Christian Feldhaar/iStock via Getty Images

Investment Summary

A firm can generate future economic value if it can sustain a high return on invested capital (“ROIC”) at a positive spread above the cost of capital. This in turn generates what is known as economic profit (“EP”), a better measure of performance/profitability than accounting profit. Warren Buffett, the famed ‘value investor’, dubbed this sustainable, competitive advantage as the economic ‘moat’ of a company: “The most important thing to me is figuring out how big a moat there is around the business. What I love, of course, is a big castle and a big moat with piranhas and crocodiles”.

Simply, a company with a high ROIC is able to fund its future growth initiatives without having to reinvest a high amount of post-tax earnings to achieve this growth. This leaves more cash left over for its investors. There is one disclaimer to this though, and it relates to the cost of capital [“r”]. If the ROIC is below the cost of capital, then growth is actually destructive to corporate and equity value, because the cash distributable to shareholders will be less than zero [i.e. if ROIC < r, FCFE ≤ 0]. Note, we’re talking free cash flows to equity holders here, not the traditional view of FCF as CFFO less CapEx – a rudimentary calculation that misses the mark, in our opinion.

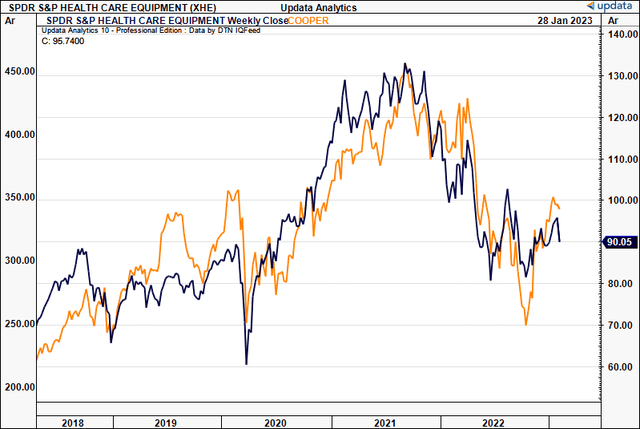

Hence, as investors, we want to be finding and allocating to these kinds of selective opportunities. Mind you, they are rare – what’s more common are companies with unsustainable growth rates, or, ROICs that are less than the hurdle rate. Such is the case for The Cooper Companies, Inc. (NYSE:NYSE:COO) over the previous 5-years to date. After catching a strong bid across the pandemic period, along with the rest of the S&P Health Care Equipment Index (Exhibit 1), it has endured a heavy selloff over the past 18 months, re-rating back to long-term range.

Exhibit 1. COO performance against S&P 500 Health Care Equipment Index

Data: Updata

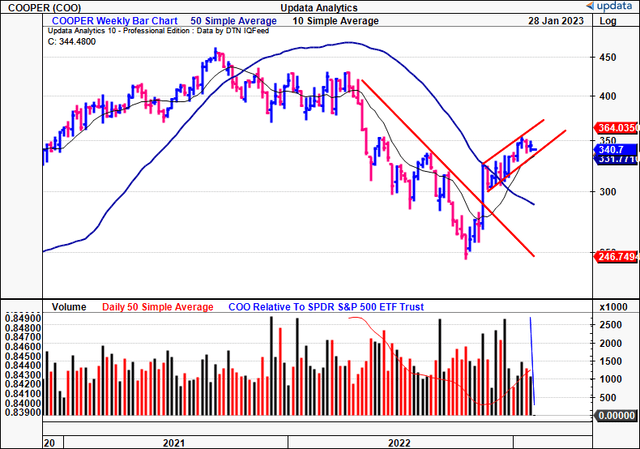

Turning to the new year and COO has rallied higher for the past 11 weeks [Exhibit 2], offering a short-term period of alpha for tactical investors rotating into/out of health care stocks in this time. Question is, what is the underlying value in this stock, and is it fairly priced?

Here I’ll demonstrate why we believe COO is highly overvalued, and, due to the negative ROIC/WACC spread it’s exhibited in recent times, how the company’s growth has actually eroded its valuation over time. Quite a paradox, but I’d encourage you to check McKinsey’s (2020, 2021), and Mauboussin’s (2014, 2016, 2020, 2022) works to understand these key concepts to investment decisions and valuation in further detail. Net-net, we rate COO a hold.

