Consumers are lastly funneling again to the housing market because of not too long ago decrease mortgage charges. However, we’ve nonetheless acquired a BIG housing downside to repair—undersupply. What’s President Trump’s plan to place extra homes on the map? Freedom cities! By turning federal lands into high-tech hubs for employees, we could possibly resolve our housing scarcity. Is that this doable, or are “freedom cities” only a far-off developer dream? We’re moving into this headline and all of the others filling your newsfeed in at this time’s episode!

House costs are about to PLUMMET…says one article for a choose few property sorts. Whereas a lot of this is perhaps clickbait, James does suppose it’s time to scoop up some candy property offers on second properties in sizzling trip markets. With good worth, financial weak point placing strain on sellers, and long-term upside, this might be a strong transfer to make!

Need to pay even LESS to an actual property agent? That’s what everybody says, however it doesn’t appear to be that’s what everybody desires as Redfin will get purchased out by Rocket Corporations. Is the low-cost actual property agent mannequin lastly about to chunk the mud, or might Rocket flip issues round, bringing consumers an entire new suite of low-cost providers? Stick round; we’re sharing our ideas!

Dave:

At present we’re diving into the housing market headlines which are dominating the information. I’m your host, Dave Meyer, and I’m joined by our professional panelists, Kathy Fettke, Henry Washington and James Dainard at this time. And collectively we’re bringing our sizzling takes on key headlines, together with using federal lands for housing growth and the steadily decreasing charges that we’re seeing. These are the headlines making the largest impression in the marketplace at this time, and we’ve got a pair others to share with you as properly. Welcome to On the Market. All proper, Henry, you might have the honour or maybe punishment of going first. So inform us what information story you’re bringing right here.

Henry:

Effectively, yeah man, I went with the press bait, so earlier within the week, and this text comes from Newsweek. I’d heard that President Trump had a plan for addressing the housing scarcity and reasonably priced housing, and that plan could be to make the most of federal lands for housing growth. Mainly, the administration has launched a job drive and that job drive is led by the Division of Inside and the Division of Housing and City Improvement, the division to establish underutilized federal lands that will be appropriate for residential growth. So looking at land that the federal authorities owns and seeing if they will develop housing in these lands. The technique would go for finding, figuring out the land, after which to associate with the federal government builders, nonprofits, building corporations, and apparently anyone else who would need to get on board to construct housing on these lands. And among the choices they might have a look at could be both promoting or leasing or transferring that land over to the events that they associate with, with the purpose of expediting the supply of reasonably priced housing.

I’m saying all these phrases as a result of us individuals who have been in the true property enterprise know that it’s very troublesome to expedite permits and approvals and constructing and why That is attention-grabbing to me, political opinions apart, again after we had an episode the place we talked about what we might do to deal with reasonably priced housing, one of many issues that I introduced up at the moment was to say that if this downside is to get solved, it’s going to take the federal authorities working with the native governments, working with dwelling builders and actual property traders. All of these events want to have the ability to work collectively. All of them have to supply one thing to one another to ensure that this to get addressed correctly. I consider builders need to be incentivized to construct reasonably priced housing. That’s why they don’t construct it as a result of it’s not as worthwhile. It’s constructing one thing a category, but when there’s a method for them to be worthwhile both by making income on these or by getting the land free so that there’s extra income on the backend or by tax advantages for constructing in these areas and it is a viable answer, it seems like that’s what would occur on this situation, however everyone knows it’s not at all times going to be that lower and dry, however that’s sort of what made me look into it.

Yeah, among the constructive impacts might be that you simply do get an elevated housing provide, you get financial progress in these areas since you’re going to have tons of recent jobs coming with the brand new building, plus numerous these authorities lands are in not as densely populated areas, and so that you gained’t have the ability to simply construct housing. You’ll need to construct different infrastructure and facilities that individuals want, which might additionally carry extra jobs. Plus it might cut back the price of housing as a result of extra provide ought to impression the price of housing. Proper now,

Kathy:

I really like the concept, the practicality of it’s a entire nother factor, and one of many traces on this article says the federal authorities owns about 640 million acres of land, so that will create numerous housing.

New Speaker:

However

Kathy:

Then it says, a lot of which isn’t appropriate for housing

New Speaker:

Due

Kathy:

To environmental laws, the character of the terrain and different restrictions. I’m born and raised within the San Francisco Bay space and all people is aware of it’s some of the costly locations within the nation, however lots of people don’t know that simply an hour away, there’s nothing however land.

