adventtr

By SchiffGold

Please note: the CoTs report was published 04/28/2023 for the period ending 04/25/2023. “Managed Money” and “Hedge Funds” are used interchangeably.

Gold

Current Trends

Gold is facing a healthy consolidation after a strong rally during March and early April. The data shows that Managed Money has been pushing the price up, but is also not totally responsible.

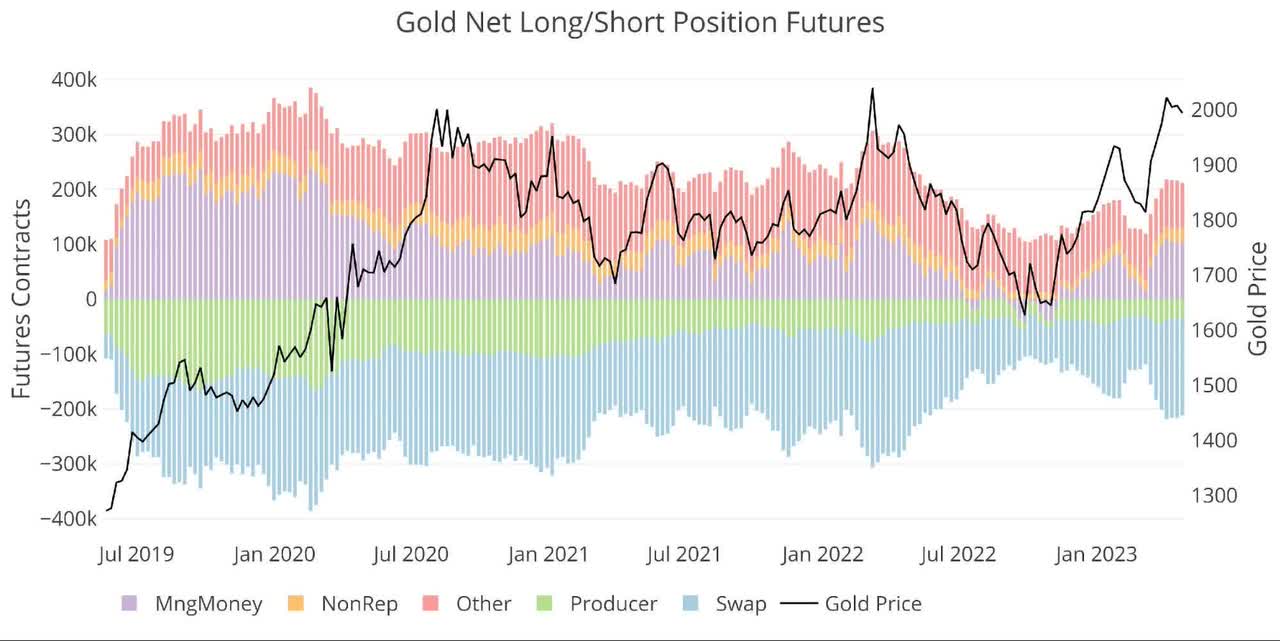

Figure: 1 Net Position by Holder (Author)

As the chart below shows, Managed Money net positions have been steady around 100k contracts while gold dances around the $2k mark. In March of 2022, when gold was last pushing the $2k level, Managed Money net positioning was almost 50% higher at 148k contracts.

A similar price, on lower overall participation from Managed Money, suggests two things. First, that buying has been coming in from elsewhere. Second, Managed Money still has the dry powder to put to use if there is a catalyst that sends gold up (e.g., a dovish Fed meeting next week).

Figure: 2 Managed Money Net Position (Author)

Weak Hands at Work

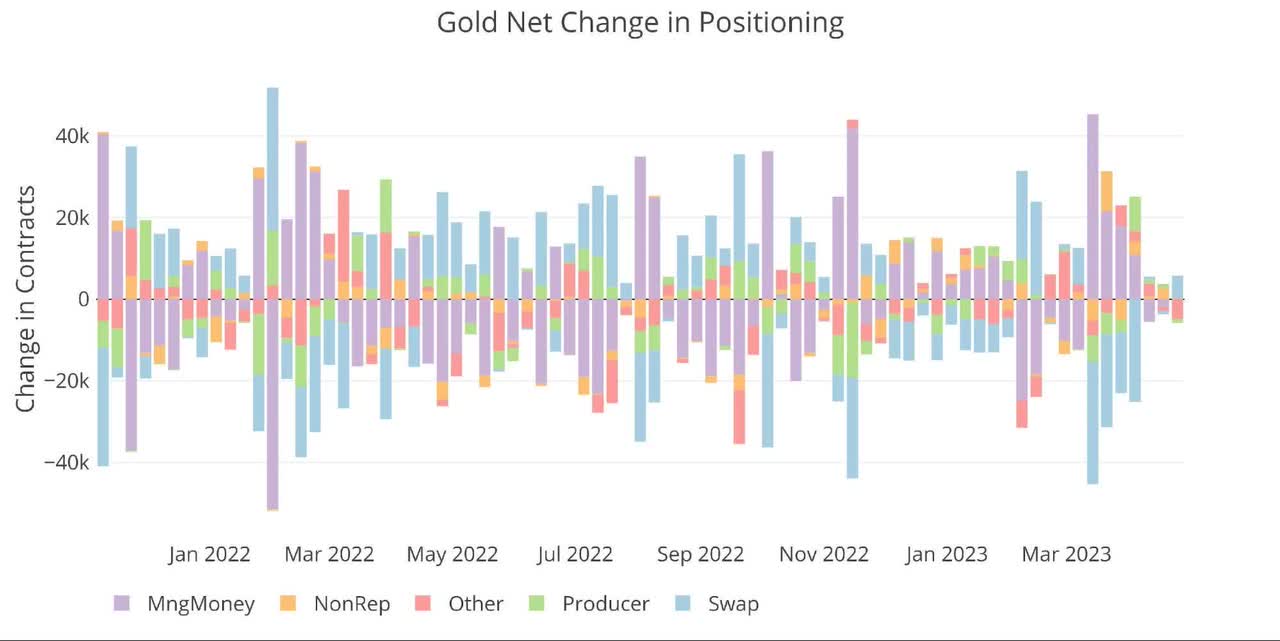

The market has gone very quiet over the last 3 weeks with little movement from any of the parties. This can be seen in the bar chart below where the last three bars are all less than 6k contracts on either side. The last movement was a modest accumulation of longs from Hedge Funds.

