CGinspiration

By Iris Pang, Chief Economist, Greater China

The People’s Bank of China has already cut its Required Reserve Ratio and has continued to pump liquidity into the money market over the past few days. Is this about global market volatility or is it more about the domestic economy?

What’s behind the large liquidity injection by the PBoC?

China’s central bank, the PBoC, has injected significant liquidity into the market since 21 March. From the 21st to the 29th of the month, the central bank injected more than CNY850 billion of net liquidity into the financial system. This includes CNY352bn injected through daily open market operations and CNY500bn by lowering the Required Reserve Ratio (RRR) which took effect on 27 March.

We believe that there are at least two considerations behind these liquidity injections.

These operations are occurring at the end of the first quarter. In China, loan growth for the year is usually booked in the first three months. This is a seasonal phenomenon and pushes up interbank interest rates at the end of the first quarter.

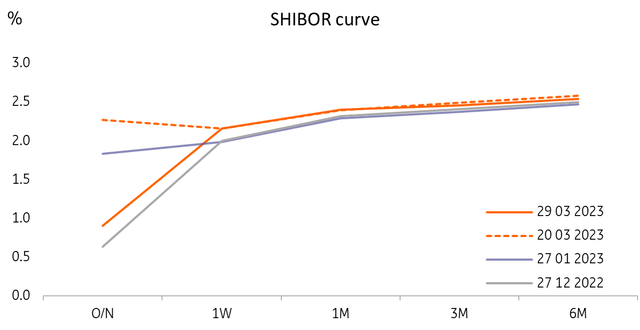

As the chart shows, the overnight SHIBOR touched 2.5% on 20 March. Therefore, we think that loan growth should continue to be very strong in March compared to 2022, even after the rapid growth in the first two months. If this is the main reason for the PBoC’s big liquidity injection, this should be seen as a positive sign for economic growth.

The volatility in global financial markets is not over; there may be some ups and downs ahead. China has a more open capital account than in the past and global events may have some impact on the Chinese market.

As such, the PBoC may be cushioning any potential volatility. This is more of a precautionary measure and should not be over-interpreted.

Interbank interest rates show that liquidity was tight before the PBoC’s injection

Source: CEIC, ING

The market is discussing a rate cut, but we don’t agree

The market is actively discussing that the PBoC will cut the 7D policy rate and the medium-term lending facility (MLF) rate, which are currently at 2.0% and 2.75%, respectively. The discussion has intensified, especially after the PBoC announced a cut in the RRR this month.

We do not see the need for China to lower interest rates. The economy is recovering at this time, although not as fast as the market expected though this is due more to the market’s overestimation of the speed of the rebound.

External markets are weakening and export activity will be dampened. But China’s interest rate cuts will not help exports. Moreover, an excessively accommodative monetary policy may attract some unnecessary investments. As the economy recovers more quickly in the second half of the year, interest rate cuts could pose a risk of economic overheating.

Therefore, we keep our forecast for an unchanged policy rate in 2023. We also do not see the need for another deposit reserve ratio cut in China, as the peak in loan growth should have passed after the first quarter.

Content Disclaimer

This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.