New Speaker:

There

Kathy:

Is a lot land surrounding the San Francisco Bay space. Why on earth is it not developed? Nobody desires to stay on the market. I imply, even Stockton, California is simply outdoors of San Jose, some of the costly, most populated areas you can’t get folks to maneuver on the market as a result of it’s an hour commute and there isn’t transportation. So I agree with what you mentioned, Henry, until you set an entire metropolis there and there’s jobs and there’s faculties and there’s infrastructure and there’s issues for folks to do, ain’t nobody going to do it. We’re making an attempt to truly try this. There’s a bunch of builders making an attempt to develop this huge land between Sacramento and San Francisco.

Dave:

I heard about that. Yeah. That’s like a tech paradise they’re making an attempt to construct, proper? Yeah.

Kathy:

They will’t do it. They can’t get it finished. Granted, it’s California

New Speaker:

They usually have some huge cash

Kathy:

They usually have some huge cash,

Dave:

Some huge cash behind it. Yeah.

Henry:

It’s attention-grabbing that you simply say that although as a result of if you dig deeper into this plan outdoors of simply this text, a part of the plan is to determine what they’re calling Freedom Cities. They might develop as much as 10 new cities termed Freedom Cities on these undeveloped federal lands, and it will look to remodel these areas into thriving communities. So it’s Its within the plan. So it’s mainly finished, proper?

Kathy:

Oh, it solely takes 30 or 40 years, in order that’s good.

James:

And that’s the issue. To construct a metropolis, there’s a lot infrastructure that has to go in they usually need to undergo a lot paperwork, the environmental, the whole lot that it simply takes eternally. These issues are nice, however they’re not an answer to what we’re making an attempt to resolve proper now, which is extra reasonably priced housing. And there’s some land it is best to by no means construct on and it doesn’t matter even in the event you get it without spending a dime. I imply, I’ll say we acquired lots one time for $15,000, and that is in an incredible neighborhood of Seattle. It was in Beacon Hill, these are view heaps. We had views and we constructed three single household homes on this lot and we ended up making about $32,000 on all three homes whole.

New Speaker:

The

James:

Mixed sale on that web site was about 2.8 to 2.9 million. And you continue to barely

Dave:

Made

James:

Cash. We barely made the true property commissions had been larger than the revenue. And that’s the issue with these items. They throw mud on the partitions. This seems like a good suggestion, however there’s no logic and hopefully they get folks in there that actually perceive constructing and the way do you systemize it? And I feel the true answer is that they need to virtually make a authorities constructing division or one thing the place the margins are mounted. You’re going to construct this home for this price and you understand precisely what it’s and never get the proposal from the builders. As a result of I keep in mind studying in California too, once they had been constructing these little homes for ADUs for homeless, they had been spending $500,000 on these items.

Dave:

800? Yeah, it was like 8 32 or

James:

One thing. Yeah,

Dave:

$800,000. These are

James:

Loopy.

Dave:

