Torsten Asmus

Inflation moving “sideways” at very high levels for nearly a year and hasn’t come down meaningfully.

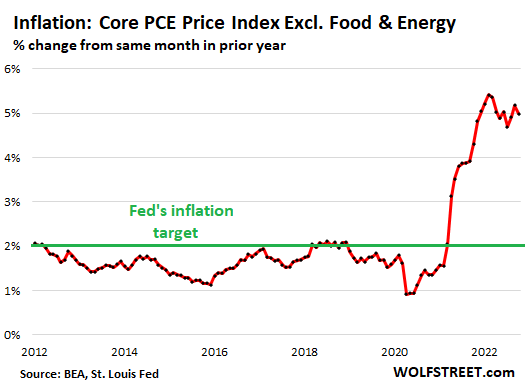

Powell, in his speech on Wednesday, discussed the issues around inflation currently and expressed his frustration that inflation has moved mostly “sideways” at very high levels over the past 12 months, and hasn’t come down from those levels despite aggressive rate hikes. His whole discussion was focused on the “core PCE price index,” which the Fed uses as yardstick for its inflation target of 2%.

“Over 2022, core inflation rose a few tenths above 5 percent and fell a few tenths below, but it mainly moved sideways,” he said.

And so we got more of that on Thursday: the Core PCE price index (which excludes food and energy products) rose 5.0% year-over-year in October, a slightly slower increase than in September, a slightly faster increase than in August and July, and same as in June, according to the Bureau of Economic Analysis. This was the last inflation report before the Fed’s next meeting in two weeks.

Inflation: Core PCE Index Excl. Food & Energy (% Change From Same Month In Prior Year) (Author)

“Down months in the data have often been followed by renewed increases”: Powell

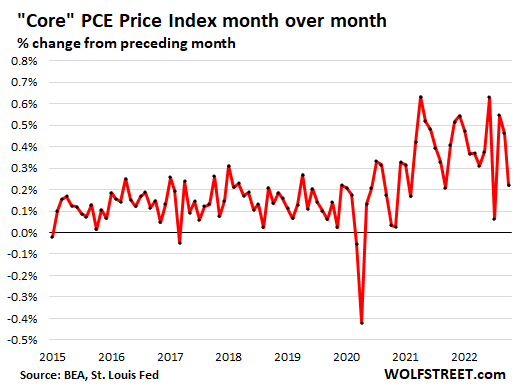

Powell also said that the Fed won’t be swayed by “a single month’s data.” The dip in October’s month-to-month data “followed upside surprises over the previous two months,” he said.

The chart of month-to-month core PCE readings shows how “down months in the data have often been followed by renewed increases,” as he said Wednesday, citing estimates of data that was released on Thursday.

“It will take substantially more evidence to give comfort that inflation is actually declining. By any standard, inflation remains much too high,” he said.

On a month-to-month basis, the “core PCE” price index rose 0.2% from the prior month, a slower increase than the 0.5% jumps in September and August, according to the Bureau of Economic Analysis.

The zigzag pattern of the month-to-month core PCE readings demonstrates what Powell meant when he said that the Fed won’t be swayed by “a single month’s data.”

Core PCE Price Index Month Over Month (% Change) (Author)

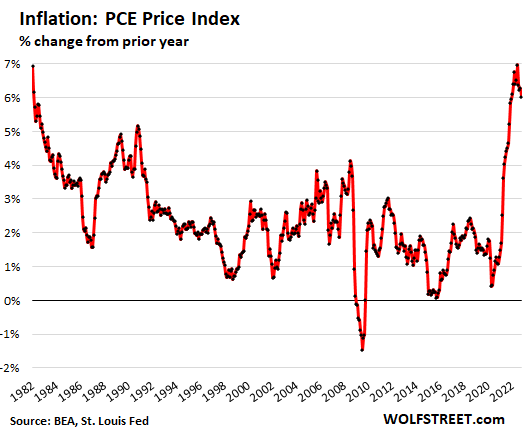

The overall PCE price index (which includes food and energy products) rose 6.0% in October compared to a year ago, down slightly from the increases in the prior months, and same rate as in December 2021. The entire group of inflation readings since November 2021 have been the highest since 1982. In other words, this measure hasn’t meaningfully come down either, despite aggressive rate hikes! And that was a big theme in Powell’s speech on Wednesday – that there just hasn’t been any meaningful progress yet in the fight against inflation:

Inflation: PCE Price Index (% Change From Prior Year) (Author)

