[ad_1]

Joe Raedle/Getty Pictures Information

The next phase was excerpted from this fund letter.

Carvana (NYSE:CVNA)

The Portfolio first purchased Carvana in Q3’19. I wrote concerning the Carvana funding thesis final quarter so I’ll attempt to maintain my feedback transient, though it has been the biggest inventory value decline and largest affect on our outcomes year-to-date so it deserves some additional dialogue.

Searching into the long run it appears inevitable that extra used automobiles will probably be purchased and bought on-line. If we break down the ~40 million used automobiles which can be bought annually, it appears possible that ~5-10 million of that complete will probably be purchased/bought on-line. Actually, one might argue a better share given how a lot better the whole buyer worth proposition is by way of choice, decrease on-line retail price construction at scale, and general shopping for/promoting comfort and expertise. Nevertheless, that may require addressing older and better mileage automobiles and extra off-lease autos.

E-commerce and far of the internet-related companies have a winner-take-most kind dynamic. Having the best choice and infrastructure offers a greater buyer worth proposition, which drives extra demand, enabling better choice and infrastructure funding. There’s sometimes little room for a quantity two participant throughout the identical vertical providing the same service, particularly if the chief has a robust head begin.

Within the used automotive market, choice isn’t the one main drawback to be solved for patrons. If it had been, CarGurus (CARG) would take the cake. Shopping for and promoting used automobiles is stuffed with buyer ache factors. Fixing them takes the power to seamlessly combine a big selection of autos that prospects can belief are the precise high quality that they anticipated at buy, handy and constant supply, streamlining financing of a high-priced merchandise, all in a self-service intuitive shopper interface.

Carvana is constructing what is really a formidable and difficult-to-provide built-in buyer worth proposition. Nevertheless, this implies little if Carvana isn’t capable of attain scale due to the huge capital necessities wanted to construct this infrastructure in addition to endure working losses till reaching scale.

Its service requires constructing inspection & reconditioning facilities (IRCs), stock ranges, its transportation community, know-how in automotive shopping for/pricing, the consumer interface, and promoting which all require a ton of upfront capital. The problem with an organization like Carvana is that it primarily must be a nationwide enterprise from day one. To achieve success, its service must be out there in every single place and due to this fact has to scale quick.

Within the final letter, I mentioned how retailing has developed over time into ever larger working leverage enterprise mannequin which requires better preliminary capital funding. At scale it will probably present better stock turns at decrease gross revenue margins due to this fact enticing returns on invested capital. Walmart (WMT) required extra upfront capital than a mother & pop retailer however was nonetheless capable of notice enticing retailer economics comparatively shortly. Amazon required a lot better upfront funding to supply its service throughout the nation.

Even CarMax (KMX), which is extensively thought of to have enticing economics for its {industry}, had a considerably disruptive and extra capital-intensive mannequin in comparison with conventional used automotive sellers. When it was attempting to scale its service and programs within the 1990’s, it incurred seven years of preliminary losses earlier than reaching profitability, financed by its father or mother firm Circuit Metropolis.

Up via 2021, Carvana was blitzscaling because it grew unit volumes and the wanted infrastructure as quick as attainable. Buyer demand for Carvana’s service was not the difficulty, it was having sufficient provide to have the ability to serve rising demand. Administration ready and employed for anticipated demand about six months upfront which labored effectively till Q1’22 when industry-wide used automotive volumes started to say no.

When mixed with winter storms, a resurge of COVID resulting in excessive workforce call-off charges, and a rising price setting squeezing the unfold on their financing gross margins, Carvana skilled sudden losses.

On prime of the Q1’22 losses Carvana acquired ADESA in Could, additional leveraging its stability sheet by elevating $3.3 billion of debt. The acquisition value seems excessive if in comparison with the $100 million it brings in anticipated EBITDA. Nevertheless, the price financial savings to Carvana by having the ADESA places, significantly all through the West Coast and Midwest, is materials. For instance, California at the moment makes up round 10% of the used automotive gross sales inside Carvana’s current markets however the closest inspection and recondition heart (IRC) is in Phoenix.

The closest IRC to Washington or Oregon is Salt Lake Metropolis. Delivering a automotive from Phoenix to a market in California could possibly be as much as a 1,500-mile spherical journey relying in the marketplace. Supply prices and transport instances may be substantial. IRCs which can be inside 200 miles of consumers save ~$750 per unit vs. the typical transaction.

For markets like California or Washington the place prospects may be a lot farther from an IRC, financial savings are even better. ADESA offers quite a few places all through the western U.S. that present Carvana the community density to instantly simplify last-mile supply and ultimately fill out its IRC community a lot sooner than beforehand attainable.

If there actually is a winner take most dynamic to on-line used automotive retail and this can be a very massive market to handle, then buying ADESA’s attractively situated properties at the moment makes a whole lot of strategic sense for long-term success. Carvana’s complete working losses don’t present a transparent image of the rising worth of the corporate and its true earnings energy. What is way extra insightful are the unit economics and whether or not there’s a sturdy buyer worth proposition with earlier cohorts offering early indications of reaching optimistic EBITDA margins.

In fact, Carvana should get to scale to succeed and due to this fact requires capital to bridge the time till money move from operations is greater than enough to assist the corporate. After elevating $3.3 billion in debt and $1.25 billion in fairness in Q2’22, Carvana has $1 billion in money and $4.7 billion in liquidity. Even throughout a chronic macro weak point in used automotive gross sales, Carvana faces little solvency threat with sufficient liquidity to take care of operations for not less than 2-3 years with no need to boost additional capital.

We aren’t investing in Carvana at the moment and anticipating it to pay us dividends throughout the subsequent yr. We’re investing in Carvana at the moment as a result of we need to personal a bit of an organization that’s extremely more likely to be the dominant on-line used automotive retailer far into the long run. If that state of affairs unfolds over the following decade or two, the dividends that Carvana will be capable of pay out to shareholders will probably be multiples of its present market cap.

|

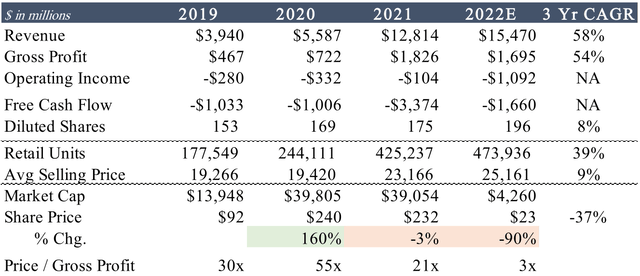

Supply: Firm filings, Factset, Saga Companions Word: 2022E values are Factset consensus expectations, market cap and share value are as of 6/30/22. |

Editor’s Word: The abstract bullets for this text had been chosen by Looking for Alpha editors.

[ad_2]

Source link