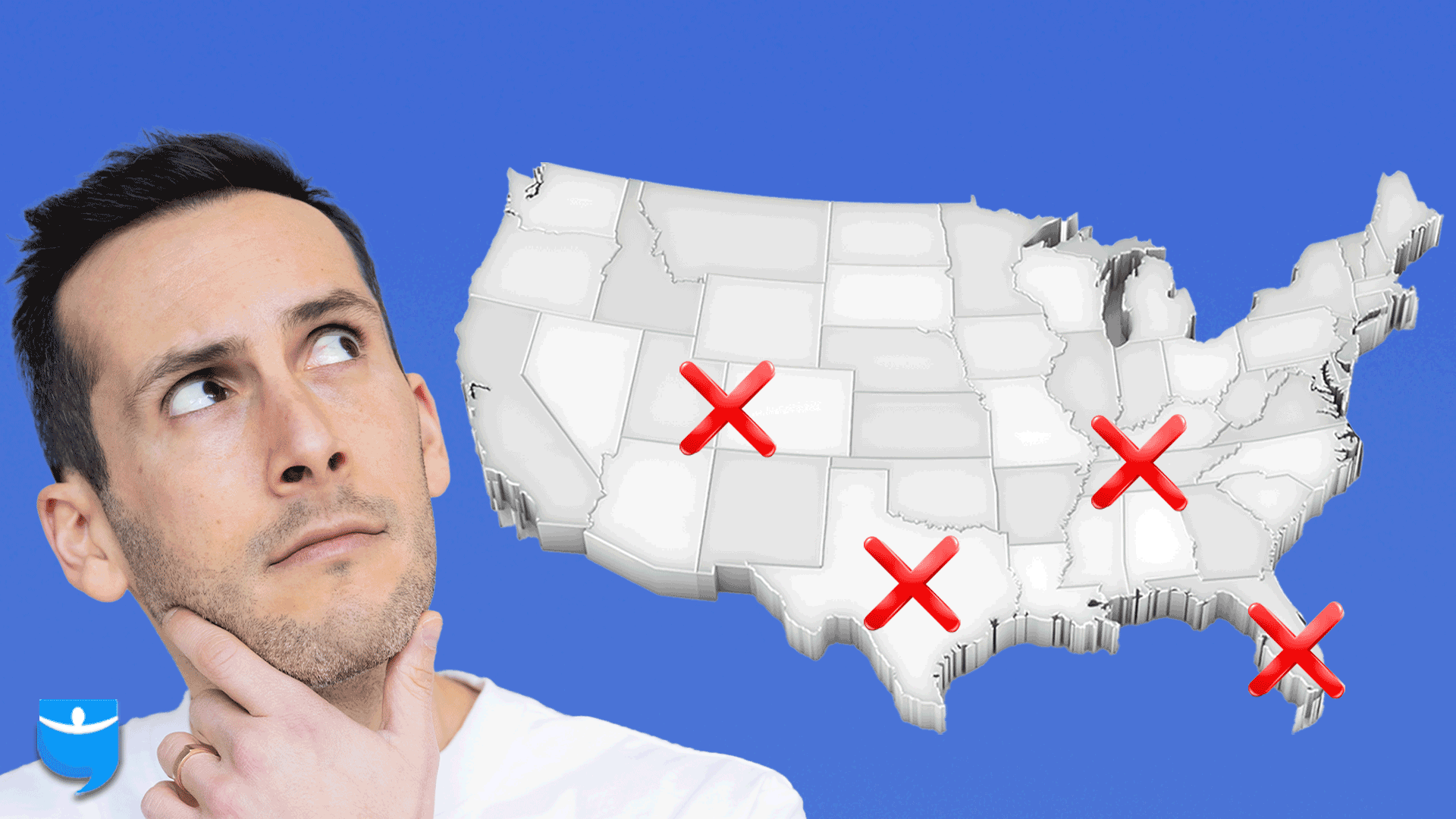

I imply, my basic sense is form of we stay in a capitalist nation and capitalist nations are usually fairly environment friendly at figuring out the locations folks need to stay and work. Commerce goes to be logical. The locations that cities have developed are locations the place there are pure sources and the place there are navigable waterways and the place there are highways and infrastructure that undergo these locations. And so it sounds nice to construct a wholly new metropolis, however you sort of need to surprise why nobody’s constructed their within the many a whole bunch of years that they’ve had the choices to construct there. Type of like Kathy was saying outdoors San Francisco. In order that I feel is one factor. The opposite factor, in the event you pull up a map of federal land, it’s all within the western half of the US. There’s very, little or no of it in among the costlier components within the southeast and within the northeast and within the Midwest, I might enterprise a guess that over 90% of it’s from Colorado West.

Kathy:

Wow,

Dave:

Wow. Yeah. So I don’t know that essentially makes it unhealthy, however it’s simply one thing to contemplate as properly that it’s not evenly distributed all through the nation. So I feel it’s the best concept to start out trying into these items. We’ll see if it really yields something priceless right here. Alright, properly nice headline Henry, and we will certainly preserve masking this. If it does begin to take off they usually begin performing on this, that is going to have large impression on the true property trade. So we will certainly be masking this one. Let’s now transfer on to our second story right here at this time. Kathy, tell us what you’re .

