Sundry Photography

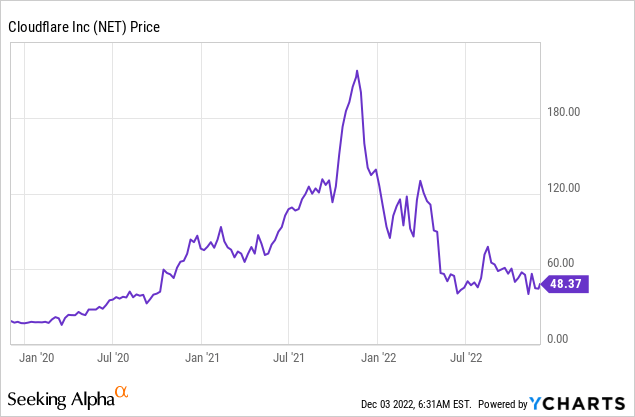

Cloudflare (NYSE:NET) owns a network of data centers that enables it to provide web content rapidly and securely. The company’s bold mission is to “build a better internet” and so far, growth has been strong. In the third quarter of 2022, Cloudflare reported solid financial results beating both top and bottom-line growth estimates. Despite the solid results, its share price has been ravaged by 77% from its all-time highs in November 2021. This was mainly driven by macroeconomic factors such as rising interest rates, which compressed the valuation multiples of growth stocks. In this post, I’m going to break down the business model, financials, and valuation, let’s dive in.

Business Model Recap

In my previous post on Cloudflare I discussed its business model in detail, here is a short recap. Cloudflare owns one of the world’s largest Content Delivery Networks [CDNs] and Cloud Security platforms. A CDN consists of a footprint of data centers globally that hold a “cached” version of a website you are visiting. The basic idea is to ensure faster web access, better security, and more flexibility with changes.

Cloudflare CDN map (Cloudflare)

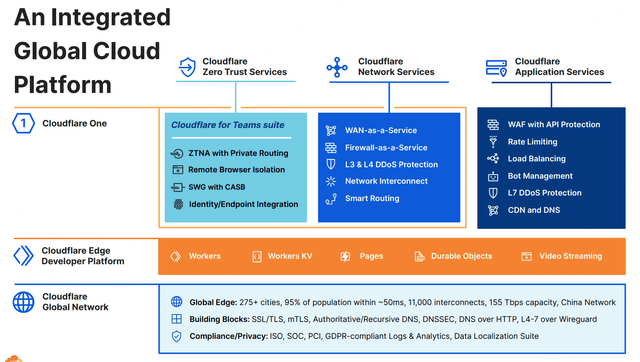

Cloudflare also has its “Cloudflare One” platform which provides three main services; a Zero Trust service, Network services, and applications. Zero Trust is a network architecture term that basically means users logging into an I.T network are “not trusted” by default. The idea is to only give employees access to the applications they need, this is called “least privileged access”. This is essential for cybersecurity as it helps to stop attackers from “moving laterally” and exploiting sensitive customer or financial data. Zero Trust is a huge growth industry that has increased in popularity due to the digital transformation to the cloud and the rise of remote working. Cloudflare competes with Zscaler (ZS) a leader in Zero Trust in this market.

Cloudflare Platform (Cloudflare)

Growing Financials

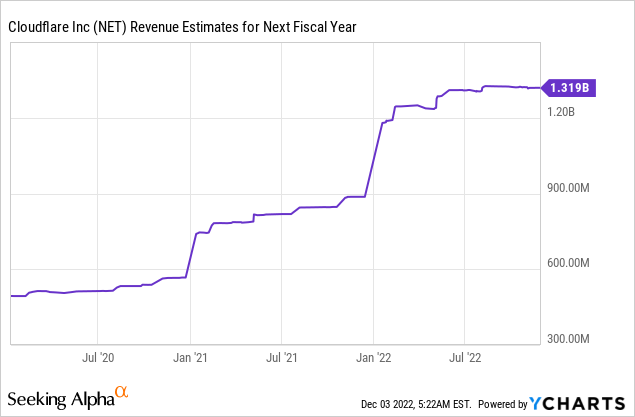

Cloudflare reported strong financial results for the third quarter of 2022. Revenue was $254 million, which beat analyst estimates by $3.99 million and increased by a rapid 47% year over year. Despite economic challenges, the business has now surpassed $1 billion in annualized revenue which puts them in the top 6% of publicly traded software companies.

