Images By Tang Ming Tung

Investment Summary

Since our last coverage of Co-Diagnostics, Inc. (NASDAQ:CODX), we’ve retained our neutral view on the company. Last time, our price target of $3.24 was premised by the following:

- Diminishing Covid-19 turnover, coupled with concentration risk in the company’s diagnostics segment to SARS-CoV-2.

- Surging inventory levels on the balance sheet coupled with the lack of inventory turnover, assay revenue.

- Innovations are in the pipeline, however, still some time to go before we see these on-market.

- An 81.6% YoY decrease in revenue for Q2 FY22 with contracting demand for its Logix Smart Covid-19 test the main driver.

As a reminder, CODX is developing its polymerase chain reaction (“PCR”) technology. It develops a suite of diagnostic tests, ranging from Covid-19 hepatitis B, tuberculosis, HPV, malaria, and many more. It benefitted from Covid-19 in terms of revenue and core EBITDA growth.

The stock trades in-line with our price target and following its Q3 FY22 numbers we observe the same central downside themes as noted above. Shares now trade at 7.3x trailing earnings – well below sector averages – and management didn’t provide forward guidance on the earnings call. Although, we don’t think this is cheap. Further, we forecast declining EPS growth into FY23, confirming our thesis. Net-net, we retain our buy call at a $3.24 price target.

Key upside risks to the thesis include:

- CODX surprises to the upside in its next earnings with strong Covid-19 revenue.

- With that, a large uptick in Covid-19 cases resulting in large demand for testing.

- Volatility within trading of small-cap stocks, where market pricing can become disconnected from fundamentals. This can result in large price movements.

- Investors should understand these risks for CODX before proceeding, to make the most informed decisions possible.

Exhibit 1. CODX 12-month weekly price action

Data: Updata

CODX Q3 numbers: structural headwinds remain

The company reported its Q3 earnings 2 weeks ago. Covid-19 demand continues to weaken with testing volumes tightening globally.

Management report it is focused on pivoting the diagnostics menu away from Covid-19, however, for the time being, this is the main driver of top-line growth for the company looking ahead in our opinion.

Per CEO, Dwight Egan’s comments on the call:

“COVID wave won’t be just one wave, but a series of waves, each fuelled by different variant that form a table meso or a table-like plateau. Aside from our belief that COVID-19 will be with us for a long time, we continue to rely on the advice of experts such as Dr. Fauci, who according to Fortune, has been warning for months that a new, more immune-evasive variant will emerge over the winter. Fauci also stresses that the pandemic is far from over. The number of deaths from COVID, which still averages around 2,600 a week, remains far too high…

…This is why our focus has been and continues to be on defining and focusing on the total addressable market for our new Co-Dx PCR Home platform…

…Among the opportunities that we have already identified have been collaborations with international NGOs and nonprofits.

The interest of these groups in the new platform extends beyond COVID to other endemic diseases such as tuberculosis, which killed 1.6 million people in 2021 alone according to the World Health Organization.”

Switching to the numbers, the company saw another 83.1% YoY downturn in revenue growth to $5.1mm. This compares to $30.1mm a year ago. Covid-19 testing volume was the key driver, as mentioned. Similarly, gross profit was down c.84% to $4.3mm on a margin of ~85%.

We note the following key data points from CODX’s performance in Q3:

- Cash conversion from receivables is a plus and serves to potentially grow revenue in periods to come. In the 9 months to September 30, 2022, it drew accounts receivable down from $20.84mm to $7.96mm. It brought in $10.6mm in net CFFO across the same period. We note that $1.1mm, or 10.4%, of this occurred in Q3 FY22. Hence, the majority of cash-conversion [89.6%] occurred pre-third quarter.

- We note the company has now completed $13mm of the $30mm authorized for its share repurchase program. This is 3.4mm shares – or 10% – of shares outstanding [from the count at the time of its annual meeting]. We believe there’s far better use for this capital and could be used to increase net operating after tax (“NOPAT”).

- With Covid-19 revenue diminishing, and despite a slight uptick in cases in the back half of 2022, the company’s now recognized sequential operating losses in Q2/Q3 FY22. It booked a $6.5mm operating loss on core EBITDA of negative $6.2mm this period, despite its R&D investment decreasing to $5mm from $5.89mm from the year prior.

