Key Takeaways

- CME XRP futures reached $542 million in buying and selling quantity inside their first month, exhibiting sturdy institutional and retail demand.

- Almost half of the XRP futures buying and selling quantity comes from outdoors North America, highlighting rising international curiosity.

Share this text

CME Group’s XRP futures and Micro XRP futures have recorded $542 million in whole buying and selling quantity since their launch on Could 19, based on a brand new report from the main derivatives market.

Since launching on Could 19, XRP and Micro XRP futures have proven demand throughout institutional and retail members, highlighting curiosity in regulated instruments to entry some of the watched crypto belongings.

Get the total breakdown ➡️ https://t.co/nmVRaXqUTO pic.twitter.com/JZG2Bnnjll

— CME Group (@CMEGroup) June 24, 2025

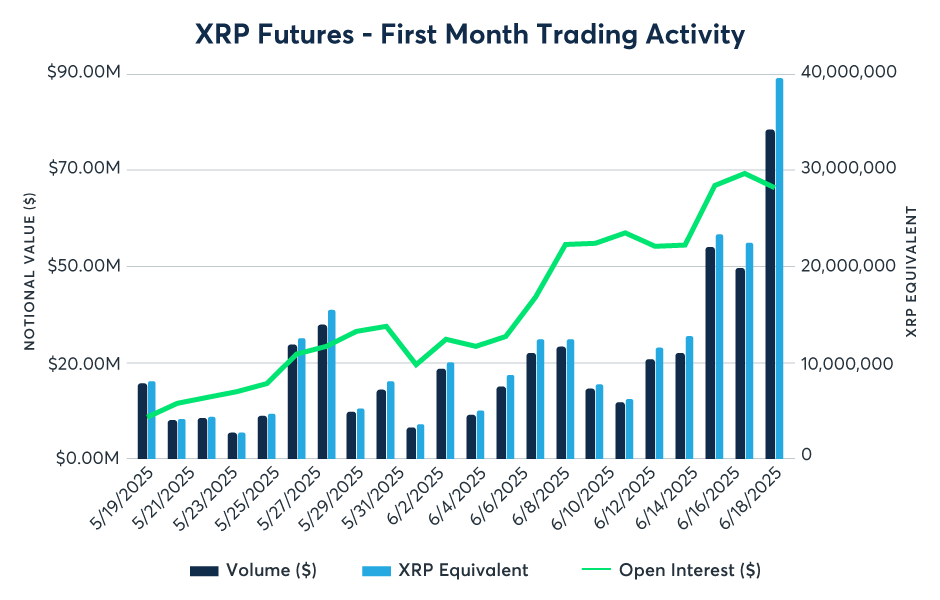

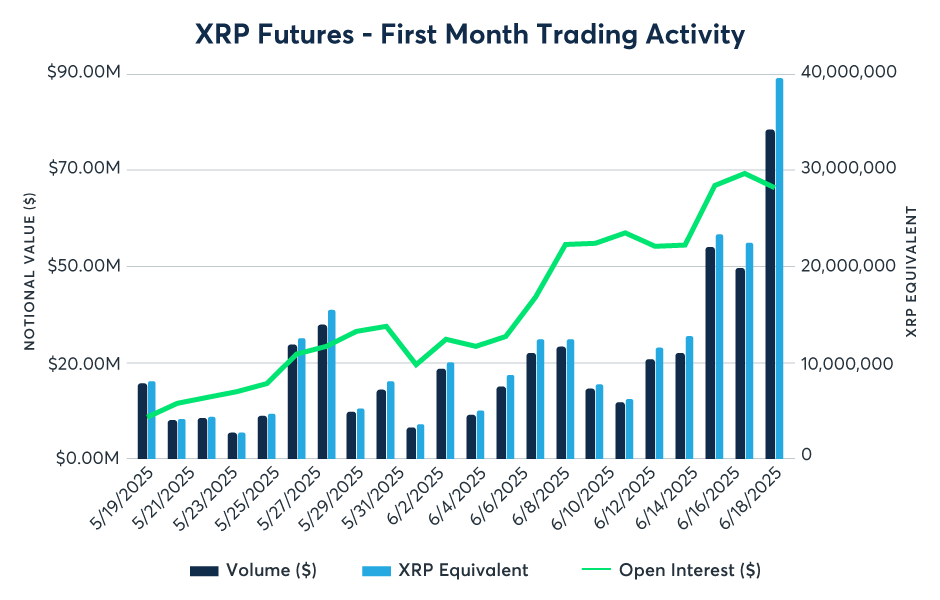

These XRP merchandise received off to a robust begin with $19 million in launch-day buying and selling, however curiosity shortly accelerated as quantity jumped 28 occasions over the primary month.

World adoption can be rising, with practically half of the exercise coming from outdoors the US and Canada, the report notes.

CME Group introduced the launch of its XRP merchandise in April, concentrating on to develop its current crypto derivatives lineup, which already options contracts tied to Bitcoin, Ethereum, and Solana. CME’s Solana futures went reside in March.

These contracts can be found in each normal (50,000 XRP) and micro (2,500 XRP) sizes, are cash-settled, and reference the CME CF XRP-Greenback Reference Price.

Along with CME Group, main exchanges like Coinbase Derivatives and Bitnomial have obtained regulatory approval to supply XRP futures contracts within the US. These choices had been rolled out after the SEC agreed to withdraw its enchantment within the Ripple Labs case.

The existence of CFTC-regulated futures is without doubt one of the most influential components within the SEC’s analysis of spot crypto ETF functions.

The SEC has beforehand cited the presence of a regulated futures market as a key requirement for approving spot Bitcoin and Ethereum ETFs. Analysts and authorized specialists notice that this precedent now applies to XRP, as CFTC-regulated XRP futures are reside on main platforms like CME Group, Coinbase Derivatives, and Bitnomial.

XRP has joined Litecoin and Solana within the prime tier for ETF approval, as specialists see a 95% chance of the SEC approving a spot ETF linked to Ripple’s flagship crypto asset.

Share this text

:max_bytes(150000):strip_icc()/health-broccoli-vs-brussel-sprouts-template-1_720-c310b4225b194326b0f2e80f1478c02b.jpg)