YvanDube/iStock Unreleased through Getty Pictures

The recent canines at Costco (NASDAQ:COST) are clearly low-cost, however the inventory doesn’t seem clearly low-cost itself. With the inventory buying and selling at 44x ahead earnings, buyers might marvel if the valuation has gotten forward of itself. That stated, with a inventory worth simply shy of $600 per share, a inventory break up could also be on the horizon. On this article I focus on the corporate’s historical past with inventory splits, the probability of a future inventory break up, and the valuation because it stands at this time.

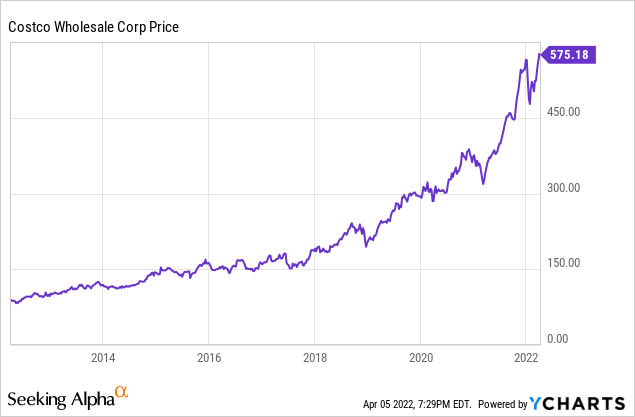

COST Inventory Value

Whereas COST just isn’t a tech inventory, it has generated tech-like returns over the previous a number of years.

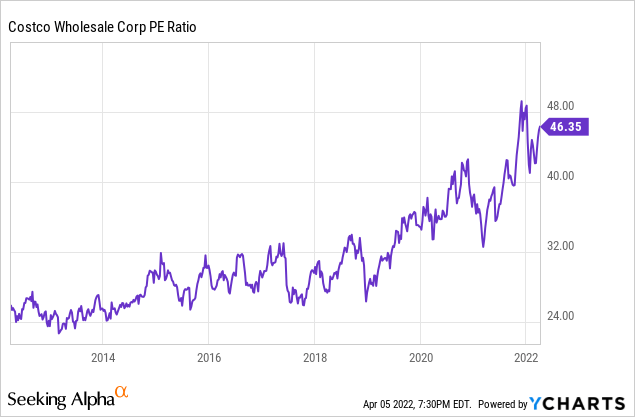

Buying and selling at round $575 per share, the inventory is round all time highs regardless of all the continuing volatility. Whereas COST has materially grown its backside line throughout this time interval, a number of enlargement has pushed fairly a little bit of the returns.