Figure: 3 (Author)

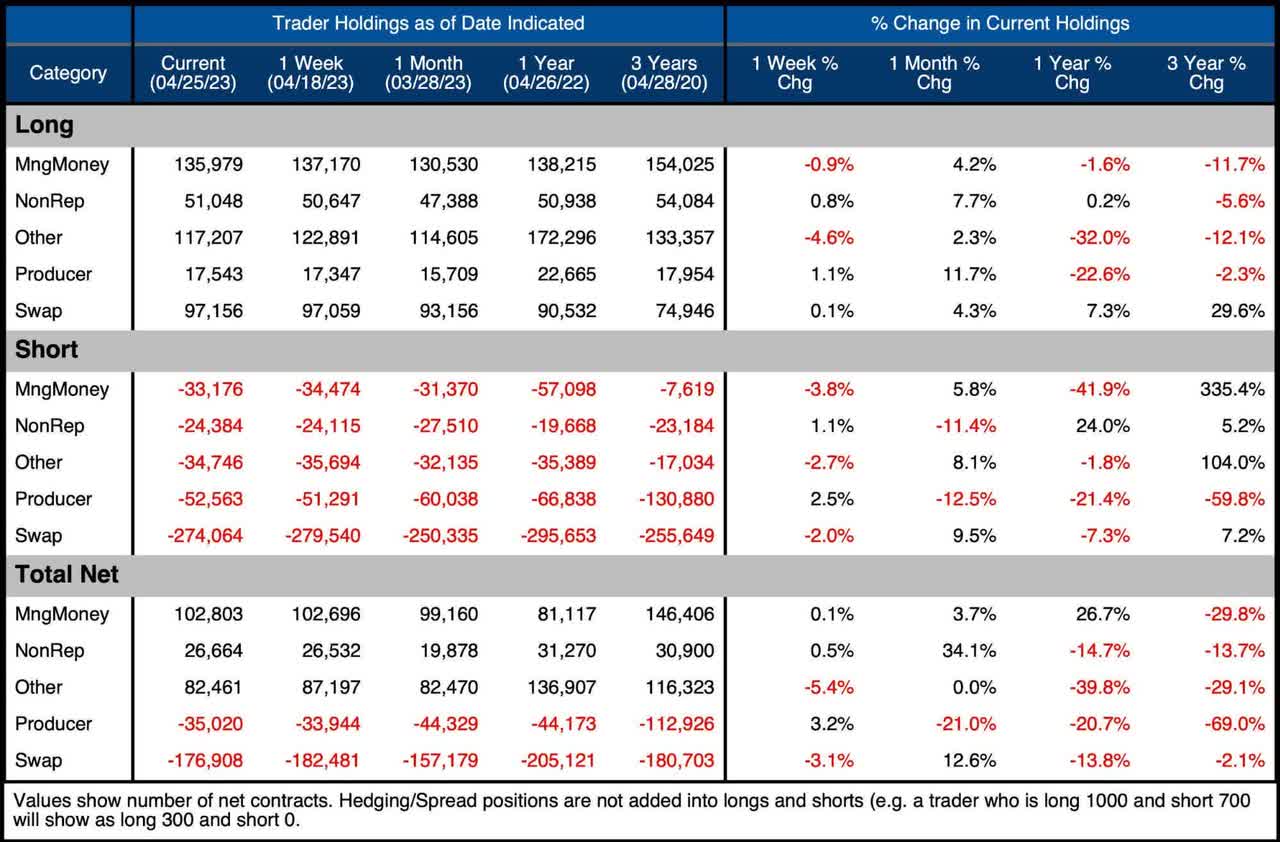

The table below has detailed positioning information. A few things to highlight:

- The one-month change is very small across all parties

- Managed Money net positioned moved by 3.7%

- Some of the other parties showed bigger percentage moves, but the gross movement is small

- “Other” has been steady longs for years but seems to be liquidating, down 40% in net longs over the year

- This has been driven by a reduction in gross longs by 32% from 172k to 117k

Over the last year, only managed money has increased its net positioning. All other parties have seen reductions. That said, over the past month, there have been large increases in net positioning.

Figure: 4 Gold Summary Table (Author)

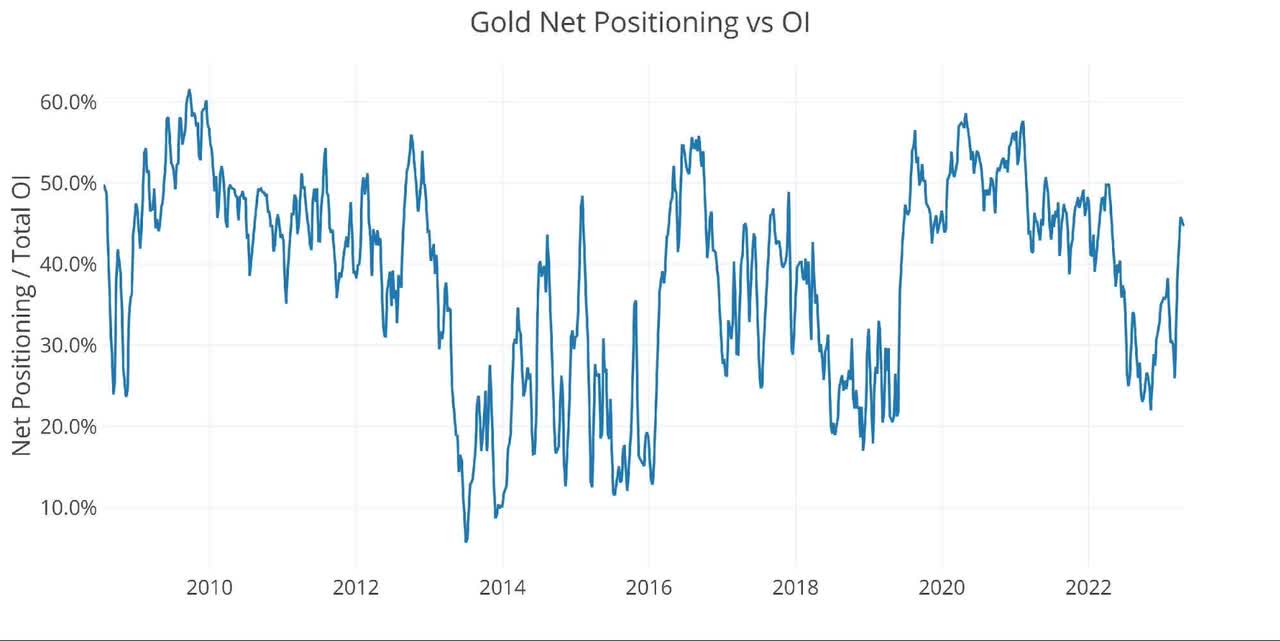

The recent increase in net positioning can be seen below. It reached a recent low of 22% in November 2022 but is now 45%. This represents the net positions divided by the gross positions.

