Two issues any observer would take away from latest information media reviews on the US economic system are in the present day’s excessive inflation and low unemployment. GDP has been rising, although not too robustly, because it collapsed in 2020 because of the pandemic lockdowns. Unemployment all the time rises in a recession, typically taking as much as two years to fall again to pre-recession ranges. The recession is taken into account over as soon as output begins rising once more, however above-normal unemployment normally persists for one or two years. The COVID-19 recession was a reasonably distinctive occasion, and its uniqueness and severity can solely be appreciated by its affect on employment and labor markets.

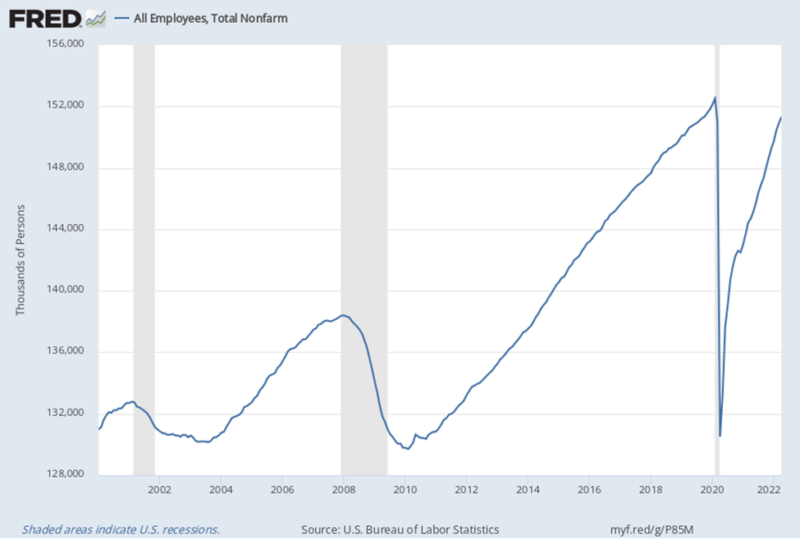

Determine 1 reveals the full variety of employed individuals within the US, excluding farmers and agricultural employees, from 2000 to 2022. This collection peaks at or close to the beginning of every recession, indicated by the grey bars. Following the 2001 tech-bubble recession and the 2007-2009 Nice Recession, complete non-farm employment continued to fall even after these recessions have been formally over, solely beginning to develop once more many months after the tip of every recession.

The 2020 COVID-19 recession seems to be dramatically totally different—this recession was a lot shorter, and the lack of jobs was a lot larger. About 3 times as many roles have been misplaced because of the COVID-19 recession in comparison with the a lot longer-lasting Nice Recession. Two saving graces have been the COVID-19 recession’s brevity and the early onset of labor market restoration, in contrast with regular, extra typical recessions. By March 2022, employment had almost returned to the pre-pandemic degree. In comparison with the recoveries from the primary two recessions, the COVID-19 recession gave labor markets much more to get well from, and the restoration has additionally been extra fast, at the very least to date.

Determine 1 Complete Non-farm Employment 2000-2022

Financial coverage makers prime the economic system for a recession by conserving rates of interest too low for too lengthy. This artificially low-cost credit score, and the truth that there’s an excessive amount of of it, permits corporations to over-optimistically overexpand their operations. This overexpansion creates extra demand for labor, reducing unemployment. When a traditional recession hits, markets appropriate to make up for corporations’ unsustainable enlargement. Some corporations notice they have been too optimistic concerning the demand their product will face, or the price of producing it. They reply by slicing again on manufacturing and shedding employees, elevating unemployment. This begins a essential retrenchment course of that ripples all through the economic system as newly laid-off employees see their incomes diminished, and in flip lower down on consumption spending, additional cooling the economic system in a vicious cycle. Companies have to cease unsustainable manufacturing, and take inventory of their newly-revealed financial actuality to border and begin new manufacturing plans that shall be extra sustainable and sensible. That is the inspiration for sustained financial progress.

Through the restoration from a recession, GDP rises earlier than employment as corporations initially improve output by working already-hired workers extra intensively, maybe by giving some extra hours or others extra time beyond regulation. Because the restoration continues, demand for output ultimately rises sufficient that corporations discover they’ve to rent extra employees to fulfill the rising demand. Determine 1, US non-farm employment, displays a robust development over time as each the inhabitants and economic system have grown over the long term. Recessions might be considered occasional bouts of visitors congestion, maybe brought on by much-needed however poorly-planned—and inconvenient—highway repairs. These are momentary disruptions to financial progress, the place drops in GDP are accompanied by will increase in unemployment; that’s, by decreases in employment. If this employment collection have been prolonged again previous 2000, the long-term development could be much more apparent.