“Core Services” Inflation Gets Worse, “Core Goods” Inflation Backs Off

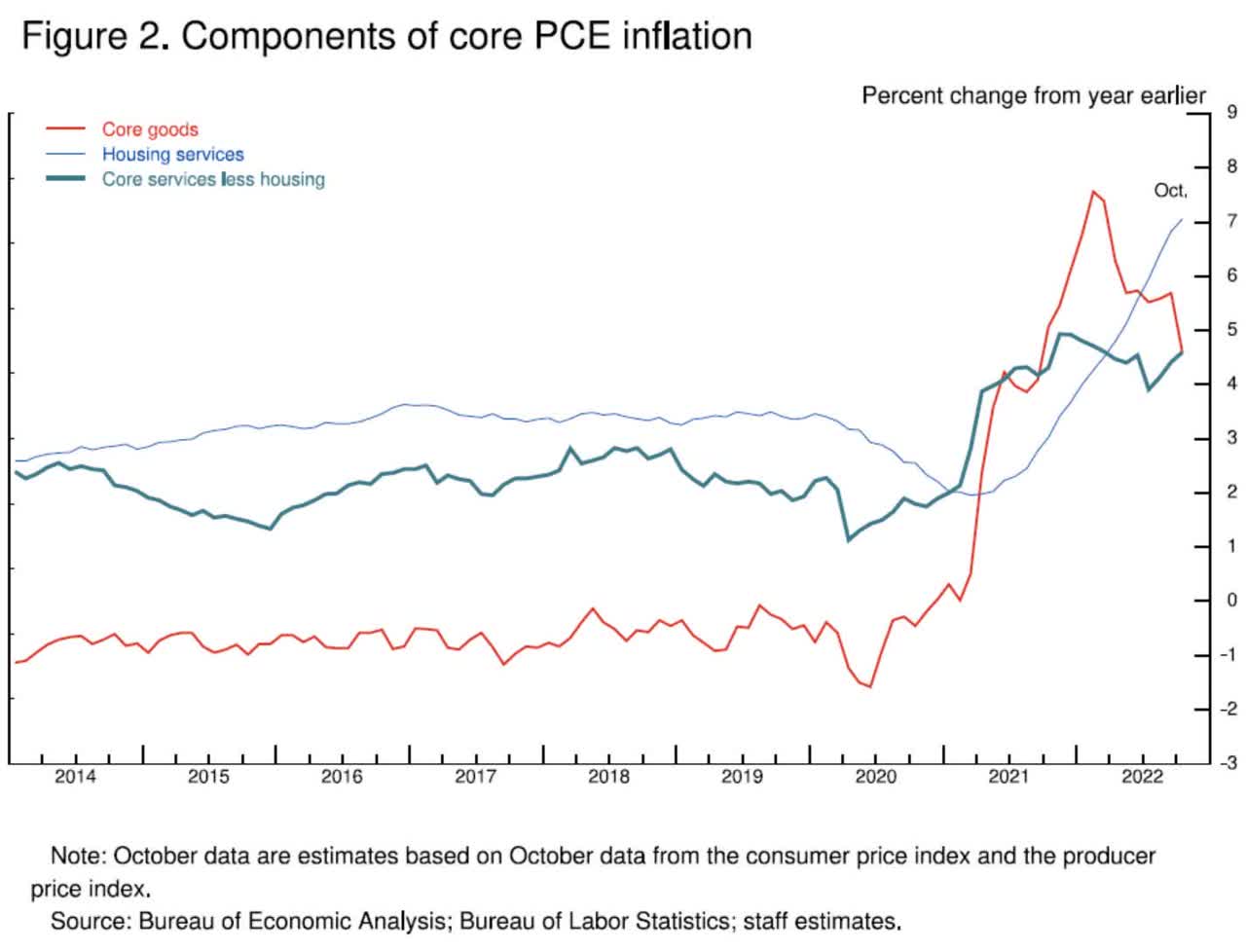

In his speech on Wednesday, Powell cited the inflation data (based on Fed staff estimates) that was released by the BEA on Thursday, and he included it in his chart. We’ll revisit that chart now (though I already discussed it) because it dissects the latest core PCE data and shows why the hoped-for inflation slowdown is just not happening.

Powell divided the core PCE price index into three categories (splitting core services into two, housing services and core services less housing):

- “Core goods” (red line in the chart below) where inflation backed off from the spike.

- “Housing services,” (thin blue line): rents surge and hit a new high in October, and Powell expects that surge to continue “well into next year.”

- “Core services less housing” (fat greenish line), which accounts for over 50% of core PCE and tracks healthcare, insurance, education, repairs, personal services, etc. This is the biggie, and it rose in October, and isn’t showing any progress in moving down.

It boils down to this: the red-hot inflation in core goods that we saw in 2021 and earlier in 2022 has been backing off as supply chain constraints are being resolved. But services inflation has been getting worse, with “housing services” inflation continuing to spike and inflation in “core services less housing” once again on the upswing.

Components Of Core PCE Inflation (% Change From Year Earlier) (Author)

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.