Igor Kutyaev/iStock by way of Getty Photos

Thesis

Calamos World Dynamic Earnings Fund (NASDAQ:CHW) is a closed finish fund with a broad allocation mandate. The fund can put capital to work amongst world equities, convertible bonds, fixed-income securities, and various investments because it sees match. CHW employs an lively buying and selling technique with the annualized portfolio turnover coming in at 133.6%.

The automobile has a 0.58 Sharpe ratio and an 18 commonplace deviation (each measured on a 5-year foundation). With a 36% leverage the fund experiences deep drawdowns, with the Covid occasion exposing a -32% most draw. The present yield for the automobile is 9.92%, and it’s effectively coated by its distribution between capital features and dividend earnings.

We like CHW and its analytics, particularly in mild of very strong long-term outcomes, with the 5- and 10-year trailing whole returns sitting at 11.7% and 10% respectively. Nonetheless, even if CHW has traditionally traded at a reduction to NAV, the fund is now buying and selling at a premium. Coupled with additional anticipated equities weak point on the again of hawkish central banks, we don’t really feel it is a good entry level for the fund. In case you are already lengthy the identify then we price it Maintain, whereas new cash is greatest suited to attend for a extra engaging entry level.

Holdings

CHW accommodates a mixture of equities, convertibles and excessive yield bonds:

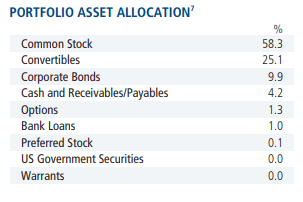

Asset Allocation (Fund Truth Sheet)

Equities presently account for roughly 58% of the portfolio, adopted by convertibles and a modest allocation of company bonds. To notice that, as per the fund’s literature CHW’s administration workforce “has most flexibility to dynamically allocate amongst equities, convertible bonds, fixed-income securities and various investments world wide.” This leads to a dynamically allotted portfolio that may change the asset allocation combine illustrated above fairly abruptly.

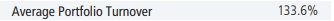

We are able to see the dynamic allocation/lively portfolio buying and selling undertaken by the supervisor within the annual portfolio turnover figures:

Portfolio Turnover (Fund Truth Sheet)

This fund doesn’t exhibit deep worth purchase and maintain traits however is extra of an lively portfolio buying and selling automobile.

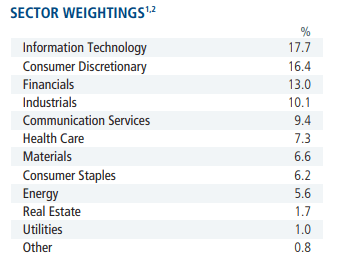

On the fairness aspect of the portfolio asset allocation, the trade sector cut up is as follows:

Sector Weightings (Fund Truth Sheet)

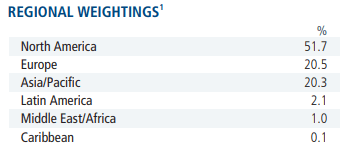

The automobile has a really excessive allocation to info expertise, carefully adopted by shopper discretionary shares and financials. Many of the equities within the portfolio are North American names:

Geographic Distribution (Fund Truth Sheet)

As per the fund’s reality sheet, “By investing a minimum of 40% and as much as 100% of managed belongings in international securities, together with rising markets, the fund blends world securities, endeavoring to take care of an optimum danger/reward profile.” The fund thus has a compulsory world allocation of a minimum of 40%, making it a real world fund.

The present prime ten inventory holdings are as follows:

Prime 10 Holdings (Fund Truth Sheet)

We are able to see that about 70% of the highest holdings are constituted by frequent inventory holdings, whereas the remaining are convertibles.

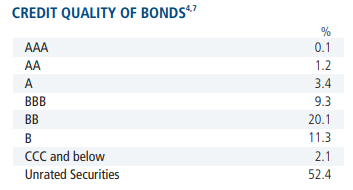

On the fastened earnings a part of the portfolio, the fund invests in excessive yield bonds:

Credit score High quality (Fund Truth Sheet)

Many of the allocation is within the BB bucket and “Unrated” part. Often, unrated bonds signify smaller personal placements that don’t garner a ranking company’s curiosity or have the spending energy to cowl the ranking charges. They don’t essentially signify weaker credit, simply names which aren’t very broadly syndicated.

