Meeko Media/iStock by way of Getty Photographs

Co-authored by Treading Softly

When was the final time that you simply had a second considered paying your energy invoice, cellular phone invoice, or Web invoice? When was the final time you thought deeply earlier than flipping on a gentle change or beginning your automobile?

You see, there are lots of issues that we do with out even a second of extra thought. We do them as a result of they’re vital, or we do them as a result of we have to. We activate the lights after we enter a room as a result of we’d like visibility. We do not take into consideration the price of doing so. We textual content with our cellular phone with out considering of the price of that month-to-month cellular phone invoice. I am an enormous fan of proudly owning revenue from important sources, however I am not the one one.

Legendary investor Peter Lynch, who’s largely identified for the continued outperformance of his Magellan Fund at Constancy Investments between 1977 and 1990, has laid out a number of standards for his picks. One of the crucial outstanding ones is to pick out corporations from boring industries that produce merchandise (or providers) that individuals hold shopping for throughout good instances and dangerous. The telecom enterprise in North America enjoys such a standing, with well-established corporations dominating the market, providing restricted room for competitors or disruption.

Right this moment, we’ll take a look at a wonderful supply of boring revenue.

Let’s dive in!

Boring Revenue Means Massive Rewards

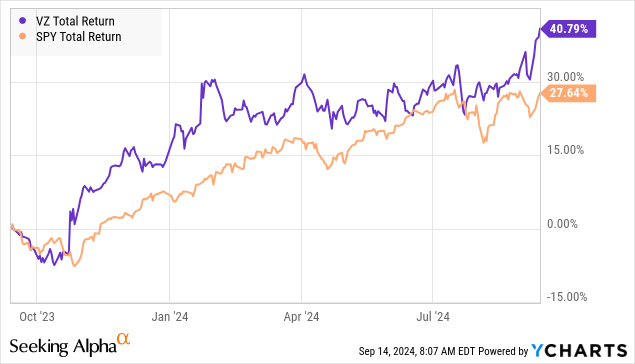

Verizon Communications Inc. (NYSE:VZ) (NEOE:VZ:CA), yielding 6.1%, is certainly one of our favourite picks, and over the previous yr, this boring previous inventory has outperformed the S&P 500.

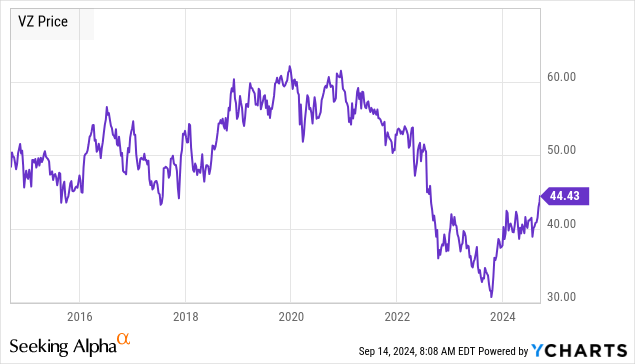

Regardless of this rally, VZ continues to commerce at costs unseen over the previous decade, making this dividend steward a compelling purchase.

It’s fascinating that for many of 2023, Wall Avenue may solely appear to speak concerning the firm’s debt ranges threatening the dividend, however overpassed the truth that lenders cannot simply come knocking after they wish to. Whereas increased rates of interest are weighing down on the revenue assertion, at $1.7 billion for Q2 (up from $1.3 billion in Q1), they continue to be manageable, with VZ producing $12.3 billion in adj. EBITDA for the quarter. As of June 30, 2024, VZ had $122.8 billion in web unsecured debt, inserting its leverage ratio (web unsecured debt to adjusted EBITDA) at 2.5 instances (down from 2.6x after Q1). The corporate’s efficient rate of interest stood at 5.1%.

One other subject of concern among the many investor neighborhood has been the potential disruption from satellite-based web and cellphone providers. Earlier this yr, VZ invested $100 million into AST SpaceMobile, a satellite tv for pc connectivity firm pioneering the space-based mobile broadband community that can permit current, unmodified smartphones to hook up with satellites in areas with protection gaps. The corporate additionally not too long ago introduced its plans to launch a satellite tv for pc messaging service in partnership with Skylo. These place VZ effectively for enlargement into city areas with their cost-effective service choices.