COST Inventory Key Metrics

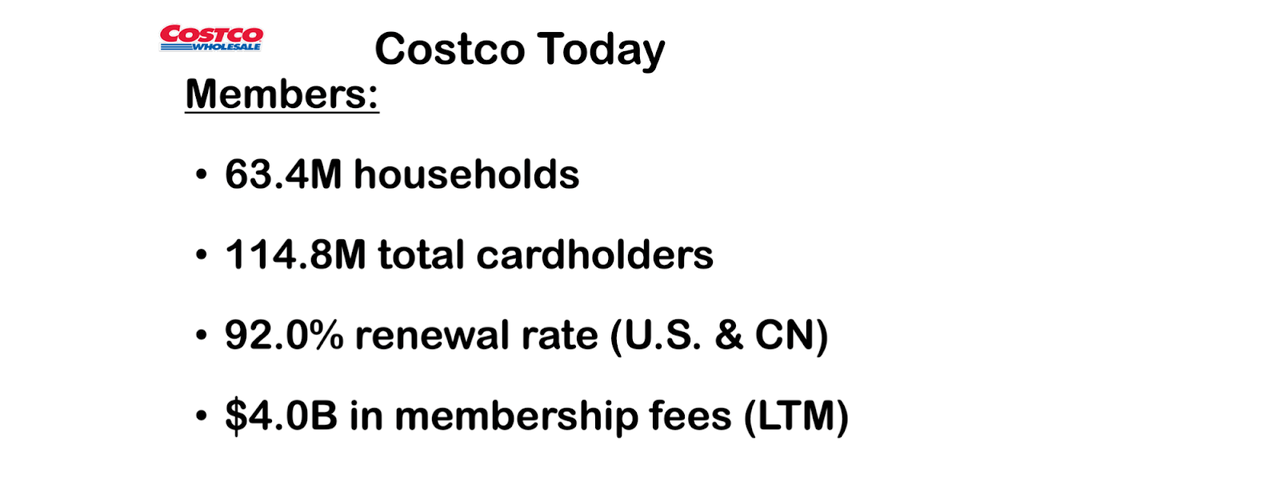

At the moment, COST boasts a buyer record spanning over 63.4 million households and 114.8 million whole cardholders. The 92% renewal fee regardless of the membership payment underscores the perceived worth delivered by the corporate.

Costco At the moment 2022 Presentation

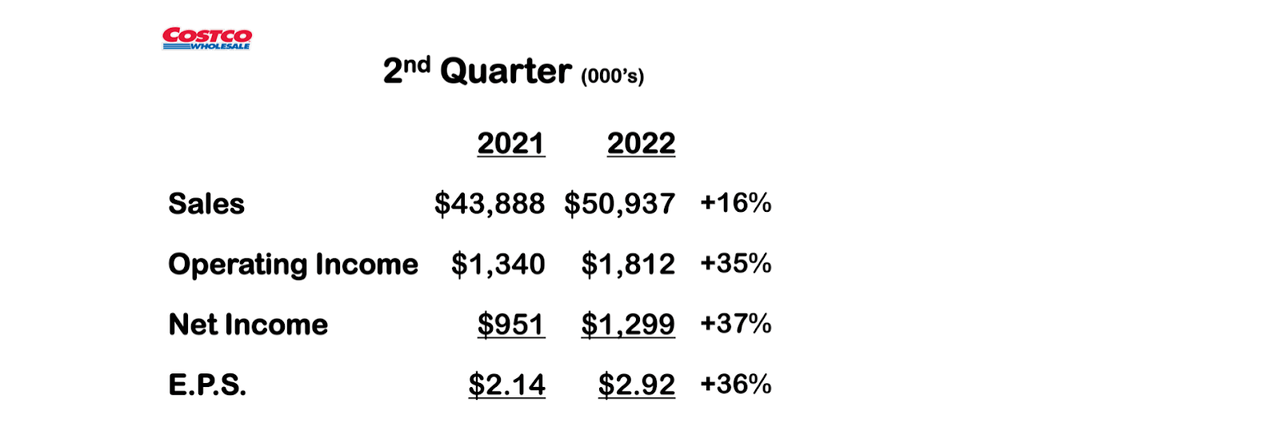

Within the newest quarter, COST sustained robust 16% gross sales development and grew web revenue by 37%. Identical retailer gross sales of 14.4% have been spectacular particularly contemplating that the corporate is lapping troublesome pandemic comparables.