Efficiency

CHW is down greater than -13% year-to-date, underperforming the Vanguard Whole World Inventory Index Fund (VT):

YTD Whole Return (Looking for Alpha)

On a 5-year foundation, the fund nonetheless outperforms the index:

5-Yr Efficiency (Looking for Alpha)

We are able to see that the automobile not solely outperforms the index however has a big time interval when it uncovered an accelerated optimistic efficiency as in comparison with the chosen benchmark. This speaks fairly effectively to the administration workforce and its potential to supply alpha-generating securities.

On a 10-year timeframe, the fund and the index expose very comparable performances:

10-Yr Whole Return (Looking for Alpha)

We are able to clearly see the impact of leverage within the above graph. On the draw back transfer triggered by Covid, CHW misplaced greater than the index, whereas on the upswing it gained extra. Leverage amplifies returns each on the draw back and on the upside.

Low cost/Premium to NAV

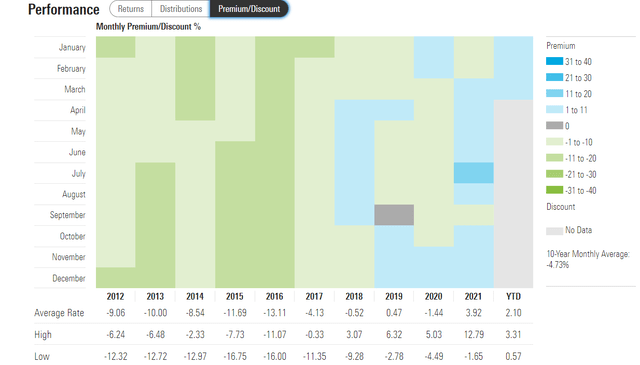

The fund often trades at a reduction to NAV that may be fairly substantial:

Premium/Low cost (Morningstar)

We are able to see how as much as 2019 the automobile often uncovered an approximate -10% low cost to NAV. With the Fed shifting charges to zero submit the Covid pandemic and traders on the lookout for yield, CHW moved into the premium to NAV territory.

We’re shocked to see that the fund continues to be at a premium to NAV even now in 2022, regardless of the large rise in rates of interest. We count on a reversion right here.

Distributions

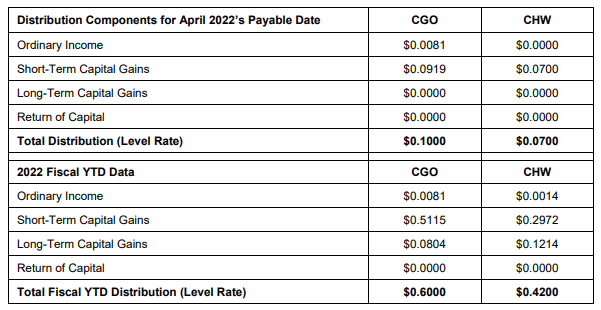

The fund does job of masking its distributions from both capital features or dividend earnings:

2022 Part 19.a Abstract (Fund Literature)

We are able to see from the above desk that particulars the April 2022 distribution composition in addition to the 2022 knowledge that the fund covers its dividend effectively from capital features (i.e., efficiency) and strange earnings. A excessive determine for return of capital right here could be worrisome.

Conclusion

CHW is a hybrid CEF that has each an fairness and stuck earnings allocation that may range. The fund has a world mandate with a 40% requirement for international securities allocation. The automobile presently allocates 60% of its funds to equities, adopted by convertibles at 25% and excessive yield bonds at 9%. CHW has very strong long-term outcomes, with the 5- and 10-year trailing whole returns sitting at 11.7% and 10%, respectively. The fund experiences deep drawdowns and has a excessive beta of 1.82.

We just like the fund and its analytics, however with CHW nonetheless buying and selling at a premium to NAV and the present fairness weak point setting not a foregone transfer we really feel the identify is just a Maintain ranking in the mean time with significantly better entry factors available.