We agree with the company’s data that Covid-19 will be around for a long time. Question is, what that means for a company like CODX, versus large, established players with commercial leverage. It continues to push Covid-19 revenues, in an industry that increasingly looks on consolidating.

With its latest set of operating losses, future value creation is called into question. It needs to generate a return on its investments greater than the cost of capital in order to unlock corporate value.

With heavy reliance on Covid-19, that’s a concentration risk and structural headwind that we aren’t keen on gaining exposure too. Alas, with the market outlook on Covid-19 murky, this regrettably confirms our neutral position.

Valuation and conclusion

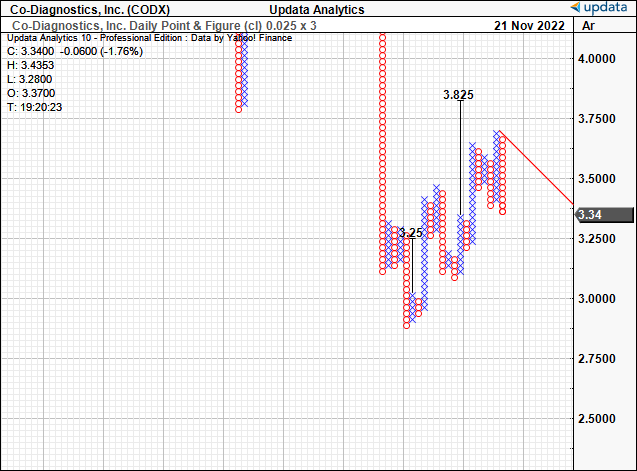

Turning to our last CODX publication, we priced the stock at 18x our FY23 EPS estimates, or $3.24. This was well supported by technical data, similar to that seen in the point and figure chart of Exhibit 2.

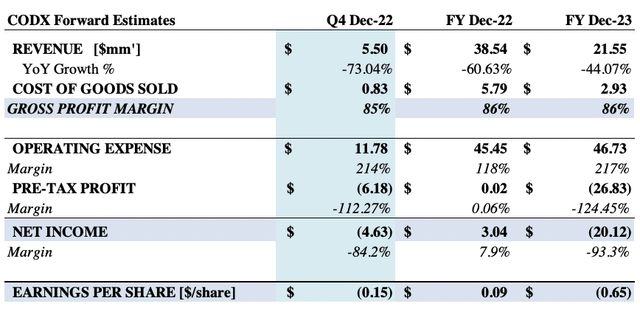

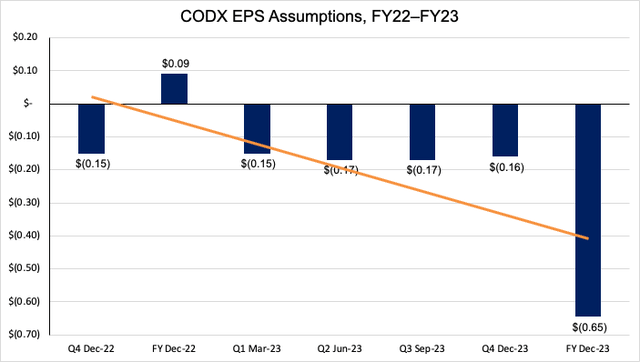

The lack of earnings upside, coupled with poor return on invested capital in the past 2 quarters renders it difficult to value CODX at a premium. You can see our EPS assumptions for CODX into FY23 below. The entire set of growth assumptions can be seen in Appendix 1.

At its current run-rate, we see it printing a loss of $0.65 per share next year. Unfortunately, this doesn’t align with the kind of equity premia we are chasing in FY22. As such, we retain our hold rating and price target of $3.24.

Exhibit 2. Forward EPS growth estimates. Key factors to note:

- Despite management’s optimism about Covid-19 demand-pull, we don’t see this matching up with bottom-line growth.

- This presents a risk to our equity budget as we are seeking tacking positions that offer EPS upside.

- Our assumptions are built by the fact CODX has seen sequential >80% YoY revenue, gross profit declines in Q2 and Q3 FY22.

Data: HB Insights Estimates

Exhibit 3.Price visibility around $3.24 well supported

Data: Updata4

Net-net, we retain our hold rating at $3.24 for CODX following its latest set of numbers. We look forward to providing further coverage in the periods to come.

Appendix 1. CODX Consolidated Forward Estimates, FY22-FY23

Note: Assumptions driven by substantial YoY revenue declines in Q2 and Q3 FY22.

Data: HB Insights Estimates