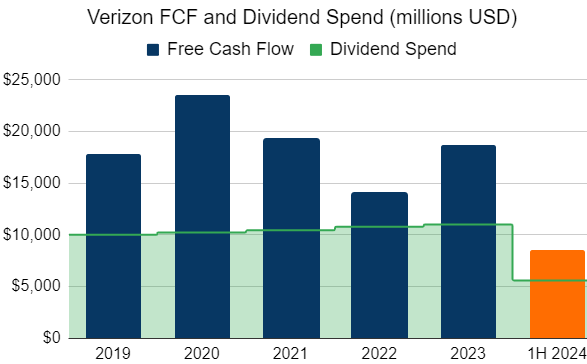

Throughout Q2, VZ generated $16.6 billion in money move from working actions, and $5.8 billion in FCF (Free Money Stream).

Creator’s Calculations

The significance of the above chart can’t be overstated. It signifies two components:

-

Constant Extra Money Availability: FCF displays the true money an organization has readily available, making it a extremely dependable technique of measuring dividend payability. Earnings, alternatively, usually embrace non-cash gadgets like depreciation, which do not characterize precise money move.

-

Sustainability: Paying dividends from FCF ensures that the corporate is not stretching its funds to pay shareholders. This method helps preserve the long-term well being of the enterprise and makes the dividend extra sustainable.

VZ’s $5.5 billion dividend spend for 1H 2024 is positioned at a snug 65% FCF payout ratio ($8.5 billion FCF for 1H 2024). The corporate additionally reported ~$3.4 billion discount in web debt, and its unsecured debt carries an A- ranking from Fitch. VZ has reaffirmed its steering for FY 2024, with 1-3% YoY adj EBITDA progress and adj EPS between $4.50 – $4.70, inserting its present annual dividend at 58% on the midpoint.

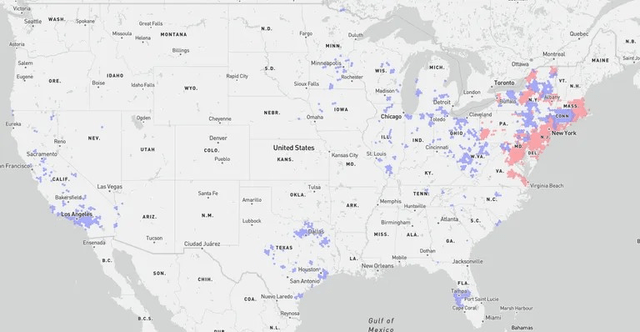

VZ and Frontier Communications not too long ago entered right into a definitive settlement by which VZ will purchase its fiber competitor for $20 billion in an all-cash transaction. Frontier has a major fiber footprint of two.2 million subscribers from 7.2 million places throughout 25 states, and the corporate has plans to broaden to 10 million places by 2026. This acquisition, which is predicted to finish in 18 months topic to shareholder approval, will considerably increase VZ’s mixed fiber community to 25 million items throughout 31 states, significantly increasing the corporate’s footprint within the North East and matching or surpassing rival AT&T’s (T) fiber protection.

Cnet.com

VZ not too long ago introduced a 1.9% YoY improve to its dividend, marking 18 years of consecutive cost will increase. The inventory at present trades at an 8.9x ahead PE, making it a cut price from a extremely worthwhile firm offering important providers to an more and more digital financial system.

Conclusion

Verizon used to have commercials promoting the reliability and energy of their total community by having somebody strolling round and saying, “Are you able to hear me now?” again and again. It illustrated that regardless of the place you had been in the whole nation, the particular person on the opposite finish of the cellphone name would have the ability to hear you clearly. Whereas it was a ridiculous instance to focus on the energy of their community, it was one thing tangible as a result of I believe nearly each certainly one of us who has a cellular phone has been in a spot with poor reception the place you’ve got requested that query – “Are you able to hear me? Hi there? Are you able to hear me?”. So, they illustrated this successfully by displaying somebody testing that all over the place to indicate the energy of their community.

With regards to retirement, the query should not be, “Are you able to hear me now?” The query must be, “Are you able to hear your revenue now?” As a result of each time these dividend {dollars} pour into your account, it’s best to have the ability to hear the cash clinking towards one another, filling your coffers. In case your portfolio is not producing a excessive stage of revenue that’s routinely pouring in from the market into your coffers, then maybe your portfolio isn’t fine-tuned successfully to offer you what you want probably the most in life. You possibly can’t purchase happiness, however you possibly can undoubtedly make life simpler and let you discover extra happiness by having the monetary means to clean issues over or discover options successfully.

That is the fantastic thing about my Revenue Technique. That is the fantastic thing about revenue investing.