Darren415

This article was first released to Systematic Income subscribers and free trials on Mar. 19.

Welcome to another installment of our CEF Market Weekly Review where we discuss closed-end fund (“CEF”) market activity from both the bottom-up – highlighting individual fund news and events – as well as the top-down – providing an overview of the broader market. We also try to provide some historical context as well as the relevant themes that look to be driving markets or that investors ought to be mindful of.

This update covers the period through the third week of March. Be sure to check out our other weekly updates covering the business development company (“BDC”) as well as the preferreds/baby bond markets for perspectives across the broader income space.

Market Action

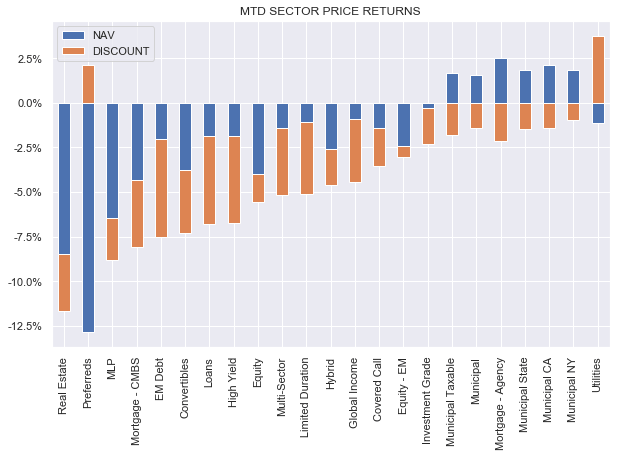

The CEF market was fairly flat this week outside of MLPs and Preferreds as lower Treasury yields and higher stocks provided a much-needed tailwind. Individual preferreds remain under pressure from continued uncertainty in the broader banking sector. Since the start of the month, preferred CEFs are about 10% lower, with a 2.5% discount tightening partly offsetting a 12.5% NAV drop. Although a tighter discount might seem puzzling in a period of poor sentiment for preferreds it’s a fairly common pattern in periods of sharp losses.

Municipal sectors continued to outperform, supported by the drop in rates. The 10Y Treasury yield has fallen 0.7% since the start of the month. HY corporate bond credit spreads have offset the drop in rates somewhat and have moved north of 5%.

Systematic Income

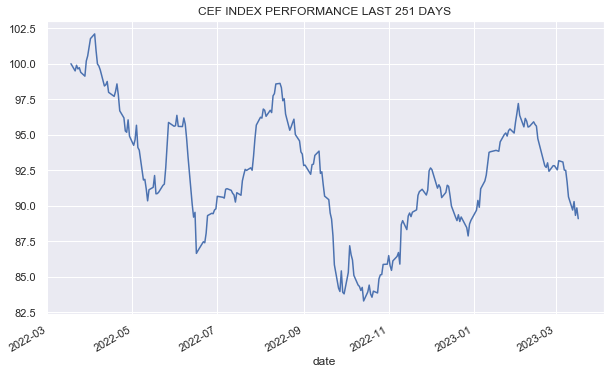

The CEF market has given back all of the year-to-date rally.

Systematic Income

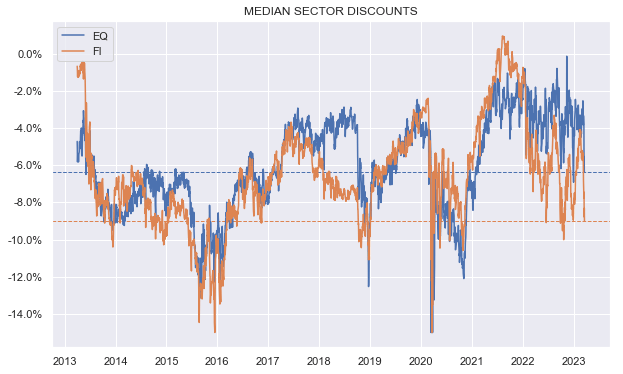

Fixed-income CEF sector discounts have moved to attractive levels.

Systematic Income

Market Themes

There was a comment on the service about the fees charged by various funds and whether it makes sense to tilt to ETFs that have significantly lower fees than CEFs. One difficulty in comparing fees is that they’re usually not presented apples to apples between CEFs and ETFs.

For example a typical Muni CEF has a total expense of around 2.5% on net assets versus something like 0.05% for a Vanguard fund – a big difference. However, we need to split CEF fund expenses into management fees and leverage costs and also take the additional CEF leverage into account.

