The ultimate August outcomes from the College of Michigan Surveys of Shoppers present general client sentiment improved versus the prior month however stays very low by historic comparability (see first chart). The composite client sentiment elevated to 58.2 in August, up from 51.5 in July and the file low of fifty.0 in June. The rise in August totaled 6.7 factors or 13.0 %. Nonetheless, the index stays in line with prior recession ranges.

The present-economic-conditions index rose barely to 58.6 versus 58.1 in July (see first chart). That could be a 0.5-point or 0.9 % enhance for the month. This element is modestly above the file low and stays in line with prior recessions.

The second element — client expectations, one of many AIER main indicators — gained 10.7 factors or 22.6 % for the month, rising to 58.0 (see first chart). Regardless of the acquire, this element index can be in line with prior recession ranges. In line with the report, “Most of this enhance was concentrated in expectations, with a 59% surge within the year-ahead outlook for the economic system following two months at its lowest studying because the Nice Recession. As well as, private monetary expectations rose 12% since July. The positive aspects in sentiment have been seen throughout age, training, revenue, area, and political affiliation and could be attributed to the current deceleration in inflation. Decrease-income shoppers, who’ve fewer sources to buffer in opposition to inflation, posted significantly giant positive aspects on all index elements. Their sentiment now even exceeds that of higher-income shoppers, when it usually lags higher-income sentiment by over 15 factors. Hopefully, this tentative enchancment will proceed, as general sentiment stays extraordinarily low by historic requirements.”

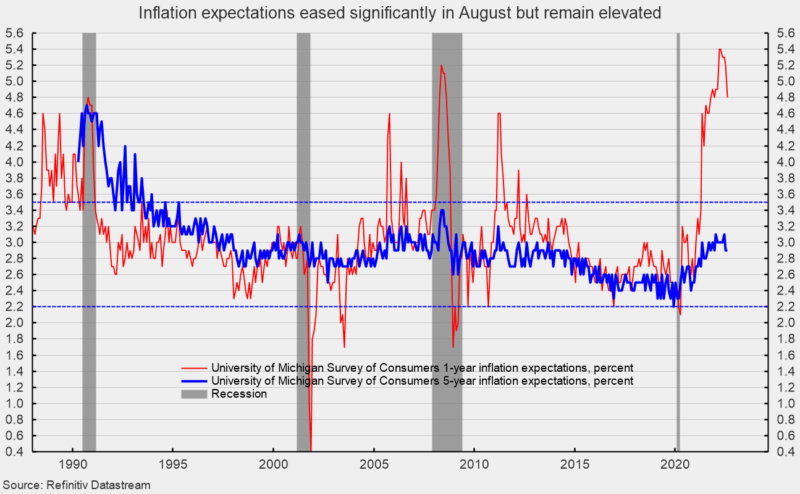

The one-year inflation expectations fell notably in August, dropping 0.4 proportion factors to 4.8 %. That’s the third decline within the final 4 months since hitting back-to-back readings of 5.4 % in March and April and the bottom studying since December 2021 (see second chart).

The five-year inflation expectations was unchanged at 2.9 % in August. That result’s nicely throughout the 25-year vary of two.2 % to three.5 % (see second chart).

The report states, “The relative reduction felt by shoppers mirrored of their inflation expectations. The median anticipated year-ahead inflation fee was 4.8%, down from 5.2% final month and its lowest studying in 8 months.” Nonetheless, the report provides, “Uncertainty over expectations rose significantly, significantly amongst lower-educated shoppers.” The plunge in client attitudes over the previous 12 months displays a confluence of occasions with inflation main the pack. Persistently elevated charges of value will increase have an effect on client and enterprise decision-making and warp financial exercise. Total, financial dangers stay elevated as a result of impression of inflation, an intensifying Fed tightening cycle, and continued fallout from the Russian invasion of Ukraine. Because the midterm elections strategy, the ramping up of detrimental political adverts may weigh on client sentiment within the coming months. The general financial outlook stays extremely unsure. Warning is warranted.