Costco At the moment 2022 Presentation

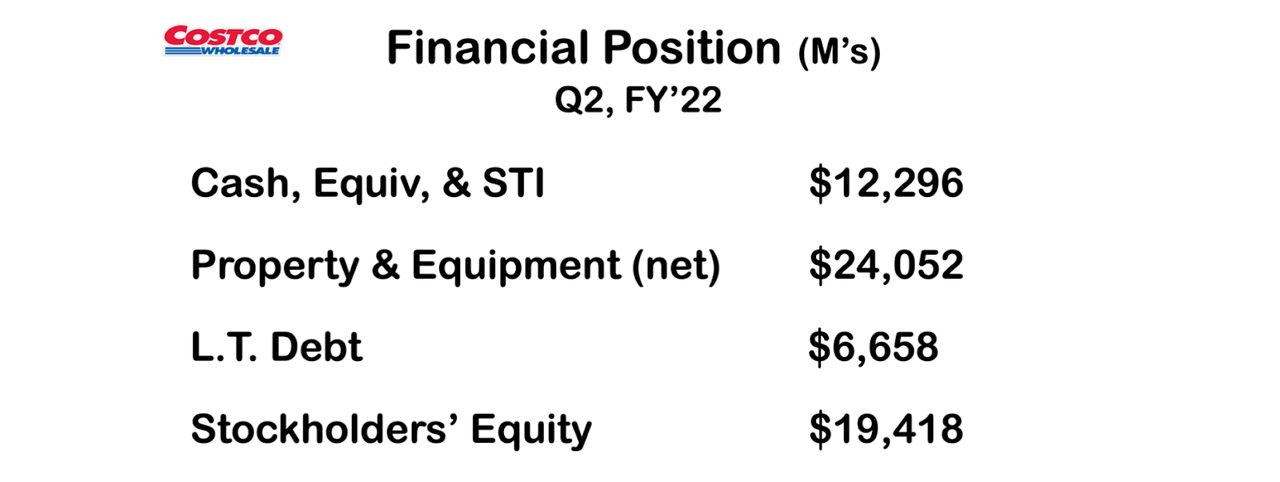

COST ended the quarter with $5.6 billion of web money. I anticipate COST to take care of web leverage over the long run. The present steadiness sheet place represents a big long run catalyst for shareholder worth.

Costco At the moment 2022 Presentation

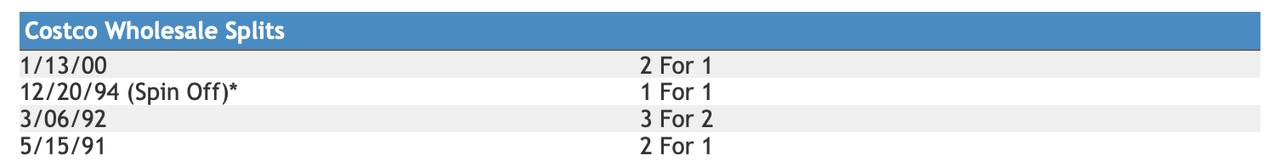

How Many Occasions Has Costco Inventory Break up Earlier than?

COST has break up its inventory 3 times earlier than – in 2000, 1992, and 1992 as seen under.

Costco Investor Relations

When it break up its inventory in 2000, the inventory traded at round $100 per share. When it break up its inventory in 1992, the inventory traded for round $50 per share. When it break up its inventory in 1991, the inventory traded for round $60 per share.

Is Costco Seemingly To Inventory Break up Once more?

Now with the inventory buying and selling close to $600 per share, it appears believable to anticipate a inventory break up sooner or later. The corporate has break up its inventory at far decrease costs, and with the earnings a number of not clearly low-cost, administration would possibly view a inventory break up as being an environment friendly approach to proceed driving shareholder worth, even when it doesn’t immediately change something on a basic foundation.

What Is The Future For Costco Inventory?

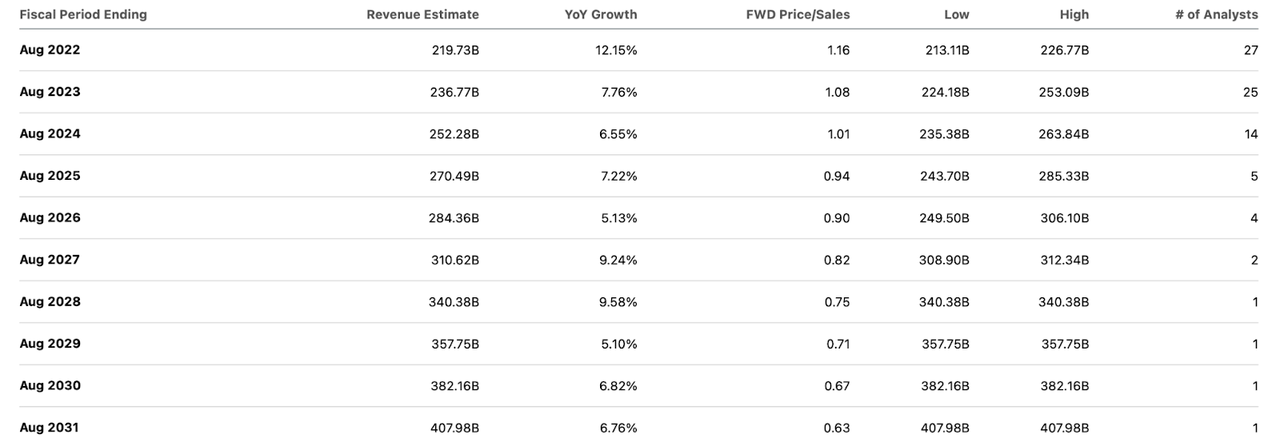

Trying ahead, Wall Road expects COST to maintain excessive single-digit income development over the subsequent decade.

