Lambert: A doom loop for local weather, eh?

By Stavros Zenios, Professor of finance and administration science at College of Cyprus, Member of the Cyprus Academy of Sciences, Letters, and Arts, Non-resident Fellow at Bruegel, and Senior Fellow on the Wharton Monetary Establishments Heart of the College of Pennsylvania. Initially printed at VoxEU

Proof means that sovereign debt markets are taking local weather results into consideration in pricing, creating the potential for a climate-debt doom loop. Nonetheless, local weather dangers to fiscal stability don’t appeal to the identical consideration as local weather dangers to monetary stability. This column discusses how built-in evaluation fashions may be linked with stochastic debt sustainability evaluation to tell our understanding of local weather dangers to sovereign debt. In a case examine of Italy, introducing local weather dangers causes the debt dynamic to deteriorate and threat premia to extend non-linearly as a manifestation of the doom loop.

Daring (and expensive) local weather motion is required through the present decade, however on the identical time, sovereign debt has reached ranges not seen since WWII. Unprecedented central financial institution interventions through the pandemic have averted a debt disaster, however issues are voiced that local weather change imperils the flexibility of nations to repay Covid-19 money owed (Dibley et al. 2021). These issues go to the guts of the hypothetical proposal by Greta Thunberg, recommended by Kotlikoff et al. (2021) once they put phrases in her mouth for a discount deal on the 2019 handle to the United Nations:

“Since we can’t depend on you to behave morally, let me suggest bribing you to save lots of the planet. Undertake a excessive world carbon tax. Nonetheless, reduce different taxes so, on steadiness, you’re higher off. My and future generations can pay increased taxes to service the deficits you run.”

However can Greta’s cohort service the money owed they inherit, given the local weather results on debt?

The CEPR assortment (Di Mauro 2021) gives a “fascinating perception into the evolution of financial analysis on local weather change over the past decade”. Local weather dangers to monetary stability take centre stage, subsequent to carbon pricing and inexperienced finance. Local weather dangers to fiscal stability appeal to scant consideration, with solely Persaud (2021) coping with debt. A 2019 survey of the EU nationwide fiscal councils discovered that their quantitative analyses don’t cowl local weather dangers. A Google tendencies search for the reason that Paris Settlement has a mean ranking of 92 for “local weather dangers + monetary” and 36 for “+ fiscal”. Google Scholar lists 1.94 million paperwork on the previous subject and 0.3 million on the latter. Cognisant of the challenges forward, the European Fiscal Board just lately requested for a holistic view of local weather dangers to fiscal planning (Thygesen et al. 2022).

In Zenios (2022), I recommend growing such a holistic view by capitalising on advances in local weather threat and debt sustainability evaluation (DSA). Combining narrative situations of local weather evaluation (Climatic Change 2014) with situation bushes from stochastic DSA, I argue that we will hyperlink built-in evaluation fashions (IAM), pioneered by Nordhaus, with DSA to tell our understanding of local weather results on debt.

Channels from Local weather Change to Sovereign Debt

Local weather change impacts sovereign debt by way of a number of channels: financial development, acute and persistent damages, and prices from low carbon transition (Determine 1).

Determine 1 From local weather change to public finance

Allow us to have a look at indicative magnitudes. A Tol (2014) meta-analysis finds {that a} 5°C temperature rise might adversely affect the world economic system by 3 to fifteen% of GDP. The affect can be 2.5% below a 2.5°C enhance, though some areas endure extra (15% for the tropics). Damages are documented in worldwide disasters databases however extrapolating from historical past underestimates future damages because the quantity and severity of utmost occasions speed up; EM-DAT experiences a doubling of occasions from 1985 to current years. Losses from extreme climate for European nations are projected to develop by €170 billion p.a. (1.4% GDP).1 Transitioning from fossil fuels additionally causes sovereign wealth to be repriced, with property price $12 trillion (3% of the capital inventory) estimated to be stranded by 2050 (Banque de France 2019).

The bond markets are pricing local weather dangers (Cevik and Tovar-Jalles 2020), and ranking businesses anticipate that local weather change will have an effect on rankings within the coming a long time. Klusak et al. (2021) discover that 55 sovereigns face downgrades below a 2°C enhance and eighty below 4.2°C, with concomitant will increase in debt servicing prices.

Placing the items collectively means that unchecked local weather change might precipitate a ‘climate-debt doom loop’. Growing debt servicing prices add to the prices from damages and local weather insurance policies, and the compounded results can turn into a first-order drawback for some sovereigns. Certainly, nations with higher publicity to local weather dangers have extra precarious public debt positions: the climate-vulnerable EU tercile averages a debt of 133% of GDP in comparison with 78% for the least susceptible. If local weather prices increase issues concerning the capability to repay, the sovereign is downrated, and its financing charges go up. The sovereign is caught in a debt lure that may be tough to flee if local weather change lowers development. Greta’s cohort can be in a bind.

Debt Sustainability Evaluation with Local weather Danger

DSA with a local weather module can assess the chance of such a lure. It tells us if a sovereign can sustainably finance its debt or estimates the accessible fiscal house if the debt is sustainable. These solutions go to the guts of Thunberg’s hypothetical proposal. To evaluate whether or not future generations might service the money owed, we have to weigh the debt created by as we speak’s insurance policies and the local weather results on debt. Linking IAM with DSA permits for structured dialogue on this complicated problem.

