JHVEPhoto/iStock Editorial via Getty Images

Instead of an investment thesis

You are now reading my 9th article on Cleveland-Cliffs Inc. (NYSE:CLF). I published my very first article in June 2021. Since then, all my writings have been either bullish or very bullish, depending on the stock’s performance and corporate events (earnings, insider buying, etc.)

YCharts (with author’s notes)![YCharts [with author's notes]](https://static.seekingalpha.com/uploads/2022/12/23/53838465-16717920879699802.png)

And just yesterday, CLF jumped 11.6% after the company said that annual fixed prices for steel will increase in 2023 while unit costs will be “significantly lower” than they were in 2022:

Specifically, with higher sales volumes and a similar mix of hot rolled, cold rolled and coated products, the Company expects from its direct carbon steel automotive customers an average selling price of approximately $1,400 per net ton in 2023, compared to an expected full-year 2022 price of approximately $1,300 per net ton. Direct carbon automotive sales represent Cliffs’ largest end market, are performed entirely on a fixed price basis, and are not influenced by spot prices.

Similarly, the Company has also achieved significantly higher contractual fixed prices for its grain-oriented electrical steels for 2023 compared to 2022, as well as meaningful increases in fixed base prices for its non-oriented electrical steel and stainless steel products, before surcharge impacts.

Fixed-price contracts are expected to represent 40-45% of the Company’s steel volumes sold in 2023, and over 50% of total steel revenue under the current futures curve for U.S. HRC.

Separately, as a result of lower input costs and normalized repair and maintenance expenses, Cliffs also expects significantly lower Steelmaking unit costs in 2023 compared to 2022.

Source: Press release (December 22, 2022)

For this reason, I think that such a strong upward movement as yesterday is only the beginning of a new round of growth, which will very likely continue until 2023, even if there is a mild recession in the US.

My reasoning

The biggest risk for CLF and the entire Materials sector, to which the company belongs, is a looming recession in the US. For this reason, 8 analysts from various banks believe that the company will lose more than half of its sales in 2023 compared to 2022 – just take a look at these depressing figures:

Seeking Alpha, CLF (author’s notes)![Seeking Alpha, CLF [author's notes]](https://static.seekingalpha.com/uploads/2022/12/23/53838465-16717926939368634.png)

I agree that the risk of a recession is very high right now – many leading indicators speak to that, as do many of the best minds among institutional managers.

