Be a part of Our Telegram channel to remain updated on breaking information protection

Citigroup has invested in stablecoin infrastructure supplier BVNK by way of Citi Ventures, simply months after warning that the cryptos might drain deposits from conventional banks

BVNK’s platform serves as an onramp and offramp for patrons to maneuver cash between fiat and crypto. Additionally it is backed by US crypto alternate Coinbase and fund supervisor Tiger World Administration.

The funding underscores TradFi’s shift from warning to participation within the stablecoin ecosystem after the US GENIUS Act supplied regulatory readability over their standing.

BVNK Valuation Exceeds $750 Million After Citi Funding

The firm has declined to reveal the quantity Citi invested or at what valuation. However co-founder Chris Harmse lately confirmed that the funding has pushed its valuation effectively above the $750 million that was disclosed at its newest funding spherical.

BVNK presently finds itself in a aggressive market alongside newcomers corresponding to Alchemy Pay, TripleA and even the effectively established Ripple. All of those corporations are vying to take the lion’s share of the cross-border digital cash market.

Amid the sturdy competitors, Harmse mentioned that BVNK has “dipped out and in of profitability” as the corporate invested in progress, however mentioned the agency is experiencing momentum, particularly within the US.

The co-founder added that the US has been the corporate’’s strongest rising market prior to now 12-18 months. This progress was spurred by the approval of the GENIUS stablecoin Act, which was signed into regulation earlier this 12 months by US President Donald Trump.

In August, US Treasury Secretary Scott Bessent expressed help for stablecoin adoption, and mentioned these tokens “will increase greenback entry for billions throughout the globe.”

Implementing the GENIUS Act is crucial to securing American management in digital property.

Stablecoins will increase greenback entry for billions throughout the globe and result in a surge in demand for U.S. Treasuries, which again stablecoins.

It’s a win-win-win for everybody concerned:… https://t.co/p5nRQpBfnw

— Treasury Secretary Scott Bessent (@SecScottBessent) August 18, 2025

The regulatory readability supplied by the GENIUS Act has boosted the capitalization of the stablecoin market in current months, whereas a number of monetary establishments have since signaled plans to launch their very own stablecoins.

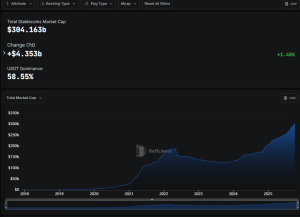

Previously week, the capitalization for the stablecoin sector surged round $4.353 billion, based on DefiLlama knowledge.

Following the expansion prior to now seven days, the stablecoin market cap now stands at over $304.163 billion.

Stablecoin market cap (Supply: DefiLlama)

Previously thirty days alone, $5 trillion in stablecoin transactions have taken place as effectively, based on on-chain analytics from Visa.

One of many corporations that has confirmed stablecoin plans is Citi, whose CEO Jane Fraser mentioned in July, the identical month the GENIUS Act was signed into regulation, that the financial institution is contemplating issuing its personal stablecoin. She additionally mentioned that Citigroup is growing custodian providers for crypto property.

By way of these merchandise, Citi goals to ship “the advantages of developments in stablecoin and digital property” to its shoppers in a protected method by modernizing its personal infrastructure.

Different corporations are additionally exploring blockchain expertise and tokenization. This consists of Wall Road big JPMorgan Chase, which has launched its personal stablecoin-like token known as JPMD. In the meantime, Financial institution of New York Mellon has mentioned that it’s testing tokenized deposits. HSBC has launched its personal tokenized deposit service as effectively.

Citi Had Warned Of Deposit Flight Threat Related To The Eighties

Citi’s funding in BVNK comes after one among its analyst, Ronit Ghose, warned in August {that a} rising curiosity in stablecoin funds presents deposit flight threat for conventional banks, much like what was seen within the Eighties when cash market funds ballooned from $4 billion to $235 billion in seven years.

Main banking teams within the US have already expressed their considerations round yield-bearing stablecoins, and have lobbied for Congress to shut what they known as a “loophole” within the GENIUS Act.

The act prohibits stablecoin issuers from providing yields on to token holders, however doesn’t prolong this ban to 3rd events or associates. This, based on the banking teams, opens the door for stablecoin issuers to avoid the restrictions. For instance, Coinbase presently gives its customers yields on Circle’s USD Coin (USDC) stablecoin.

If that “loophole” stays unaddressed, the banking teams predicted that it might end in as much as $6.6 trillion in deposit outflows from the standard banking system. This might then basically alter how banks fund loans.

Nonetheless, the crypto business has pushed again towards the banking teams’ claims, with many dismissing them as simply an effort by banks to stop competitors. Some, together with Stripe CEO Patrick Collison, have additionally mentioned that stablecoins will now power banks to supply greater yields to clients.

Good put up on evolving stablecoin market construction. I’d prolong it additional: sure, I feel that stablecoin issuers are going to should share yield with others, however this is only one occasion. Everybody goes to should share yield. At this time, the common curiosity on US financial savings… https://t.co/yjjLOzxoOk

— Patrick Collison (@patrickc) October 3, 2025

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection

:max_bytes(150000):strip_icc()/Health-GettyImages-1057064406-fa98c68bbc5d465c95f2407d2dfb89a5.jpg)