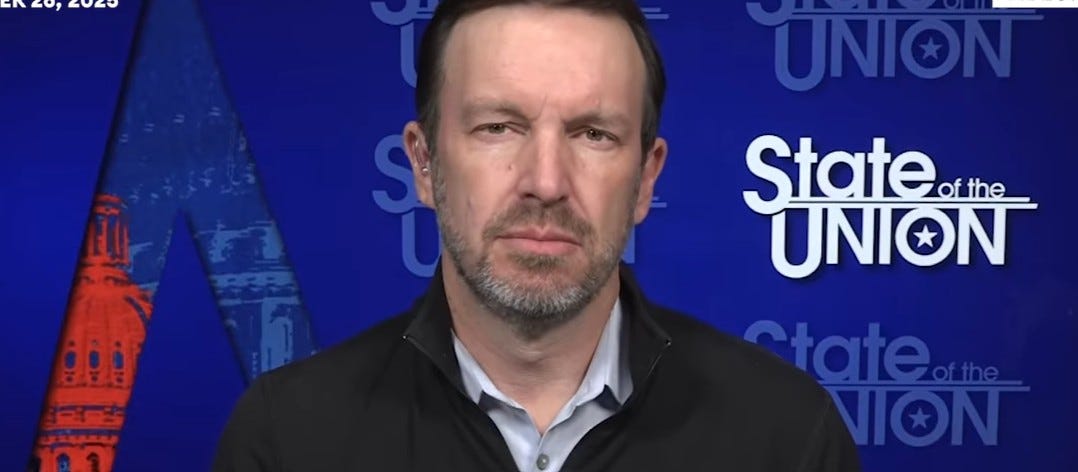

The embodiment of the type of acceptable liberal journalist to at this time’s left, CBS Night Information Plus has all the time ended with anchor John Dickerson let it rip on no matter challenge he needs weighing in on. More and more, it’s been political and snide, giving his opinion on how a lot he loathes Trump and the MAGA agenda. Thursday was no exception as he denounced the Massive, Stunning Invoice as concocted to hurt the poor to profit the wealthy.

Dickerson’s tease stated all of it that he could be political with a jab on the time period made well-known in fashionable occasions by the good Artwork Laffer: “Trickle-down economics will get a reboot.”

Perpetually smug like his CBS colleague Scott Pelley, Dickerson had a sarcastic begin:

Right here’s one thing each ideological sides are likely to agree on. Authorities ought to spend correctly, shield the susceptible, reward effort, and keep away from waste. Proper or left, you most likely imagine federal coverage ought to assist strengthen the muse below working households whereas preserving alternative for the profitable. These are the broad requirements for these large finances payments you hear about.

He dropped that act with the smug dismissal of the invoice that extends the tax cuts for all Individuals and imposes work (and training or volunteer) necessities for Medicaid: “The newest? President Trump’s home coverage proposal that simply handed the Home, prioritizes tax aid for the rich whereas decreasing assist for the poor.”

Dickerson then proclaimed the Congressional Funds Workplace’s (CBO) discovering that, in his summation, “[i]f you’re within the backside 10% of earners, this invoice would cut back authorities assist by about $1,600 per 12 months, roughly 4% of your revenue” whereas these on the high ten “would achieve $12,000 yearly, a 2.3% improve” and the center class simply “a achieve of $500 to 1,000 a 12 months.”

“Greater earners see bigger positive factors. Decrease earners face cuts. This consequence is a direct results of how tax cuts are structured. Bigger advantages accrue to those that pay essentially the most federal revenue tax. Decrease-income Individuals, a lot of whom pay little or no federal revenue tax, see minimal monetary positive factors from tax aid. On the similar time, cuts to very important packages like Medicaid and meals help straight have an effect on those that depend on them essentially the most,” he huffed.

This went into his conclusion that appeared like a screed concerning the Reagan administration as a lot because it was about Trump:

Supporters of the invoice argue these selections will create jobs and improve wages. Nonetheless, comparable plans in 1981 and 2017 didn’t obtain the promised outcomes. Development was modest and prosperity proved to be inconsistently distributed. So, this invoice stays a bet. That development will happen on a big sufficient scale and, even when it does, that prosperity will trickle right down to those that are shedding assist from the invoice at this time. And if that gamble doesn’t repay, the CBO suggests these already most in danger are essentially the most in danger.

Conservatives have roundly rejected the CBO report, together with on the Hill. However we’ll let our good friend Bonchie at RedState do the speaking, flashing again to 2017: “[T]he CBO projected in 2017 that American unemployment would stay round 4.7 % for years on finish. That very same 12 months, it dipped to three.7 %. Over 1,000,000 extra individuals joined the labor market than the CBO stated would. Why? As a result of they used Obama-era baselines on financial development.”

“It additionally must be famous that the adjustments being proposed to Medicare and Medicaid within the reconciliation invoice revolve round eliminating fraud, not chopping advantages for legit recipients…Are Democrats arguing it is dangerous to cease individuals from defrauding the U.S. authorities? As a result of it positive looks as if what they’re arguing,” he astutely noticed.

A former Trump administration official, Fox Enterprise Community host Larry Kudlow additionally took the CBO report back to job, pointing to, amongst different issues, record-high income from the 2017 tax cuts, the CBO lacking the mark on ObamaCare sign-ups, and astronomically small gross home product (GDP) projections of lower than two % for the Massive, Stunning Invoice.

To see the related CBS transcript from June 12, click on “broaden.”

CBS Night Information Plus

June 12, 2025

7:23 p.m. Jap [TEASE][ON-SCREEN HEADLINE: Reporter’s Notebook]

JOHN DICKERSON: Trickle-down economics will get a reboot. My Reporter’s Pocket book is subsequent.

(….)

7:27 p.m. Jap

DICKERSON: Right here’s one thing each ideological sides are likely to agree on. Authorities ought to spend correctly, shield the susceptible, reward effort, and keep away from waste. Proper or left, you most likely imagine federal coverage ought to assist strengthen the muse below working households whereas preserving alternative for the profitable. These are the broad requirements for these large finances payments you hear about. The newest? President Trump’s home coverage proposal that simply handed the Home, prioritizes tax aid for the rich whereas decreasing assist for the poor. This, based on the Congressional Funds Workplace, report launched at this time. Right here’s what the CBO discovered. When you’re within the backside 10% of earners, this invoice would cut back authorities assist by about $1,600 per 12 months, roughly 4% of your revenue. When you’re within the high 10%, you’ll achieve $12,000 yearly, a 2.3% improve. Center-income households would see a achieve of $500 to $1,000 a 12 months, or lower than 1% of revenue. Greater earners see bigger positive factors. Decrease earners face cuts. This consequence is a direct results of how tax cuts are structured. Bigger advantages accrue to those that pay essentially the most federal revenue tax. Decrease-income Individuals, a lot of whom pay little or no federal revenue tax, see minimal monetary positive factors from tax aid. On the similar time, cuts to very important packages like Medicaid and meals help straight have an effect on those that depend on them essentially the most. Supporters of the invoice argue these selections will create jobs and improve wages. Nonetheless, comparable plans in 1981 and 2017 didn’t obtain the promised outcomes. Development was modest and prosperity proved to be inconsistently distributed. So, this invoice stays a bet. That development will happen on a big sufficient scale and, even when it does, that prosperity will trickle right down to those that are shedding assist from the invoice at this time. And if that gamble doesn’t repay, the CBO suggests these already most in danger are essentially the most in danger.

:max_bytes(150000):strip_icc()/Health-GettyImages-1433622411-85282e3253214e4890bf7e16532aa395.jpg)