Exhibit 2. COO rally off lows since November 2022

Data: Updata

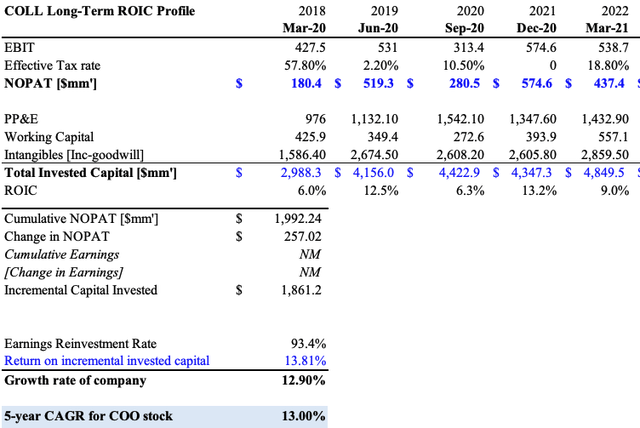

Reinvestment, returns on capital compressed COO’s value

A firm can generate value when it sustainably generates a return on its investments higher than the hurdle rate, as mentioned. You’ll see below that, since FY18–FY22′, COO produced a cumulative $1.82Bn in net operating profit after tax (“NOPAT”), resulting in an additional growth of $257mm in NOPAT over this time. Overall, it achieved a steady growth rate of ~13% in annual growth over the FY18–22′ period. Note, NOPAT is a better measure to gauge corporate profitability versus earnings, as it backs out the effects of leverage [COO has $2.34Bn in long-term debt, $1.8Bn in notes payable, and the latter doesn’t generate operating income].

However, to produce these numbers, it had to invest an additional $1.86Bn in capital to achieve the growth rates. Hence, whilst it achieved a 13.8% return on incremental invested capital (“ROIIC”), COO had to reinvest more than ~93% of its post-tax earnings to recognize a 13% upside in post-tax earnings. Not attractive at all. Consequently, we’d note the COO share price compounded at 13% per year, in-line with the company’s growth rate. But, a 13% growth rate isn’t terrible. So, you might ask, is the market missing something?

Exhibit 3. Despite reasonably strong ROIIC, COO required to reinvest 95% of post-tax earnings to achieve this.

Data: Author, using data from COO SEC Filings

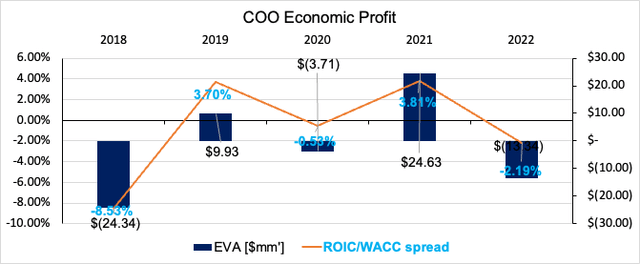

Well, first of all, intelligent investors measure a firms valuation by the cash flows it can distribute to its shareholders. COO reinvesting 93% of post-tax earnings for a 13% growth isn’t that appealing for investors, leaving only 7% leftover to feast on. We want as much of the profits as possible. Moreover, without delving too much into the unit economics of COO’s multiple divisions and product lines, we can obtain a great deal of information on the market’s valuation for COO by the fact it’s delivered a negative EP over the 5-year period [Exhibit 4].

Exhibit 4. COO’s negative EP over the 5-year to date

Data: Author, using data from COO SEC Filings

As mentioned, if the EP is negative, the available free cash to equity holders is either low, or negligent, ultimately compressing the company’s value in the process. Consequently, growth has been destructive to COO’s valuation, seeing investors re-rate the stock back to the downside in FY22′ amid the normalization of the interest rate environment.

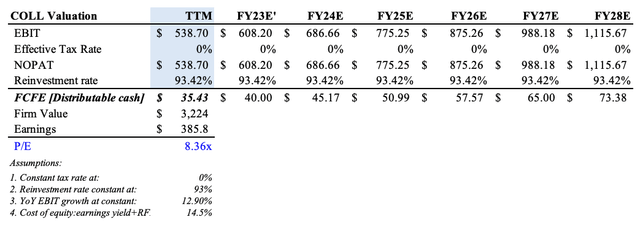

We’d note the stock trades at 27x forward P/E [non-GAAP consensus estimates]. Utilizing the ROIIC, reinvestment rate and growth rates for COO exhibited, we believe the stock is heavily overvalued, and should be trading closer to an 8.4x P/E, discounting its future FCFE at the cost of capital of ~14%, not even baking in an effective tax rate [Exhibit 5]. As such, until COO can bring up its ROIC above the hurdle rate, or lower the amount of earnings required to reinvest for growth, we believe there’s little scope for the stock to meaningfully deliver long-term alpha looking ahead.

Exhibit 5.

Data: Author’s Estimates

In short

COO is a classic example of when a company’s ROIC doesn’t beat the hurdle rate, that growth is actually destructive to valuation. Whilst this may seem paradoxical, remember that a firm generates value in the first place when it can reinvest earnings at a high rate of return, and then distribute high amounts of free cash flow to shareholders. COO does neither, by estimation. Here we took a data-driven approach to illustrate the economics of its business model aren’t attractive as an investment right now. Whilst we like the company, we don’t like the opportunity to invest, hence we rate COO a hold.