Prostock-Studio/iStock via Getty Images

Corus Entertainment (OTCPK:CJREF) reports know-how in the digital advertising market as well as recurring revenue from large traditional channels. I believe that new products, like STACKTV, and a further decrease in the total amount of debt could bring demand for the stock. Future free cash flow would, in my view, justify a valuation of close to $2.91 per share. Even considering risks from choppy advertising conditions, CJREF remains undervalued.

Corus Entertainment: Net Income From Digital Advertising, Many Products, And A Diversified Business Profile

Transforming the way in which the news and entertainment market is set up, managing to place more content at more places, and adding content are the three main axes in the long-term growth plan of Corus Entertainment.

In my view, in the last two decades, there has been a strong revolution in the way of consuming audiovisual content, moving the news and entertainment market from traditional platforms towards digital formats, and on-demand streaming platforms, leaving aside the consumption of television as well as newspapers on paper. The same has happened with the movie industry, in which currently films by well-known directors are released directly on digital platforms without even going through theatres.

In my opinion, Corus is one of the companies that have been able to successfully join the new wave of content production. Founded in 1999 in Canada as part of Shaw Communications (SJR), the company has a large presence on television channels, a large number of radio stations, and a content creation agency that is exported to more than 160 countries globally. I believe that diversification could bring significant stock demand.

Among the best-known brands and products of this Canadian company are the History Channel, Adult Swim, and National Geographic. It also has its own news agency, Global News, with a strong presence in both Canada and the United States. An example of the scope of the company’s strategy is that it has had content for children since its foundation, with Peppa Pig being one of its best-selling products globally and one of the most consumed children’s cartoons in the world.

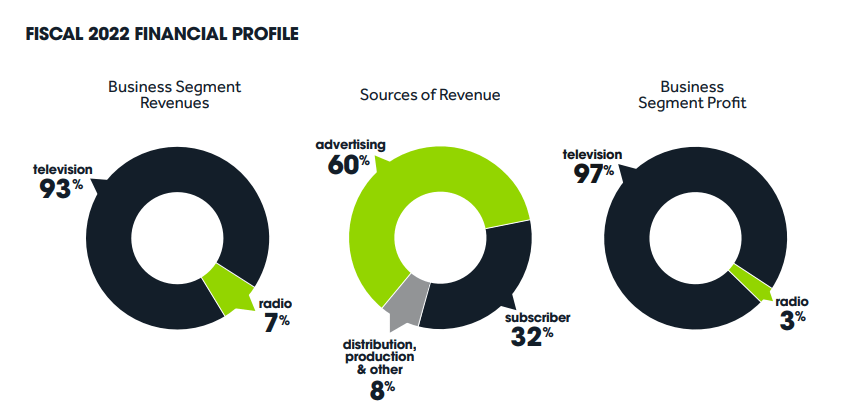

Source: Company’s Website

By making a breakdown of its statistics presented in the annual report for the year 2022, we distinguish that 60% of its income comes from digital advertising, 32% from the subscriptions of its clients to its different products, and only 8% from the sale and distribution of its products. On the other hand, 94% of its segmented earnings come from its television establishments and only 6% from its radio stations.

