The Shopper Confidence Index from The Convention Board rose in August, the primary enhance following three consecutive month-to-month declines. The composite index elevated by 7.9 factors, or 8.3 p.c to 103.2 (see first chart). From a yr in the past, the index continues to be down 10.4 p.c. Each elements gained in August.

The expectations element added 9.5 factors, or 14.5 p.c, to 75.1 (see first chart) whereas the present-situation element – one in every of AIER’s Roughly Coincident Indicators – rose 5.7 factors to 145.4 (see first chart). The current state of affairs index is down 2.4 p.c over the previous yr whereas the expectations index is down 19.1 p.c from a yr in the past. The current state of affairs index stays in step with financial enlargement whereas the expectations index stays in step with prior recessions (see first chart).

Inside the expectations index, all three elements improved versus July. The index for expectations for greater earnings gained 0.5 factors to fifteen.8 whereas the index for expectations for decrease earnings fell 1.0 factors, leaving the web (anticipated greater earnings – anticipated decrease earnings) up 1.5 factors to 1.3.

The index for expectations for higher enterprise situations rose 3.8 factors to 17.5 whereas the index for anticipated worse situations fell 3.9 factors, leaving the web (anticipated enterprise situations higher – anticipated enterprise situations worse) up 7.7 factors, however nonetheless at -4.8.

The outlook for the roles market improved in August because the expectations for extra jobs index elevated 2.3 factors to 17.4 whereas the expectations for fewer jobs index fell by 1.8 factors to 19.3, placing the web up 4.1 factors to -1.9.

Present enterprise situations improved for the current state of affairs index elements, however present employment situations weakened. The online studying for present enterprise situations (present enterprise situations good – present enterprise situations unhealthy) was -4.0 in August, up from -7.9 in July. Present views for the labor market noticed the roles laborious to get index lower, falling 1.0 level to 11.4 whereas the roles plentiful index fell 1.2 factors to a still-strong 48.0 leading to a 0.2-point drop within the internet to 36.6.

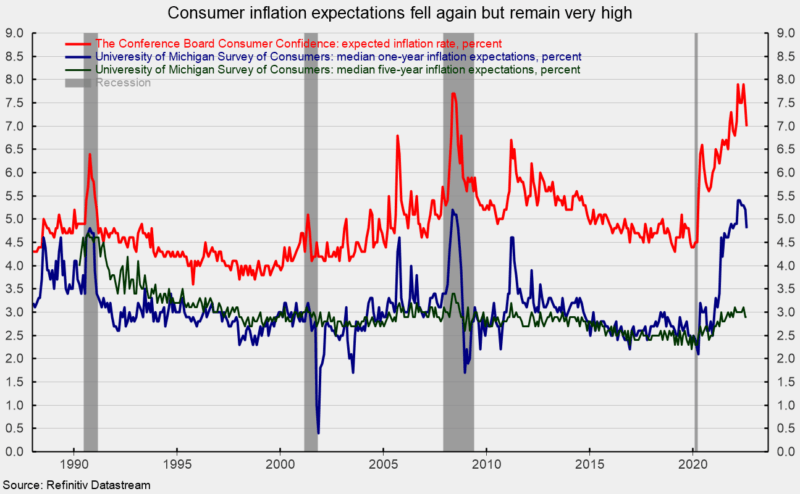

Inflation expectations eased all the way down to 7.0 p.c in August from 7.4 p.c in July; expectations had been 4.4 p.c in January 2020 (see second chart). The sharp rise in anticipated inflation from The Convention Board survey is in step with the College of Michigan survey outcomes, although the magnitudes are completely different (see second chart). Inflation expectations stay extraordinarily excessive as costs for a lot of items and companies proceed to rise at an elevated tempo. The acute outlook for inflation is a key driver of weaker shopper expectations.

The surge in costs for a lot of shopper items and companies is essentially a operate of shortages of supplies, a good labor market, and logistical points that stop provide from assembly a post-lockdown-recession surge in demand. Nevertheless, there was vital progress in boosting manufacturing. Worth pressures have been compounded by periodic lockdowns in China and surging power costs as a result of Russian invasion of Ukraine. Moreover, the intensifying Fed tightening cycle raises the chance of a coverage mistake and provides to the acute degree of threat and uncertainty within the general financial outlook.