In search of Alpha

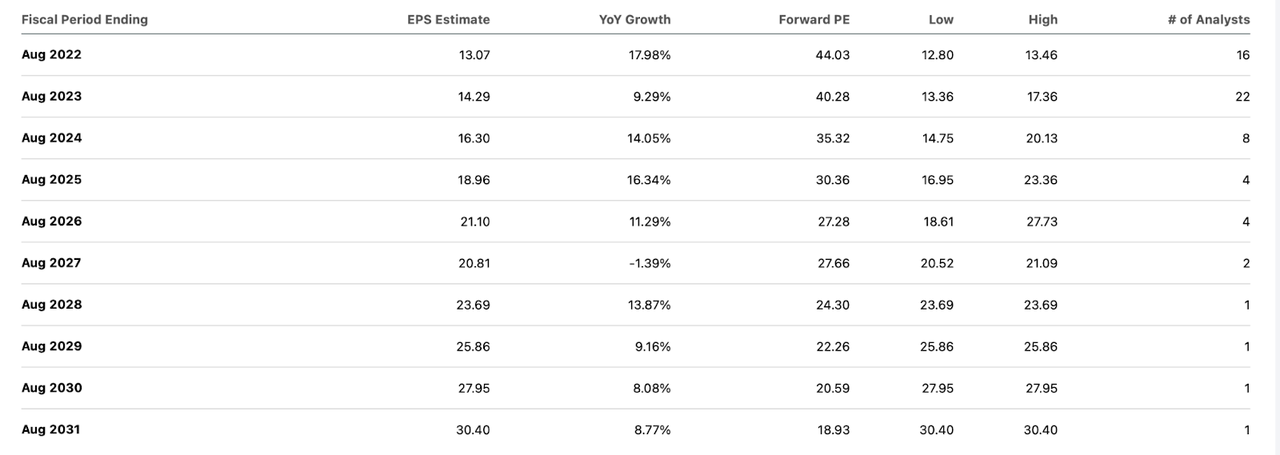

Consensus earnings estimates look far too low. Whereas analysts anticipate COST to develop revenues by 86% by 2031, analysts solely anticipate 133% earnings development by the identical time interval.

In search of Alpha

COST’s enterprise mannequin is one which inherently has a number of working leverage, and thus I anticipate earnings to develop a lot quicker than revenues going ahead. It’s price noting that earnings development was greater than double income development within the newest quarter. In 2021, COST grew revenues by 17.7% and earnings by 25%.

Is COST Inventory A Purchase, Promote, or Maintain?