Kathy:

So mine is information that comes out each month, however I wished to share it. It’s from the Nationwide Affiliation of Realtors, their current dwelling gross sales, and in February it accelerated 4.2%. So that is good. Which means extra properties are promoting and I feel that has lots to do with rates of interest coming down a bit of bit. I imply even I feel at one level it was 6.4%. That’s fairly fabulous contemplating mortgage charges had been within the sevens not too way back. It simply sort of exhibits how delicate actual property is to mortgage charges. And as many individuals have predicted, as quickly as charges go down, there shall be consumers flocking to the market. Just a few of the opposite stats which are attention-grabbing, seasonally adjusted annual price is 4.26 million properties buying and selling, promoting. And lots of people suppose the housing market caught, however 4.2 million properties had been offered. It’s nonetheless 1.2% lower than a yr in the past, however I simply wished to make that time. The median current dwelling gross sales value rose 3.8% from February of 2024 to now. In order that’s the twentieth consecutive month of yr over yr dwelling value will increase. That is

Dave:

Stunning.

Kathy:

Completely. After which stock of unsold current properties climbed 5% from the prior month to 1.24 million on the finish of February. In order that’s about three and a half months provide that’s getting nearer to regular, nonetheless not the place it I assume ought to be, however that may be a part of why there’s extra gross sales. If there’s extra stock, there’s extra to select from. There’s extra of a capability to barter. It turns into extra of a purchaser’s market and consumers are getting sensible and going out and benefiting from that. Decrease mortgage charges mixed with a bit of bit extra elevated stock if mortgage charges proceed to return down. I don’t know that inventories are going to proceed to climb, however that has been a principle by some economists that if we will get extra stock in the marketplace, we’re going to have larger gross sales. And have a look at that we did. And better dwelling costs as properly.

James:

I’m really not that shocked by it. It’s like there’s a lot pent up purchaser demand. We do numerous listings, so sometimes we’re itemizing like 200, 250 properties a yr which are all renovated new building. And so we get to see the our bodies coming by means of. And I can say proper now, even with the whole lot happening, the quantity of our bodies coming by means of listings and never everyone seems to be writing provides, however I imply issues are promoting. We’re nonetheless promoting issues for more cash for certain. And the traders I’m speaking to, issues are taking longer to promote. There may be extra stock, however issues are nonetheless promoting. And most people that I’m speaking to that may’t get their properties offered, they listed it larger than their performer was simply due to current comps. So that they’ve already acquired appreciation and generally they’re itemizing like 20 grand extra on a 200,000 home. Effectively, that’s a ten% improve that you simply noticed throughout your renovation on that

New Speaker:

Pricing.

James:

And so it’s sort of trying on the actuality of truly what’s happening. However I imply there’s sufficient consumers, there’s nonetheless low sufficient stock of excellent product that persons are absorbing it.

Henry:

I simply put a home in the marketplace possibly two days in the past, and this one we listed at 3 85, so it’s larger than I sometimes do. And I’d say we’ve in all probability had 10 showings within the final two days. So there’s folks which are on the market trying,

Dave:

Rattling, that’s fairly encouraging.

Henry:

Yeah,

Kathy:

We now have subdivisions in Oregon, in Bozeman, Montana, within the Reno space in Florida, and all of them are, they’re seeing elevated gross sales, elevated provides. That is only a discover I acquired from our undertaking in Florida. It’s large. It’s been happening for a very long time, referred to as the marada 16 internet gross sales for the week. We had 129 internet gross sales in March. So simply That’s wonderful.

Dave:

So it seems like we’re seeing Seattle, Arkansas, or everywhere in the nation. That is form of a development. I’m questioning if that is going to proceed or do you guys suppose it’s simply sort of like persons are excited as a result of charges dropped and now they’re leaping in and it’ll stage out? Or do you suppose we’ll see some momentum on this path going ahead?

Kathy:

Sure, that mixture, decrease mortgages, hotter climate and better wages, not in barely decrease inflation.

James:

I imply it’s the seasons, proper? Timing is the whole lot in actual property if you’re promoting, it’s at all times good. Proper now, sometimes July hits a wall in numerous spots and we’re going to see a slowdown and it shouldn’t be a shock simply what occurs. And I don’t suppose it’s going to be as a lot the financial system, it’s simply it’s the seasons of slowing. However we listed a home in West Seattle not too long ago, and we listed for 1.5 million and we offered it for 1.7. In case you have the best factor, all people is leaping throughout it. And so it’s simply, you actually acquired to place it into the plans, value it accordingly and it’ll promote.

