HeliRy

Note:

I have covered Castor Maritime (NASDAQ:CTRM) previously, so investors should view this as an update to my earlier articles on the company.

Two months ago, I discussed junior Cyprus-based shipping company Castor Maritime’s proposal to spin off its tanker fleet into a new Nasdaq-listed entity named “Toro Corp.” or “Toro”.

While shares went ex-dividend on December 6 and distribution of Toro shares was expected by December 15, closure has been delayed as the SEC has not yet declared effectiveness of Toro’s registration statement on form 20-F.

Last week, the company announced the filing of a revised registration statement with the SEC which included very substantial changes to the proposed transaction terms based “on the recommendation of a special committee of the Board” (emphasis added by author):

1. Compensation

Under the original proposal, Toro would have issued $60 million in 1% Series A Fixed Rate Cumulative Perpetual Preferred Stock in exchange for Castor Maritime contributing its fleet of eight tanker vessels.

According to the revised terms, Castor Maritime’s compensation has more than doubled to $140 million in 1% Series A Fixed Rate Cumulative Perpetual Convertible Preferred Shares.

The Series A Preferred Shares are convertible, in whole or in part, at their holder’s option, to common shares at any time and from time to time from and after the third anniversary of their issue date and prior to the seventh anniversary of such date. Subject to certain adjustments, the “Conversion Price” for any conversion of the Series A Preferred Shares shall be the lower of (i) 150% of the VWAP of our common shares over the five consecutive trading day period commencing on and including the Distribution Date, and (ii) the VWAP of our common shares over the 10 consecutive trading day period expiring on the trading day immediately prior to the date of delivery of written notice of the conversion; provided, that, in no event shall the Conversion Price be less than $2.50.

2. Distribution Ratio

The original plan called for Castor Maritime shareholders to receive two Toro shares for every five shares of Castor Maritime owned at the record date but this has been changed to only one Toro share for every ten shares of Castor Maritime now.

Accordingly, the total number of outstanding Toro shares post spin-off calculates to approximately 9.5 million as compared to 37.8 million under the original proposal.

3. Updated Financial Results

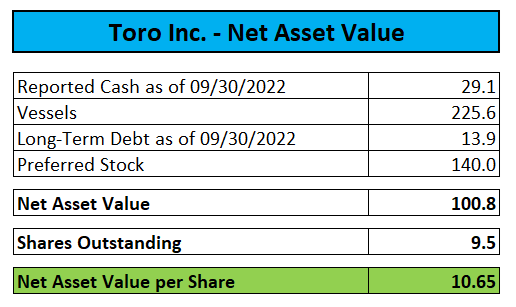

The revised registration statement now includes Toro’s pro forma Q3 results which show decent cash generation thus resulting in cash and cash equivalents increasing from just $5.5 million at the end of Q2 to $29.1 million as of September 30, 2022.

Impact To Net Asset Value

Not surprisingly, the above-discussed changes will impact Toro’s net asset value (“NAV”) which will be reduced by $80 million simply due to the vastly increased preferred stock issuance to Castor Maritime.

But due to lower debt levels, increased second hand vessel values, higher cash balances and particularly the much lower number of outstanding shares, NAV per share almost triples from my previous $3.70 estimate:

Revised Registration Statement, MarineTraffic.com

Under the original proposal and using the December 6 closing price, an investment in Castor Maritime of $7.80 (5x $1.56) would have been eligible for receiving Toro shares with an aggregate net asset value of $7.40 (2x $3.70).

Under the new terms, an investment in Castor Maritime of $15.60 (10x $1.56) will now result in the receipt of one Toro share with an estimated NAV of $10.65.

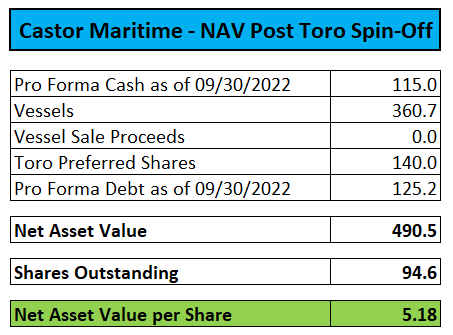

As a result, Castor Maritime will retain substantially higher value than previously anticipated even when adjusting for an aggregate $40 million in higher Toro cash balances, increased secondhand tanker values and lower Toro debt levels.