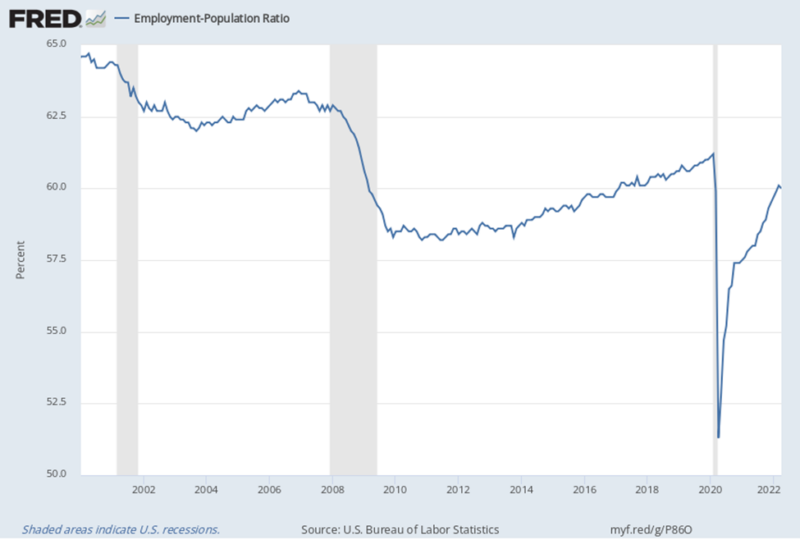

The long-term development might be eliminated by dividing complete employment by a associated collection with the same development, on this case inhabitants. Determine 2 reveals the employment-to-population ratio from 2000 to 2022. That is the ratio of all employed individuals, now together with agriculture, divided by the full grownup inhabitants. This ratio reveals extra clearly the damaging, long-term affect of every of the three recessions within the interval lined. Determine 2 reveals that this ratio has partially recovered from the COVID-19 recession, however it nonetheless has a approach to go to succeed in its pre-recession worth—it provides a clearer image of how far we now have to go than Determine 1. If we prolonged this collection again earlier than 2000, we’d see that the ratio grew steadily from about 1960-1980, primarily as a result of throughout that interval girls joined the labor drive in growing numbers, peaking at about 70 % by 1985, however then fell under 65 % by the flip of the century. The ratio falls sharply to various levels throughout every recession, after which grows slowly because the economic system recovers.

Discover that the employment-to-population ratio peaked virtually a 12 months earlier than the 2001 recession. It was already falling earlier than the official begin of the recession, persevering with to fall for almost two years after the recession’s official finish. The tech-bubble recession of 2001 noticed the ratio fall from roughly 65 to 62 %, and over the restoration main as much as the Nice Recession it actually didn’t get well a lot, solely rising to about 63 % by the tip of 2006. The truth that the ratio by no means absolutely recovered means that the gentle 2001 recession caused everlasting structural adjustments within the economic system. Throughout this era the tech sector continued to develop, although many corporations outsourced tech employment abroad. Finance, building, and actual property growth additionally grew. US manufacturing turned more and more automated, producing a rising worth of complete manufactured output, however not essentially including employees.

Equally with the 2007-2009 Nice Recession, the ratio peaked almost a 12 months earlier than the recession’s official begin, persevering with to fall till 2010. The ratio didn’t actually develop or get well, reaching a roughly 57-58 % decrease plateau from 2010-2014. The restoration after that was very gradual. Though the economic system was gaining jobs in the course of the restoration, the US inhabitants grew almost as quick, conserving the employment-to-population ratio at 50-year lows till the pandemic hit.

Determine 2 U.S. Employment-to-Inhabitants Ratio 2000-2022

The COVID-19 recession diminished this ratio right down to virtually 50 %, however happily it has recovered quickly. Employment fell so dramatically in 2020 due to drastic emergency lockdowns of so-called nonessential companies, disproportionately affecting transportation, hospitality, tourism, recreation, and restaurant sectors. Though authorities stimulus and reduction funds lessened the lockdowns’ monetary affect, they have been poorly administered. All households acquired stimulus funds, which weren’t means examined, so households with uninterrupted incomes acquired the identical funds as those who misplaced jobs at some stage in the disaster.

Companies have been eligible to use for stimulus and paycheck safety grants—euphemistically referred to as loans however by no means meant for compensation—however many that ought to have been prioritized weren’t eligible and others that didn’t want the grants bought them. Consequently many companies needed to shut utterly and have by no means reopened. Some eating places switched to an solely takeout or supply mannequin, enabling them to scale back their waitstaff, and in lots of instances enhancing their revenue margins, even on diminished gross sales. The affect of lockdown insurance policies have been borne disproportionately by poorer households, falling on blue collar employees who have been extra more likely to be laid off utterly. Normally, white collar employees labored from house with none lack of revenue. The burden additionally fell disproportionately on minorities and deprived teams, additional amplifying prevailing revenue inequality.

The pandemic additionally offered enterprise alternatives for alert entrepreneurs, as disinfection providers, meals and product deliveries, teleconferencing providers, and many others., confronted dramatic will increase in demand. Zoom was a comparatively little-known, little-used video assembly software program, use of which exploded. Because the restoration progresses, many corporations are actually having issue discovering employees to rent. This factors to the plain want for employers to begin providing larger wages. Why would possibly corporations be reluctant to take action?

Customary labor market idea is that markets clear when provide and demand are equal. Labor shortages point out that prevailing wages are too low to clear the market. Companies can’t supply employees a wage larger than the employee’s marginal income product, and a potential rationalization of why corporations gained’t pay sufficient is that their appraisal of the employee’s worth is simply too impaired by uncertainty of future market situations—corporations are questioning whether or not inflation shall be introduced underneath management, or proceed, and in that case, for the way lengthy; whether or not the weak restoration will proceed, or be derailed by one other recession; and whether or not COVID returns with any severity, and if it does, what restrictions shall be carried out?

Recessions usually happen after protracted financial enlargement permits an excessive amount of funding in less-productive actions. This involves a head when intricate interrelationships among the many economic system’s productive actions grow to be so difficult, conflicting, and fragile that too many can’t be accomplished efficiently. Although it was way more extreme than any recession for the reason that Nice Melancholy, the COVID-19 recession has carried out little to take away the economic system’s underlying structural issues. This may be seen most clearly within the nonetheless booming actual property market. The final a number of recessions, even going again farther than 2000, have carried out lasting harm to the US economic system, particularly labor markets, and to date it seems the COVID-19 recession has been no exception.

:max_bytes(150000):strip_icc()/Health-GettyImages-2148115727-320342eaa3ce4fb6bda09bf3994791ea.jpg)