Dave:

Superior. Effectively thanks Kathy for bringing us some encouraging information with this story. We do need to take a fast break, however after we come again, James goes to shatter all the nice occasions and inform us about 5 dwelling sorts which are anticipated to plummet in 2025. Hey, stick to us. We’ll be proper again. Welcome again to On the Market. I’m right here with Henry, Kathy and James speaking about information and tendencies which are shaping our trade to this point. We’ve talked about President Trump’s plan to see if they will construct new reasonably priced housing on federal land. We’ve talked a couple of form of sudden improve in current dwelling gross sales. Now, James, I feel you’re going to carry us again all the way down to actuality a bit of bit. I noticed the URL, you mentioned round earlier than this recording, inform us what article you need to speak about.

James:

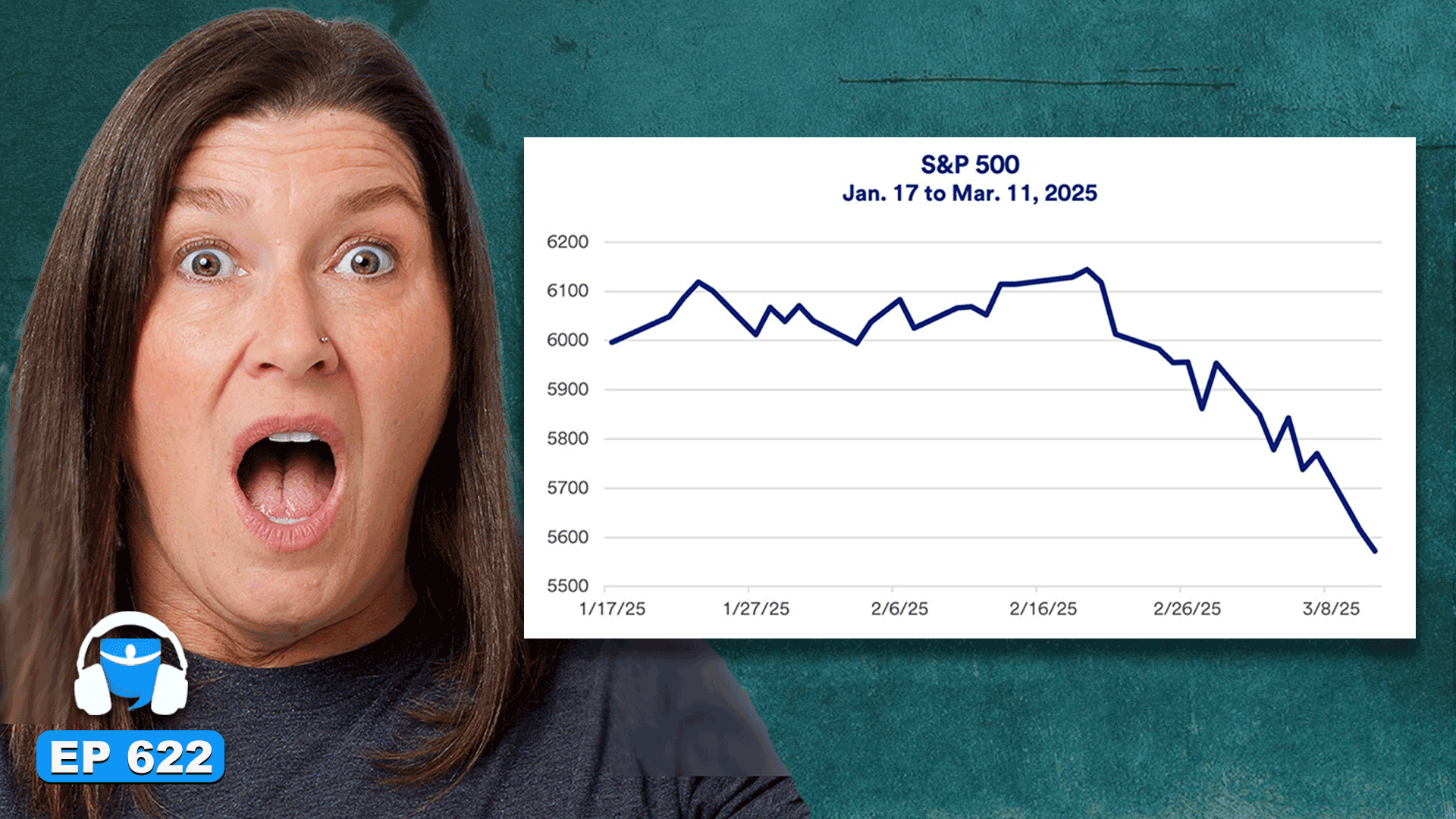

Individuals are beginning to get pressured in regards to the inventory market. There’s numerous recession headlines floating round. After which this one had that key phrase that acquired my consideration was plummet, was in there. It says 5 varieties of properties anticipated to plummet in 2025, together with condos and concrete flats, older suburban properties, sure luxurious properties and trip properties in second properties in cities which have excessive unemployment. And the explanation I actually introduced this text in is, I’m sorry, these items is a joke to me and I’ve a cause why I’m saying that, however it’s like because the inventory market comes down, all these items occur. We now have tariffs, there’s going to be all kinds of articles like this, and it’s actually vital for us as traders to remain levelheaded and concentrate on the info. Not issues like this, as a result of I’m this text they usually’re going city and condos. Okay, sure, I do know there’s lots being constructed, however you understand what? There’s a really large lack of recent townhome permits being issued throughout the nation proper now. There’s really going to be an enormous hole in stock in there. And so I really suppose that’s among the best product to be shopping for and growth proper now as a result of there’s going to be decrease stock there.

Henry:

Additionally, we lack reasonably priced housing. That’s what that

James:

Is. It simply doesn’t make sense. Or the older properties, older properties are extra reasonably priced they usually sometimes promote for fairly a bit underneath renovated properties, however they don’t plummet in worth. I’m not shopping for properties cheaper and cheaper and cheaper as a result of older we purchase ’em based mostly on what they might be restored to or what the mechanicals are. And so it doesn’t have numerous logic behind it, and I feel it’s vital for everyone as these headlines come out to essentially dig into are they making an attempt to get your consideration or not?

