Sundry Pictures/iStock Editorial by way of Getty Pictures

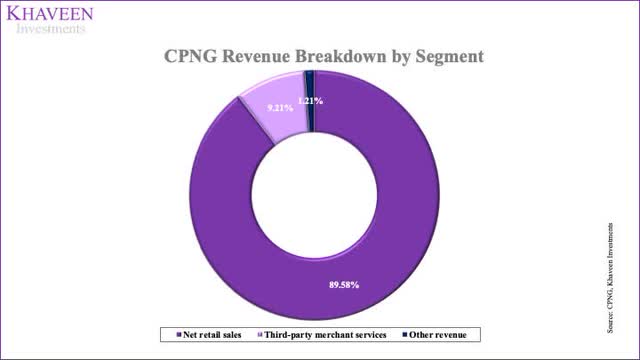

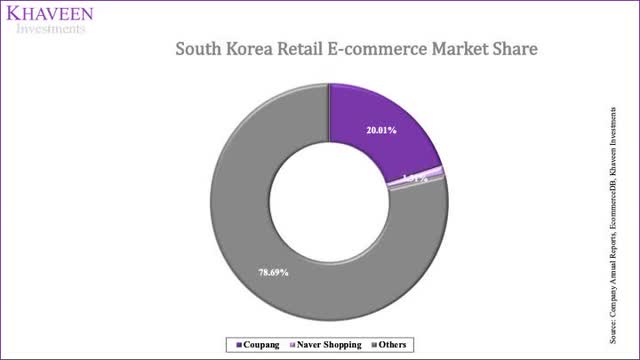

Coupang (CPNG) is the most important retail e-commerce firm in South Korea with a market share of 20.01% in 2021. In addition to that, based mostly on its prospectus, the corporate ventured into different income segments akin to third-party service provider providers the place the corporate fees commissions, promoting, and supply charges from its retailers. The corporate has additionally been concerned in different e-commerce companies akin to video streaming providers, meals supply, and extra.

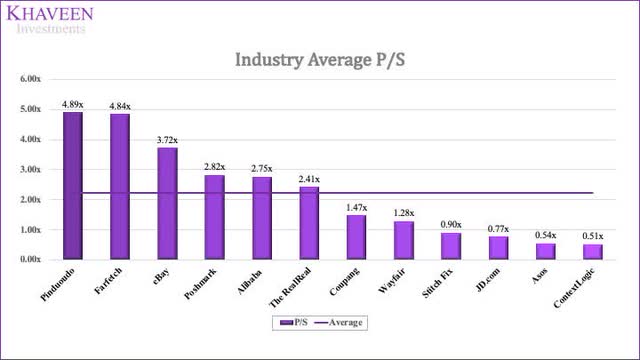

On this evaluation of Coupang, we analyzed its e-commerce enterprise and anticipate its progress to be pushed by elevated spending by customers and continued person progress. Moreover, we examined its benefit by way of having an enormous person base and excessive fee construction for third-party retailers which we imagine may proceed to result in the expansion of its third-party service provider providers phase income. Lastly, we analyzed its profitability development which has improved since 2018 however we anticipate it to stay unprofitable sooner or later because it aggressively expands its logistics community. Utilizing a P/S comparable valuation, we derived a worth goal for the corporate based mostly on the business common ratio of two.24x.

Coupang

E-commerce Income Progress Pushed by Elevated Spending and Consumer Progress

In 2021, the South Korean retail e-commerce market measurement was $92 bln in keeping with ecommerceDB. Coupang has the very best market share of 20.01% in 2021 based mostly on transaction quantity.

Firm Annual Experiences, ecommerceDB, Khaveen Investments

In South Korea, the share of e-commerce gross sales of whole retail gross sales has elevated to 25.8% in 2021 from 21.5% in 2019. Based mostly on Statista, South Korea’s e-commerce penetration charge by customers has been rising from 2017 at 61% to 77% in 2022. Additionally, the penetration charge is predicted to achieve 83% by 2025. As compared, South Korea’s web penetration charge elevated from 78% in 2011 to 92% in 2021.