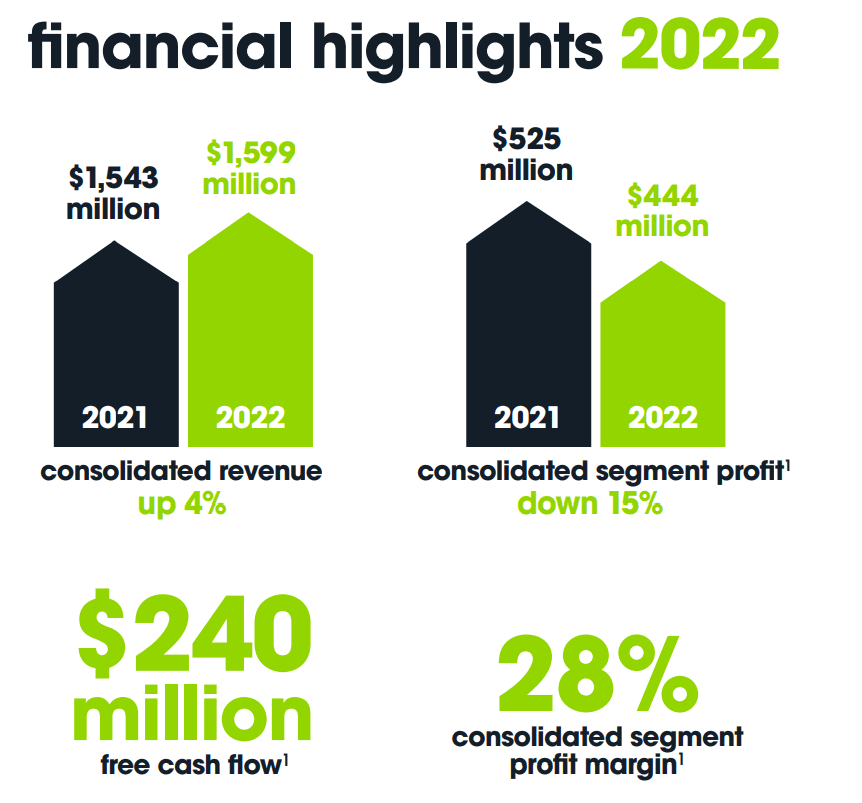

Source: 2022 Annual Report

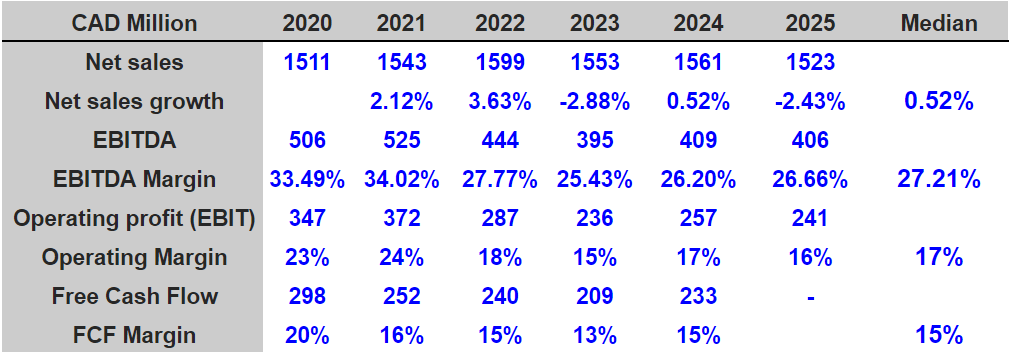

A recent annual report included consolidated income of CAD1.599 billion in 2022, meaning a 4% growth as compared to the CAD1.543 billion in the previous year. Despite the drastic changes that this industry is undergoing, the company has registered a segmented profit of CAD444 million dollars, which shows a loss of 15% against the CAD525 million in the previous year.

Source: 2022 Annual Report

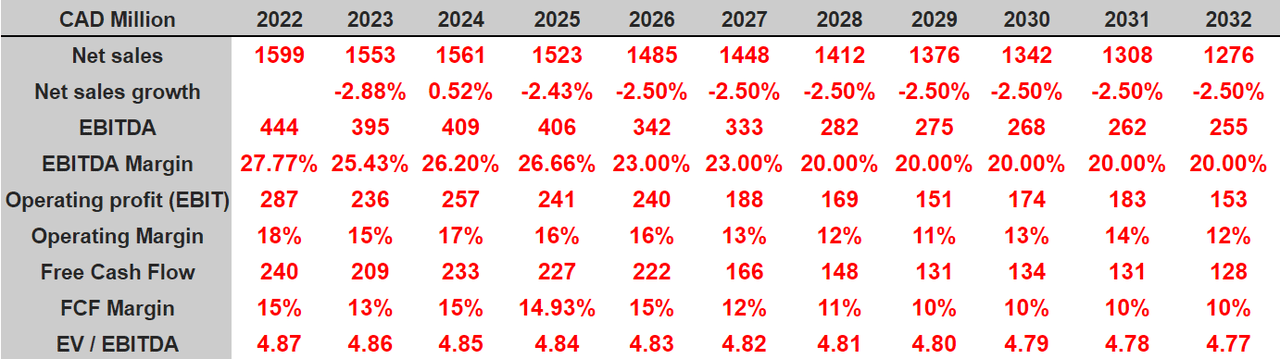

Market Expectations Include 2025 EBITDA Margin Of 26% And Stable Free Cash Flow Close To CAD201 Million

I believe that expectations from market analysts are quite beneficial. The expectations include 2025 net sales of CAD1.523 billion and net sales growth of -2.43%. 2025 EBITDA would stand at CAD406 million, which would imply an EBITDA margin of 26.66%. Operating profit will likely be close to CAD241 million in addition to an operating margin of 16%. Finally, 2024 FCF would stand at CAD233 million with a FCF margin of 15%.