The issues I do suppose there may be alternatives in and what these items might help you get your mind stepping into is the posh market and the secondary dwelling market. These are areas I’m so far as alternatives. I used to be digging into Lake Tahoe the opposite day in California and I used to be some properties that you possibly can purchase for $260 a sq. foot, which is under alternative price. And these items had been constructed within the nineties and I’m going, okay, there’s good worth there and good long-term upside as a result of it’s a spot that everybody desires to go. There’s larger rents. You may really short-term rental it, despite the fact that I’m not a short-term rental man, I would do it up there. And I do suppose secondary dwelling markets, your Lake Havasu, your lake Tahoes, your ski mountains, these areas, they’ll have alternative as a result of the rents preserve going up and the price of mortgage and the price of charges till they arrive down. It’s not pleasant to have a look at shopping for a secondary dwelling if you’re placing in your mortgage cap. I’m like, Nope. I’d slightly go on a cruise each 60 days.

Kathy:

There’s one factor I do agree with on this text, and it truly is simply condos in Florida, and that has lots to do with the, in the event you guys keep in mind the collapse of that constructing, I feel it was referred to as the Surf facet. And since then there’s been numerous new laws and that’s actually growing dues and charges for folks. So I’d be sort of nervous about proudly owning an older apartment in Florida. I feel the newer ones are constructed higher.

Dave:

Particular assessments. Loopy. Yeah,

Kathy:

They’re loopy. Yeah. Yeah. That’s one factor I simply actually don’t like normally about both townhomes or condos is a particular assessments. You have got zero management over that.

James:

No, and I feel it’s about simply digging into that, for instance, luxurious market. I do suppose the posh market goes to say no.

Dave:

I agree.

James:

I do consider that. And stock’s up in the US luxurious properties on the market yr over yr. There’s 15% extra stock proper now, which that’s a tougher absorption price. It’s costly,

But additionally as an investor, that doesn’t imply I’m not going to have a look at alternatives there and it creates extra alternatives despite the fact that in my mind I feel luxurious markets coming down, I’m seeing tons of stock pop up all over the place. I simply gotten contract on the costliest flip I’ve ever bought and I’m going to be making an attempt to promote it for $10 million and I really feel very assured in my numbers. And so it’s nearly breaking it down, what are you making an attempt to do? After which if there may be luxurious coming down, that’s a superb time to possibly get a few of that stuff on sale. Wow. Whenever you suppose one thing’s taking place, look to purchase it and don’t look to keep away from it.