Based mostly on OpenSurvey, the highest elements Korean customers desire to buy on-line are on account of its good worth, the comfort of supply, and handy cost with 44.5%, 33.1%, and 24.7% respectively. In a survey of buyer satisfaction of e-commerce platforms by the Korean Client Company, Coupang beat out its rivals with the very best rating of three.85 out of 5 with an environment friendly supply service whereas different rivals scored under 3.8.

By way of the breadth of its logistics community, in 2020, Coupang had 200 fulfilment centres with roughly 20 mln sq. toes in Korea. Whereas Naver & CJ Logistics solely had 2 fulfilment centres with a complete of 57,574 sq. toes. We imagine that with its superior logistics capabilities, Coupang may keep its benefit over rivals and keep its excessive buyer satisfaction and entice extra customers. Furthermore, we imagine that is additional supported with a optimistic NPS rating of 76 for the corporate.

Its person base grew however at a reducing charge from 2018 to 2021. From 2022 onwards, we assume its person base to develop on the common decline in progress from 2019 to 2021. We projected its person progress charge to lower by the 2-year common YoY distinction of 4% for 2022 and maintained it fixed within the forecast interval till 2024.

|

Coupang Customers |

2018 |

2019 |

2020 |

2021 |

2022F |

2023F |

2024F |

|

Customers (mln) |

9.16 |

11.79 |

14.85 |

17.90 |

20.84 |

24.27 |

28.27 |

|

Progress % |

29% |

26% |

21% |

16% |

16% |

16% |

Supply: Coupang, Khaveen Investments

Whereas its person progress has deteriorated over the previous 3 years, its ARPU has been rising at a 3-year common of 33%. Coupang’s administration has talked about that the corporate is specializing in clients’ loyalty relatively than increasing its clients base.

…much less aggressive on buyer acquisition this quarter to guard the expertise for present clients, prioritizing what’s greatest for purchasers drives loyalty and engagement, and we imagine that’s the greatest long-term method – Gaurav Anand, Chief Monetary Officer at Coupang.

The South Korean retail market is forecasted to develop by Analysis and Markets at 4% CAGR whereas the e-commerce market is forecasted to develop by MarketResearch.com at a considerably larger CAGR of 19.92%. For the ARPU progress, we tapered down the expansion charge by 10% in 2022 and 5% by 2024 for APRU.

|

Coupang ARPU (mln) |

2018 |

2019 |

2020 |

2021 |

2022F |

2023F |

2024F |

|

Customers (mln) |

9.16 |

11.79 |

14.85 |

17.90 |

20.84 |

24.27 |

28.27 |

|

Progress % |

29% |

26% |

21% |

16% |

16% |

16% |

|

|

ARPU ($) |

414.75 |

490.85 |

743.78 |

921.12 |

1048.63 |

1141.36 |

1185.22 |

|

Progress % |

18% |

52% |

24% |

14% |

9% |

4% |

|

|

Internet retail gross sales ($ mln) |

3,799 |

5,787 |

11,045 |

16,488 |

21,859 |

27,706 |

33,504 |

|

Progress % |

52% |

91% |

49% |

33% |

27% |

21% |

Supply: Coupang, Khaveen Investments

Third-party Vendor Companies Anticipated to Profit from Excessive Fee Construction

As of Q3 2021, the corporate has talked about its excessive income progress of third-party service provider providers income by incomes commissions, ads, and supply charges from third-party retailers. As of February 2021, the corporate has claimed to have greater than 200,000 third-party sellers onboard. The administration has talked about the significance of its lively clients contributing in direction of increasing Coupang’s outreach and engagement, offering further revenues.