Source: marketscreener.com

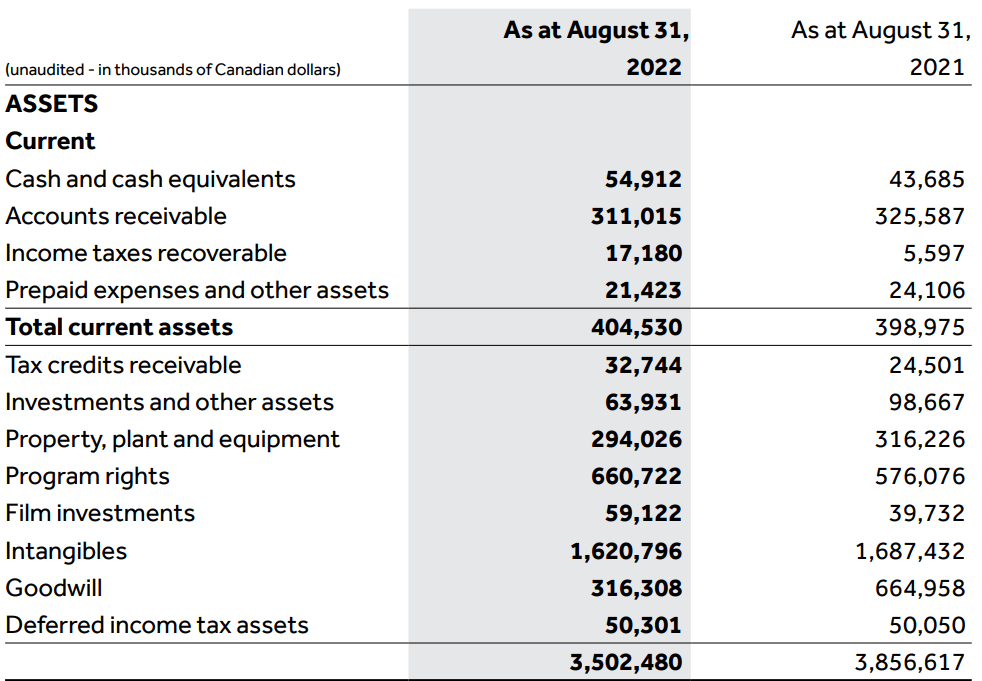

Balance Sheet

As of August 31, 2022, Corus Entertainment reported cash worth CAD54.912 million with accounts receivable worth CAD311.015 million. Total current assets stood at CAD404.530 million, a bit lower than the current amount of liabilities, which is not ideal.

On the other hand, property stood at CAD294.026 million with program rights of approximately CAD660.722 million. Intangibles were equal to CAD1.620 billion with goodwill worth CAD316.308 million. Finally, the total amount of assets is equal to CAD3.502 billion, which implies an asset/liability ratio over 1x. With this figure in mind, even taking into account the total amount of debt, I believe that Corus’ balance sheet appears stable.

Source: Quarterly Report

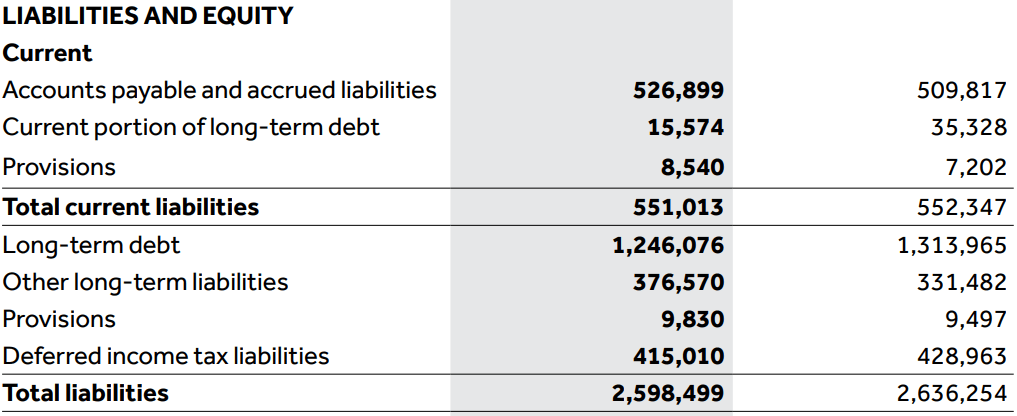

The liabilities include accounts payable of CAD526.899 million with the total current liabilities of CAD551.013 million. The long term debt stands at CAD1.246 billion together with other long term liabilities of CAD376.570 million and deferred income tax liabilities of CAD415.010 million. The total liabilities would be close CAD2.598 billion.