Figure: 5 Net Positioning (Author)

Historical Perspective

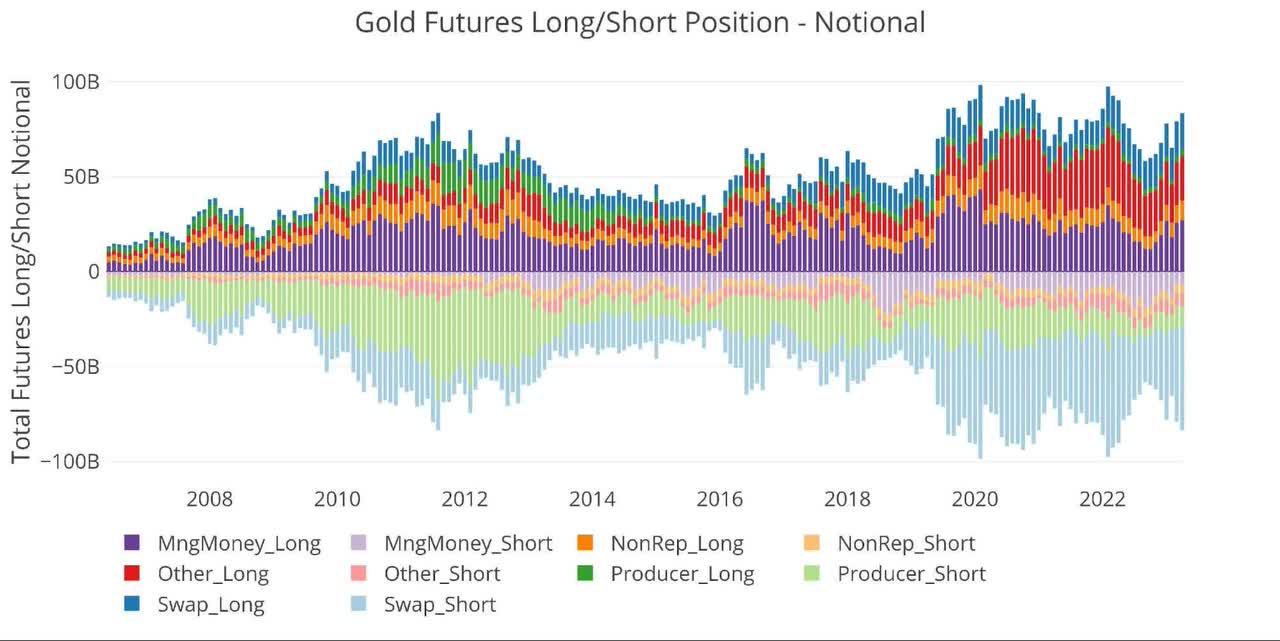

Looking over the full history of the CoTs data by month produces the chart below (values are in dollar/notional amounts, not contracts). Gross positioning has topped out just shy of $100B twice, in Feb 2020 and Feb 2022, before seeing large corrections. The current price advance has taken gross positioning to $85B. Still below the records and below $100B, but the market is getting close to that level. As it gets nearer to $100B, the possibility of a sell-off could increase as paper holders find themselves over-exposed.

Figure: 6 Gross Open Interest (Author)

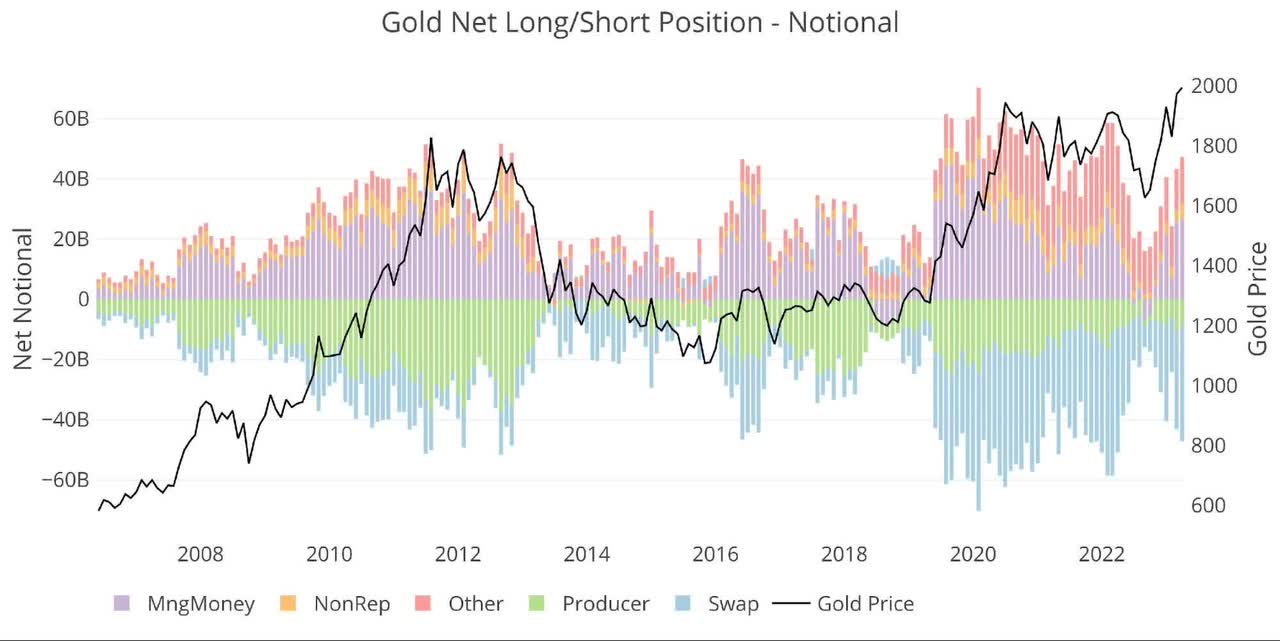

The net positioning should give some comfort though. Despite the price at the highest monthly close on record, the net positioning is more than $10B below 2022 high and $23B below the 2020 high.