We view the variety of Lively Prospects as a key indicator of our potential for progress in whole internet revenues, the attain of our community, the notice of our model, and the engagement of our clients – Q1 2021 Press Launch

On this case, with Coupang’s sturdy person base, we anticipate the corporate to proceed attracting retailers to this platform as Coupang gives entry to a bigger person base in comparison with its rivals. With 17.90 mln customers as of 2021, Coupang has a considerably larger variety of customers in comparison with chosen firms as said under.

|

Korea Retail E-commerce Corporations Customers (mln) |

2021 |

|

Coupang |

17.90 |

|

G Market |

5.77 |

|

11 Road |

7.45 |

|

WeMakePrice |

4.49 |

|

BucketPlace |

4.08 |

|

TMON |

4.22 |

Supply: Coupang, Pulse, Khaveen Investments

Furthermore, Coupang has launched a brand new initiative to offer new sellers with images and video studios free of charge moreover offering free on-line lectures for them in keeping with The Korea Financial Day by day. From the partnership with Payoneer, a cost know-how firm for e-commerce, Coupang opens up cost options for worldwide sellers for cross-border companies. In addition to that, as of December 2021, Coupang has at the moment the very best fee construction at 31.2% carried out to third celebration sellers in comparison with KakaoTalk Reward, SSG.com, GS Store, and Lotte I Mall.

Taking into consideration its big person base and highest fee construction for retailers, we imagine this gives it with a bonus and alternative to draw extra sellers to its platform. From 2022 onwards, we anticipate the third-party service provider providers income to be lower than the 3-year common by 15% by 2024.

|

Coupang Income Projection ($ mln) |

2018 |

2019 |

2020 |

2021 |

2022F |

2023F |

2024F |

|

Third-party service provider providers |

252 |

441 |

790 |

1,695 |

2,961 |

4,727 |

6,839 |

|

Progress % |

75% |

79% |

115% |

75% |

60% |

45% |

Supply: Coupang, Khaveen Investments

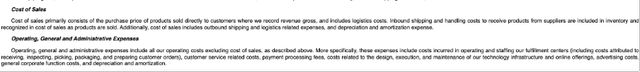

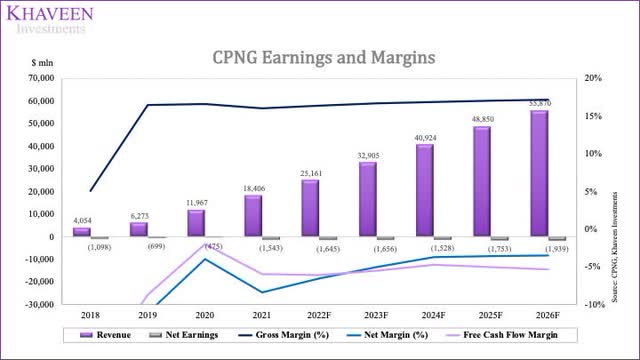

Profitability Weighed Down by Logistics Growth

Coupang has a 3-year common value of products offered in % of income at 86.11% and alongside its SG&A bills at 26.26% of its income, the corporate has not been capable of cowl its working prices from the income generated. Nonetheless, the price of items offered in % of income has been experiencing a ten.72 share factors decline since 2018. Based mostly on the corporate’s prospectus, Coupang has talked about that almost all of its value of gross sales comes from product costs together with logistics prices.

Coupang

Coupang has introduced that the corporate will spend $308 mln on increasing its distribution community. In accordance with Symbia, labour prices are probably the most important working prices for warehouses. In addition to that, the rising prices for constructing provides may additionally hike up the working prices required to construct new fulfilment centres. As of Q3 2021, the corporate has incurred $95 mln into labour and operational prices. With the extra working prices to maintain its warehouse operations, we imagine Coupang may very well be going through unprofitability with its e-commerce phase.

Whereas the working margin for Coupang has improved from 2018 to 2021, the corporate has initiated the enlargement of its fulfilment centres which we imagine may jeopardize its profitability. We anticipate Coupang’s unprofitability to be maintained as the corporate expands its fulfilments sooner or later.

Coupang, Khaveen Investments

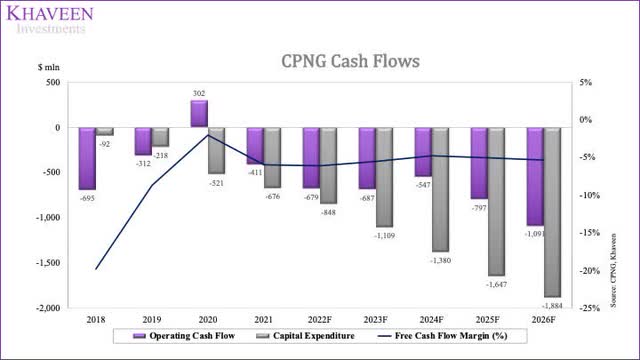

Whereas by way of its FCF, we don’t anticipate the corporate to generate optimistic FCFs based mostly on an assumption of Capex to revenues of three.4% on a 4-year common.