By region, the U.S makes up 53% of total revenue and increased by a rapid 49% year over year. This was followed by the EMEA, which represented 27% of revenue and increased by 51% year over year. The APAC region is the smallest for the company, making up just 13% of the revenue but still increased by a solid 38% year-over-year. However, management did state they are seeing more price sensitivity and buying decision delays in the APAC region.

The company added 4,197 customers in the quarter, which brings the total to 156,000 paying customers. Cloudflare has historically been known as a “freemium” solution for small websites to distribute their content globally using its CDN or Content Delivery Network. However, management has executed its growing upmarket strategy well as the business added 156 larger customers in the quarter which pay over $100,000 per year. These larger customers increased by 51% year over year, which brings the total to 1,908 and makes up 61% of revenue. Larger customers also tend to offer greater account expansion and upsell opportunities, which is a strong positive for the business. Its super large customers, which bring in over $500,000 in annual spending, increased by an even faster rate of 88% year over year. In addition, its customers, who bring in over $1 million in annual revenue for the business, increased by 63% year over year.

Notable customer wins in the quarter included a Fortune 500 fintech company that signed a 1-year $2.8 million contract. According to the earnings call for Q1,23 this customer was offered lower pricing by competitors but Cloudflare stood out as the “clear technical leader”. This is a huge positive as it means Cloudflare could have “pricing power” which would be a solid competitive advantage.

The company has also expanded its relationship with a Fortune 500 pharmaceutical giant, which signed an extra $915,000 3-year deal. The business is adopting a data localization suite that is powered by “Cloudflare workers”. Data localization is a key trend as increasing legislation and cybersecurity threats means storing data locally in countries is necessary long term. For example, the TikTok CEO recently announced at a New York Times event that its long-term strategy is to store data “locally” in each country after accusations the business is sending details to the Chinese government.

Cloudflare also scored a 3-year $1.2 million deal with a Fortune 500 European telecoms company. This was part of the digital transformation of their onsite IT to the Cloud and Cloudflare’s data localization again tipped the scales in favor of the company over competitors.

The company reported a solid dollar-based net retention rate of 124% which was down slightly from 126% in the last quarter. However, this is still extremely strong as it means the product is “sticky” with customers and they are spending more. Management has bold plans to increase this retention figure to 130% as it expands its products such as Zero Trust and R2. As a comparison, Zscaler is a giant of the Zero Trust market and recently grew its revenue by 54% year over year to $356 million in the quarter.

Cloudflare has recently hired a new “President of Revenue” Marc Boroditsky who is the former CRO of Twilio (TWLO) when the company was growing revenue at a 50% clip with a $4 billion annualized run rate. The new recruit to Cloudflare is very confident. He sees a “clear path to $5 billion in 5 years” by selling the customer’s new products directly to its existing customers. $5 billion in annualized revenue over the next 5 years would put Cloudflare in the top 1% of all publicly traded software companies, which would be a game-changer.

Profitability and Expenses

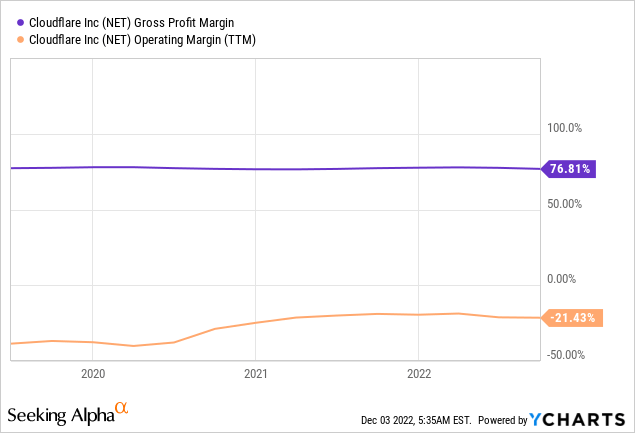

Cloudflare has a super high gross margin of 78% which was above its target range of between 75% and 77%, despite inflation headwinds.

The company is unprofitable on a GAAP basis with Earnings Per Share of negative $0.13 which beat analyst estimates by $0.06. However, the company did generate record Non-GAAP operating profit of $14.8 million at a 5.8% operating margin. With non-GAAP EPS of $0.06 which beat analyst estimates by $0.06.

In terms of expenses, it was great to see that operating expenses as a portion of revenue have declined by 6% year over year to 72%. This means the business is starting to show signs of operating leverage as it scales.

This was mainly driven by a decline in Sales and Marketing expenses from 45% of total revenue last year to 41% this year or $104 million. Research and development expenses were $46.4 million in the quarter, which decreased from 19% of revenue last year to 18% this year. General and Administrative expenses showed a similar pattern as it declined from 14% of revenue last year to 13% this year.