Dave:

Effectively, I feel these are articles, they simply miss the second half of the sentence. It’s like luxurious properties, however that you must say the market that you simply’re speaking about, like Kathy mentioned, condos, sure, there are markets the place condos costs are going to go down, however it’s important to say which market as a result of there are different locations. In case you look within the Northeast, condos are going loopy proper now. The values are rising by double digits.

Kathy:

It’s the one factor folks can afford.

Dave:

Yeah, precisely. After which I do agree with the posh dwelling second dwelling factor as a result of that truly, in the event you have a look at it as sort of correlated to the inventory market, and for the reason that inventory market is down proper now, numerous the individuals who would purchase a second dwelling or a luxurious dwelling are closely invested into equities. And so when these issues decline or there’s much less confidence within the inventory market, these pull again. So I agree with that, however as James mentioned, there’s sure markets the place it’s going to do nice. So I feel this James is true, nice instance to form of get your head spinning, however don’t simply learn the headline and draw broad conclusions about what this implies for no matter market you’re trying particularly. Alright, we’ve gone by means of three of our tales. I’ve yet one more for you after we come again from this quick break. Stick with us.

Hey everybody. Welcome again to On The Market. I’m right here with James, Henry and Kathy speaking about newest information and tendencies. We now have yet one more story for you. I’m certain you guys all noticed this. Effectively, Kathy and James, I do know as actual property brokers, I’m certain you noticed this particularly, the information is that Rocket Mortgage is shopping for Redfin for about $2.4 billion. And I feel you guys know I really like Redfin as a result of they’ve an incredible knowledge heart. They put out actually excellent news, however they’ve been struggling lots. They’re public corporations, so you’ll be able to go and see that they’ve had hassle turning a revenue for a number of years. So it’s not all collectively. That stunning to see that Rocket is shopping for them. James, let’s begin with you. As somebody who has a brokerage and is an agent, do you suppose that is simply one other instance of those low price fashions that each couple of years everybody talks about these low price new methods of shopping for and promoting properties they usually by no means appear to work. Is that this simply one other instance of it? Are folks going to cease making an attempt or do you suppose it’s nonetheless an inexpensive concept?

James:

No, I at all times really feel like there’s the low price after which it doesn’t fairly dominate. They thought it will as a result of folks really need to service

New Speaker:

And

James:

Then they go, okay, that’s not fairly there. So now what we’re going to do is we’re going to make the superpower group of low price. Let’s get the mortgage firm and the true property. That’s all low price and let’s see how we will add this in and we’re going to make it so low-cost that individuals have to make use of it. And I’m all for purchasing it out, getting one of the best value, doing all your factor, however it’s important to have a sure expertise if you’re going by means of these issues. If I acquired the most affordable sort of mortgage originator and the most affordable dealer combining their superpowers, I might need a nasty shopping for expertise

New Speaker:

And

James:

The communication might fall. And I cope with numerous gross sales on the itemizing facet. And if you’re coping with a mortgage firm that’s simply snapping out stuff they usually’re simply making an attempt to push it by means of they usually shopped that price after which your deal will get all sideways. I imply, I’ve positively seen consumers earn us cash for certain. However I simply suppose that is one other factor. I’m not too involved about this so far as an actual property skilled.

Dave:

You in all probability like this as an actual property skilled who supplies a superb service, proper? It’s sort of validating, I might think about.

Kathy:

Yeah, I imply we tried this at our brokerage, our actual world realty. We used to have all of our brokers on fee. After which in California you really, it’s a fantastic line. So we sort of did a hybrid the place they’re on a wage, however then they get an upside in revenue sharing. However on this article, I assumed what was so attention-grabbing is that the highest sellers left

New Speaker:

As a result of

Kathy:

In case you’ve acquired actually good brokers, why would they stick to only a wage? They’re used to consuming what they kill, so to talk. And in the event you kill lots, you need to eat lots. And you understand what I imply? They lose their greatest brokers. And you possibly can see exp is an instance on this article of an organization that’s been rising sort of doing the alternative of Redfin. And that’s as a result of EXP is absolutely rewarding these high salespeople, having them solely need to pay a restricted quantity of commissions to exp they usually get the remainder. So if you flip that and say the corporate will get a lot of the commissions and also you simply get a flat price, you’re simply not going to have the fighters. And you then’ve acquired this set overhead, which is what we’ve skilled. In case you’ve acquired highs and lows, however you’ve acquired a set overhead, that’s actually powerful.

