alfexe/iStock via Getty Images

Introduction

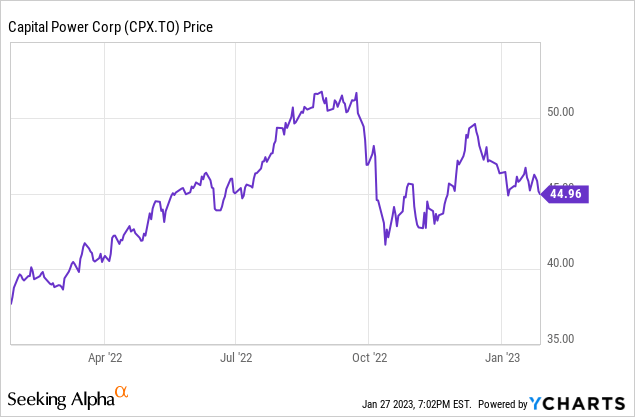

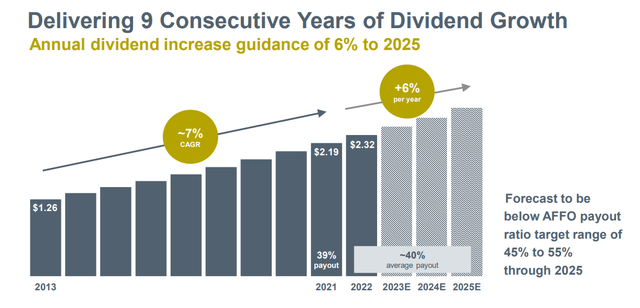

Capital Power (TSX:CPX:CA) (OTCPK:CPXWF) is an Alberta, Canada based independent power producer undergoing a major change as one of its main facilities is being converted to burn natural gas rather than coal. The company has low sustaining capex requirements and is able to spend the majority of its AFFO on dividends (with a targeted payout ratio of 45-55%) and growth projects (mainly in the solar and wind space). The stock is trading at a sustaining FCF yield of in excess of 15% based on the 2023 guidance. The company has also promised to increase its dividends by 6% per year between now and 2025, resulting in a forward dividend yield of in excess of 6%, while maintaining a payout ratio of 45-55%.

2022 will be a strong year for Capital Power

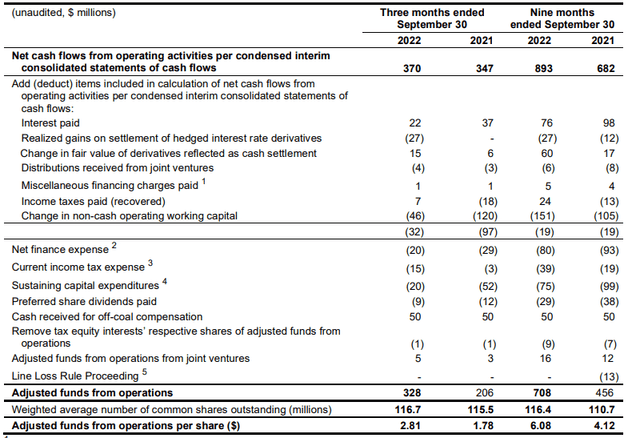

We shouldn’t look at Capital Power’s reported net income as the company should be valued based on its free cash flow profile. Fortunately Capital Power does provide an AFFO calculation which basically is the sustaining free cash flow result.

As you can see below, the starting point of the AFFO calculation is the C$893M in operating cash flow generated in the first nine months of the year. A total of C$19M is being deducting a myriad of adjustments (including the working capital changes) before then deducting the interest expenses, tax payments, the preferred dividend payments and more importantly, the sustaining capex.

Capital Power Investor Relations

That’s important as the AFFO calculation only includes the capex required to keep the plants up and running, and does not take any growth investments into consideration. While the growth investments clearly will have to be funded from the total incoming cash flow, I think the AFFO is the superior metric to use here.

The total AFFO in the first nine months of the year was C$708M which translates into an AFFO per share of C$6.08. You’ll see the third quarter was pretty strong thanks to the higher power prices in Alberta during the summer months, which helped to boost the adjusted EBITDA to C$383M in Q3, a new record.

