As India approaches the rabi season, the latest halt in speciality fertiliser exports by China presents each challenges and important alternatives for home Indian fertiliser producers. Whereas China has been limiting provides of specialty fertilisers to India for the previous 4-5 years, an entire halt impacts 80 per cent of specialty fertilisers provide for high-value crops reminiscent of vegatables and fruits, affecting agricultural belts in Maharashtra, Gujarat, Tamil Nadu, Uttar Pradesh and West Bengal.

An estimated 130,000-140,000 tonnes of speciality fertilisers have been imported from China between June and December 2024 alone. Notable merchandise embrace controlled-release fertilisers (CRFs) reminiscent of polymer-coated urea (PCU), chelated micronutrients (Fe-EDTA, Zn-EDTA, Fe-EDDHA), water-soluble fertilisers (WSFs) reminiscent of monoammonium phosphate (MAP) and potassium nitrate (KNO₃); and stabilised nitrogen fertilisers with urease inhibitors (NBPT). There are fears of worth rises, as availability is just not anticipated to be a serious problem. India has different import choices from Russia, Jordon, and Israel; nonetheless, well timed cargo arrival stays a priority.

Market state of affairs and development drivers

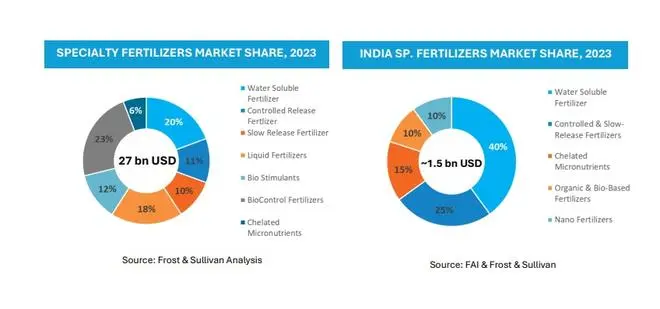

The Speciality Fertiliser Market has robust development potential and is predicted to achieve $63 billion by 2035 globally, backed by sustainable agricultural practices.

Key development drivers for speciality fertilisers

1. Nutrient environment friendly: CRF and SRF make the vitamins obtainable for longer durations by lowering nitrogen loss by way of leaching, thus bettering crop yield.

2. Atmosphere-friendly: Delays denitrification by controlling the response of soil micro organism with nitrates

3. Water-solubility shortage: Water-soluble fertilisers will be utilized utilizing drip irrigation methods, optimising water utilization.

4. Sustainability: Using bio-stimulants reduces the quantity of mineral fertilisers launched into the atmosphere, decreasing air pollution of soil, water and air.

There’s a robust want for high-efficiency fertilisers. The implementation of speciality fertilisers is rising throughout international market, together with the US, Canada, Brazil, Europe, India, China and Japan. That is because of the rising consciousness about the advantages related to speciality fertilisers as they’re extra environment friendly as in comparison with commonplace fertilisers. Using speciality fertilisers with drip irrigated and different fertigation tools helps farmers obtain higher price yields successfully.

Pushed by rising adoption of precision and sustainable farming practices, India’s speciality fertiliser market is projected to achieve $5-6 billion by 2030, with a CAGR of 18 per cent from 2025-2030 – if the federal government’s aggressive subsidies and China+1 technique are successfully deployed. Nevertheless, the federal government’s subsidies don’t all the time translate into increased business worth. For instance, the Indian controlled-release fertiliser market noticed a decline in market worth regardless of elevated consumption. The principle motive was the Indian authorities mandating that every one home urea producers manufacture 100 per cent neem-coated urea and distribute it at subsidised costs to the farmers.

Home gamers herald India’s self-reliance

China’s export halt is ready to speed up India’s self-reliance in speciality fertilisers. Home gamers reminiscent of IFFCO, Coromandel, Tata Chemical compounds, and GSFC are main the cost, supported by authorities insurance policies and R&D investments. The availability hole presents immense alternatives to home gamers throughout all segments of speciality fertiliser demand.

Managed/slow-release fertilisers: India imported ~200 KTPA of PCU and sulfur-coated urea (SCU).

How are home gamers filling the market hole?

IFFCO’s Nano urea – A liquid nitrogen different lowering urea demand, Deepak Fertiliser’s Nitroplus® – Neem-coated slow-release urea; new start-ups growing lignin-coated urea for delayed nutrient launch.

Chelated micronutrients: India imported ~50 KTPA of Fe/Zn-chelates.

Coromandel Worldwide – Expanded Gromor micronutrient manufacturing; GSFC & Aries Argo – ramping up EDTA/DTPA chelates. Nevertheless, the native manufacturing of Fe-EDDHA continues to be a problem resulting from high-tech necessities.

Water-soluble fertilisers (WSFs): Disruptions in provides of MAP & KNO₃ for fertigation.

Tata Chemical compounds is scaling up hydroponic-grade fertilisers; Chambal Fertilisers is rising soluble NPK blends. New JVs with Israeli corporations reminiscent of Haifa Group for superior WSFs are on the horizon.

Natural and bio-based fertilisers: Whereas not halted, decreased the imports of humic acid and seaweed extracts.

Aquagro & Biostadt are increasing natural soil conditioners; Camson Bio is producing microbial biofertilisers.

On the expertise entrance, IFFCO and KRIBHCO are main improvements in nano-fertilisers, whereas Biostadt and Aquagro are scaling up for Bio-stimulants & precision agriculture options.

Conclusion

The Indian speciality fertiliser market is diversifying quickly, with CRFs, WSFs and nano-fertilisers driving development. Authorities initiatives and China’s export curbs are accelerating home manufacturing, albeit challenges reminiscent of Indian speciality fertilisers stay 10-12 per cent costlier than Chinese language ones.

The expertise gaps in Fe-EDDHA & superior CRFs require overseas collaboration, for which there are 100 per cent FDI initiative by the Authorities. In the meantime, alternate options from Israel’s Haifa Group, Morocco’s OCP Group, Belgium’s Solufeed and Germany’s BASF, are being thought-about for merchandise together with – Polymer-coated urea, Fe-EDDHA/Zn-EDTA, Monoammonium phosphate (MAP) and NBPT-treated urea.

China’s export halt has acted as a catalyst for India’s self-reliance, powered by PM-PRANAM scheme and diversified commerce partnerships. Nevertheless, area of interest specialities reminiscent of high-purity Fe-EDDHA stay troublesome to exchange totally.

Balan is Affiliate Companion and Awalla is Consulting Supervisor, Chemical compounds Progress Advisory, Frost & Sullvan

Revealed on July 13, 2025