Figure: 7 Net Notional Position (Author)

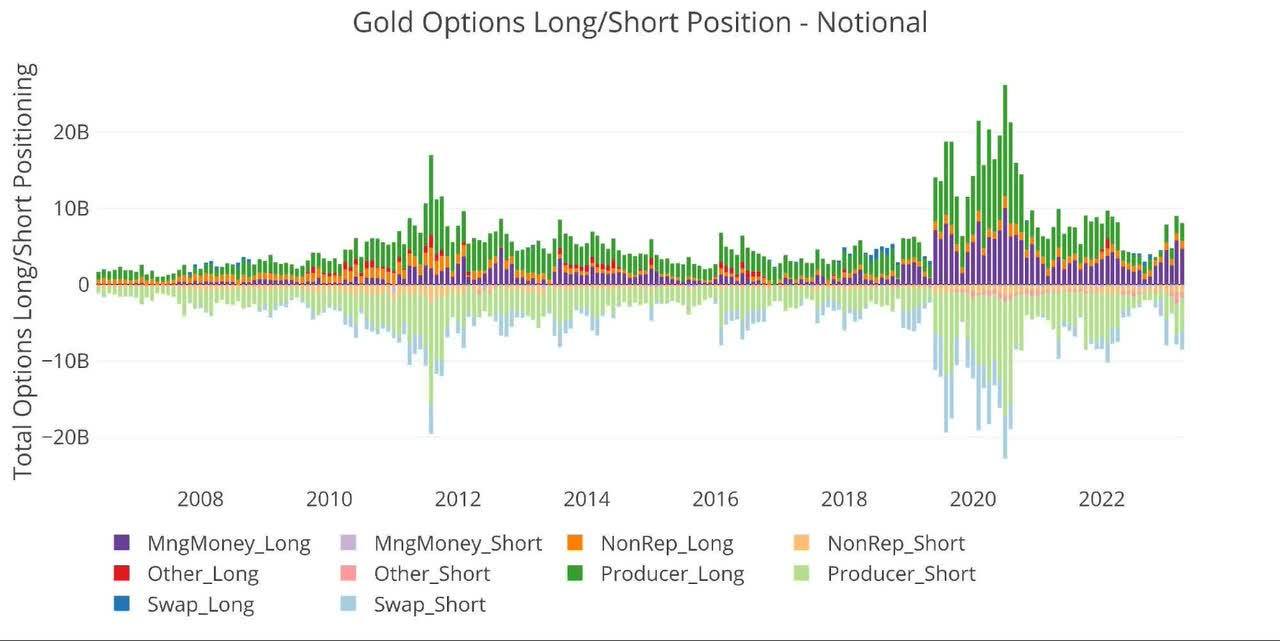

Another sign the market has not gotten too far ahead of itself is the options market. This represents very speculative money. In 2020 the notional amount exceeded $20B and it now sits at less than $10B. That said, Managed Money is near $5B which is greater than at any point in 2022 and only below the 2019-2020 price run-up.

Figure: 8 Options Positions (Author)