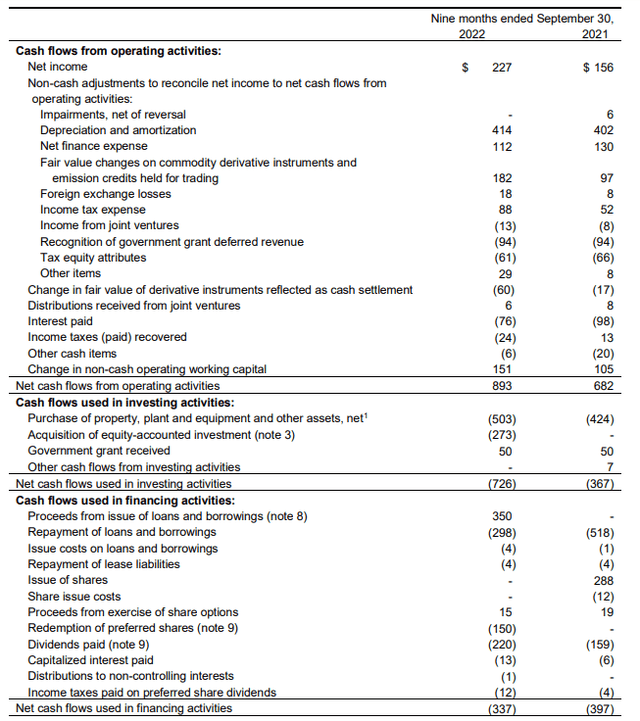

The strong operating cash flow generated in Q3 and the first nine months of the year helped Capital Power to fund the growth investments as well. The cash flow statement below shows the total capex was about C$503M and considering we know the sustaining capex was just C$75M, this means Capital Power spent in excess of C$425M on growth.

Capital Power Investor Relations

Seeing how the company paid about C$220M in total dividends (including the preferred dividends) which means that the C$708M in AFFO was sufficient to cover all dividends and all growth investments, and that is quite an achievement. The 2022 budget should be in equilibrium, including the dividend payment as Capital Power is expecting an AFFO of C$770-810M.

Capital Power Investor Relations

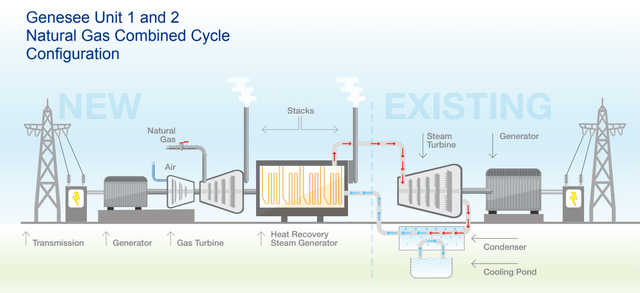

A substantial portion of the capex will be spent on the Genesee facility where the coal-to-gas conversion should be completed this year.

Capital Power Investor Relations

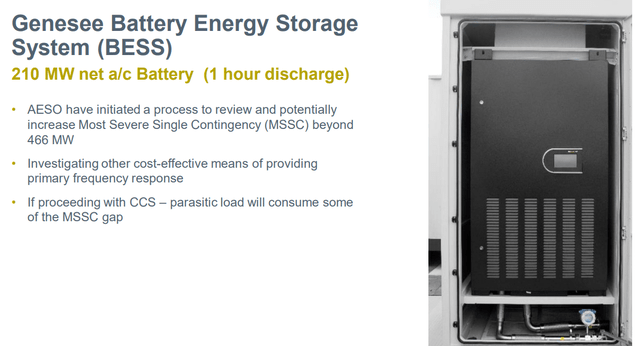

Commissioning of Genesee 1 & 2 should start later this year which will result in Capital Power becoming a coal-free electricity producer. Capital Power will also take advantage of the Genesee conversion to install a battery to help fill the demand during peak times.

Capital Power Investor Relations

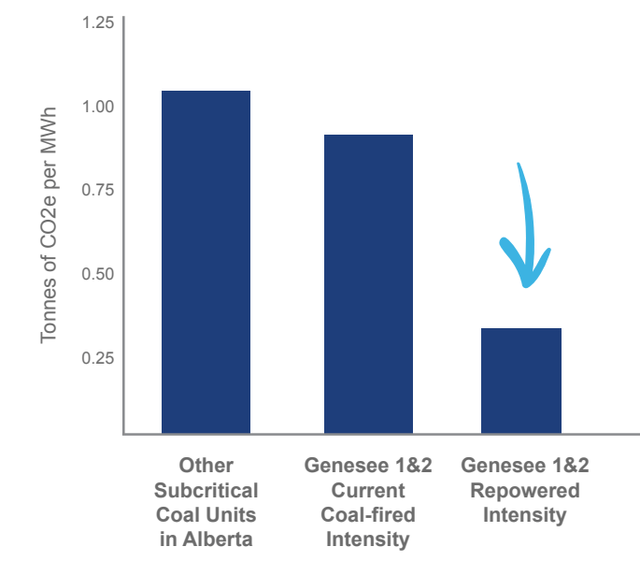

And simply by converting Genesee from a coal-fired plant to a natural gas powered plant will reduce the emission of CO2 per MWh of produced electricity by about 60-70%.