The DSA of Zenios et al. (2021) makes use of situation bushes to signify future unsure GDP development, authorities major steadiness, and rates of interest. Debt-to-GDP ratios are stochastic variables on the tree. A tail threat measure tells us if the debt stays on a non-increasing path with excessive chance in order that it’s deemed sustainable with excessive confidence. If the debt declines, we will estimate the accessible house to run extra deficits ‘to save lots of the planet’.

Presently, DSA situations ignore local weather dangers and lengthen over medium horizons when specialists’ projections are dependable, with chances calibrated to market information. Past that, situations converge to long-term tendencies, such because the historic common development or inflation goal. The evaluation of local weather dangers, however, is difficult by deep uncertainty. There may be ambiguity the place outcomes could also be recognized, however their probability will not be, and there are misspecifications with no consensus on fashions.

It’s potential to cope with this complexity, even when not with excessive precision. Local weather scientists postulate potential future states of the world, however they can not pin down chances as future situations rely on unknown coverage paths. To combine local weather threat into DSA, we calibrate situation bushes on IAM financial projections below future states. To cope with the paradox about future situations, we construct on the work of the Built-in Evaluation Consortium (IAC).2

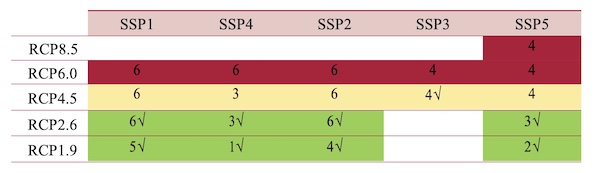

IAC developed a story situation structure (Climatic Change 2014) that mixes consultant focus pathways (RCPs) of atmospheric greenhouse gases with narratives on shared socioeconomic pathways (SSPs). Desk 1 illustrates the situation structure. For every cell, the variety of accessible IAM can generate projections and utilizing ensembles of fashions, we cope with mannequin misspecification.

The situation structure gives clear states of the world for what-if analyses. For every SSP-RCP pair, current IAM present forward-looking projections of mitigation and adaptation prices, damages, GDP development, and different outcomes to combine local weather dangers into DSA.

Desk 1 Narrative situation structure of local weather dangers

I current the case examine for Italy, utilizing development projections from two outstanding IAM to showcase the local weather results on debt and the problem of misspecifications.3

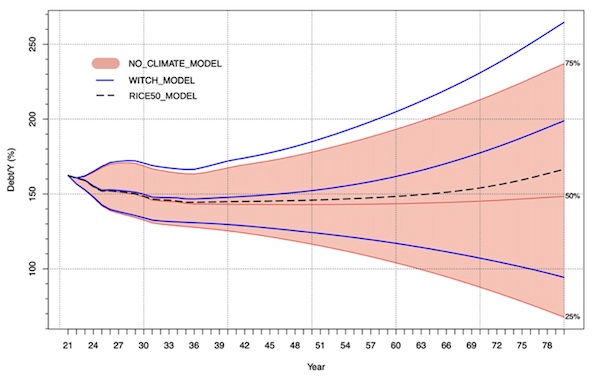

Determine 2 reveals the 25/75 quantiles of debt dynamics with climate-free DSA utilizing projections from the IMF World Financial Outlook and the ECB, with volatilities and correlations matching their historic values. The median debt is secure with important upside threat. I then introduce local weather results in keeping with the Paris Settlement (RCP2.6-SSP2) utilizing the WITCH mannequin (Emmerling et al. 2016) and RICE50+ (Gazzotti et al. 2021). Each fashions venture downward changes to Italy’s development, and I exploit these projections to re-calibrate the bushes. The climate-adjusted DSA outcomes are overlayed onto the fan chart of Determine 2, and we observe deteriorating debt dynamics. With RICE50+, the results kick in from 2050, whereas WITCH modifications are noticeable from the mid-2030s. We be aware an accelerating pattern after mid-century on account of rising antagonistic local weather results and the nonlinear enhance in threat premia as a manifestation of the doom loop.

Determine 2 Dynamics of Italian debt inventory with local weather affect on development

Local weather‑Proofing Public Finance

Governments want to organize public finance for local weather change:

- Local weather challenges are world (or regional) and require coordination. A coordinated modelling effort utilizing the situation structure will ship transparency and make sure the acceptability of situations for fiscal planning. A community for climate-proofing public finance might play the coordinating function.

- Fiscal authorities ought to mainstream local weather threat evaluation in public finance. Budgetary plans ought to embody damages and the prices of mitigation and adaptation, together with social prices, maybe as contingent liabilities, and search risk-sharing devices that present fiscal house throughout climate shocks (Demertzis and Zenios 2019).

- Fiscal authorities ought to disclose their exposures following the Activity Pressure on Local weather-related Monetary Disclosures tips. The resilience of a rustic’s debt to local weather change is crucial, whether or not the nation is contributing so much or just a little to local weather change.

It isn’t as much as any single nation to mitigate local weather change. However it’s as much as the fiscal stability establishments to make sure that the budgetary place of sovereigns is resilient.

References accessible on the authentic.