Silver

Current Trends

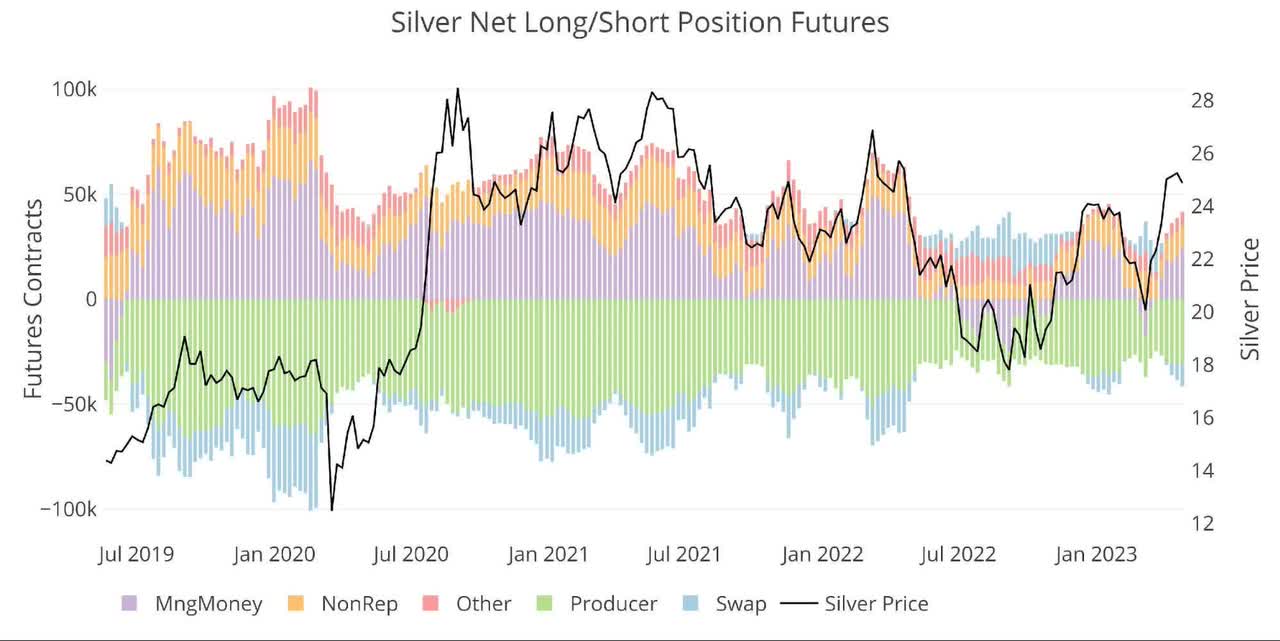

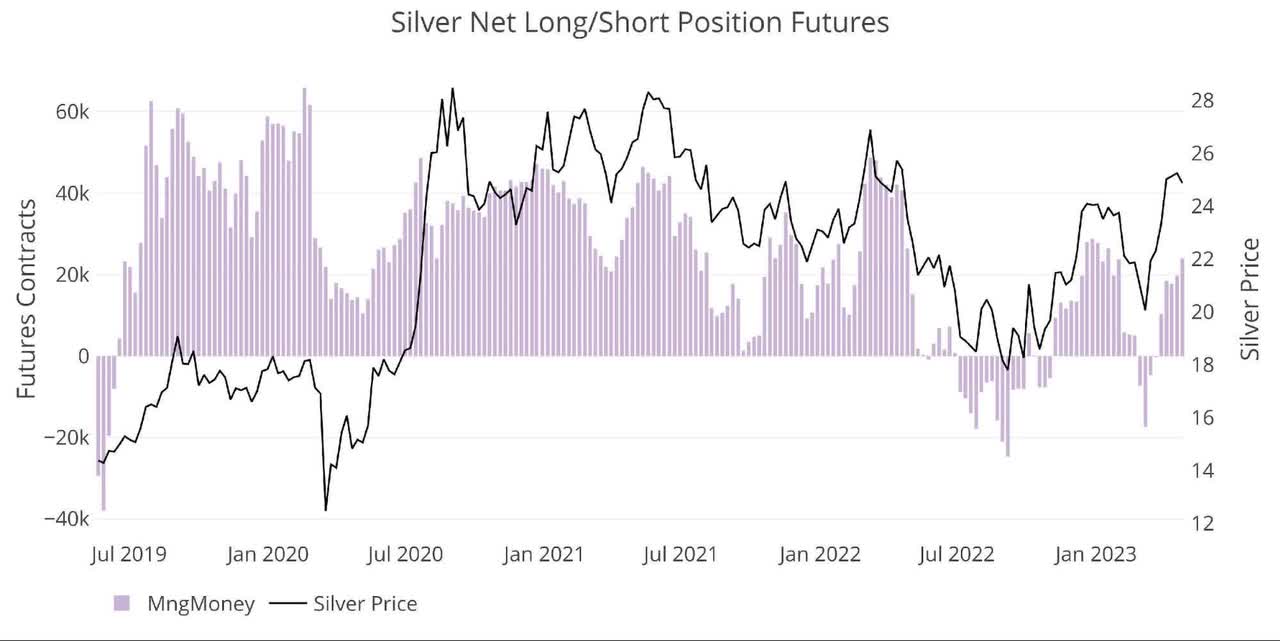

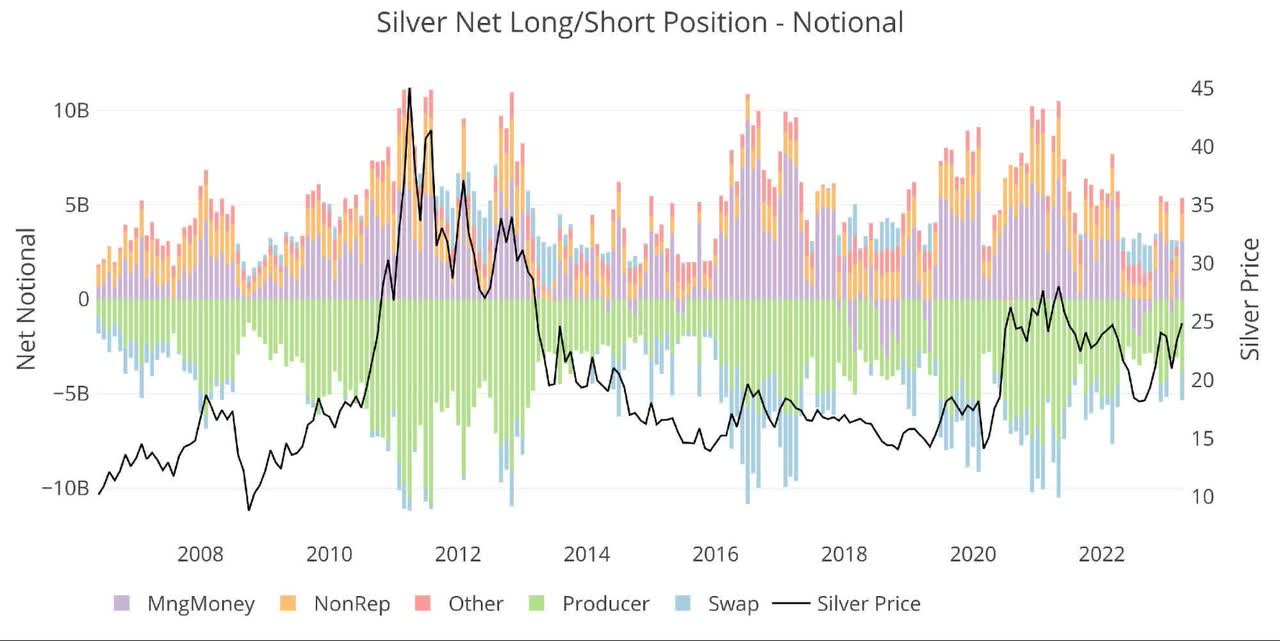

Similar to gold, there are other forces at play pushing the price up. Net positioning is lower than it was last year, but the price is more than 3% higher.

Figure: 9 Net Position by Holder (Author)

Perhaps even more surprising is that Managed Money increased its net positioning in the latest week, but the price actually fell. This is a very rare occurrence!

Figure: 10 Managed Money Net Position (Author)