Capital Power Investor Relations

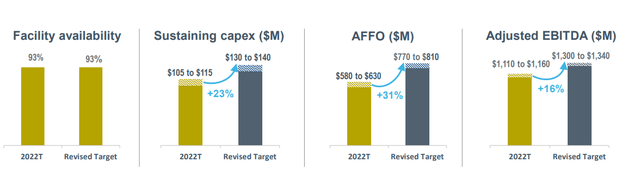

2023 will be even stronger

We shouldn’t expect the fourth quarter to be as strong as the third quarter. Capital Power provided a full-year guidance with an AFFO of C$790M and seeing how the company generated C$708M in the first nine months of the year, it basically implies a Q4 AFFO of C$82M. I think the potential exist for Capital Power to exceed its C$790M AFFO guidance (the Q4 2021 AFFO was C$149M), but for argument sake, let’s just use the official numbers and use the C$790M midpoint of the guidance.

C$790M in AFFO divided over just under 117M shares outstanding results in an AFFO result of C$6.75 per share. That already makes Capital Power’s current share price of just around C$45 pretty cheap.

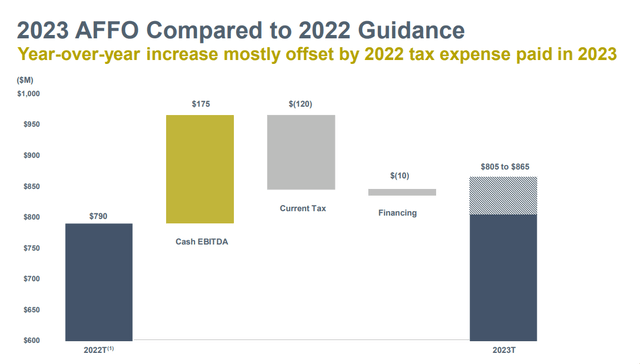

But it doesn’t end here. Some of the growth investments are actually starting to contribute right now. In December, the company hosted a capital markets day and provided a more detailed outlook for 2023. The AFFO is anticipated to increase by C$805-865M. And that includes about C$130M in additional cash taxes and cash interest payments. If I would use the midpoint (C$835M), the AFFO/share would come in at C$7.15. The higher end of the equation of C$865M in AFFO would end up in about C$7.40 per share.

Capital Power Investor Relations

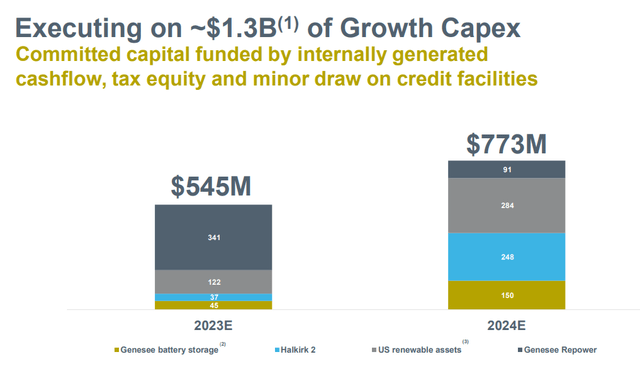

This means Capital Power is in an excellent position. The strong AFFO result will not immediately result in a rapidly improving balance sheet as a very substantial portion of the AFFO will be used for growth investments (Genesee, solar and wind). As the Genesee investment should be completed later this year and in any case require a lower capex in 2024, we should see a higher reported free cash flow result, but I am fine with Capital Power spending its excess cash on new projects as long as there is a strong return on the invested capital. Capital Power plans to spend C$284M on US renewable assets in 2024 as well as C$248M on the Halkirk 2 project which is anticipated to generate C$27M in AFFO per year. So while C$248M is a lot of money, it will start to contribute to the AFFO from 2025 on.

Capital Power Investor Relations

Investment thesis

Capital Power is cheap. The stock is currently trading at just over 6.3 times the anticipated AFFO in 2023 which means the free cash flow yield exceeds 15%. The net debt is just around C$3.2B (excluding lease liabilities) which means the enterprise value of C$8.5B is very reasonable considering Capital Power expects to generate an EBITDA of in excess of C$1.45B (excluding lease amortizations).

The majority of the FCF will be reinvested in growth projects and about C$550M will be invested in new projects in 2024 which should start to contribute to the bottom line from 2025 on. Although the power prices per MWh will vary (the 2023 outlook is based on C$136/MWh and the AFFO will decrease by C$25M for every C$10/MWh in electricity price decreases), I trust Capital Power’s management to take the right steps to protect the long-term future of the company. Hedging power prices has been a valid strategy in the past, and I expect Capital Power’s management to continue to hedge prices in order to improve earnings visibility.

Capital Power Investor Relations

Capital Power is currently paying a dividend of C$2.32 per share for a yield of approximately 5%. This will increase by about 6% per year between now and 2025 which means the 2025 dividend per share will exceed C$2.75 per share for a yield north of 6%. And as Capital Power is aiming to spend just 45-55% of its AFFO on dividends, that dividend should be safe.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.