Source: Quarterly Report

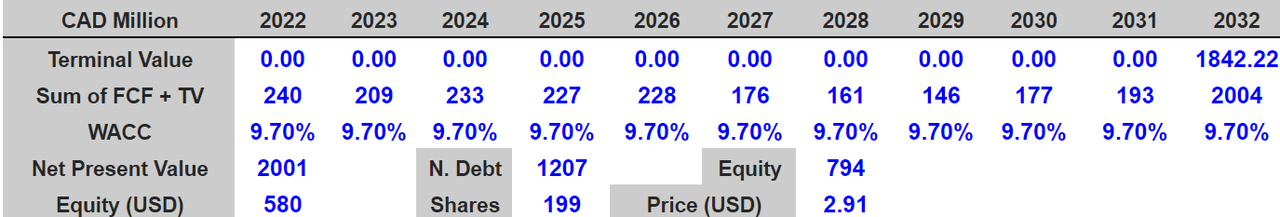

My Conservative Case Scenario Implied A Valuation Of $2.91 Per Share

Considering Corus’ know-how accumulated in digital advertising, I believe that management will likely be successful in designing new channels and products. Under normal conditions, I would expect revenue growth thanks to organic growth. If the company can experience some of the expected growth in the digital advertising market, Corus’ revenue will likely trend north.

The global market for Digital Advertising and Marketing estimated at US$476.9 Billion in the year 2022, is projected to reach a revised size of US$786.2 Billion by 2026, growing at a CAGR of 13.9% over the analysis period. Source: Global Digital Advertising and Marketing Market to Reach

Besides, in my view, if subscription revenue continues to trend north, more investors will likely have a look at the stock. Keep in mind that in 2022, the recurring revenue from large traditional channels increased thanks to STACKTV. If the company continues to successfully put more content at more places, the company’s financials will likely improve.

This year we reached a company milestone with our highest subscription revenue of $518 million for the year, which was up 4% over last year. A combined result of recurring revenue from our large traditional channels business accentuated by the growth of STACKTV, this is evidence that our strategy to put more content in more places is working. Source: Annual Report

The economic sustainability and success of the company’s business model depend directly on the clarity and forcefulness of its long-term strategy, which not only includes the creation of updated and innovative content for the needs of the audiences of its different brands, but also investment in new companies and research areas.

An example of the achievements in the acquisitions of new assets belonging to the industry is its annexation in the last decade of both Cartoon Network and Nickelodeon, two of the most consumed children’s programming channels in the Western world. Under this case scenario, I assumed that ongoing transactions and previous acquisitions would be successful.

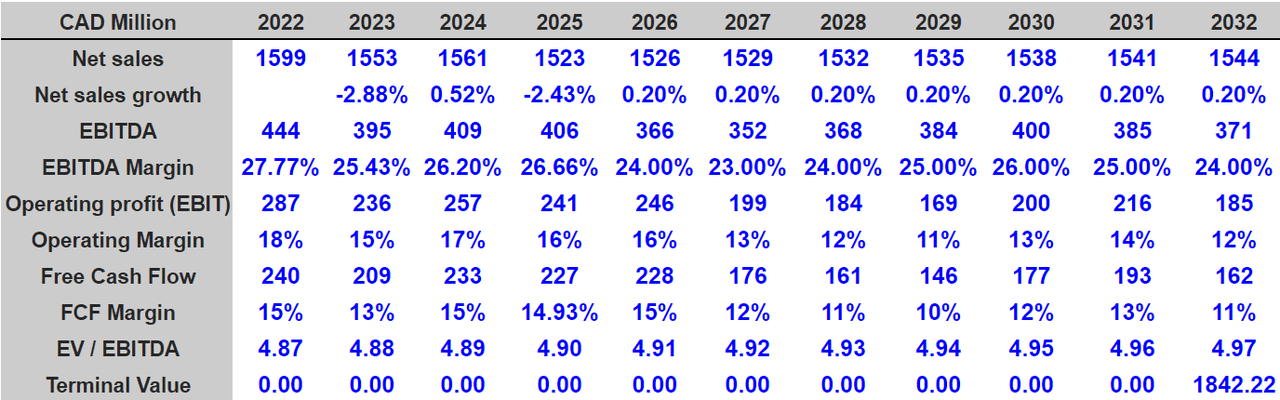

Under this case scenario, I assumed 2032 net sales of CAD1.544 billion, 2032 EBITDA of CAD371 million, and an EBITDA margin of 24%. I also expect an operating profit of CAD185 million and an operating margin of 12%. 2032 free cash flow would be CAD162 million with the FCF margin of 11%.