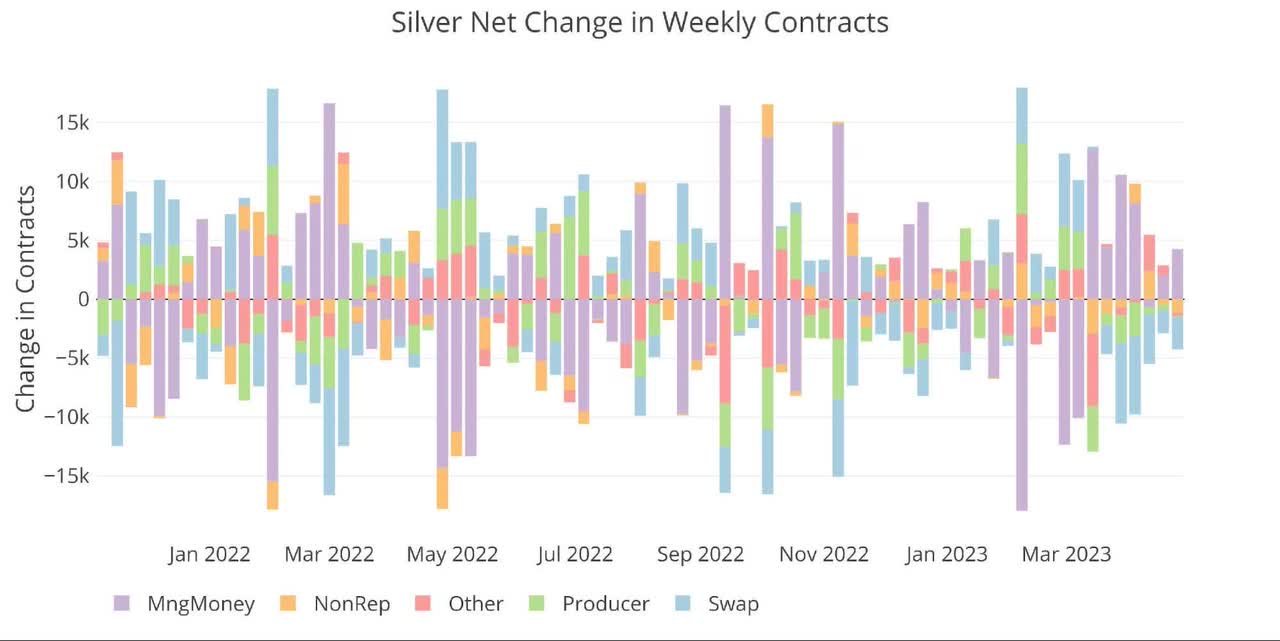

Managed Money is very volatile week to week in silver. This can be seen below. One reason for concern is that 6 of the last 7 weeks have seen Managed Money increase net longs. Trends like this in either direction do not typically last for too long. The Fed meeting could be a major mover in this upcoming week. This may be the first leg up as it was in July 2020. It’s also possible the silver net longs see an excuse to bail.

Figure: 11 Net Change in Positioning (Author)

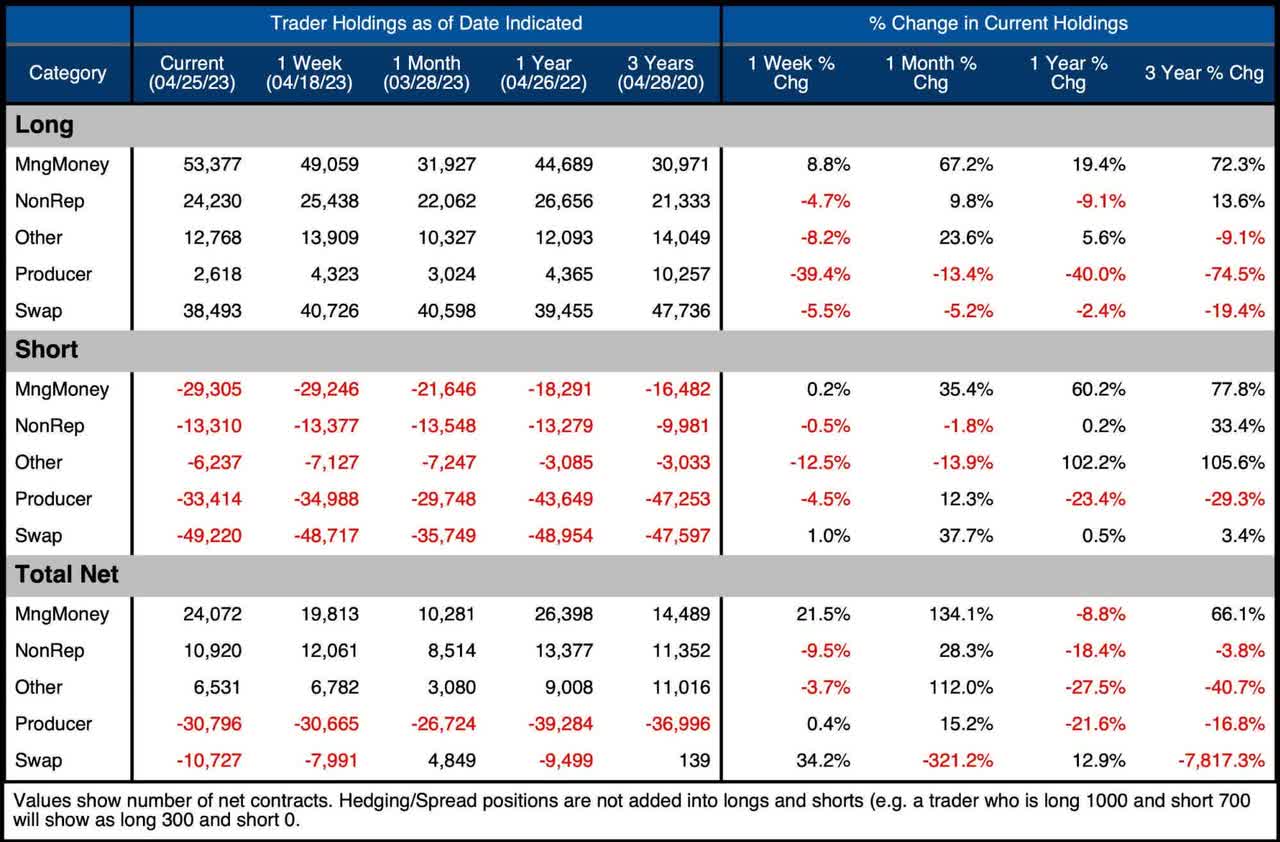

The table below shows a series of snapshots in time. This data does NOT include options or hedging positions. Important data points to note:

- Managed Money increased net longs by 134% over the month

- This was driven entirely by a large increase in gross longs because gross shorts also saw a meaningful increase of 35%

- Others had gotten very low but increased their net long position by 3.5k contracts

- Over the last month, Swap actually went from net long to net short

- This is mostly to balance out the market – every long needs a short

Figure: 12 Silver Summary Table (Author)

