has a history of under-promising and overdelivering. This is why I continue to believe that we will end up with 35%+ y/y growth in 2023. Unfortunately, Mr. Market is short-sighted, and CRWD is probably being punished for its ongoing growth deceleration. That said, cybersecurity trends are looking strong despite tough macro conditions, and CrowdStrike is likely to grow at a healthy clip for years to come.

Here’s My Updated Valuation For CRWD Stock

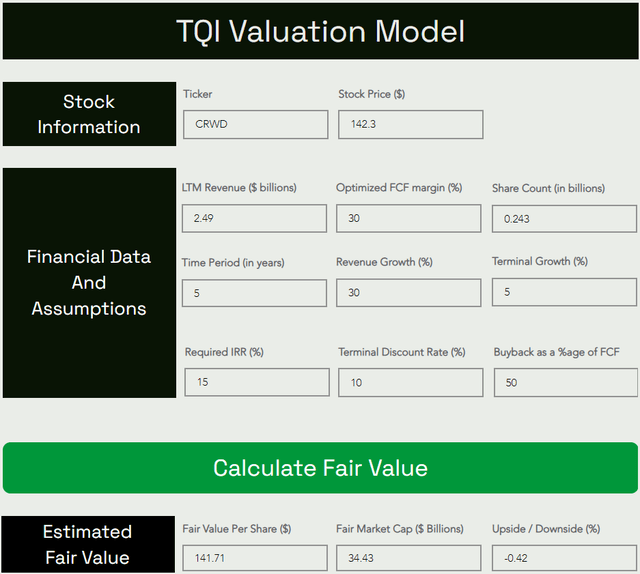

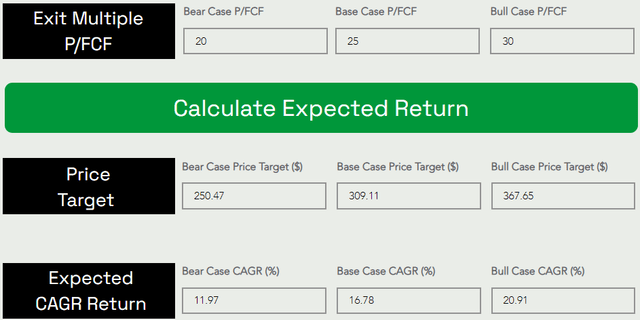

TQI Valuation Model (Author’s Website: TQIG.org) TQI Valuation Model (Author’s Website: TQIG.org)

Summary of Changes:

- Old fair value (“FV”) Estimate: $149.96, New FV Estimate: $141.71.

- Old Base Case price target (“PT”) (5-yr): $328.36, New Base Case PT (5-yr): $309.11.

After factoring in today’s after-hours dip, CrowdStrike is now trading at fair value, and the risk/reward continues to remain favorable for long-term investors. With a 5-yr expected CAGR return of 16.78%, CRWD exceeds my investment hurdle rate of 15%; hence, I remain bullish on CrowdStrike.

Bottom Line

Heading into its Q1 report, CrowdStrike Holdings, Inc. stock had rallied beyond our fair value estimate. And I think the double-digit after-hours pullback in CRWD stock is a result of the stock running too far too fast and has nothing to do with business fundamentals.

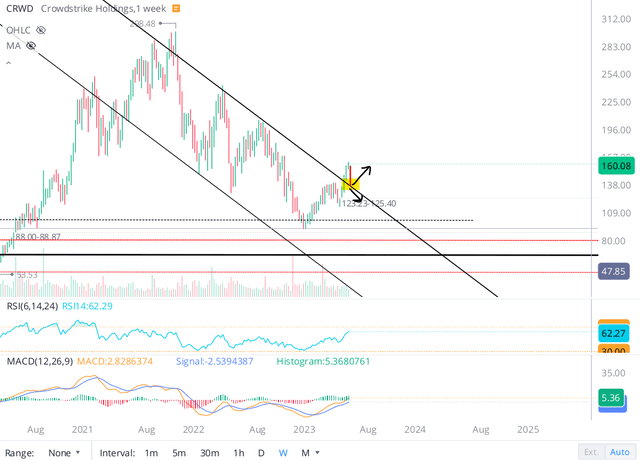

WeBull Desktop

Technically, CrowdStrike is now testing the upper trendline of the bear-market channel at ~$140. In the near term, the stock could break down or bounce up from this level. Unfortunately, I do not have a crystal ball to predict the directional move. However, I like CrowdStrike as a long-term investment here, with the stock now trading at ~30x P/FCF.

At our investing group, The Quantamental Investor, we have gained exposure to the secular growth trends in cybersecurity via a basket of stocks that contains CrowdStrike, Zscaler, Inc. (ZS), Okta, Inc. (OKTA), and SentinelOne, Inc. (S). And this entire basket has performed extremely well so far in 2023. In the digital era, cybersecurity software is critical infrastructure for all businesses regardless of which sector or industry they operate in. And this secular growth trend is set to go on for several years to come.

CrowdStrike Holdings, Inc. is a best-of-breed cybersecurity platform that continues to deliver rapid growth at scale with improving profitability. On the back of a double-digit after-hours plunge in CRWD stock, the shares are now fairly valued. Considering the long-term risk/reward on offer, I view this dip as a buying opportunity in CrowdStrike Holdings, Inc. stock.

Key Takeaway: I rate CrowdStrike Holdings, Inc. stock a “Buy” in the low $140s.

Thanks for reading, and happy investing. Please share your thoughts, questions, or concerns in the comments section below.