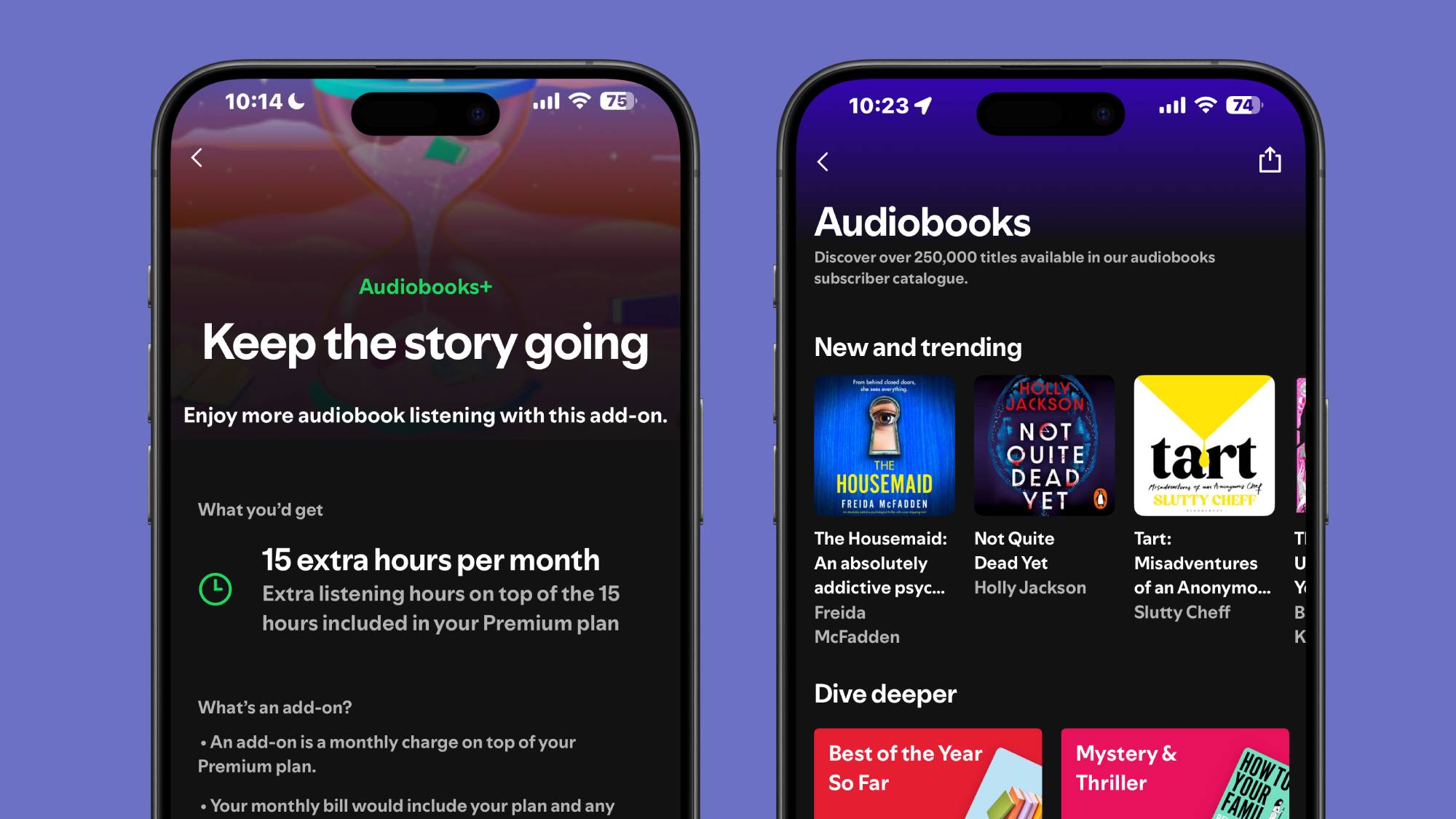

If you have been following CLF for a long time, you know how conservative the company’s management is in its approach to press and sell-side communications. That’s why, despite its right moves in terms of capital allocation practices and lots of insider buying activities, CLF has not had the success it deserves against the backdrop of other steelmakers:

You need to be aware that selling prices will not increase on their own – the company is most likely feeling strong demand in the end markets, which will contribute to volume growth.

Yes, the CEO of Nucor Corp. (NUE) spoke about declining volumes back in October, which is a bad sign for CLF:

In the steel mills segment, we expect considerably lower earnings in the fourth quarter of 2022 as compared to the third quarter of 2022 due to lower average selling prices and lower volumes, with the largest decrease in profitability expected at our sheet mills. The steel products segment is expected to have another strong quarter in the fourth quarter of 2022, but the segment’s profitability is anticipated to decrease from the third quarter of 2022 primarily due to typical seasonality experienced in the fourth quarter. The raw materials segment is expected to have significantly decreased earnings in the fourth quarter of 2022 as compared to the third quarter of 2022 due to decreased selling prices for raw materials.

Source: Press release (October 20, 2022)

But even if CLF’s volumes shrink as well – will they really decline enough to meet the analysts’ target of over -50% in sales in FY2023 (YoY)? I doubt it very much.

CLF ended the 3rd quarter of 2022 with cash of $56 million, an increase from the $48 million they had at the end of 2021. Long-term debt decreased to $4.5 billion, down from $5.2 billion at the end of 2021. As of October 21, 2022, CLF had total liquidity of $24 billion, according to Argus. The company’s balance sheet and liquidity are in excellent condition as far as I see it.

The company paid down $155 million in borrowings on their ABL facility and completed open market repurchases of $41 million in senior notes at an average of 88% of par value. CLF’s liabilities were at $1.1 billion, a decrease from the $4.2 billion they had following the ArcelorMittal acquisition in December 2020.

CLF also repurchased 2 million shares at an average price of $16.97 per share in 3Q 2022 ($34 million or 0.39% of market cap) – this is approximately the price at the time of yesterday’s close. I assume that if the market does not bid up the stock, management itself will continue to do so.