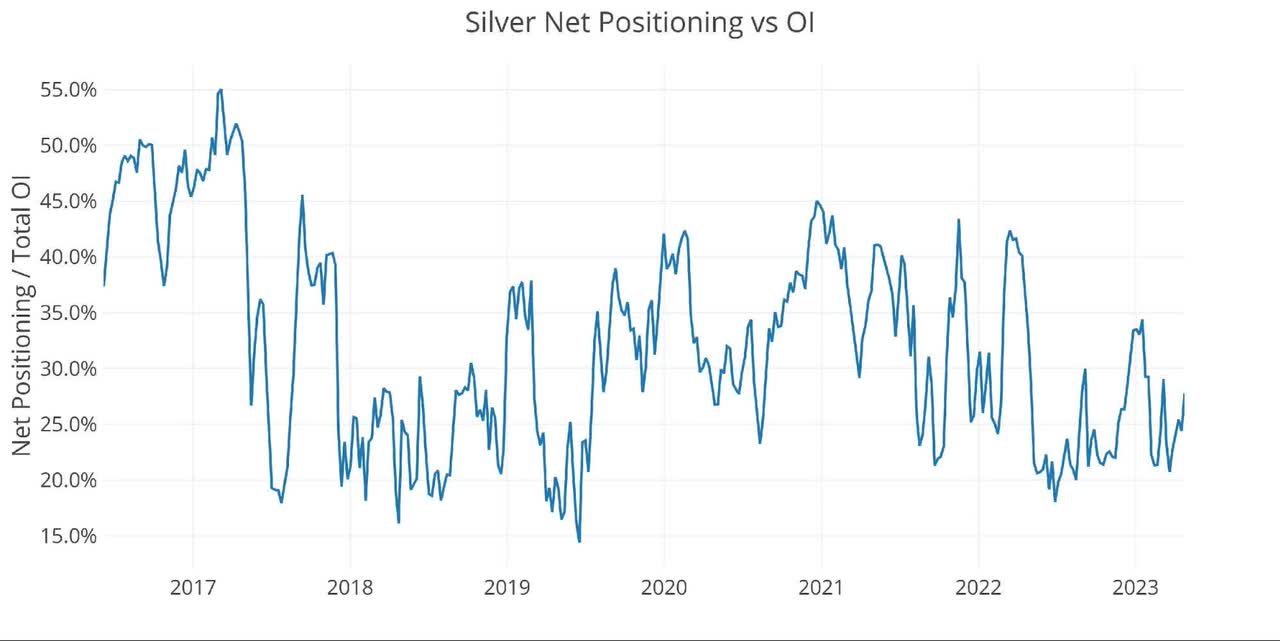

Net positioning in silver has rebounded but not as much as in gold. This gives the metal more room to run if traders got behind a move.

Figure: 13 Net Positioning (Author)

Historical Perspective

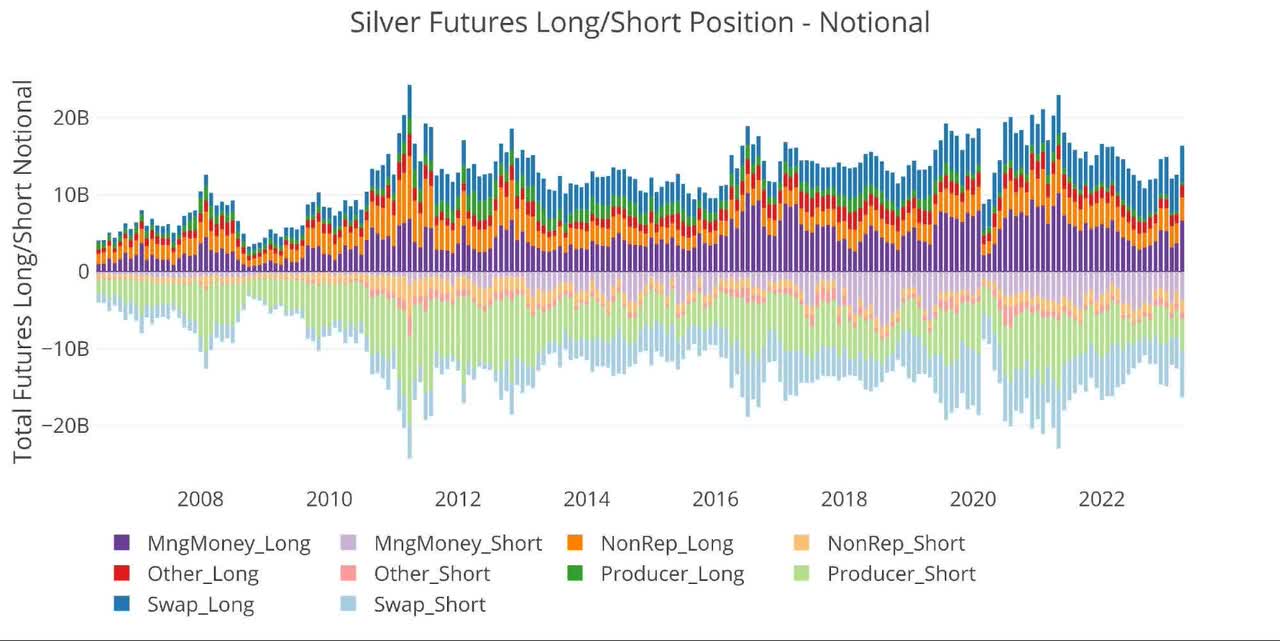

Looking over the full history of the CoTs data by month produces the chart below. During the run-ups in 2011 and 2020, the gross notional value exceeded $20B. While April did drive the market above $15B, it is still short of the $20B barrier.

Figure: 14 Gross Open Interest (Author)

Managed Money is very volatile in its swings, but right now their net view is to be long by the tune of $3.1B. This is a stark reversal from February when they were net short $743M.

Figure: 15 Net Notional Position (Author)

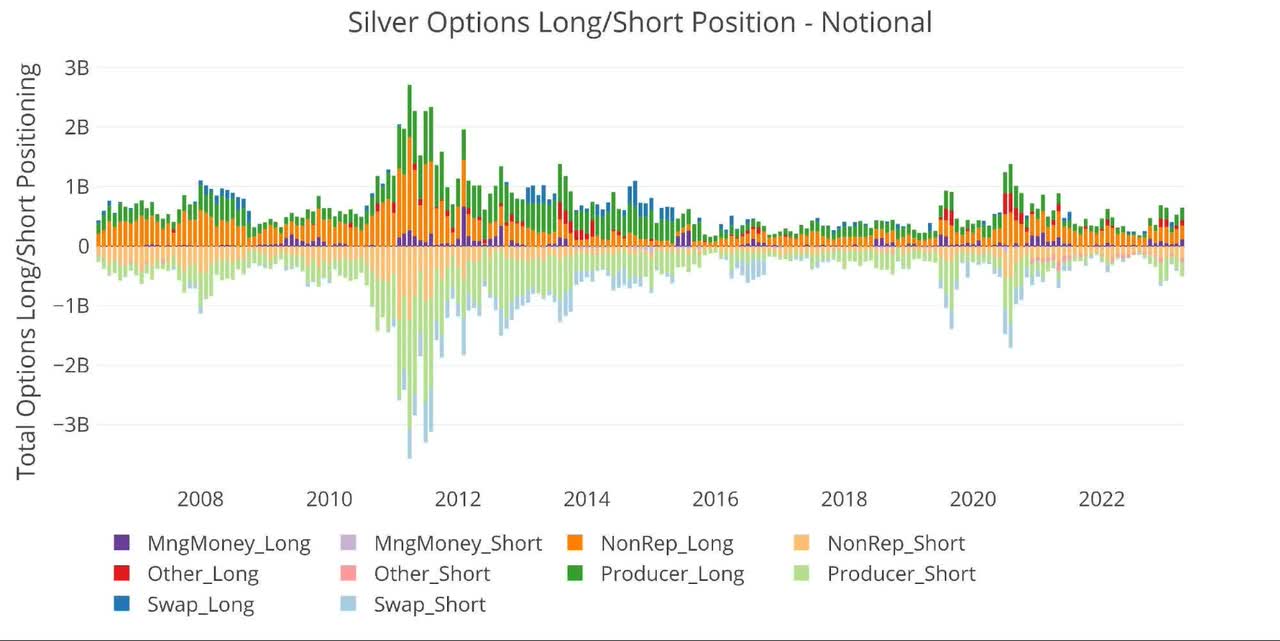

The options market is catching a bid but remains below the 2020 highs and well below the speculative move seen in 2011.