Operating cash flow expanded to $42.7 million or 17% of revenue in the third quarter of 2022, which was up from the 4% of revenue reported in the equivalent quarter last year.

The company has a solid balance sheet with $1.6 billion in cash, cash equivalents and marketable securities. In addition to ~$1.4 billion in long term debt.

Advanced Valuation

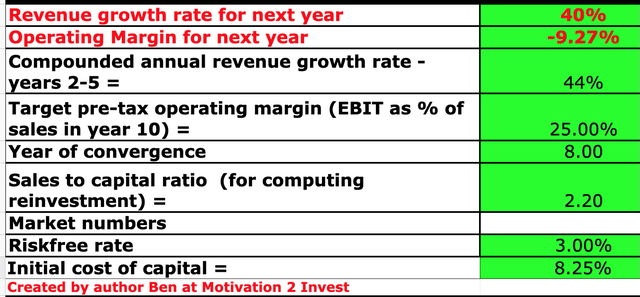

In order to value Cloudflare, I have plugged the latest financials into my discounted cash flow model. I have forecasted a conservative 40% revenue growth for next year which is aligned with management guidance. I have then forecasted revenue growth to increase by 44% per year over the next 2 to 5, as economic conditions improve.

Cloudflare stock valuation 1 (Created by Author at Motivation 2 Invest)

To increase the accuracy of the valuation I have capitalized R&D expenses. In addition, I have forecasted the target pre-tax operating margin to increase to 25% over the next 8 years. I expect this to be driven by continued improvements in operating leverage and increased upsells.

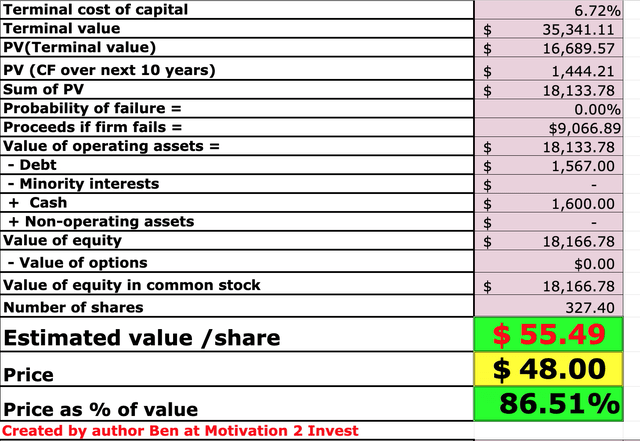

Cloudflare stock valuation 2 (created by author Ben at Motivation 2 Invest)

Given these factors I get a fair value of $55.49 per share, the stock is trading at $48 per share at the time of writing and is thus ~13% undervalued.

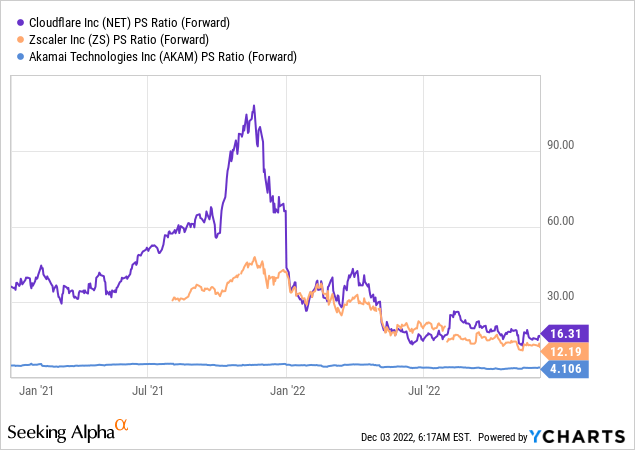

As an extra datapoint, Cloudflare trades at a Price to Sales ratio = 17, which is 55% cheaper than its 5-year average. Relative to the cybersecurity/IT industry peers in the CDN and Zero trust space, Cloudflare is trading at a slightly higher rate.

Risks

Longer Sales Cycles/Recession

Many analysts are forecasting a recession in 2023, due to the high inflation and rising interest rate environment. Even if this doesn’t occur, decision-makers are already starting to slow down processes, and longer sales cycles have been noted by both Cloudflare and competitors such as Zscaler.

Final Thoughts

Cloudflare is a tremendous technology company that has continually diversified its business and is growing rapidly. The business has a clear path to $5 billion in annualized revenue and the right team to execute on this. The stock is undervalued intrinsically at the time of writing which means the stock could be a great long-term investment.