Estimated post spin-off NAV increases by approximately 15% from $4.50 to $5.18:

Revised Registration Statement, Company Press Releases, MarineTraffic.com

Assessing Toro

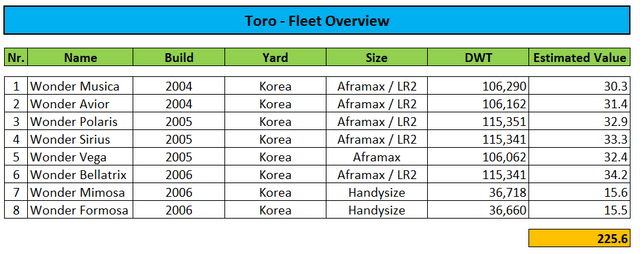

At first glance, Toro appears an interesting and highly profitable bet on the red hot tanker markets with decent dividend potential. Moreover, due to recent geopolitical events, the company’s fairly old fleet is currently in the sweet spot of buying interest with second hand vessel valuations at all-time highs.

According to MarineTraffic, the company’s small tanker fleet with an average age of 17.5 years is currently valued at well above $200 million, more than double its aggregate purchase price of approximately $100 million last year.

Company Press Releases, MarineTraffic.com

Unfortunately, disclosures made in Toro’s registration statement clearly show the company’s intent to dilute common shareholders shortly following the proposed spin-off, very similar to peers Imperial Petroleum (IMPP, IMPPP), OceanPal (OP) and United Maritime (USEA):

Toro has an authorized share capital of 3,900,000,000 common shares that it may issue without further shareholder approval. Our growth strategy may require the issuance of a substantial amount of additional shares. Based on market conditions, we may also opportunistically seek to issue equity securities, including additional common shares, shortly following the Spin Off.

(…)

On November 14, 2022, Castor, in its capacity as our sole shareholder, authorized our Board to effect one or more reverse stock splits of our common shares issued and outstanding at the time of the reverse stock split at a cumulative exchange ratio of between one-for-two and one-for-five hundred shares. Our Board may determine, in its sole discretion, whether to implement any reverse stock split by filing an amendment to our Articles of Incorporation, as well as the specific timing and ratio, within such approved range of ratios; provided that any such reverse stock split or splits are implemented prior to the Company’s annual meeting of shareholders in 2026.

Given the apparent risk of substantial, near-term dilution, I would strongly advise Castor Maritime equity holders to sell their Toro shares immediately following the spin-off.

Also keep in mind that shipping companies employing dilutive capital raising schemes are usually valued at steep discounts to NAV which is very much visible in the shares of parent Castor Maritime which currently trade at an approximately 85% discount to estimated net asset value.

Quite frankly, investors would be much better off if Castor Maritime would sell the entire tanker fleet into the exceptionally strong second hand market and distribute the net cash proceeds to common shareholders.

But I think the company continues to be managed primarily to the benefit of its Chairman, CEO and CFO, Petros Panagiotidis and his family, and investors shouldn’t expect the massive inherent value to apply to common equity holders anytime soon, if ever.

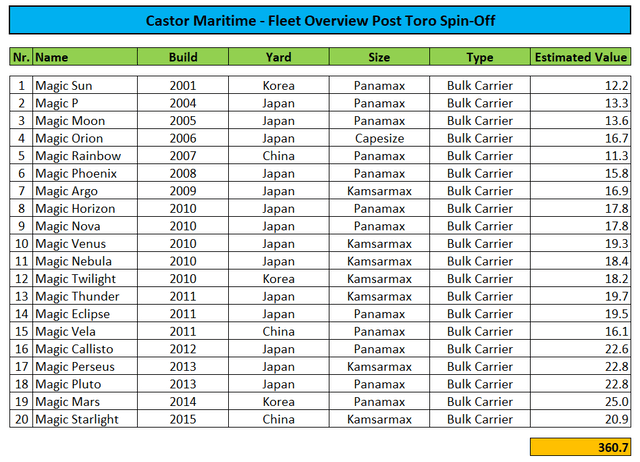

Going forward, Castor Maritime will be a dry bulk pure play again commanding a fleet of 20 vessels:

Company Press Releases, MarineTraffic.com

For equity holders eligible for the receipt of Toro spin-off shares to make money out of this special situation, it will be crucial that Toro trades at a reduced discount to NAV following the spin-off which I consider as likely given the small number of outstanding shares and the company’s focus on the red hot tanker market.

That said, as discussed above, it will be imperative for investors to dispose of their Toro shares shortly after the spin-off to avoid potential near-term dilution.

The company currently expects the distribution to occur in mid-January but closing of the transaction still requires the SEC to declare the revised registration statement effective which might result in further delays.

Bottom Line

Based on the revised registration statement, Castor Maritime will retain more value following the upcoming Toro spin-off. Unfortunately, the company continues to be managed to the sole benefit of its founder and his family, a common theme among many smaller Greece- and Cyprus-based shipping companies.

With the record date for the Toro spin-off having passed already and dry bulk markets expected to remain weak in the near future, I am downgrading shares from “Speculative Buy” to “Hold“.