Figure: 16 Options Positions (Author)

Conclusion

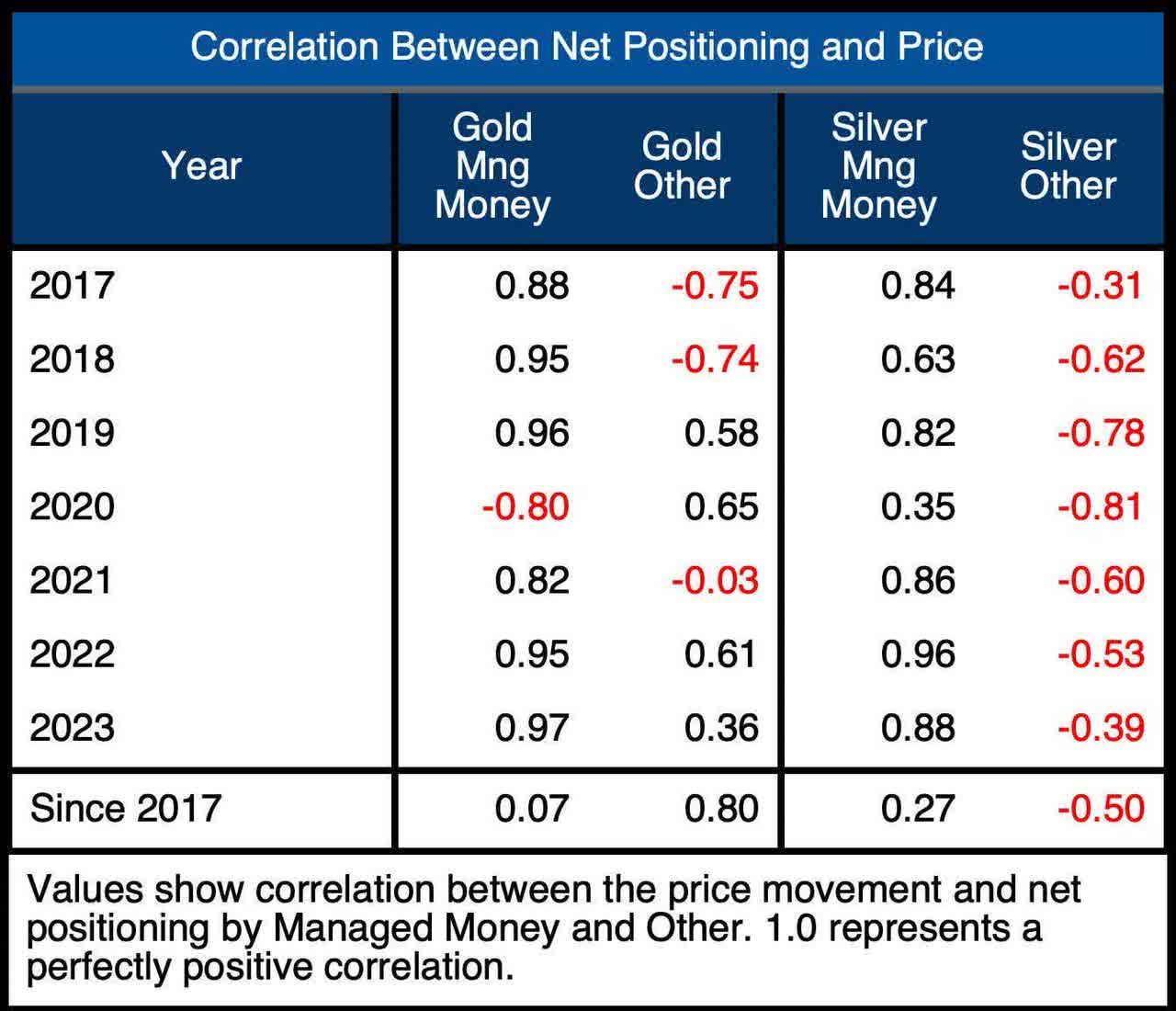

Over the short term, Managed Money dominates the price action. This correlation breaks down over the long term because the overall trend in both gold and silver is up while Managed Money trades around the short term.

Interestingly, the control of Managed Money in the gold market has increased while the silver market has seen it shrink. The gold market is trading at a correlation of .97 to Managed Money. In silver, 2022 saw a record correlation of .96. It has now dropped to .88. This is still high and higher than any other year… but definitely down since last year.

Figure: 17 Correlation Table (Author)

With the price of gold near all-time highs, the futures market does not appear to be getting ahead of itself. The same is true in silver.

The market has gone abnormally quiet over the last few weeks. This is most likely due to traders feeling comfortable with their positions heading into the Fed meeting this week. The Fed has a very narrow path to walk. First Republic (FRC) is now another bank that has collapsed, albeit less shocking to the market than SVB (OTC:SIVBQ) or Silvergate (SI). Still, there is no doubt the Fed’s actions are applying lots of stress to the market.

Both gold and silver are near the middle of their speculative positioning, not overly short or long. This gives room on both sides for the price to move in a big way. When the market is overly short or long, it limits the chance for a bigger move in one direction. Considering that the Fed could do little to surprise on the hawkish side, it’s more likely a slightly dovish Fed this week could lead to a new attempt at all-time highs in gold.

Data Source: Commitments of Traders

Data Updated: Every Friday at 3:30 PM as of Tuesday

Last Updated: Apr 25, 2023

Gold and Silver interactive charts and graphs can be found on the Exploring Finance dashboard: https://exploringfinance.shinyapps.io/goldsilver/

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.