The growing optimism about CLF’s underperformance was evident as early as Dec. 16, when Goldman Sachs analyst Neil Mehta published a note on the sector:

Goldman Sachs (Dec. 16, 2022) with author’s notes![Goldman Sachs [Dec.16, 2022] with author's notes](https://static.seekingalpha.com/uploads/2022/12/23/53838465-1671794404566344.png)

A day earlier, the GS team – Marcio Farid and others – published another report pointing out the most delicious upside potential in CLF among other industry players:

Goldman Sachs (Dec. 15, 2022) with author’s notes![Goldman Sachs [Dec.15, 2022] with author's notes](https://static.seekingalpha.com/uploads/2022/12/23/53838465-16717945400423899.png)

Now it’s only 6% left to reach their price target – I think analysts will revise this forecast upward and other banks will likely follow them because the news about the selling prices increase and cost cuts in FY2023 are too big to lose sight of.

Your Takeaway

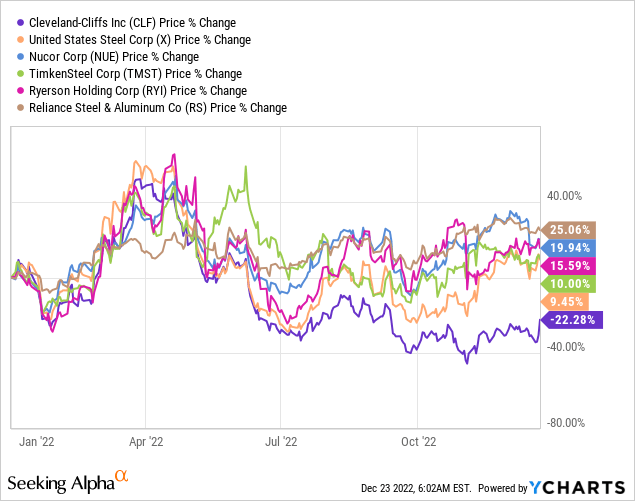

Going back to Argus’ report, which is updated quarterly – according to Q3 2022 results, CLF became even more attractive compared to its peers in terms of a relative assessment of P/E (TTM) and 5-year revenue growth rate:

Argus Research, October 26, 2022

If we compare Cliffs to “more alike” companies (in terms of their operations), we can see that CLF has maintained its leading position that I pointed to in my previous article (October 1, 2022). The only change since then has been a slight decrease in the company’s premium in its absolute valuation multiples, which is what I call a good argument for buying shares at the current levels of $17.

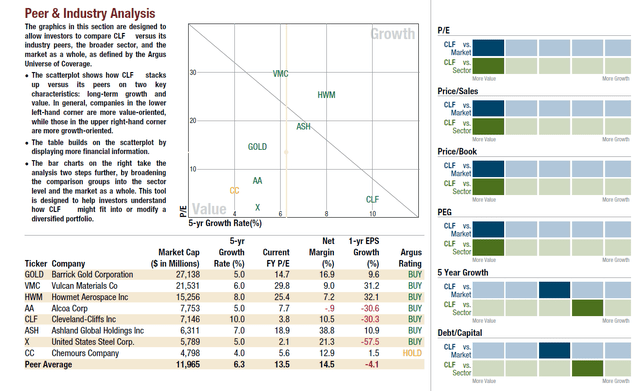

The jump in CLF’s share price that we saw yesterday was most likely due in part to its high short-interest ratio, which was one of the largest among its peers.

The bears (those who have been shorting lately) are now sitting on their losses – they may start closing out their positions massively if the positive market sentiment continues for some time. I would like to think so.

Based on the above, I reiterate my Buy rating again and see a good technical picture that supports my fundamental thesis:

TrendSpider, CLF (author’s notes)![TrendSpider, CLF [author's notes]](https://static.seekingalpha.com/uploads/2022/12/23/53838465-16717964983373086.png)

In the medium term, I expect the CLF to rise by 10-15% as the risk of a recession recedes again, as is often the case in a bear market.

/cdn.vox-cdn.com/uploads/chorus_asset/file/24302378/226457_Keychron_Q10_NEdwards_0005.jpg)