Arnd Wiegmann/Getty Images News

The Credit Suisse (NYSE:CS) meltdown is threatening to spill over into a systemic crisis affecting the global financial system at a time when the U.S. banking system is already highly stressed in the wake of the Valley SVB Financial Group (SIVB) and Signature Bank (SBNY).

Therefore it is not a huge surprise that The Swiss National Bank (“SNB”) and regulator FINMA are looking to orchestrate a shot-gun wedding this weekend as reported by the FT.

It is also clear that last week’s intervention by the SNB did not allay the fears or stem the outflows from Credit Suisse. The Swiss banking industry could unravel very quickly and there is little doubt that the Swiss authorities have to intervene and quickly. It appears that this weekend, a deal is going to get done.

How Did Credit Suisse Get Itself Into This Mess?

It was mostly self-inflicted scandals and risk management failures over the last several years that got CS to this point. The most consequential ones were material financial losses and reputational damage suffered as a result of its engagement with the disgraced financier Lex Greensill and failed hedge fund Archegos Capital Management in 2021.

The most painful episode, though, that instigated the downward spiral was the Archegos Capital debacle which demonstrated astounding risk management failures in the Prime Finance business unit. Instead of running to the exit as soon as possible, CS was looking to “coordinate” an orderly sale with its peers Goldman Sachs (GS) and Morgan Stanley (MS) over that fateful weekend. That was awfully naive. GS and MS sold the collateral held as soon as possible in block sales with minimal losses whereby CS ended up holding the baby and ~$4 billion in losses. As a matter of course, the Prime Finance business unit should be low risk if managed properly. At the time (when CS shares were trading at ~$10), I noted the following:

Beyond the financial loss, there are other significant downstream implications for CS in the short and medium term. Whilst the current share price appears attractive in the context of the long-term valuation of the stock, I am not quite ready to buy the dip. There appear to be major risk management matters plaguing its investment bank and fixing these will likely be a protracted and costly process.

Consequently, CS had to raise equity to plague the capital hole created by the losses and trimmed down its ambitions in the investment bank. However, this proved to be insufficient as the bank entered the bear market of 2022.

It was clear that CS would need a favorable market environment for its turnaround to succeed. Unfortunately, 2022 was not that year as it applied to the CS business model. CS investment bank is geared mostly toward credit markets and capital markets issuances. These were areas that were quite challenged in 2022. Similarly, CS’s areas of strength in leveraged finance, M&A, and SPAC deal activity were either loss-making or inactive.

On the flip side, CS has little exposure to FX trading, rates, and commodities trading which were booming in 2022 and rewarded the likes of Barclays (BCS) and Deutsche Bank (DB). It was a perfect storm for CS and it was forced to raise capital once again and announce a massive restructuring of the Investment Bank with the expectation of bleeding losses for the foreseeable future.

At that point, given the newsflows, market participants as well as clients began to lose confidence in the firm and the contagion spread to the wealth management division as well. The fourth quarter of 2022 was characterized by unprecedented client outflows which were most dramatic in its Asian wealth management division that for many years has been its growth engine. CS went into a tailspin as it lost key staff and rainmakers to rivals.

UBS

UBS (NYSE:UBS), on the other hand, has been executing exceptionally well in recent years. Following its bailout in the 2008/2009 global financial crisis (“GFC”), UBS has de-emphasized the investment banking division and refocused its efforts on wealth and asset management and this has proven to be the right strategy.

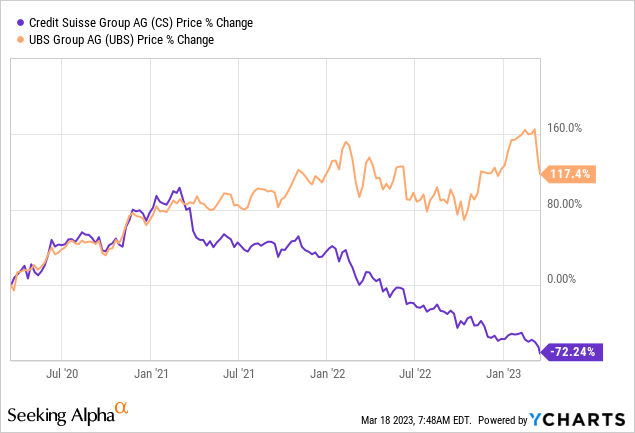

The relative price return in the last 3 years between UBS and CS, says it all:

As can be seen above, the returns path diverged around the time of the Archegoes Capital episode in 2021.