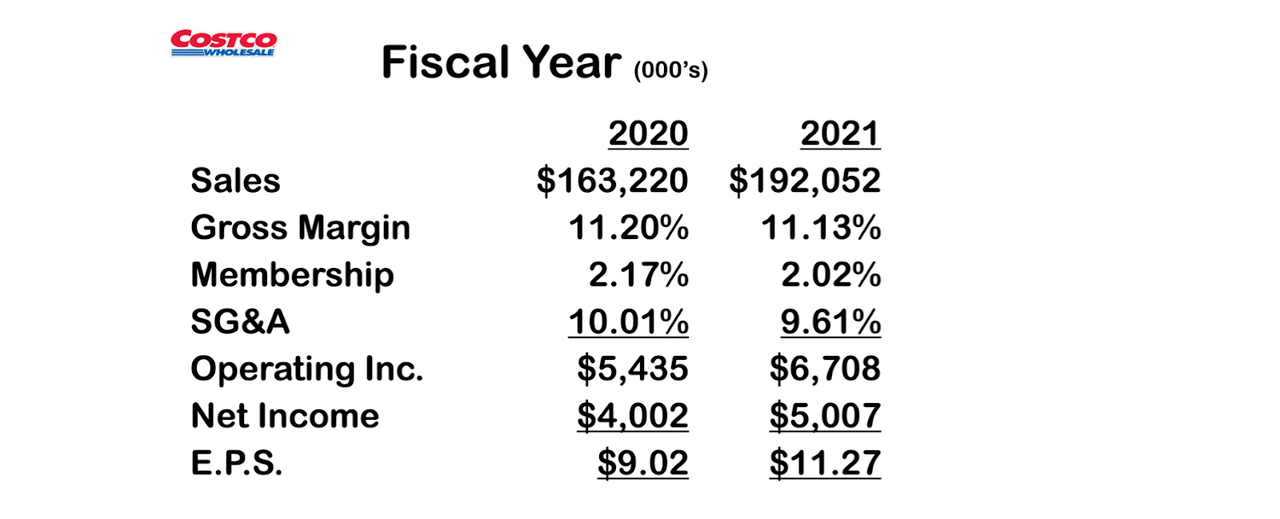

Working leverage is key to the COST bull thesis and explains why I nonetheless personal the inventory regardless of the 44x ahead earnings a number of. We will see under a snapshot of the revenue assertion.

Costco At the moment 2022 Presentation

Whereas COST generated $195.9 billion in whole gross sales in 2021, it generated solely $5 billion of web revenue. Membership charges totaled $3.9 billion, making up the overwhelming majority of web revenue. Traditionally, membership charges have pushed the majority if not all of web revenue, main buyers to consider that the corporate’s technique is to solely generate income from membership charges. In my opinion, that’s underestimating the corporate’s skill to drive working leverage. Positive, the corporate has utilized an aggressive pricing scheme to proceed taking retail market share. But there is no such thing as a cause why the corporate couldn’t improve its margins ever so barely. As a result of COST’s present working margins are so low, very slight will increase in gross margins might result in dramatic will increase in web revenue. I word that the 11.1% gross margin posted in 2021 is sort of larger than the ten% gross margin posted in 2012. I assume COST can simply drive one other 1% of gross margin enlargement. This would possibly happen by a mixture of accelerating costs to clients and suppliers. 100 foundation factors of gross margin enlargement would have led to $1.9 billion extra of gross earnings and boosted web revenue by almost 40% in 2021. The inventory would commerce at simply over 31x earnings utilizing that adjustment for long run earnings energy. Primarily based on consensus estimates, COST is anticipated to earn a 3.3% web margin by 2031 – solely barely larger than the two.6% web margin posted in 2021. Assuming COST continues its follow of accelerating membership charges by $5 each 5 years, the corporate would possibly improve charges by a minimum of 20% over the subsequent decade (there ought to be 2 or 3 payment will increase throughout this time interval), which itself might already result in web margins increasing to three.0%. Whereas COST trades at 18.9x 2031 consensus earnings estimates, the inventory trades at simply 13.5x that 12 months’s earnings energy (utilizing the above projected 100 foundation level gross margin enlargement). I might see the inventory buying and selling as much as 40x earnings energy by 2031, suggesting just below 200% upside over 9 years. That’s a 12.8% compounded annual return – a lot decrease than the everyday inventory I’m shopping for nowadays. That stated, I see a excessive probability that COST outperforms consensus estimates, and the sturdy enterprise mannequin is one during which the inventory can present a mixture of low volatility and stable returns – giving it a spot in most portfolios even at these valuations. The important thing dangers to this thesis embody competitors from the likes of Walmart (WMT) and Amazon (AMZN). Whereas shoppers appear typically pleased with their Costco purchasing expertise, it’s unclear if the corporate can maintain market share if opponents provide cheaper costs and/or on-line marketplaces provide extra comfort. Probably the most clear indication of a breaking within the basic thesis can be seen in a weak point of identical retailer gross sales. I fee shares a purchase particularly if one is in search of a supply of security in at this time’s unstable market.