Dave:

That’s a superb level. It is sensible, proper? The Redfin innovation is like they had been going to wage their workers, they had been going to get medical health insurance, they’re going to get advantages, they had been going to have PTO and all that sounds good, however if you clarify it that method, Kathy, yeah, that’s good for possibly a middling or an entry stage agent, however the high brokers are going to see that as a restriction on their progress.

Kathy:

Completely. Yeah. They’re simply not even going to contemplate it. And that brings us to what James says is who’re you getting any individual new, any individual who’s simply not that motivated. Do they actually care in the event that they value it or if they’ve a sale? So is it good for the shopper if the agent is simply form of like, I’m going to receives a commission anyway.

James:

And one factor to know that is the largest competitors for Redfin. This is the reason numerous it’s additionally a difficulty is in 2020 4, 71 to 74% of brokers didn’t promote a home within the us. So the blokes that actually can’t get a list, any gross sales guys or gals that get a list, what do you suppose they do? They’re additionally providing low-cost, extra reasonably priced providers and reductions. So now you bought 71% of the dealer pool simply throwing reductions out simply to get a deal finished and also you at the least get an individual that’s really a salesman slightly than Redfin’s sort of arrange extra like a conveyor belt, which isn’t unhealthy. I’m not knocking on it, however the competitors’s on the market, persons are slicing their commissions simply to get enterprise.

Dave:

It makes me surprise, I’ve been on this trade for 15 years and for 15 years persons are at all times saying commissions are going to return down for X cause, for Y cause for Z cause. I’m uninterested in it. They’re not coming down. Possibly they’ll come down a bit of bit. I noticed that after the entire NAR factor, they’re coming down a bit of bit for probably the most excessive finish properties, however we’re speaking going from a 2.9% common to a 2.8% common. It’s not materially coming down. Possibly that is simply the market worth and that is what it prices, and if one thing comes up, we’ll definitely cowl it. However to me it simply, each time we hear that some new enterprise mannequin, some new lawsuit goes to essentially change. It doesn’t transform correct and the market bears this value and in order that’s what persons are going to pay. All proper. Effectively that’s what we acquired for you. Anything guys? Something newsworthy you need to speak about earlier than we get out of right here? The Fed. Oh, sticking.

Kathy:

Yeah, the Fed held charges regular and now Trump is, as soon as once more, he did this in his first time period. He’s preventing the Fed, he desires decrease charges, will he get it? He acquired it final time, even when

New Speaker:

Throne

Kathy:

Powell mentioned, Nope, not going to do it. After which the following time he did, I don’t know what occurred, however the Fed didn’t comply this time and stored charges the place they’re. In order that’s attention-grabbing.

Dave:

It’s. However I feel the opposite factor is that the final assembly, they mentioned they’d in all probability nonetheless lower charges twice in 2025 and that stayed. So that they’re nonetheless form of sticking to their expectation. The market wasn’t actually considering they had been going to chop charges. This one, I feel, what’s it, June and September, they’re form of predicting one thing like that. In order that’s what the market will react to if the expectations going ahead actually change, I feel that shall be completely different or if President Trump will get extra concerned. That’s a superb level, Kathy. That would positively occur. Alright, properly James, Kathy, Henry, thanks guys a lot for being right here. We admire it. And thanks all a lot for listening to this episode of On The Market. We’ve clearly shared with you what we expect is vital happening within the financial system and the housing market, however in case you are watching this on YouTube, I’d love so that you can inform me the tales that we’re lacking or the tales that you simply’d like us to cowl in future episodes of On the Market. Inform us what’s in your thoughts within the feedback under. And in the event you’re listening, simply ship it to me on Instagram. We’ll think about something that you simply suppose’s attention-grabbing. Thanks once more for watching. We’ll see you subsequent time.

Assist us attain new listeners on iTunes by leaving us a ranking and evaluate! It takes simply 30 seconds and directions could be discovered right here. Thanks! We actually admire it!

All for studying extra about at this time’s sponsors or turning into a BiggerPockets associate your self? E-mail [email protected].