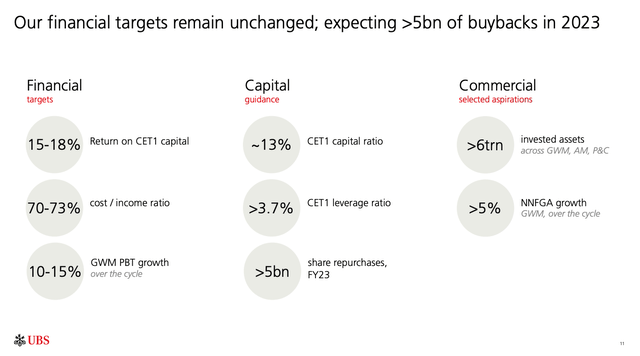

UBS business, however, is very stable and delivers high returns on capital as well as strong capital returns to shareholders. It is clearly a picture of rude health when compared to CS.

UBS Investor Relations

What Would UBS Want To Buy Credit Suisse?

Wealth and Asset Management profitability are highly correlated to scale. UBS has the opportunity to scale up materially and instantaneously bringing on significant additional AUM and AUS. The operational leverage and significant synergies that can be derived would be exceptionally high. And UBS would likely only need to pay a token amount to complete this deal.

There are material risks of course as CS may have various hidden skeletons in the closet. These may involve conduct or legal costs that may be multi-billion and thus future charges could be both distracting and costly. At the end of 2022, CS disclosed ~$1.3 billion of potential fines and legal costs with an indication of additional charges to be provided for in the future.

I also suspect UBS would have no interest in taking on the investment bank. The unwinding of the CS investment bank is likely to require a suitor to take on significant losses for an indeterminate length of time. It is really a poison pill for a would-be buyer.

The Shape Of The Deal To Come

Credit Suisse’s crown jewel remains the Swiss domestic universal banking unit which provides banking and wealth management services in the Swiss market. The domestic unit is also very important to the Swiss economy and has seen few deposits and AUM outflows, even during the current crisis, compared to the international wealth management arm. It remains a valuable banking business and the value of the franchise has not been impaired in recent years and it is the only part of the franchise that remained consistently profitable throughout the last 10 years.

The Swiss regulators’ first priority would be to protect the domestic banking market and in my view, the preference would be for it to remain a stand-alone business. I suspect it will be spun off or IPOed to avoid over-concentration in the Swiss domestic banking market and prevent significant job losses.

UBS would most likely take over the international wealth and asset management divisions which should be very complementary to its existing businesses. There will need to be regulatory approvals in several countries, notably the U.S. and the UK, but I expect these to be readily forthcoming given the global and systemic nature of this crisis.

UBS will most certainly seek some sort of protection from losses in the investment bank (if it does take it on) as well as recovery for any legal and conduct costs.

The Swiss regulators would have to coordinate closely with the U.S., UK, and other EU regulators to get this deal over the line and help to calm down systemic risks in the global banking markets. Everyone is likely to play ball in these circumstances, the risks are too great otherwise.

Final Thoughts

This is a shotgun wedding for sure. I am not sure UBS is overly interested in taking over the whole of Credit Suisse. There are too many risks involved.

UBS was probably already organically onboarding many of the wealth-management clients that departed CS, it really doesn’t need to buy the legal shell but it may be forced to. UBS is certainly not interested in acquiring the liabilities in the legal structure as well as the investment bank. Unfortunately, it may not have a choice, if the Swiss regulators insist on this deal getting done. This may be seen as a “national service” as far as UBS is concerned. Its main prerogative would be to limit the downside risks involved in this by obtaining hard assurances on the risks it absorbed from Swiss and other regulators.

I highly suspect that the Swiss regulators would look to retain the CS domestic banking unit intact. UBS may buy the rest and look to dispose of the investment bank over time. Given the global systemic and contagion risks, this is all about detonating the CS “bomb” with at least damage as possible.

Nonetheless, the medium and long-term winner here is clearly UBS. Wealth management is all about scale, and UBS is about to get materially larger.

I now rate UBS as a buy and I may upgrade to a strong buy depending on the shape of this deal.