Source: My DCF Model

With an EV/EBITDA multiple of CAD4.97x and WACC of 9.70%, the net present value of future FCF stands at CAD2.001 billion. Implied equity would stand at CAD580 million, and with a share count close to 199 million, the implied price would be $2.91.

Source: My DCF Model

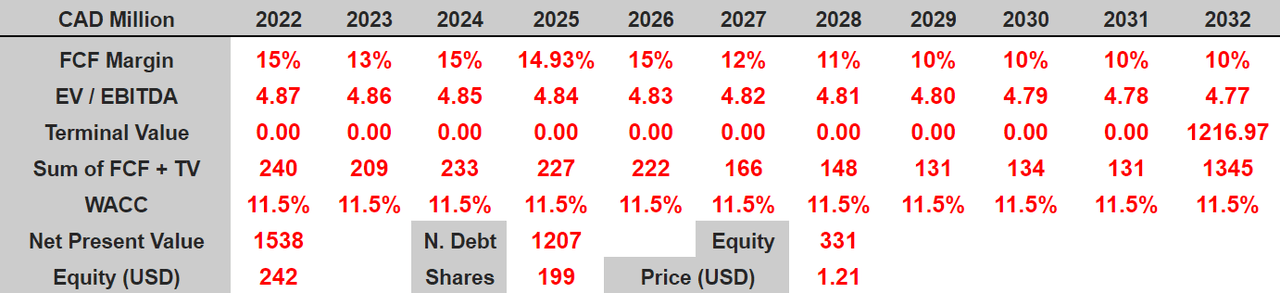

A Choppy Advertising Market, Risks Related To The Debt Outstanding, Or New Regulations Would Lead To Stock Price Declines

Under bearish conditions, I assumed a choppy advertising market like we saw in Q4, which may diminish the company’s revenue growth in 2024 and 2025.

We faced a choppy advertising market in the fourth quarter and as we enter our new fiscal year, cross currents persist, ebbing and flowing through all advertising categories. Source: Annual Report

I also assumed that Corus’ efforts to reduce its debt outstanding would not be successful. Without more debt repayment, many investors would not invest in Corus Entertainment, which may lower the demand for the stock. As a result, the cost of equity would increase, which may lead to less fair valuation.

Our goal to drive net debt to segment profit below 2.5 times over the longer term remains in focus, despite the emergence of macroeconomic challenges which are currently impacting advertising revenues. We have paid down $735 million of total debt in the last four years, demonstrating a strong commitment to financial and operating discipline. Source: Annual Report

In addition, taking into account the percentage of its earnings from advertising in the media, whether digital, television, or radio, the company has to develop strategies and technologies that allow it to administer and manage the data of its users, third-party cookies, and different and varied elements that are part of this market. In this sense, one of the risks to which the Corus business model is primarily exposed is the regulation and restriction of governments on the use of their customers’ data. Such types of restrictions have advanced rapidly on the European continent, and have not yet been established with regulatory clarity, neither in Canadian territory nor in European territory.

In the same way, the volatility of this type of industry, together with the development of technologies, strategies, and developments of competing companies as well as global economic conditions are part of the risks with which they are forced to live. During the Covid-19 pandemic, although the number of consumers increased due to the amount of time people were at home, there were enormous complications due to sanitary restrictions when not only going to offices, but also for the production of shootings and massive business events. We can’t say that a new crisis would not affect Corus’ business model.

Under this case scenario, I included 2032 net sales of CAD1.276 billion together with a net sales growth of -2.50%. 2032 EBITDA would be CAD255 million with EBITDA margin of 20%. The operating profit would be CAD153 million with an operating margin of 12%. Finally, free cash flow would stand at CAD128 million with a FCF margin of 10%.

Source: My DCF Model

If we use a WACC of 15%, future discounted FCF would sum up to CAD1.538 billion. The equity valuation would be CAD331 million, and with a share count close to 199 million, the fair price would be $1.21 per share.

Source: My DCF Model

Takeaway

Corus Entertainment has a significant amount of know-how accumulated in digital advertising, and reports growing recurring revenue from large traditional channels. In my view, further development of successful products, like STACKTV, and more content put at more places will likely bring revenue growth. Under my base case scenario, future free cash flow would be sufficient to justify a valuation of $2.91 per share. I obviously see risks if management doesn’t lower the debt outstanding, or choppy advertising conditions continue. With that, I believe that Corus Entertainment is undervalued.