Coupang, Khaveen Investments

Danger: Japan E-commerce Enterprise Growth Headwinds

Coupang has continued to develop its companies abroad akin to in Japan, Taiwan, and Singapore. From MMD Labo’s survey, Rakuten Ichiba (OTCPK:RKUNY) is the preferred e-commerce website in Japan with 41.4% of respondents indicating it as their foremost website adopted by Amazon at 38.1% and Yahoo Buying at 13%.

Based mostly on our earlier protection of Rakuten, we imagine it has a bonus with a broad product and repair portfolio throughout telecommunications, e-commerce and fintech. 72.3% of Rakuten customers had been utilizing multiple service in 2019, up from 64.9% in 2017. With the implementation of its rewards program and built-in platform, we imagine that it gives a stronger buyer loyalty benefit to Rakuten and imposes a headwind to Coupang to compete available in the market.

Valuation

Based mostly on chosen retail e-commerce firms, we’ve got obtained an business common P/S ratio of two.24x.

Searching for Alpha, Khaveen Investments

We projected the corporate’s internet retail gross sales income based mostly on our projected person and ARPU progress as mentioned above. For the third-party service provider providers, we took the 3-year common progress charge and tapered down progress by 15% per 12 months. For the Different income, we tapered down progress by 15% YoY from 2022 onwards.

|

Coupang Income Projection ($ mln) |

2018 |

2019 |

2020 |

2021 |

2022F |

2023F |

2024F |

|

Internet retail gross sales |

3,799 |

5,787 |

11,045 |

16,488 |

21,859 |

27,706 |

33,504 |

|

Progress % |

52% |

91% |

49% |

33% |

27% |

21% |

|

|

Third-party service provider providers |

252 |

441 |

790 |

1,695 |

2,961 |

4,727 |

6,839 |

|

Progress % |

75% |

79% |

115% |

75% |

60% |

45% |

|

|

Different income |

3 |

45 |

133 |

223 |

341 |

471 |

580 |

|

Progress % |

1470% |

193% |

68% |

53% |

38% |

23% |

|

|

Whole Income |

4,054 |

6,273 |

11,967 |

18,406 |

25,161 |

32,904 |

40,923 |

|

Progress % |

55% |

91% |

54% |

37% |

31% |

24% |

Supply: Coupang, Khaveen Investments

By taking the business P/S of two.24x, we discover the shares undervalued by 56%.

| P/S Valuation | 2022F | 2023F | 2024F |

| Income ($ mln) | 25,161 | 32,904 | 40,923 |

| Progress % | 37% | 31% | 24% |

| P/S A number of | 2.24x | 2.24x | 2.24x |

| Valuation ($ mln) | 56,402 | 73,761 | 91,735 |

| Shares Excellent (mln) | 1,756 | 1,756 | 1,756 |

| Value Goal ($) | 32.13 | 42.01 | 52.25 |

| Present Value ($) | 20.54 | 20.54 | 20.54 |

| Upside / Draw back | 56% | 105% | 154% |

Supply: Coupang, Khaveen Investments

Verdict

In conclusion, our forecast reveals Coupang’s ahead 3-year common ARPU progress at 9% and person progress at 16% as the corporate is predicted to profit from the expansion of the South Korean e-commerce market with its environment friendly supply community. Moreover, we anticipate Coupang’s third-party service provider providers income to develop at a 3-year common of 60% supported by the large person base together with initiatives akin to images and videography studios and free on-line lectures which is predicted to proceed attracting retailers to the platform. Nonetheless, we projected the corporate to stay unprofitable by 2025 as the corporate expands its logistics community. Total, the corporate has been the market chief within the South Korea Retail e-commerce market and nonetheless has the potential to develop based mostly on its excessive income progress. Based mostly on our P/S valuation, we charge Coupang as a Sturdy Purchase with a goal worth of $32.13.