For instance a typical Muni CEF management fee is around 0.6% which is the right number to compare against the ETF’s 0.05%. Once we apply it to all of the fund’s assets (typically 50% higher than the fund’s equity) that becomes around 0.9% on net assets. The rest of the differential between ETF and CEF fees is due to leverage costs which obviously don’t go to management though they are paid for by shareholders.

However you slice it, CEF costs are going to be higher than those of passive ETFs so why hold CEFs over ETFs right now? Subscribers that have been around for a while know that one of our favorite allocation strategies is to switch between CEFs and open-end funds. 2021 was a good time to rotate away from CEFs as discussed at the time as CEFs were particularly unappealing due to expensive discounts and low underlying yields. Right now, the situation is quite a bit different and there are four reasons why CEFs are more compelling now in aggregate despite their higher fees.

First, CEF discounts are quite wide. What this means is that some CEFs are in effect cheaper than ETFs once you take their discounts into account. If a fund charges 0.7% but then adds 0.8% in yield terms due to its discount, its management fee is basically negative.

The second reason why CEFs can be more compelling is because of active management. The hope is that active management creates a positive return – it’s not guaranteed to do this but it’s easier in fixed-income than in stocks and, in theory at least, it’s easier when volatility is high such as now.

Three, once yields move up, the risk to yields is more symmetric i.e. there is a decent chance that yields fall which would allow leveraged vehicles like CEFs to generate a higher total return over unleveraged counterparts like ETFs.

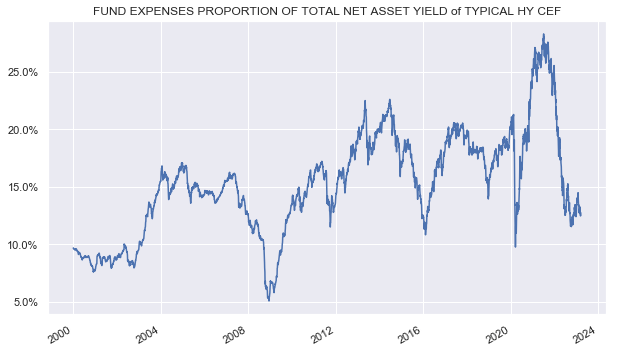

Four, when yields are high, the higher CEF fee matters much less. For example, the chart we revisit occasionally is fund expenses of a typical HY CEF relative to portfolio yield. In 2021 that reached nearly 30% which made CEFs less appealing and today that number is around 13%. In short, the higher the underlying yields, the less of the fund’s total yield goes to pay for its fees. This makes CEFs “cheaper” right now than when asset yields were lower.

Systematic Income

Market Commentary

Blackstone loan CEFs BGX, BGB and BSL raised their distribution once again by 3-5%. This is the fourth time in a year as the funds continued to raise distributions every quarter. Consensus has shifted rapidly towards expecting lower rates. This doesn’t mean it will happen very soon but what’s clear is that the recent slowdown in the Fed policy rate means the uptrend in loan CEF distribution hikes is unlikely to last past the middle of the year. Loan CEF discounts have widened recently, perhaps, in expectation of lower short-term rates. This is too early in our view as the next Fed move is much more likely to be higher than lower. Even if the Fed stops hiking, it’s likely to keep rates stable for some time as inflation remains much too high for its liking. This should allow loan CEFs to continue to drive a high level of income.

Stance And Takeaways

Prior to the recent sell-off across income markets we highlighted that high-yield corporate bond credit spreads were overly tight, trading not far from 4%, particularly in light of worsening leading indicators. Now that spreads have jumped 1% to north of 5%, they are no longer obviously expensive. That said, we would wait for spreads to revisit their 2022 peak of 6% before increasing our public corporate credit allocation.

Among funds on our radar – on the higher risk spectrum is the XAI Octagon Floating Rate & Alternative Income Term Trust Fund (XFLT), trading at a 14.2% yield and a 2% discount. The fund holds primarily CLO Equity and bank loans and is trading not far from its 2022 low. The fund has strong historic total NAV returns and has held up well over the past year.

On the lower risk spectrum we like the Nuveen Corporate Income 2023 Target Term Fund (JHAA) which is a lightly leveraged / higher-quality high-yield corporate bond fund that is due to either terminate or have a tender offer at the end of this year – the pattern of Nuveen term CEFs. The fund trades at a 3.9% discount which offers an attractive return for little risk.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

/cdn.vox-cdn.com/uploads/chorus_asset/file/8532907/adinline.jpg)